La valeur de l'actif de l'entreprise est calculée sur la base de la valeur de l'actif de la société.

Auteur:ChaoZhang est là., Date: 2023-12-20 14:06:18 Je suis désoléLes étiquettes:

Résumé

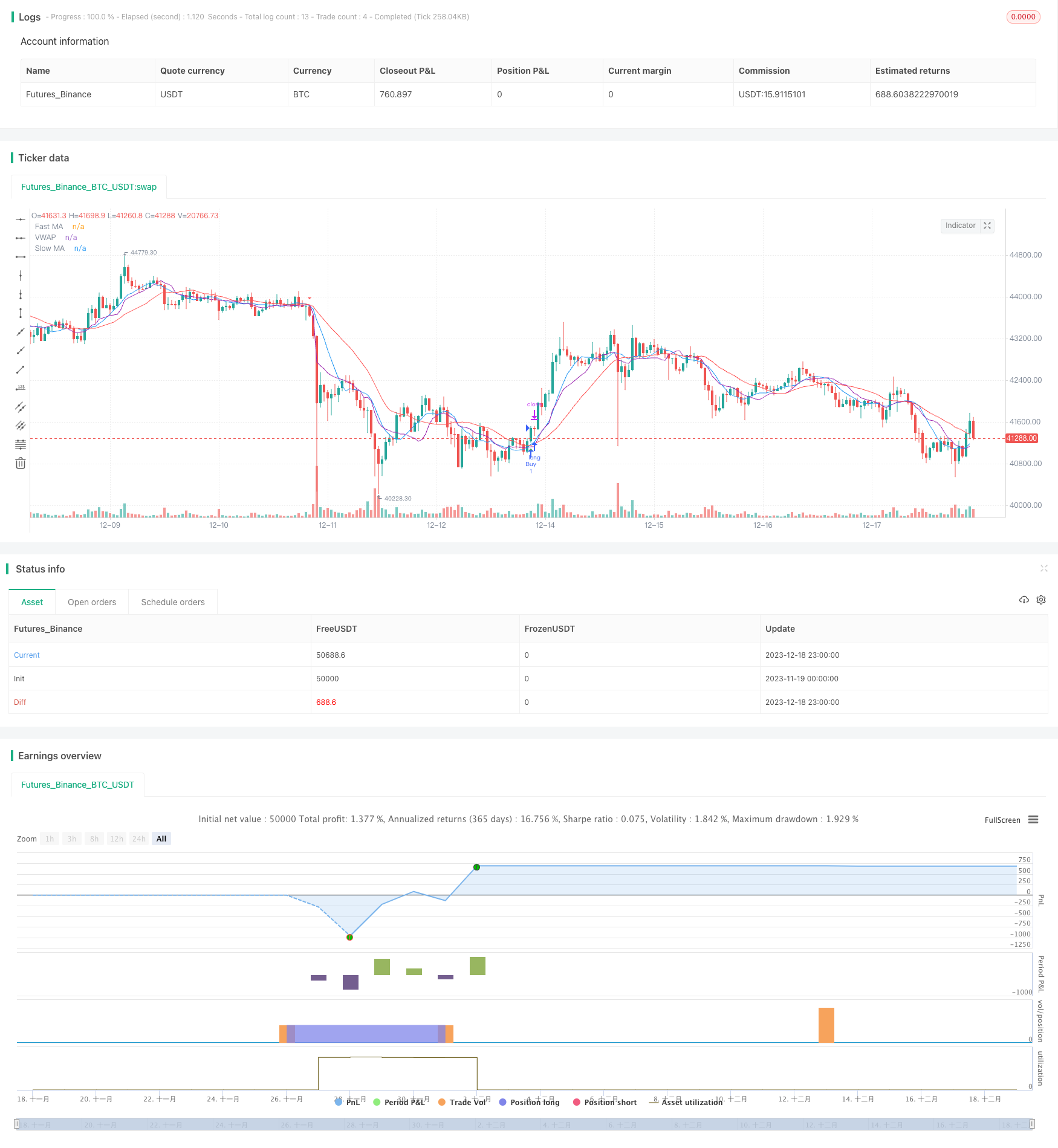

Cette stratégie identifie les croisements entre la moyenne mobile rapide, la moyenne mobile lente et le prix moyen pondéré par volume (VWAP) pour capturer les mouvements de prix potentiels.

