Plusieurs indicateurs suivent la stratégie

Auteur:ChaoZhang est là.Les étiquettes:

Résumé

La logique de la stratégie

La stratégie se compose de deux parties:

- 123 Indicateur d'inversion

- Indicateur Qstick

Cet indicateur évalue la force des taureaux et des ours en calculant la moyenne mobile simple de la différence entre le prix d'ouverture et le prix de clôture.

Si Qstick traverse au-dessus de la ligne zéro, il indique une dynamique haussière croissante et génère un signal d'achat.

La stratégie Multiple Indicators Follow examine ensuite de manière exhaustive les signaux de trading de l'indicateur 123 Reversal et de l'indicateur Qstick.

Analyse des avantages

En outre, cette stratégie n'entre sur le marché que lorsque les signaux des deux indicateurs sont cohérents, ce qui permet de contrôler efficacement les risques et de prévenir les anomalies dans la différence entre les deux indicateurs.

Risques et solutions

- La différence de temps dans la génération de signal entre les indicateurs ne peut pas correspondre parfaitement

- Différence anormale entre les indicateurs à l'origine d'une survente

Peut définir une période de conservation minimale pour éviter d'annuler et de créer des commandes fréquemment.

Directions d'optimisation

-

Optimiser les paramètres de longueur des deux indicateurs pour trouver des combinaisons optimales de paramètres

-

Ajouter une stratégie de stop loss

Conclusion

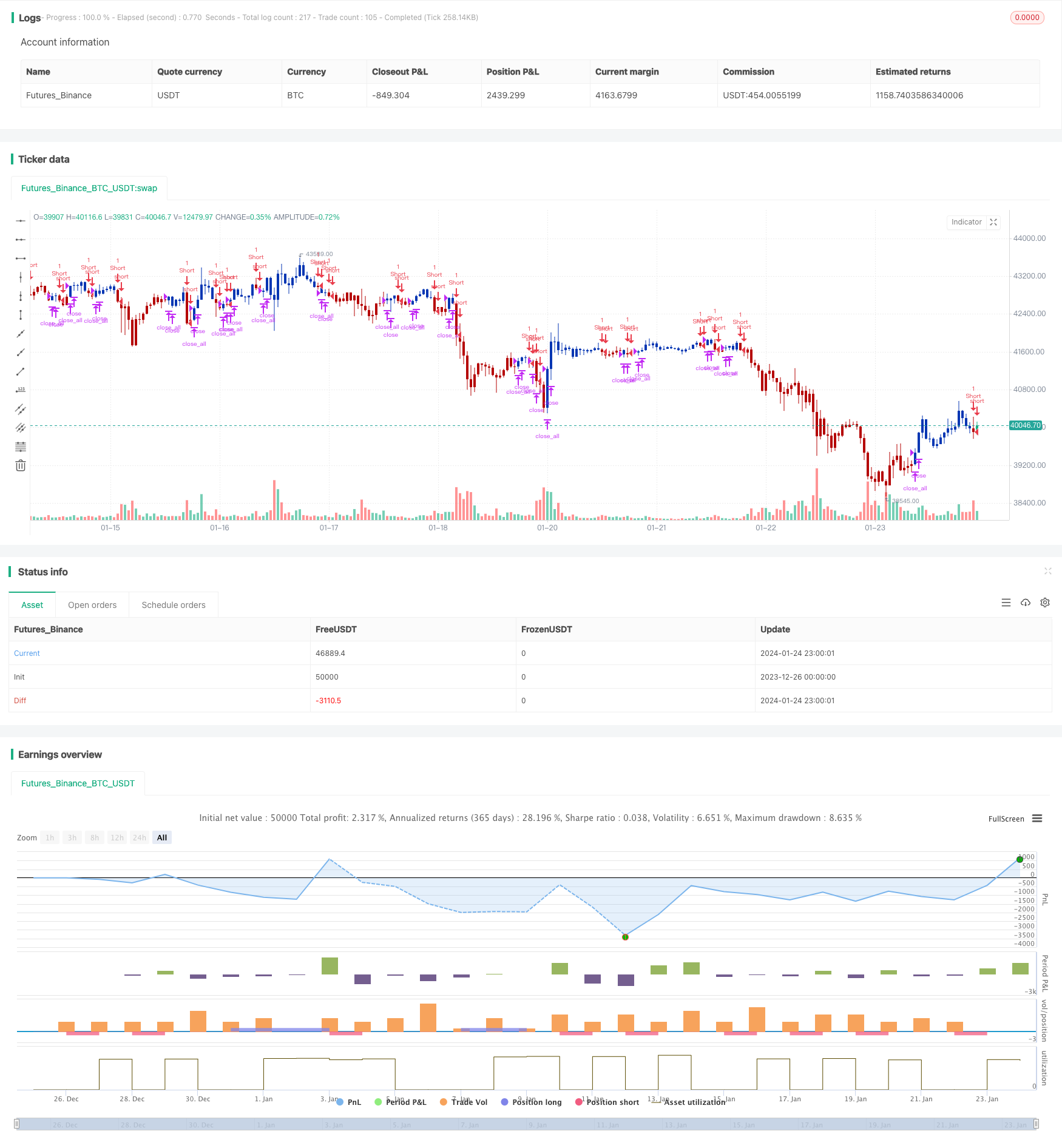

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 24/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// A technical indicator developed by Tushar Chande to numerically identify

// trends in candlestick charting. It is calculated by taking an 'n' period

// moving average of the difference between the open and closing prices. A

// Qstick value greater than zero means that the majority of the last 'n' days

// have been up, indicating that buying pressure has been increasing.

// Transaction signals come from when the Qstick indicator crosses through the

// zero line. Crossing above zero is used as the entry signal because it is indicating

// that buying pressure is increasing, while sell signals come from the indicator

// crossing down through zero. In addition, an 'n' period moving average of the Qstick

// values can be drawn to act as a signal line. Transaction signals are then generated

// when the Qstick value crosses through the trigger line.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Qstick(Length) =>

pos = 0.0

xR = close - open

xQstick = sma(xR, Length)

pos:= iff(xQstick > 0, 1,

iff(xQstick < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Qstick Indicator", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Qstick Indicator ----")

LengthQ = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posQstick = Qstick(LengthQ)

pos = iff(posReversal123 == 1 and posQstick == 1 , 1,

iff(posReversal123 == -1 and posQstick == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Stratégie de négociation automatisée de la vague B du chiffre de marché

- Stratégie clé de contre-test

- Stratégie de canal à bas prix à bas prix V.1

- Stratégie de négociation de renversement de l'élan

- Stratégie de canal de régression linéaire adaptative

- Stratégie croisée zéro différence moyenne mobile

- Une tendance solide à la suite d'une stratégie

- Traverser la tendance de la moyenne mobile des prix selon la stratégie

- Stratégie de rupture à double EMA Golden Cross

- Stratégie de tendance progressive de BB KC

- Stratégie de suivi automatique à triple SMA

- Stratégie de négociation de positions sur les contrats à terme sur Bitcoin

- EMA des prix avec optimisation stochastique basée sur l'apprentissage automatique

- La stratégie de rupture dynamique de Bollinger

- Stratégie de moyenne mobile à retraite à deux ans

- Stratégie de négociation à moyenne mobile double