Stratégie d'inversion de l'élan à trois indicateurs

Auteur:ChaoZhang est là., Date: le 26 octobre 2023 16:12:33Les étiquettes:

Résumé

Cette stratégie combine trois indicateurs publics open-source - Trend Magic, Squeeze Momentum et Cumulative Delta Volume pour détecter les mouvements extrêmes sur le marché. Ces trois indicateurs se vérifient mutuellement et peuvent identifier efficacement les points d'inversion sur le marché. Cette stratégie tente d'ouvrir des positions lorsque les trois indicateurs donnent des signaux d'achat / vente simultanément, afin de mettre en œuvre un trading d'inversion de momentum à faible risque.

La logique de la stratégie

Cette stratégie utilise un graphique à chandeliers d'une minute ou de trois minutes, avec un stop loss de 1,5 fois l'ATR du prix de clôture.

Tout d'abord, l'indicateur Trend Magic, conjointement avec l'indicateur ATR, évalue la tendance et la volatilité du marché. Lorsque l'indicateur CCI est supérieur à 0, il indique que la volatilité a lieu. À ce moment, si la position de l'indicateur ATR est supérieure au prix, elle indique une tendance à la hausse, sinon elle indique une tendance à la baisse.

Deuxièmement, l'indicateur Squeeze Momentum juge quand la volatilité augmente et diminue. Lorsque les bandes de Bollinger sont comprimées dans les canaux de Keltner, cela indique que la volatilité du marché diminue. Après cette compression, les bandes de Bollinger traversent inévitablement les canaux de Keltner, déclenchant des hausses ou des baisses de prix extrêmes.

Enfin, l'indicateur de volume cumulatif delta déduit les forces du marché en calculant la différence entre les volumes d'achat et de vente.

Lorsque les trois indicateurs donnent des signaux en même temps, cela confirme que le marché est proche d'un point d'inversion.

Analyse des avantages

- L'utilisation de plusieurs indicateurs pour confirmer peut éviter efficacement les fausses fuites

- Les bandes de Bollinger et les canaux de Keltner ont un taux de gain relativement élevé

- Les renversements de volume indiquent un changement de forces, soutenant les signaux de renversement

- Les opérations de contrepartie présentent des risques relativement faibles et conviennent aux opérations à court terme.

Analyse des risques

- La négociation sur une seule période présente des risques importants d'être piégée

- Il est possible que des renversements ne se produisent pas au premier point de rupture, le risque de manquer l'entrée optimale

- Nécessité de surveiller également les délais plus longs pour éviter de négocier contre la tendance

- Peut choisir d'aller seulement long ou court en fonction de la direction de la tendance principale

- Peut définir des conditions ADX pour éviter les transactions lorsque la tendance est incertaine

Directions d'optimisation

- Ajouter une validation intertemporelle, en utilisant des périodes plus longues pour déterminer la tendance

- Ajouter le dépistage des produits, choisir des produits à volatilité plus élevée

- Ajuster les paramètres des indicateurs pour optimiser les effets des indicateurs

- Incorporer des modèles d'apprentissage automatique pour améliorer le taux de réussite

- Combiner les indicateurs de sentiment, le commerce contre les extrêmes dans le sentiment du marché

Conclusion

Cette stratégie utilise plusieurs indicateurs pour déterminer les tendances du marché et ouvre des positions lorsque plusieurs indicateurs donnent des signaux cohérents. Par rapport à des indicateurs uniques, elle peut filtrer plus de faux signaux. Mais comme elle ne fonctionne que sur un seul laps de temps, elle est toujours encline à être piégée dans les marchés en tendance. Les prochaines étapes pourraient être d'incorporer des techniques plus avancées telles que l'apprentissage automatique pour améliorer les performances, ou combiner des indicateurs à plus long laps de temps pour éviter de négocier contre la tendance, rendant la stratégie viable dans plus de conditions de marché.