La logique de la stratégie

La stratégie combine les forces des moyennes mobiles et du VWAP. Les moyennes mobiles peuvent filtrer efficacement le bruit du marché et déterminer la direction de la tendance. Le VWAP reflète plus précisément les intentions de la grande monnaie.

Analyse des avantages

- Le double filtre MA réduit les faux signaux

- Le VWAP juge avec précision les intentions des gros riches

- Paramètres d'AM flexibles adaptés aux différentes périodes

- Contrôle efficace des risques avec stop loss/take profit

Analyse des risques

- Les marchés à piqûre peuvent générer plusieurs faux signaux

- Les paramètres VWAP inexacts ne permettent pas de juger de l'intention du fonds

- Stop-loss trop serré incapable de suivre les tendances, trop lâche risque excès

Directions d'optimisation

- Optimiser les paramètres MA et VWAP pour les différentes conditions du marché

- Signaux de filtrage supplémentaires avec RSI

- Ratios dynamiques stop loss/take profit

Conclusion

Cette stratégie intègre les atouts des moyennes mobiles et du VWAP, identifie les signaux croisés grâce à un double filtrage et contrôle efficacement les risques avec des mécanismes de stop loss/take profit flexibles.

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Flexible MA VWAP Crossover Strategy with SL/TP", shorttitle="MA VWAP Crossover", overlay=true)

// Input parameters

fast_length = input(9, title="Fast MA Length", minval=1)

slow_length = input(21, title="Slow MA Length", minval=1)

vwap_length = input(14, title="VWAP Length", minval=1)

// Stop Loss and Take Profit inputs

stop_loss_percent = input(1.0, title="Stop Loss (%)", minval=0.1, maxval=5.0, step=0.1)

take_profit_percent = input(2.0, title="Take Profit (%)", minval=1.0, maxval=10.0, step=0.1)

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

vwap = sma(close * volume, vwap_length) / sma(volume, vwap_length)

// Buy and sell conditions

buy_condition = crossover(fast_ma, vwap) and crossover(fast_ma, slow_ma)

sell_condition = crossunder(fast_ma, vwap) and crossunder(fast_ma, slow_ma)

// Plot the moving averages

plot(fast_ma, title="Fast MA", color=color.blue)

plot(slow_ma, title="Slow MA", color=color.red)

plot(vwap, title="VWAP", color=color.purple)

// Plot buy and sell signals

plotshape(buy_condition, style=shape.triangleup, location=location.belowbar, color=color.green, title="Buy Signal")

plotshape(sell_condition, style=shape.triangledown, location=location.abovebar, color=color.red, title="Sell Signal")

// Define stop loss and take profit levels

var float stop_loss_price = na

var float take_profit_price = na

if (buy_condition)

stop_loss_price := close * (1 - stop_loss_percent / 100)

take_profit_price := close * (1 + take_profit_percent / 100)

// Strategy entry and exit with flexible SL/TP

strategy.entry("Buy", strategy.long, when = buy_condition)

if (sell_condition)

strategy.exit("SL/TP", from_entry = "Buy", stop = stop_loss_price, limit = take_profit_price)

Plus de

- Stratégie de percée de la moyenne inverse

- Stratégie d'inversion de la moyenne mobile double

- Stratégie logarithmique de prévision des prix

- Stratégie de croisement de moyenne mobile simple

- Les bandes de Bollinger et l'indicateur RSI suivant la tendance de la stratégie

- Stratégie d'interconnexion méticuleuse de l'EMA

- Tendance suivant une stratégie basée sur la moyenne mobile

- Stratégie de négociation RSI

- Système de négociation de tendance Turtle

- Stratégie de négociation croisée des moyennes mobiles multiples

- Stratégie d'action des prix basée sur la bande de Bollinger

- Stratégie de rupture de la moyenne mobile à portée double

- Stratégie de grille avec lignes moyennes mobiles

- Stratégie de suivi intelligent à moyenne mobile double

- La stratégie de rupture de tendance de l'indice RSI-EMA

- Stratégie de contre-test de l'oscillateur de prévision des points pivots

- Système de négociation intégré Ichimoku Keltner basé sur une stratégie de moyenne mobile

- Stratégie de négociation à double traçage

- Une stratégie de trading basée sur Ichimoku Kinko Hyo

- Tendance basée sur les indicateurs de l'AO à la suite de la stratégie