概述

逆转均值突破策略是一种多因子组合的趋势反转策略。它结合了移动平均线、布林带、CCI指标、RSI指标等多种技术指标,旨在捕捉价格从超买超卖区域反转的机会。该策略同时结合了正则散度分析,可检测当前趋势与之前是否一致,从而避免交易假突破。

策略原理

该策略的核心逻辑是,当价格从超买超卖区域反转时,采取适当做空做多。具体来说,策略从四个方面判断反转机会:

CCI指标或动量指标发出金叉死叉信号,判断超买超卖。

RSI指标判断是否处于超买超卖区域。规定RSI高于65为超买区,低于35为超卖区。

利用布林带上下轨,判断价格是否偏离常态区域。当价格重新进入常态区域,可能反转。

检测RSI指标的正则散度,避免追逐假突破。

满足上述条件时,策略会采取反方向入场。并设置止损位,控制风险。

策略优势

该策略最大的优势在于组合多个指标判断反转机会,平均获胜率较高。具体来说,主要有以下几点:

多因子判断,可靠性较高。不会单纯依赖单一指标,减少了误判概率。

反转交易获胜概率大。趋势反转是一种较为可靠的交易方式。

检测散度,避免追逐假突破,减少系统性风险。

止损机制控制风险。可以最大限度避免单笔损失过大。

风险及解决

该策略也存在一些风险,主要集中在以下几点:

反转时间点判断不准。导致止损被触发。可适当扩大止损范围。

布林带参数设置不当,将正常价格当成异常。应该配合市场波动率设置参数。

交易次数可能较多。适当扩大CCI等判断参数范围,减少交易频率。

多空平衡可能差异大。应根据历史数据判断指标参数是否合理。

优化方向

该策略可从以下几个方向进行优化:

利用机器学习算法自动优化指标参数。避免人工经验误差。

增加页岩指标、幅度指标等判断超买超卖强度。

增加交易量指标判断反转可靠性。例如成交量,持仓 Daten 等。

结合区块链数据判断市场情绪面。提高策略的适应性。

引入自适应止损机制。根据市场波动率变化调整止损位。

总结

逆转均值突破策略综合运用多种指标判断反转机会。在控制风险的前提下,其获胜概率较大。该策略有很强的实用性,也有进一步优化的空间。如果参数设置得当,应能获得较为理想的效果。

