Stratégie de renversement vers le bas

Auteur:ChaoZhang est là., Date: 15 décembre 2023 11:07:41Les étiquettes:

Résumé

Cette stratégie est basée sur les fonds du marché pour le trading d'inversion. Elle utilise les points les plus bas de l'EMA de 200 jours combinés avec les niveaux de support/résistance de Camarilla pour déterminer les fonds du marché.

La logique de la stratégie

- Calculer le prix le plus bas de l'EMA200Les plus bas de l'EMA de 200 jours Lorsque les prix se ferment en dessous de cette EMA, le marché est considéré comme proche du bas.

- Calculer l'EMA de 9 jours du niveau de support Camarilla 3 (S3), ema_s3_9, comme niveau de support important.

- Calculez également l'EMA de 9 jours du point médian de la Camarilla ema_center_9 comme signal d'inversion.

- Lorsque ema_center_9 traverse ema200Lows, et les 3 dernières barres sont inférieures à ema200Lows, allez long.

- Utilisez l'ATR pour bloquer les profits, en suivant le prix le plus bas.

- Les objectifs de profit sont ema_h4_9 (niveau de résistance de la camarilla 4) et ema_s3_9.

Analyse des avantages

- Le prix le plus bas de l'EMA de 200 jours évite de prendre des positions avant le fond réel.

- Les niveaux de Camarilla combinés avec le point médian identifient les renversements de manière fiable.

- ATR stop loss est plus raisonnable.

Analyse des risques

- Cette stratégie favorise les transactions à court terme.

- Les mouvements importants du marché peuvent entraîner un grand stop loss.

- Les signaux ne sont pas toujours exacts.

Directions d'optimisation

- Considérez l'ajout d'indicateurs tels que le RSI pour compléter les signaux d'inversion.

- Rechercher des paramètres optimaux pour différents produits.

- Explorez l'apprentissage automatique pour une perte d'arrêt ATR dynamique.

Résumé

Cette stratégie identifie les fonds du marché et les retours en arrière en utilisant les bas de l'EMA et les niveaux de Camarilla. Elle bloque les bénéfices avec les arrêts de trail ATR. Dans l'ensemble, elle est assez complète avec une valeur pratique. Des optimisations supplémentaires amélioreront la robustesse.

