多策略自适应趋势跟踪与突破交易系统

Author: ChaoZhang, Date: 2024-11-12 16:43:34Tags: EMARSIOBVATRADX

概述

该策略是一个集成了多种交易方法的自适应交易系统,通过趋势跟踪、区间交易和突破交易三种策略的灵活组合来适应不同的市场环境。系统采用EMA、RSI、OBV等技术指标进行市场状态判断,并结合ADX指标进行趋势强度确认,通过ATR动态止损来控制风险。策略的独特之处在于允许用户自由选择启用哪些交易策略,并通过资金管理参数来精确控制每笔交易的风险。

策略原理

策略包含三个主要的交易模块: 1. 趋势交易模块:通过EMA和ADX指标判断趋势状态,当价格位于EMA之上且ADX大于25时确认趋势,在RSI超卖区域寻找做多机会。 2. 区间交易模块:在非趋势市场中运行,通过RSI指标在超买超卖区域进行反转交易。 3. 突破交易模块:结合价格突破和OBV指标确认成交量支撑,在高成交量配合下捕捉突破机会。

每个模块都采用基于ATR的动态止损方案,并通过用户自定义的风险收益比来设置获利目标。系统通过成交量过滤器来确保交易发生在充足的流动性环境下。

策略优势

- 适应性强:通过多策略组合适应不同市场环境

- 风险控制完善:采用ATR动态止损,并可自定义风险收益比

- 灵活性高:用户可根据市场特征选择性启用不同策略

- 交易确认机制严格:整合价格、成交量和技术指标多重确认

- 资金管理科学:可精确控制每笔交易的资金风险比例

策略风险

- 参数优化风险:过多的可调参数可能导致过度优化

- 市场环境判断风险:不同策略之间可能产生冲突信号

- 流动性风险:在低流动性环境下可能造成滑点

- 系统性风险:市场突发事件可能导致止损失效

建议采取以下措施来控制风险: - 进行充分的历史数据回测 - 采用保守的资金管理比例 - 定期检查和调整策略参数 - 设置最大持仓时间限制

策略优化方向

增加市场波动率适应机制:

- 根据波动率大小动态调整进场条件

- 在高波动环境下提高信号确认门槛

完善策略切换机制:

- 建立市场环境评分系统

- 实现策略权重的动态调整

强化资金管理系统:

- 引入动态持仓规模管理

- 根据历史盈亏情况调整风险参数

优化信号过滤机制:

- 增加趋势强度确认指标

- 完善成交量分析方法

总结

该策略通过多策略组合和严格的风险控制体系,实现了对不同市场环境的适应性交易。系统的模块化设计允许灵活配置,而完善的资金管理机制则确保了交易的安全性。通过持续优化和完善,该策略有望在各种市场环境下保持稳定的表现。为了进一步提高策略的稳健性,建议在实盘交易中采用保守的资金管理方案,并定期对策略参数进行评估和调整。

