Stratégie de suivi de tendance RSI Stop Loss

Aperçu

Il s’agit d’une stratégie de trading quantitative qui utilise le RSI pour déterminer la tendance et mettre en place un stop loss. Cette stratégie est combinée avec le RSI pour déterminer la direction de la tendance du marché et avec le stop loss dynamique pour bloquer les bénéfices et minimiser les risques.

Principe de stratégie

Cette stratégie consiste à déterminer la direction de la tendance du marché en fonction de l’indicateur RSI. Lorsque l’indicateur RSI franchit la ligne de basse position, le marché est en tendance à la hausse.

En même temps, la stratégie définit un stop-loss flottant en suivant le prix d’ouverture de chaque position. Pour les ordres multiples, un certain pourcentage du prix d’ouverture de position est défini comme une ligne de stop-loss, tandis que pour les ordres blancs, un certain pourcentage du prix d’ouverture de position est défini comme une ligne de stop-loss. Lorsque le prix touche la ligne de stop-loss, la stratégie prend automatiquement un stop-loss ou un stop-loss.

Avantages stratégiques

- L’indicateur RSI est utilisé pour déterminer l’orientation des tendances du marché et éviter les périodes de reprise.

- La mise en place d’un stop-loss flottant, permettant de verrouiller les bénéfices de manière flexible et de contrôler efficacement les risques;

- Les paramètres RSI et le ratio stop-loss peuvent être ajustés et optimisés par des entrées externes.

Risque stratégique

- L’indicateur RSI est en retard et risque de manquer le point de conversion de la tendance à court terme;

- Le câble d’arrêt de perte trop près peut être percé.

Direction d’optimisation

- Il est possible de tester l’efficacité de l’indicateur RSI sur différents cycles.

- Il est possible de tester différentes combinaisons de paramètres pour trouver le meilleur ratio de stop-loss.

- Des indicateurs additionnels peuvent être ajoutés pour juger le signal de filtrage.

Résumer

La stratégie dans son ensemble est une stratégie de trading quantitative qui utilise le RSI pour suivre la tendance et s’accompagne d’un stop-loss flottant. Comparée à la stratégie de trading sur un seul indicateur, la stratégie fait mieux en matière de contrôle des risques et permet de verrouiller efficacement les bénéfices.

