Triple Supertrend dengan EMA dan ADX

Penulis:ChaoZhang, Tanggal: 2022-05-08 20:48:42Tag:EMAADX

Menerbitkan strategi yang mencakup adx dan ema filter juga

Entry: ketiga Supertrend berubah positif. Jika filter dari ADX dan EMA diterapkan, juga memeriksa apakah ADX di atas level yang dipilih dan dekat di atas EMA Exit: ketika supertrend pertama berubah menjadi negatif

berlawanan untuk entri pendek

Filter diberikan untuk mengambil atau menghindari masuk kembali di sisi yang sama. Misalnya, Setelah keluar panjang, jika kondisi masuk terpenuhi lagi untuk waktu yang lama sebelum single pendek dipicu maka masuk kembali jika dipilih.

backtest

/*backtest

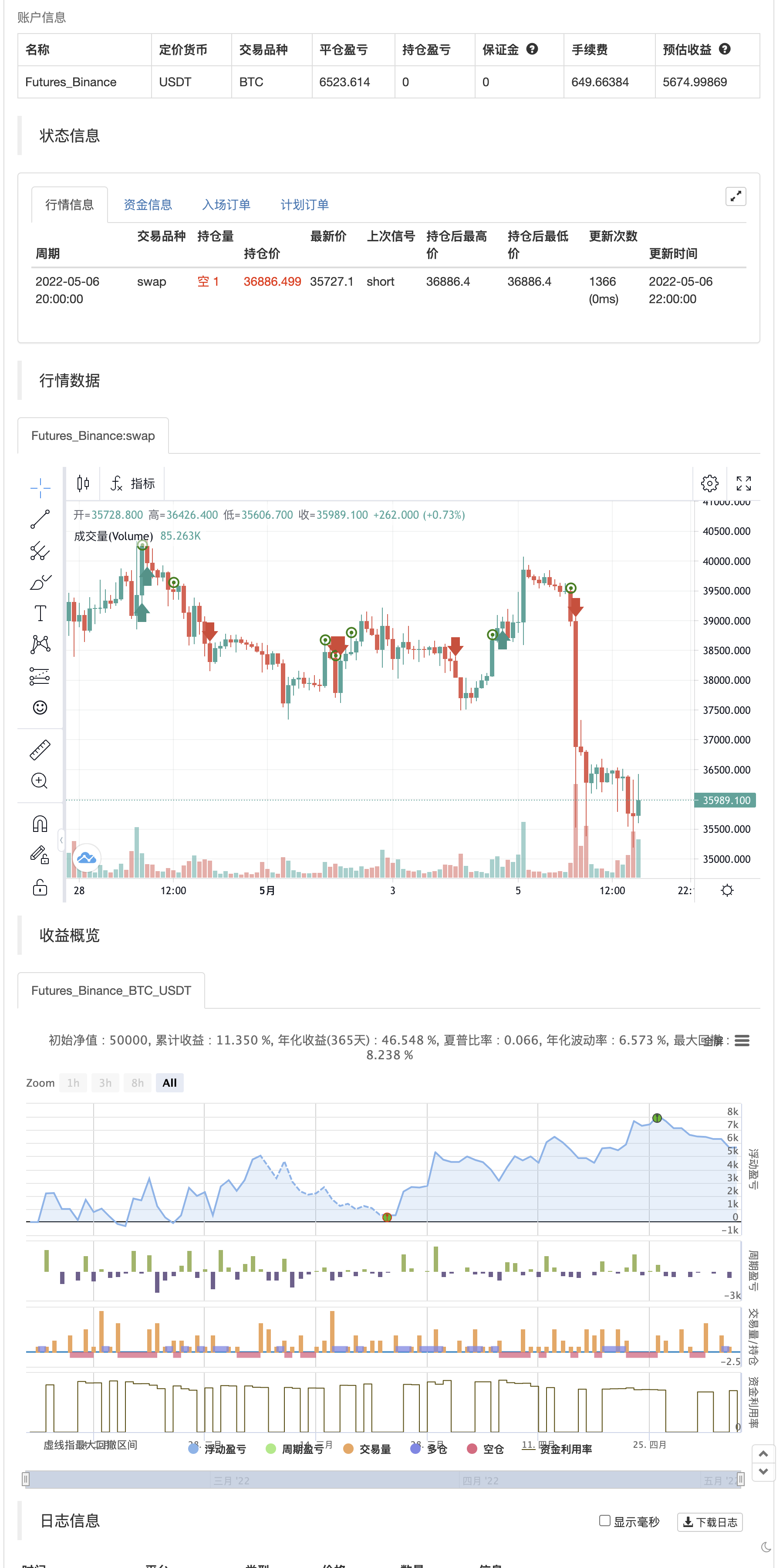

start: 2022-02-07 00:00:00

end: 2022-05-07 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©kunjandetroja