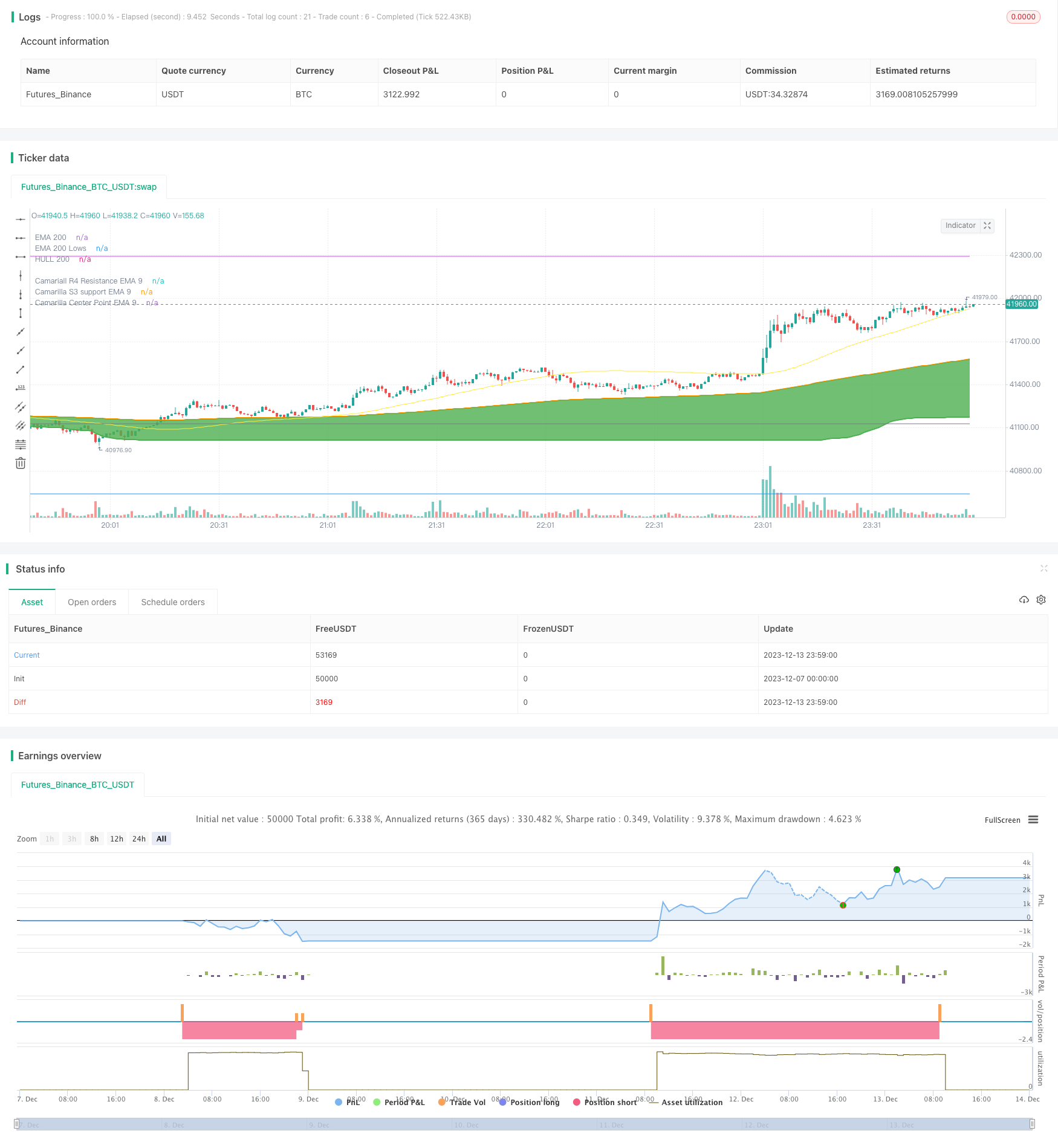

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//Using the lowest of low of ema200, you can find the bottom

//wait for price to close below ema200Lows line

//when pivot

//@version=4

strategy(title="PickingupFromBottom Strategy", overlay=true ) //default_qty_value=10, default_qty_type=strategy.fixed,

//HMA

HMA(src1, length1) => wma(2 * wma(src1, length1/2) - wma(src1, length1), round(sqrt(length1)))

//variables BEGIN

length1=input(200,title="EMA 1 Length")

length2=input(50,title="EMA 2 Length")

length3=input(20,title="EMA 3 Length")

sourceForHighs= input(hlc3, title="Source for Highs", type=input.source)

sourceForLows = input(hlc3, title="Source for Lows" , type=input.source)

hiLoLength=input(7, title="HiLo Band Length")

atrLength=input(14, title="ATR Length")

atrMultiplier=input(3.5, title="ATR Multiplier")

//takePartialProfits = input(true, title="Take Partial Profits (if this selected, RSI 13 higher reading over 80 is considered for partial closing ) ")

ema200=ema(close,length1)

hma200=HMA(close,length1)

////Camarilla pivot points

//study(title="Camarilla Pivots", shorttitle="Camarilla", overlay=true)

t = input(title = "Pivot Resolution", defval="D", options=["D","W","M"])

//Get previous day/week bar and avoiding realtime calculation by taking the previous to current bar

sopen = security(syminfo.tickerid, t, open[1], barmerge.gaps_off, barmerge.lookahead_on)

shigh = security(syminfo.tickerid, t, high[1], barmerge.gaps_off, barmerge.lookahead_on)

slow = security(syminfo.tickerid, t, low[1], barmerge.gaps_off, barmerge.lookahead_on)

sclose = security(syminfo.tickerid, t, close[1], barmerge.gaps_off, barmerge.lookahead_on)

r = shigh-slow

//Calculate pivots

//center=(sclose)

//center=(close[1] + high[1] + low[1])/3

center=sclose - r*(0.618)

h1=sclose + r*(1.1/12)

h2=sclose + r*(1.1/6)

h3=sclose + r*(1.1/4)

h4=sclose + r*(1.1/2)

h5=(shigh/slow)*sclose

l1=sclose - r*(1.1/12)

l2=sclose - r*(1.1/6)

l3=sclose - r*(1.1/4)

l4=sclose - r*(1.1/2)

l5=sclose - (h5-sclose)

//Colors (<ternary conditional operator> expression prevents continuous lines on history)

c5=sopen != sopen[1] ? na : color.red

c4=sopen != sopen[1] ? na : color.purple

c3=sopen != sopen[1] ? na : color.fuchsia

c2=sopen != sopen[1] ? na : color.blue

c1=sopen != sopen[1] ? na : color.gray

cc=sopen != sopen[1] ? na : color.blue

//Plotting

//plot(center, title="Central",color=color.blue, linewidth=2)

//plot(h5, title="H5",color=c5, linewidth=1)

//plot(h4, title="H4",color=c4, linewidth=2)

//plot(h3, title="H3",color=c3, linewidth=1)

//plot(h2, title="H2",color=c2, linewidth=1)

//plot(h1, title="H1",color=c1, linewidth=1)

//plot(l1, title="L1",color=c1, linewidth=1)

//plot(l2, title="L2",color=c2, linewidth=1)

//plot(l3, title="L3",color=c3, linewidth=1)

//plot(l4, title="L4",color=c4, linewidth=2)

