Stratégie quantitative d'oscillation de soutien et de résistance

Auteur:ChaoZhang est là., Date: 2024-01-25 15:53:06 La date est fixée àLes étiquettes:

Résumé

Cette stratégie combine la stratégie de croisement RSI avec une stratégie de stop loss optimisée pour obtenir un contrôle logique précis et un stop loss et un profit précis.

Principe de stratégie

- L'indicateur RSI détermine l'aire de surachat et de survente.

- Introduit la reconnaissance des modèles de chandeliers pour aider à juger les signaux de tendance afin d'éviter les mauvais métiers.

- Les lignes SMA aident à déterminer la direction de la tendance.

Analyse des avantages

- L'optimisation du paramètre RSI détermine précisément la zone de surachat et de survente pour éviter les mauvais échanges.

- Optimisation des paramètres STO, réglage de la douceur filtre le bruit et améliore la qualité du signal.

- La technologie Heikin-Ashi a été introduite pour reconnaître les changements de direction des chandeliers et assurer des signaux de trading précis.

- La stratégie de stop loss garantit un profit maximal pour chaque transaction.

Analyse des risques

- Faire face à un plus grand risque lorsque le marché continue de baisser.

- Une fréquence de négociation élevée augmente les coûts de négociation et les coûts de glissement.

Optimisation de la stratégie

- Ajustez les paramètres du RSI, optimisez le jugement sur les surachats.

- Ajustez les paramètres STO, la douceur et la période pour améliorer la qualité du signal.

- Ajustez la période de moyenne mobile pour optimiser le jugement de la tendance.

- Mettre en place davantage d'indicateurs techniques pour améliorer la précision du signal.

- Optimiser le taux de stop loss pour réduire le risque de transaction unique.

Conclusion

La stratégie intègre les avantages de plusieurs indicateurs techniques traditionnels. Grâce à l'optimisation des paramètres et au raffinement de la logique, elle équilibre la qualité du signal de trading et le stop loss. Avec une certaine polyvalence et une rentabilité constante. Une optimisation supplémentaire peut améliorer le taux de gain et la rentabilité.

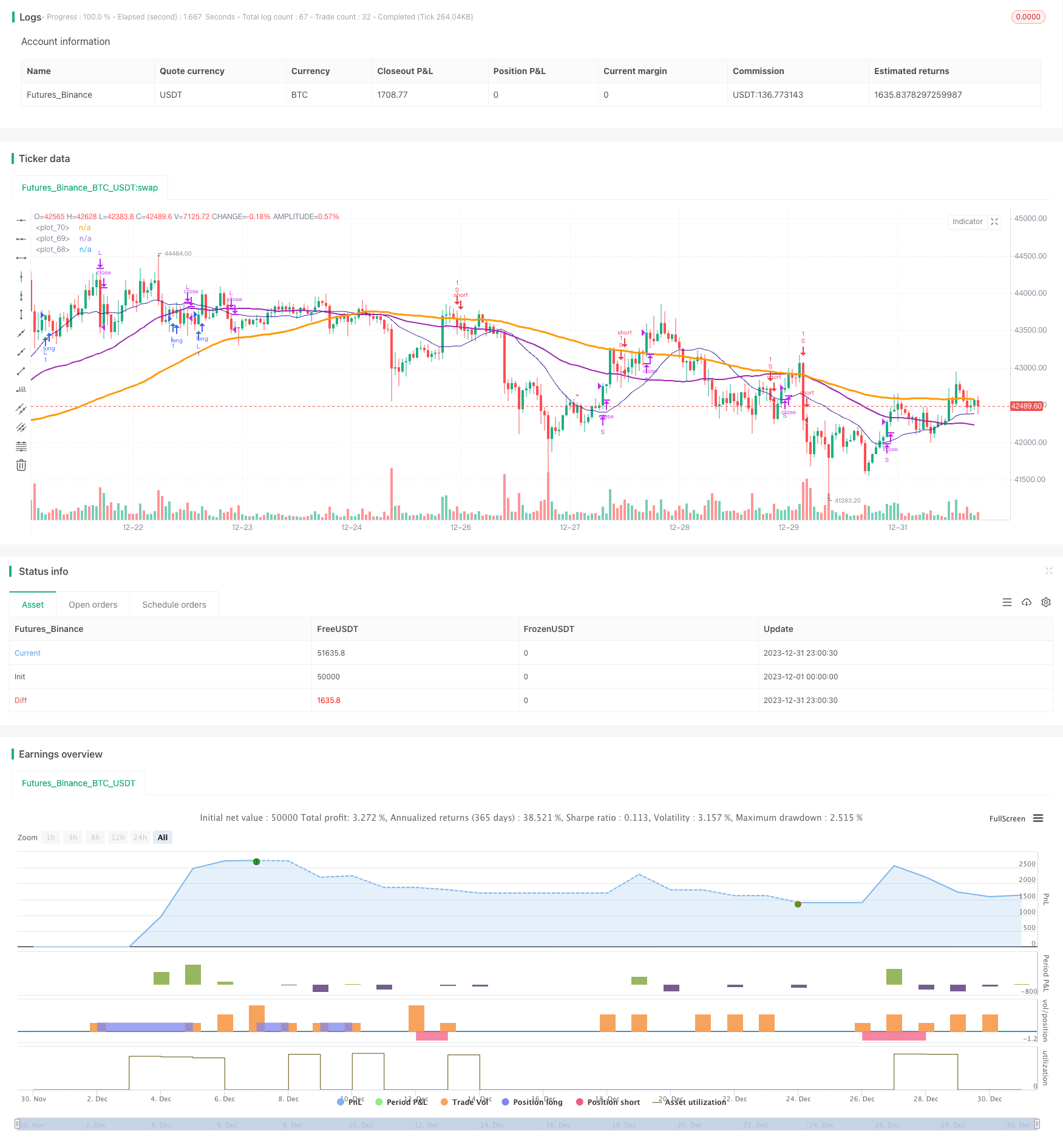

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true)

strategy(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true )