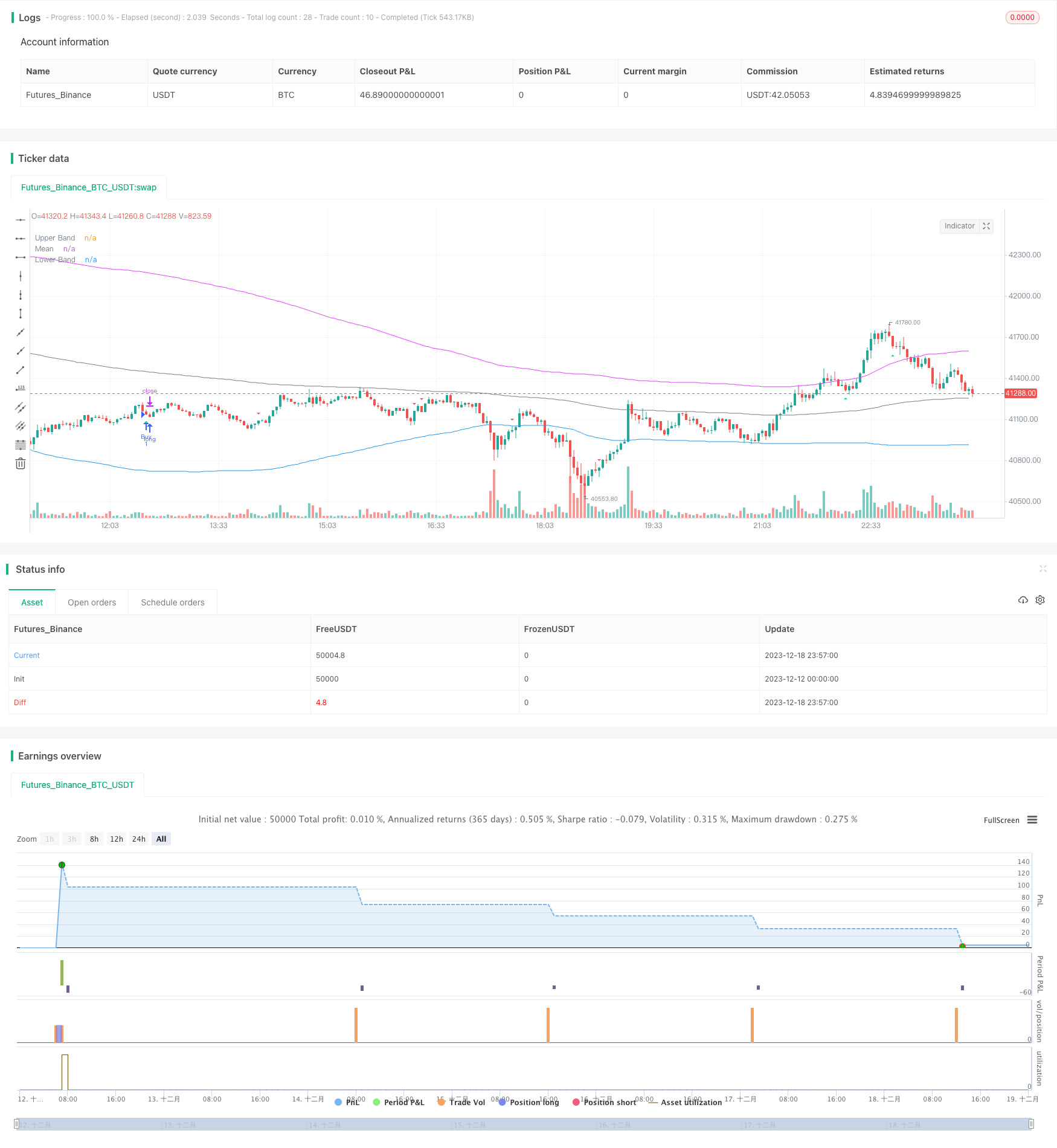

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-19 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='BroTheJo Strategy', shorttitle='BTJ INV', overlay=true)

// Input settings

stopLossInPips = input.int(10, minval=0, title='Stop Loss (in Pips)')

ccimomCross = input.string('CCI', 'Entry Signal Source', options=['CCI', 'Momentum'])

ccimomLength = input.int(10, minval=1, title='CCI/Momentum Length')

useDivergence = input.bool(false, title='Find Regular Bullish/Bearish Divergence')

rsiOverbought = input.int(65, minval=1, title='RSI Overbought Level')

rsiOversold = input.int(35, minval=1, title='RSI Oversold Level')

rsiLength = input.int(14, minval=1, title='RSI Length')

plotMeanReversion = input.bool(true, 'Plot Mean Reversion Bands on the chart')

emaPeriod = input(200, title='Lookback Period (EMA)')

bandMultiplier = input.float(1.6, title='Outer Bands Multiplier')

// CCI and Momentum calculation

momLength = ccimomCross == 'Momentum' ? ccimomLength : 10

mom = close - close[momLength]

cci = ta.cci(close, ccimomLength)

ccimomCrossUp = ccimomCross == 'Momentum' ? ta.cross(mom, 0) : ta.cross(cci, 0)

ccimomCrossDown = ccimomCross == 'Momentum' ? ta.cross(0, mom) : ta.cross(0, cci)

// RSI calculation

src = close

up = ta.rma(math.max(ta.change(src), 0), rsiLength)

down = ta.rma(-math.min(ta.change(src), 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

oversoldAgo = rsi[0] <= rsiOversold or rsi[1] <= rsiOversold or rsi[2] <= rsiOversold or rsi[3] <= rsiOversold

overboughtAgo = rsi[0] >= rsiOverbought or rsi[1] >= rsiOverbought or rsi[2] >= rsiOverbought or rsi[3] >= rsiOverbought

// Regular Divergence Conditions

bullishDivergenceCondition = rsi[0] > rsi[1] and rsi[1] < rsi[2]

bearishDivergenceCondition = rsi[0] < rsi[1] and rsi[1] > rsi[2]

// Mean Reversion Indicator

meanReversion = plotMeanReversion ? ta.ema(close, emaPeriod) : na

stdDev = plotMeanReversion ? ta.stdev(close, emaPeriod) : na

upperBand = plotMeanReversion ? meanReversion + stdDev * bandMultiplier : na

lowerBand = plotMeanReversion ? meanReversion - stdDev * bandMultiplier : na

// Entry Conditions

prevHigh = ta.highest(high, 1)

prevLow = ta.lowest(low, 1)

shortEntryCondition = ccimomCrossUp and oversoldAgo and (not useDivergence or bullishDivergenceCondition) and (prevHigh >= meanReversion) and (prevLow >= meanReversion)

longEntryCondition = ccimomCrossDown and overboughtAgo and (not useDivergence or bearishDivergenceCondition) and (prevHigh <= meanReversion) and (prevLow <= meanReversion)

// Plotting

oldShortEntryCondition = ccimomCrossUp and oversoldAgo and (not useDivergence or bullishDivergenceCondition)

oldLongEntryCondition = ccimomCrossDown and overboughtAgo and (not useDivergence or bearishDivergenceCondition)

plotshape(oldLongEntryCondition, title='BUY', style=shape.triangleup, text='B', location=location.belowbar, color=color.new(color.lime, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(oldShortEntryCondition, title='SELL', style=shape.triangledown, text='S', location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// Strategy logic

if (longEntryCondition)

stopLoss = close - stopLossInPips

strategy.entry("Buy", strategy.long)

strategy.exit("exit", "Buy", stop=stopLoss)

if (shortEntryCondition)

stopLoss = close + stopLossInPips

strategy.entry("Sell", strategy.short)

strategy.exit("exit", "Sell", stop=stopLoss)

// Close all open positions when outside of bands

closeAll = (high >= upperBand) or (low <= lowerBand)

if (closeAll)

strategy.close_all("Take Profit/Cut Loss")

// Plotting

plot(upperBand, title='Upper Band', color=color.fuchsia, linewidth=1)

plot(meanReversion, title='Mean', color=color.gray, linewidth=1)

plot(lowerBand, title='Lower Band', color=color.blue, linewidth=1)