//plot(l5, title="L5",color=c5, linewidth=1)////Camarilla pivot points

ema_s3_9=ema(l3, 9)

ema_s3_50=ema(l3, 50)

ema_h4_9=ema(h4, 9)

ema_center_9=ema(center, 9)

plot(ema_h4_9, title="Camariall R4 Resistance EMA 9", color=color.fuchsia)

plot(ema_s3_9, title="Camarilla S3 support EMA 9", color=color.gray, linewidth=1)

//plot(ema_s3_50, title="Camarilla S3 support EMA 50", color=color.green, linewidth=2)

plot(ema_center_9, title="Camarilla Center Point EMA 9", color=color.blue)

plot(hma200, title="HULL 200", color=color.yellow, transp=25)

plotEma200=plot(ema200, title="EMA 200", style=plot.style_linebr, linewidth=2 , color=color.orange)

ema200High = ema(highest(sourceForHighs,length1), hiLoLength)

ema200Low= ema(lowest(sourceForLows,length1), hiLoLength)

ema50High = ema(highest(sourceForHighs,length2), hiLoLength)

ema50Low= ema(lowest(sourceForLows,length2), hiLoLength)

ema20High = ema(highest(sourceForHighs,length3), hiLoLength)

ema20Low= ema(lowest(sourceForLows,length3), hiLoLength)

//plot(ema200High, title="EMA 200 Highs", linewidth=2, color=color.orange, transp=30)

plotEma200Low=plot(ema200Low, title="EMA 200 Lows", linewidth=2, color=color.green, transp=30, style=plot.style_linebr)

//plot(ema50High, title="EMA 50 Highs", linewidth=2, color=color.blue, transp=30)

//plotEma50Low=plot(ema50Low, title="EMA 50 Lows", linewidth=2, color=color.blue, transp=30)

fill(plotEma200, plotEma200Low, color=color.green )

// Drawings /////////////////////////////////////////

//Highlight when centerpont crossing up ema200Low a

ema200LowBuyColor=color.new(color.green, transp=50)

bgcolor(crossover(ema_center_9,ema200Low) and (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low)? ema200LowBuyColor : na)

//ema200LowBuyCondition= (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low)

strategy.entry(id="ema200Low Buy", comment="LE2", qty=2, long=true, when= crossover(ema_center_9,ema200Low) and (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low) ) //or (close>open and low<ema20Low and close>ema20Low) ) ) // // aroonOsc<0

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

sl_val = atrMultiplier * atr(atrLength)

trailing_sl = 0.0

//trailing_sl := max(low[1] - sl_val, nz(trailing_sl[1]))

trailing_sl := strategy.position_size>=1 ? max(low - sl_val, nz(trailing_sl[1])) : na

//draw initil stop loss

//plot(strategy.position_size>=1 ? trailing_sl : na, color = color.blue , style=plot.style_linebr, linewidth = 2, title = "stop loss")

plot(trailing_sl, title="ATR Trailing Stop Loss", style=plot.style_linebr, linewidth=1, color=color.red, transp=30)

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

strategy.close(id="ema200Low Buy", comment="TP1="+tostring(close - strategy.position_avg_price, "####.##"), qty=1, when=abs(strategy.position_size)>=1 and crossunder(close, ema_h4_9) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89

strategy.close(id="ema200Low Buy", comment="TP2="+tostring(close - strategy.position_avg_price, "####.##"), qty=1, when=abs(strategy.position_size)>=1 and crossunder(close, ema_s3_9) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89

Plus de

- Stratégie d'inversion à long terme du MACD

- Stratégie de suivi des tendances à deux délais

- Stratégie de rupture avec confirmation sur plusieurs délais

- Stratégie complète des modèles de chandeliers multiples

- Stratégie de rupture de consolidation

- Quatre stratégies croisées de l'EMA

- Stratégie de négociation quantitative basée sur l'opération de moyenne mobile mensuelle et trimestrielle

- Une stratégie de combinaison de facteurs multiples avec moyenne mobile adaptative

- Stratégie de négociation à court terme de l'EMA Golden Cross

- Heiken Ashi et la stratégie de combinaison de Super Trend

- Stratégie de négociation de l'oscillateur dynamique

- WMX Stratégie de pivot de renversement des fractals Williams

- Stratégie longue et courte de croisement stochastique

- Le MACD linéaire débloque la magie de la régression linéaire dans le tradingView

- Stratégie du chandelier de renversement de pivot

- Valeria 181 Robot Stratégie améliorée 2.4

- Stratégie de RSI stochastique pour le trading de crypto-monnaie

- Stratégie de suivi de la tendance à double renversement

- Différence de convergence moyenne mobile pondérée par volume

- Stratégie combinée d'inversion basée sur un facteur de redressement stochastique et un signal clé d'inversion