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

overbought = input(80, minval=1)

oversold = input(20, minval=1)

smaLengh = input(100, minval=1)

smaLengh2 = input(50, minval=1)

smaLengh3 = input(20, minval=1)

src = input(close, title="RSI Source")

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testPeriod() =>

time >= testPeriodStart ? true : false

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

crossBuy = crossover(k, d) and k < oversold

crossSell = crossunder(k, d) and k > overbought

dcLower = lowest(low, 10)

dcUpper = highest(high, 10)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashiPositive = heikinashi_close >= heikinashi_open

heikinashiBuy = heikinashiPositive == true and heikinashiPositive[1] == false and heikinashiPositive[2] == false

heikinashiSell = heikinashiPositive == false and heikinashiPositive[1] == true and heikinashiPositive[2] == true

//plotshape(heikinashiBuy, style=shape.arrowup, color=green, location=location.belowbar, size=size.tiny)

//plotshape(heikinashiSell, style=shape.arrowdown, color=red, location=location.abovebar, size=size.tiny)

buy = (crossBuy == true or crossBuy[1] == true or crossBuy[2] == true) and (heikinashiBuy == true or heikinashiBuy[1] == true or heikinashiBuy[2] == true)

sell = (crossSell == true or crossSell[1] == true or crossSell[2] == true) and (heikinashiSell == true or heikinashiSell[1] == true or heikinashiSell[2] == true)

mult = timeframe.period == '15' ? 4 : 1

mult2 = timeframe.period == '240' ? 0.25 : mult

movingAverage = sma(close, round(smaLengh))

movingAverage2 = sma(close, round(smaLengh2))

movingAverage3 = sma(close, round(smaLengh3))

uptrend = movingAverage < movingAverage2 and movingAverage2 < movingAverage3 and close > movingAverage

downtrend = movingAverage > movingAverage2 and movingAverage2 > movingAverage3 and close < movingAverage

signalBuy = (buy[1] == false and buy[2] == false and buy == true) and uptrend

signalSell = (sell[1] == false and sell[2] == false and sell == true) and downtrend

takeProfitSell = (buy[1] == false and buy[2] == false and buy == true) and uptrend == false

takeProfitBuy = (sell[1] == false and sell[2] == false and sell == true) and uptrend

plotshape(signalBuy, style=shape.triangleup, color=green, location=location.belowbar, size=size.tiny)

plotshape(signalSell, style=shape.triangledown, color=red, location=location.abovebar, size=size.tiny)

plot(movingAverage, linewidth=3, color=orange, transp=0)

plot(movingAverage2, linewidth=2, color=purple, transp=0)

plot(movingAverage3, linewidth=1, color=navy, transp=0)

alertcondition(signalBuy, title='Signal Buy', message='Signal Buy')

alertcondition(signalSell, title='Signal Sell', message='Signal Sell')

strategy.close("L", when=dcLower[1] > low)

strategy.close("S", when=dcUpper[1] < high)

strategy.entry("L", strategy.long, 1, when = signalBuy and testPeriod() and uptrend)

strategy.entry("S", strategy.short, 1, when = signalSell and testPeriod() and uptrend ==false)

//strategy.exit("Exit Long", from_entry = "L", loss = 25000000, profit=25000000)

//strategy.exit("Exit Short", from_entry = "S", loss = 25000000, profit=25000000)

Plus de

- Stratégie de tendance à la dynamique

- Stratégie quantitative de la moyenne mobile de l'élan

- Stratégie combinée de double inversion de la moyenne mobile et de l'arrêt de traînée ATR

- Stratégie de négociation des contrats à terme à effet de levier Martingale

- Stratégie de reprise de l' élan

- Prédiction à deux bougies stratégie de clôture

- Stratégie de négociation de suivi des supertendances stochastiques avec arrêt des pertes

- Tendance à la double inversion de la bande oscillante suivant la stratégie

- Suivre la tendance en suivant une stratégie basée sur l'IMD et l'ISR

- Stratégie de suivi des tendances avec 3 EMA, DMI et MACD

- Stratégie révolutionnaire à double indicateur

- Stratégie du système de négociation Pete Wave

- Stratégie quantitative basée sur la pondération exponentielle de la moyenne mobile et du volume

- Stratégie d' Origix Ashi basée sur une moyenne mobile lisse

- Stratégie du scanner de tendance macro de BlackBit Trader XO

- Tendance de l'ADX du pétrole brut à la suite de la stratégie

- Stratégie de négociation par MT-coordination

- Stratégie combinée d'inversion des doubles facteurs et d'amélioration de la tendance du volume des prix

- Stratégie de croisement de l'angle de tendance et de la moyenne mobile