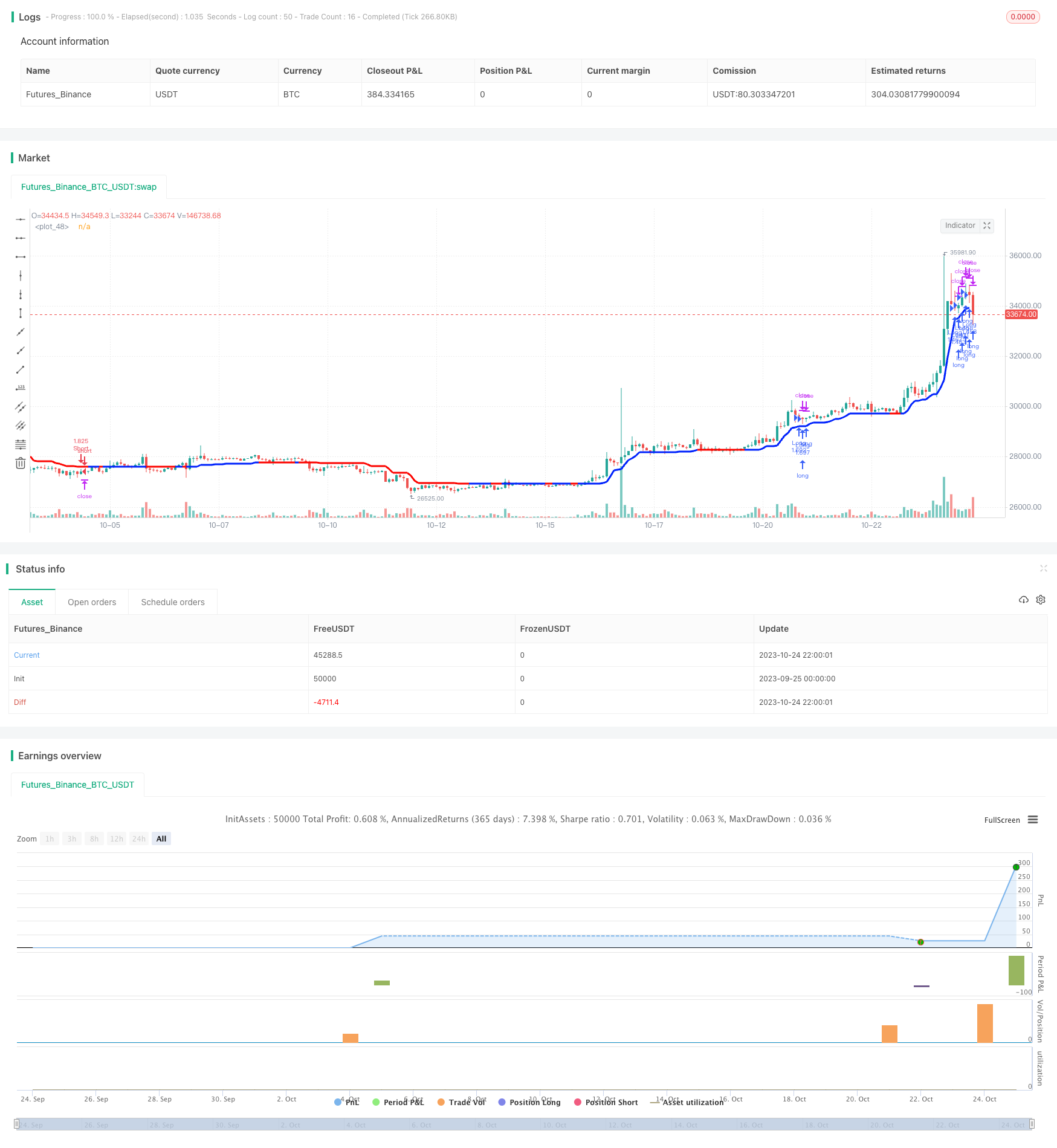

/*backtest

start: 2023-09-25 00:00:00

end: 2023-10-25 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #11 - TrendMagic+SqzMom+CDV - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=1000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=1, commission_value=0.075, use_bar_magnifier = false)