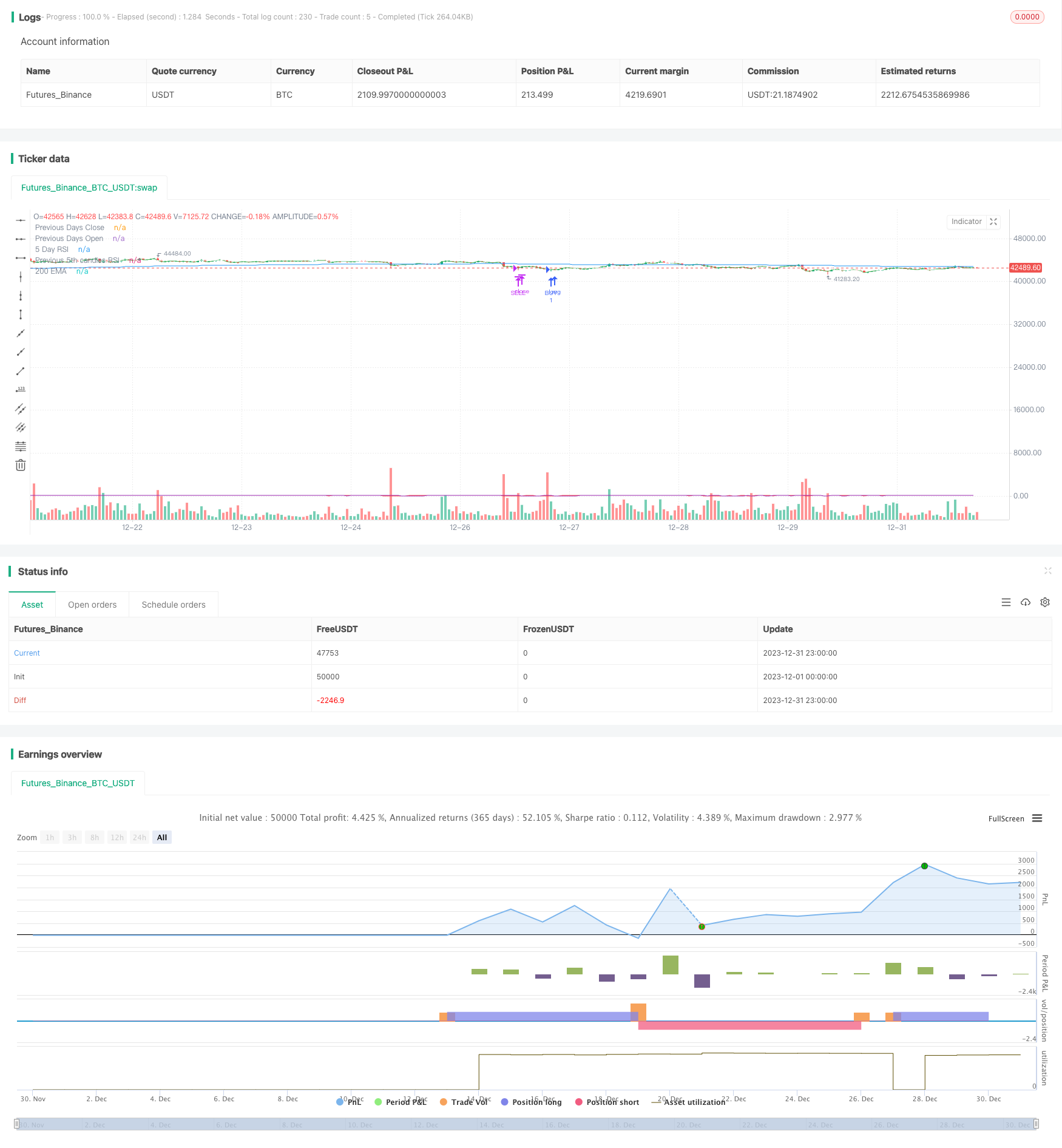

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©chewyScripts.

//@version=5

strategy("96er RSI+200EMA Strategy + Alerts", overlay=true, shorttitle = "The old 96er - RSI5 + 200 EMA")

//,use_bar_magnifier=false

// This works best on a small account $100, with 50% of equity and up to 10 max open trades.

// 96% Profitable, turns $100 into $350 in 1 month. very few losses. super happy with it.

// So far it triples the account on a 1m chart in 1 month back testing on the SEI-USD pair.

// I did not test on FX pairs or other instruments.

// had some issues with the inputs not working so had to hard code some, also the lastClose var sometimes breaks and starts following every candle, not sure why.

in_r1 = input.int(8,"5 day input or RSI1", group = "Signals")

in_lowerRSI = input.int(28,"RSI Lower", group = "Signals")

in_upperRSI = input.int(72,"RSI Upper ", group = "Signals")

in_emaperiod = input.int(200,"EMA Period", group = "Signals")

in_daysback = input.int(1,"Look back days for close/open", group = "Signals")

in_openOrders = input.int(5,"max open orders",tooltip = "Be careful, to high and you will get margin called!! 5 is probably the highest you should go", group = "Order Controls")

in_buybreakout = input.int(40,"Buy breakout range", group = "Order Controls")

in_buyTP = input.float(1.1500,"Buy TP: 1+TP %, .05 seems to work well.", group = "TPSL")

in_sellTP = input.float(0.9750, "Sell TP: 1-TP%. .025 seems to work well. ", group = "TPSL")

in_useAlerts = input.bool(false,"Turns on Buy/Sell Alerts",group = "Alerts")

in_useCustomAlertMSG = input.bool(false,"Use default Buy/Sell or the messages below",group = "Alerts")

in_alertBuySignalTxt = input("Buy","Buy signal API/TXT message template", tooltip = "Review the UserGuid on JSON varibles in alerts", group = "Alerts")

in_alertSellSignalTxt = input("Sell","Sell signal API/TXT message template", tooltip = "Review the UserGuid on JSON varibles in alerts", group = "Alerts")

simple int rsi5 = in_r1

// 3 rsi strategy , when all of them are overbought we sell, and vice versa

rsi7 = ta.rsi(close,rsi5)