//@version=5

strategy('Triple Supertrend with EMA and ADX', overlay=true)

m1 = input.float(1,"ATR Multi",minval = 1,maxval= 6,step=0.5,group='ST 1')

m2 = input.float(2,"ATR Multi",minval = 1,maxval= 6,step=0.5,group='ST 2')

m3 = input.float(3,"ATR Multi",minval = 1,maxval= 6,step=0.5,group='ST 3')

p1 = input.int(10,"ATR Multi",minval = 5,maxval= 25,step=1,group='ST 1')

p2 = input.int(15,"ATR Multi",minval = 5,maxval= 25,step=1,group='ST 2')

p3 = input.int(20,"ATR Multi",minval = 5,maxval= 25,step=1,group='ST 3')

len_EMA = input.int(200,"EMA Len",minval = 5,maxval= 250,step=1)

len_ADX = input.int(14,"ADX Len",minval = 1,maxval= 25,step=1)

len_Di = input.int(14,"Di Len",minval = 1,maxval= 25,step=1)

adx_above = input.float(25,"adx filter",minval = 1,maxval= 50,step=0.5)

var bool long_position = false

adx_filter = input.bool(false, "Add Adx & EMA filter")

renetry = input.bool(true, "Allow Reentry")

f_getColor_Resistance(_dir, _color) =>

_dir == 1 and _dir == _dir[1] ? _color : na

f_getColor_Support(_dir, _color) =>

_dir == -1 and _dir == _dir[1] ? _color : na

[superTrend1, dir1] = ta.supertrend(m1, p1)

[superTrend2, dir2] = ta.supertrend(m2, p2)

[superTrend3, dir3] = ta.supertrend(m3, p3)

EMA = ta.ema(close, len_EMA)

[diplus,diminus,adx] = ta.dmi(len_Di,len_ADX)

// ADX Filter

adxup = adx > adx_above and close > EMA

adxdown = adx > adx_above and close < EMA

sum_dir = dir1 + dir2 + dir3

dir_long = if(adx_filter == false)

sum_dir == -3

else

sum_dir == -3 and adxup

dir_short = if(adx_filter == false)

sum_dir == 3

else

sum_dir == 3 and adxdown

Exit_long = dir1 == 1 and dir1 != dir1[1]

Exit_short = dir1 == -1 and dir1 != dir1[1]

// BuySignal = dir_long and dir_long != dir_long[1]

// SellSignal = dir_short and dir_short != dir_short[1]

// if BuySignal

// label.new(bar_index, low, 'Long', style=label.style_label_up)

// if SellSignal

// label.new(bar_index, high, 'Short', style=label.style_label_down)

longenter = if(renetry == false)

dir_long and long_position == false

else

dir_long

shortenter = if(renetry == false)

dir_short and long_position == true

else

dir_short

if longenter

long_position := true

if shortenter

long_position := false

strategy.entry('BUY', strategy.long, when=longenter)

strategy.entry('SELL', strategy.short, when=shortenter)

strategy.close('BUY', Exit_long)

strategy.close('SELL', Exit_short)

//buy1 = ta.barssince(dir_long)

//sell1 = ta.barssince(dir_short)

//colR1 = f_getColor_Resistance(dir1, color.red)

//colS1 = f_getColor_Support(dir1, color.green)

//colR2 = f_getColor_Resistance(dir2, color.orange)

//colS2 = f_getColor_Support(dir2, color.yellow)

//colR3 = f_getColor_Resistance(dir3, color.blue)

//colS3 = f_getColor_Support(dir3, color.maroon)

//plot(superTrend1, 'R1', colR1, linewidth=2)

//plot(superTrend1, 'S1', colS1, linewidth=2)

//plot(superTrend2, 'R1', colR2, linewidth=2)

//plot(superTrend2, 'S1', colS2, linewidth=2)

//plot(superTrend3, 'R1', colR3, linewidth=2)

//plot(superTrend3, 'S1', colS3, linewidth=2)

// // Intraday only

// var int new_day = na

// var int new_month = na

// var int new_year = na

// var int close_trades_after_time_of_day = na

// if dayofmonth != dayofmonth[1]

// new_day := dayofmonth

// if month != month[1]

// new_month := month

// if year != year[1]

// new_year := year

// close_trades_after_time_of_day := timestamp(new_year,new_month,new_day,15,15)

// strategy.close_all(time > close_trades_after_time_of_day)

Artikel terkait

- Strategi GM-8 & ADX dua garis lurus

- Strategi lintas linear indeks dinamis yang dikombinasikan dengan sistem penyaringan intensitas tren ADX

- VuManChu Cipher B + Divergences Strategi

- Strategi Stop Loss dengan Garis Garis Ganda

- Tren super multi rata-rata yang digabungkan dengan strategi perdagangan terobosan Blinken

- Strategi trading terobosan untuk pasar terbuka berdasarkan manajemen dinamis ATR

- Strategi perdagangan kuantitatif lintas momentum multi-teknis - analisis terintegrasi berdasarkan EMA, RSI, dan ADX

- Sistem manajemen dana berdasarkan momentum RSI dan intensitas tren ADX

- Multi-strategic adaptive trend tracking and breakthrough trading system

- Pelacakan tren multi-indikator dan strategi untuk mematahkan volatilitas

Informasi lebih lanjut

- EMA bands + leledc + Bollinger bands strategi trend catching

- RSI MTF Ob+Os

- Strategi MACD Willy

- RSI - Sinyal Beli Jual

- Tren Heikin-Ashi

- HA Kebiasan Pasar

- Ichimoku Cloud Smooth Oscillator

- Williams %R - Dihaluskan

- QQE MOD + SSL Hibrida + Ledakan Waddah Attar

- Membeli/Menjual Strat

- Tom DeMark Peta Panas Berurutan

- jma + dwma oleh multigrain

- MAGIC MACD

- Z Skor dengan Sinyal

- Kebijakan volatilitas yang sederhana dari Shinto dalam bahasa Pine

- 3EMA + Boullinger + PIVOT

- baguette dengan multigrain

- MillMachine

- Indikator pembalikan K I

- Lilin yang Menelan