// HA to Regular Candlestick resolover

useHA = input.bool(true, "Use Heiken Ashi")

CLOSE = close

OPEN = open

HIGH = high

LOW = low

CLOSE := useHA ? (OPEN + CLOSE + HIGH + LOW) / 4 : CLOSE

OPEN := useHA ? na(OPEN[1]) ? (OPEN + CLOSE) / 2: (OPEN[1] + CLOSE[1]) / 2 : OPEN

HIGH := useHA ? math.max(HIGH, math.max(OPEN, CLOSE)) : HIGH

LOW := useHA ? math.min(LOW, math.min(OPEN, CLOSE)) : LOW

isCrypto = input.bool(true, "Is Crypto?")

// Functions

f_priorBarsSatisfied(_objectToEval, _numOfBarsToLookBack) =>

returnVal = false

for i = 0 to _numOfBarsToLookBack

if (_objectToEval[i] == true)

returnVal = true

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

// Trend Magic by KivancOzbilgic

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

period = input(20, 'CCI period')

coeff = input(2, 'ATR Multiplier')

AP = input(5, 'ATR Period')

ATR = ta.sma(ta.tr, AP)

src = CLOSE

upT = LOW - ATR * coeff

downT = HIGH + ATR * coeff

MagicTrend = 0.0

MagicTrend := ta.cci(src, period) >= 0 ? upT < nz(MagicTrend[1]) ? nz(MagicTrend[1]) : upT : downT > nz(MagicTrend[1]) ? nz(MagicTrend[1]) : downT

color1 = ta.cci(src, period) >= 0 ? #0022FC : #FC0400

plot(MagicTrend, color=color1, linewidth=3)

alertcondition(ta.cross(CLOSE, MagicTrend), title='Cross Alert', message='Price - MagicTrend Crossing!')

alertcondition(ta.crossover(LOW, MagicTrend), title='CrossOver Alarm', message='BUY SIGNAL!')

alertcondition(ta.crossunder(HIGH, MagicTrend), title='CrossUnder Alarm', message='SELL SIGNAL!')

i_numLookbackBarsTM = input(17,title="Number of bars to look back to validate Trend Magic trend")

//trendMagicEntryLong = trendMagicEntryConditionLong and f_priorBarsSatisfied(trendMagicEntryConditionLong,i_numLookbackBarsTM)

//trendMagicEntryShort = trendMagicEntryConditionShort and f_priorBarsSatisfied(trendMagicEntryConditionShort,i_numLookbackBarsTM)

trendMagicEntryConditionLong = ta.cci(src, period) >= 0 and src > MagicTrend + (isCrypto ? 5 : 0 )

trendMagicEntryConditionShort = ta.cci(src, period) < 0 and src < MagicTrend - (isCrypto ? 5 : 0)

trendMagicEntryLong = trendMagicEntryConditionLong and ta.barssince(trendMagicEntryConditionShort) > i_numLookbackBarsTM

trendMagicEntryShort = trendMagicEntryConditionShort and ta.barssince(trendMagicEntryConditionLong) > i_numLookbackBarsTM

// Squeeze Momentum by LazyBear

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

length = input(10, title='BB Length', group="Squeeze Momentum")

mult = input(2.0, title='BB MultFactor')

lengthKC = input(10, title='KC Length')

multKC = input(1.5, title='KC MultFactor')

useTrueRange = input(true, title='Use TrueRange (KC)')