[lastOpen, lastClose] = request.security(syminfo.tickerid, "D", [open,close], lookahead = barmerge.lookahead_on)

rsi3 = ta.rsi(close[5],rsi5)

ma = ta.ema(close,in_emaperiod)

plot(rsi7,"5 Day RSI",color.red)

plot(lastClose,"Previous Days Close",color.green)

plot(lastOpen,"Previous Days Open",color.white)

plot(rsi3,"Previous 5th candles RSI",color.purple)

plot(ma,"200 EMA",color.blue)

//sell = ta.crossunder(rsi7,70) and ta.crossunder(rsi14,70) and ta.crossunder(rsi21,70)

//buy = ta.crossover(rsi7,in_lowerRSI) and close < ma and rsi3 <= in_upperRSI and strategy.opentrades < in_openOrders

//sell = ta.crossunder(rsi7,in_upperRSI) and close > ma and rsi3 >= in_lowerRSI3 and strategy.opentrades < in_openOrders

//buy condition

buy = ta.crossover(rsi7,in_lowerRSI) and close < ma and close < lastClose and strategy.opentrades < in_openOrders

// sell condition

sell = ta.crossunder(rsi7,in_upperRSI) and close > ma and close > lastClose and strategy.opentrades < in_openOrders

var lastBuy = close

var lastSell = close

//var buyLabel = label.new(na,na,yloc = yloc.belowbar, style = label.style_none, textcolor = color.green, size = size.normal)

//var sellLabel = label.new(na,na,yloc = yloc.abovebar, style = label.style_none, textcolor = color.red, size = size.normal)

if (buy)

strategy.entry("BUY", strategy.long,alert_message = "Buy @"+str.tostring(close))

lastBuy := close

//buyLabel := label.new(na,na,yloc = yloc.belowbar, style = label.style_none, textcolor = color.green, size = size.normal)

//label.set_x(buyLabel,bar_index)

//label.set_y(buyLabel,low)

//label.set_text(buyLabel,"Buy!!@ " +str.tostring(lastBuy) + "\n TP: " + str.tostring(lastBuy*in_buyTP) + "\n↑")

if(not in_useAlerts)

alert("Buy")

//label.delete(buyLabel)

if ((close >= lastBuy*in_buyTP ) or (rsi7 > in_buybreakout) and close >= lastClose and (close >= lastClose*in_buyTP or close >= lastBuy*in_buyTP ) )

//label.new(bar_index,na,"TP!!@ " +str.tostring(close), yloc = yloc.abovebar, style = label.style_none, textcolor = color.green, size = size.normal)

strategy.close("BUY", "BUY Exit",alert_message = "Buy Exit: TP @" +str.tostring(close) + " OR TP: " + str.tostring(lastBuy*in_buyTP))

if(not in_useAlerts)

alert("Buy Exit")

if (sell)

strategy.entry("SELL", strategy.short, alert_message = "Sell @ " + str.tostring(close))

lastSell := close

//sellLabel := label.new(na,na,yloc = yloc.abovebar, style = label.style_none, textcolor = color.red, size = size.normal)

//label.set_x(sellLabel,bar_index)

//label.set_y(sellLabel,high)

//label.set_text(sellLabel,"Sell!!@ " +str.tostring(lastSell) + "\n TP: " + str.tostring(lastSell*in_sellTP) + "\n🠇")

if(not in_useAlerts)

alert("Sell")

//label.delete(sellLabel)

if ( close < ma and (close <= lastSell*in_sellTP ) or (close < lastClose*in_sellTP) )

//label.new(bar_index,na,"TP!!@ " +str.tostring(close), yloc = yloc.belowbar, style = label.style_none, textcolor = color.red, size = size.normal)

strategy.close("SELL", "Sell Exit", alert_message = "Sell Exit TP @" +str.tostring(close) + " OR TP: " + str.tostring(lastSell*in_sellTP))

if(not in_useAlerts)

alert("Sell Exit")

alertcondition(buy and in_useAlerts,"Buy Alert","test")