// Calculate BB

source = CLOSE

basis = ta.sma(source, length)

dev = multKC * ta.stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = ta.sma(source, lengthKC)

range_1 = useTrueRange ? ta.tr : HIGH - LOW

rangema = ta.sma(range_1, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

val = ta.linreg(source - math.avg(math.avg(ta.highest(HIGH, lengthKC), ta.lowest(LOW, lengthKC)), ta.sma(CLOSE, lengthKC)), lengthKC, 0)

iff_1 = val > nz(val[1]) ? color.lime : color.green

iff_2 = val < nz(val[1]) ? color.red : color.maroon

bcolor = val > 0 ? iff_1 : iff_2

scolor = noSqz ? color.blue : sqzOn ? color.black : color.gray

//plot(val, color=bcolor, style=plot.style_histogram, linewidth=4)

//plot(0, color=scolor, style=plot.style_cross, linewidth=2)

i_numLookbackBarsSM = input(14,title="Number of bars to look back to validate Sqz Mom trend")

//sqzmomEntryLong = val > 0 and f_priorBarsSatisfied(val > 0,i_numLookbackBarsSM)

//sqzmomEntryShort = val < 0 and f_priorBarsSatisfied(val < 0,i_numLookbackBarsSM)

sqzmomEntryConditionLong = val > 0

sqzmomEntryConditionShort = val < 0

sqzmomEntryLong = sqzmomEntryConditionLong and ta.barssince(sqzmomEntryConditionShort) > i_numLookbackBarsSM

sqzmomEntryShort = sqzmomEntryConditionShort and ta.barssince(sqzmomEntryConditionLong) > i_numLookbackBarsSM

// Cumulative Delta Volume by LonesomeTheBlue

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

linestyle = input.string(defval='Candle', title='Style', options=['Candle', 'Line'], group="Cumlative Delta Volume")

hacandle = input(defval=true, title='Heikin Ashi Candles?')

showma1 = input.bool(defval=false, title='SMA 1', inline='ma1')

ma1len = input.int(defval=50, title='', minval=1, inline='ma1')

ma1col = input.color(defval=color.lime, title='', inline='ma1')

showma2 = input.bool(defval=false, title='SMA 2', inline='ma2')

ma2len = input.int(defval=200, title='', minval=1, inline='ma2')

ma2col = input.color(defval=color.red, title='', inline='ma2')

showema1 = input.bool(defval=false, title='EMA 1', inline='ema1')

ema1len = input.int(defval=50, title='', minval=1, inline='ema1')

ema1col = input.color(defval=color.lime, title='', inline='ema1')

showema2 = input.bool(defval=false, title='EMA 2', inline='ema2')

ema2len = input.int(defval=200, title='', minval=1, inline='ema2')

ema2col = input.color(defval=color.red, title='', inline='ema2')

colorup = input.color(defval=color.lime, title='Body', inline='bcol')

colordown = input.color(defval=color.red, title='', inline='bcol')

bcolup = input.color(defval=#74e05e, title='Border', inline='bocol')

bcoldown = input.color(defval=#ffad7d, title='', inline='bocol')

wcolup = input.color(defval=#b5b5b8, title='Wicks', inline='wcol')

wcoldown = input.color(defval=#b5b5b8, title='', inline='wcol')

tw = HIGH - math.max(OPEN, CLOSE)

bw = math.min(OPEN, CLOSE) - LOW

body = math.abs(CLOSE - OPEN)

_rate(cond) =>

ret = 0.5 * (tw + bw + (cond ? 2 * body : 0)) / (tw + bw + body)

ret := nz(ret) == 0 ? 0.5 : ret

ret

deltaup = volume * _rate(OPEN <= CLOSE)

deltadown = volume * _rate(OPEN > CLOSE)

delta = CLOSE >= OPEN ? deltaup : -deltadown

cumdelta = ta.cum(delta)

float ctl = na

float o = na

float h = na

float l = na

float c = na

if linestyle == 'Candle'

o := cumdelta[1]

h := math.max(cumdelta, cumdelta[1])

l := math.min(cumdelta, cumdelta[1])

c := cumdelta

ctl

else

ctl := cumdelta

ctl

plot(ctl, title='CDV Line', color=color.new(color.blue, 0), linewidth=2)

float haclose = na

float haopen = na

float hahigh = na

float halow = na

haclose := (o + h + l + c) / 4

haopen := na(haopen[1]) ? (o + c) / 2 : (haopen[1] + haclose[1]) / 2

hahigh := math.max(h, math.max(haopen, haclose))

halow := math.min(l, math.min(haopen, haclose))

c_ = hacandle ? haclose : c

o_ = hacandle ? haopen : o

h_ = hacandle ? hahigh : h

l_ = hacandle ? halow : l

//plotcandle(o_, h_, l_, c_, title='CDV Candles', color=o_ <= c_ ? colorup : colordown, bordercolor=o_ <= c_ ? bcolup : bcoldown, wickcolor=o_ <= c_ ? bcolup : bcoldown)

//plot(showma1 and linestyle == 'Candle' ? ta.sma(c_, ma1len) : na, title='SMA 1', color=ma1col)

//plot(showma2 and linestyle == 'Candle' ? ta.sma(c_, ma2len) : na, title='SMA 2', color=ma2col)

//plot(showema1 and linestyle == 'Candle' ? ta.ema(c_, ema1len) : na, title='EMA 1', color=ema1col)

//plot(showema2 and linestyle == 'Candle' ? ta.ema(c_, ema2len) : na, title='EMA 2', color=ema2col)

i_numLookbackBarsCDV = input(14,title="Number of bars to look back to validate CDV trend")

//cdvEntryLong = o_ < c_ and f_priorBarsSatisfied(o_ < c_,i_numLookbackBarsCDV)

//cdvEntryShort = o_ > c_ and f_priorBarsSatisfied(o_ > c_,i_numLookbackBarsCDV)

cdvEntryConditionLong = o_ <= c_

cdvEntryConditionShort = o_ > c_

cdvEntryLong = cdvEntryConditionLong and ta.barssince(cdvEntryConditionShort) > i_numLookbackBarsCDV

cdvEntryShort = cdvEntryConditionShort and ta.barssince(cdvEntryConditionLong) > i_numLookbackBarsCDV

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = trendMagicEntryLong and sqzmomEntryLong and cdvEntryLong

shortCondition = trendMagicEntryShort and sqzmomEntryShort and cdvEntryShort

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(HIGH)

adxdown = -ta.change(LOW)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=2, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=6, minval=0.01, group='Stop Loss') * 0.01

slLongClose = CLOSE < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = CLOSE > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / CLOSE * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(OPEN) + ',' + str.tostring(HIGH) + ',' + str.tostring(LOW) + ',' + str.tostring(CLOSE) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=false)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + "\n" + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// Draw dashboard table

if showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)

- Stratégie de rupture de l'élan des crypto-monnaies

- Stratégie de combinaison d'indicateurs de stochastique double et de moyenne mobile pondérée par volume

- Tradition de tendance avec double EMA crossover

- Tendance progressive de la moyenne mobile suivant une stratégie

- RSI Momentum Stratégie courte longue

- L'oscillateur stochastique combiné et la stratégie d'inversion 123

- Stratégie sélective de chevauchement par inversion double

- Stratégie de négociation combinée de deux moyennes mobiles inversées et de trois moyennes mobiles à baisse

- Stratégie de négociation stochastique moyenne

- Stratégie de négociation de rupture de force de volatilité

- Stratégie de négociation de la moyenne mobile par écart

- Stratégie de tendance adaptative du canal de Donchian

- Stratégie de négociation à risque contrôlé MACD

- Tendance de l'indice de risque suivant la stratégie

- Stratégie de négociation de la réversion moyenne basée sur la moyenne mobile

- Stratégie de négociation de la réversion moyenne de l'EMA

- Stratégie de négociation combinée multi-indicateurs

- Combinaison de stratégies à plusieurs facteurs

- Les stratégies de vote sont en train de s'arrêter

- Stratégie de stop loss en deux étapes