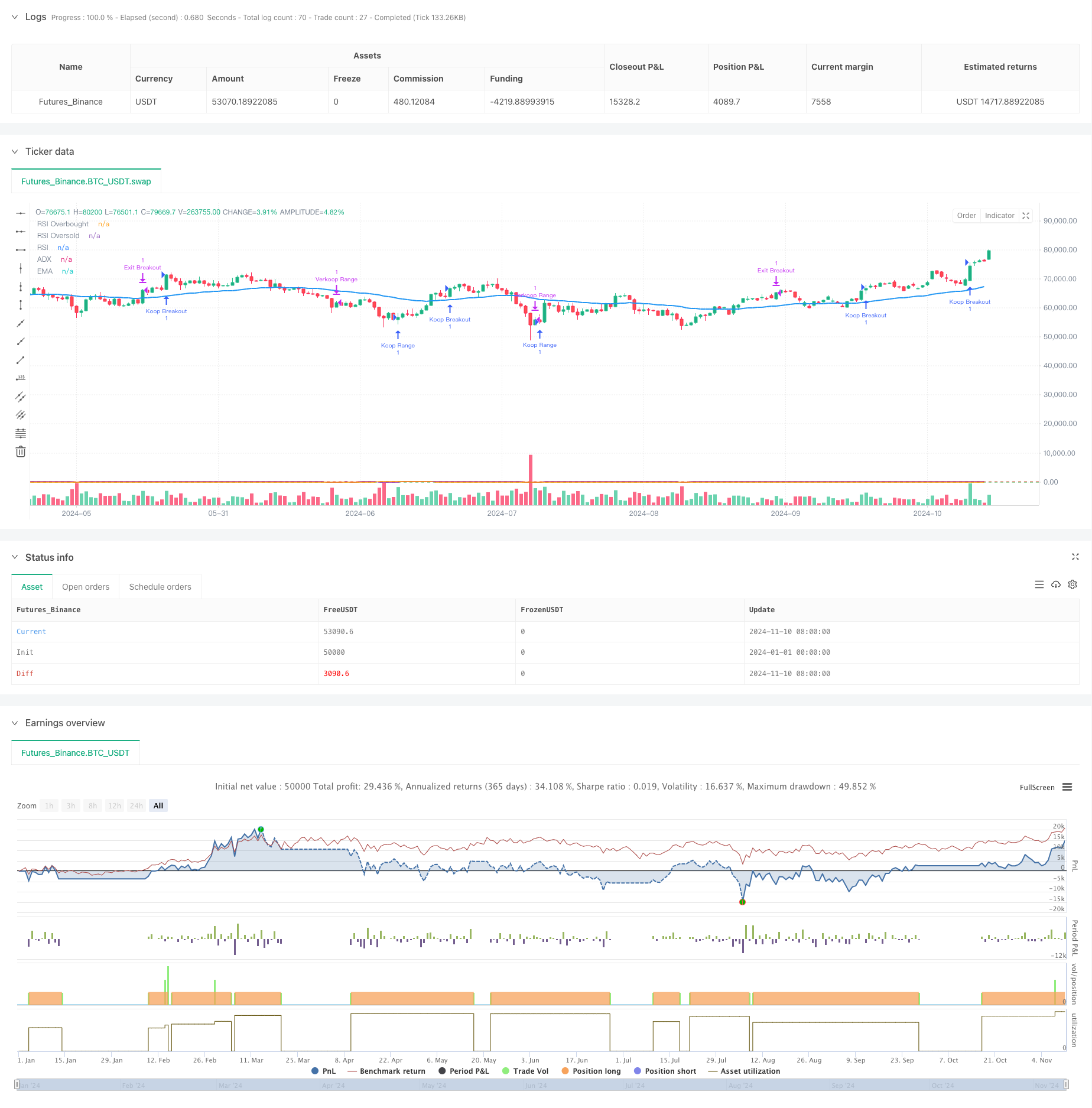

/*backtest

start: 2024-01-01 00:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ceulemans Trading Bot met ADX, Trendfilter en Selecteerbare Strategieën", overlay=true)

// Parameters voor indicatoren

emaLength = input.int(50, title="EMA Lengte")

rsiLength = input.int(14, title="RSI Lengte")

obvLength = input.int(20, title="OBV Lengte")

rsiOverbought = input.int(65, title="RSI Overbought")

rsiOversold = input.int(35, title="RSI Oversold")

atrLength = input.int(14, title="ATR Lengte")

adxLength = input.int(14, title="ADX Lengte")

adxSmoothing = input.int(14, title="ADX Smoothing") // Voeg de smoothing parameter toe

// Money Management Parameters

capitalRisk = input.float(1.0, title="Percentage van kapitaal per trade", step=0.1)

riskReward = input.float(3.0, title="Risk/Reward ratio", step=0.1)

stopLossMultiplier = input.float(1.2, title="ATR Stop-Loss Multiplier", step=0.1)

// Strategieën selecteren (aan/uit schakelaars)

useTrendTrading = input.bool(true, title="Gebruik Trend Trading")

useRangeTrading = input.bool(true, title="Gebruik Range Trading")

useBreakoutTrading = input.bool(true, title="Gebruik Breakout Trading")

// Berekening indicatoren

ema = ta.ema(close, emaLength)

rsi = ta.rsi(close, rsiLength)

obv = ta.cum(ta.change(close) * volume)

atr = ta.atr(atrLength)

[diplus, diminus, adx] = ta.dmi(adxLength, adxSmoothing) // ADX berekening met smoothing

avgVolume = ta.sma(volume, obvLength)

// Huidige marktsituatie analyseren

isTrending = close > ema and adx > 25 // Trend is sterk als ADX boven 25 is

isOversold = rsi < rsiOversold

isOverbought = rsi > rsiOverbought

isBreakout = close > ta.highest(close[1], obvLength) and obv > ta.cum(ta.change(close[obvLength]) * volume)

isRange = not isTrending and (close < ta.highest(close, obvLength) and close > ta.lowest(close, obvLength))

volumeFilter = volume > avgVolume

// Strategie logica

// 1. Trend Trading met tight stop-loss en ADX filter

if (useTrendTrading and isTrending and isOversold and volumeFilter)

strategy.entry("Koop Trend", strategy.long)

strategy.exit("Exit Trend", stop=strategy.position_avg_price - stopLossMultiplier * atr, limit=strategy.position_avg_price + riskReward * stopLossMultiplier * atr)

// 2. Range Trading

if (useRangeTrading and isRange and rsi < rsiOversold and volumeFilter)

strategy.entry("Koop Range", strategy.long)

strategy.exit("Verkoop Range", stop=strategy.position_avg_price - stopLossMultiplier * atr, limit=strategy.position_avg_price + riskReward * stopLossMultiplier * atr)

if (useRangeTrading and isRange and rsi > rsiOverbought and volumeFilter)

strategy.entry("Short Range", strategy.short)

strategy.exit("Exit Short Range", stop=strategy.position_avg_price + stopLossMultiplier * atr, limit=strategy.position_avg_price - riskReward * stopLossMultiplier * atr)

// 3. Breakout Trading met volume

if (useBreakoutTrading and isBreakout and volumeFilter)

strategy.entry("Koop Breakout", strategy.long)

strategy.exit("Exit Breakout", stop=strategy.position_avg_price - stopLossMultiplier * atr, limit=strategy.position_avg_price + riskReward * stopLossMultiplier * atr)

// Indicatoren plotten

plot(ema, title="EMA", color=color.blue, linewidth=2)

hline(rsiOverbought, "RSI Overbought", color=color.red)

hline(rsiOversold, "RSI Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

plot(adx, title="ADX", color=color.orange)

相关内容

- 多指标趋势跟踪与波动突破策略

- 基于ATR动态管理的开市突破交易策略

- 基于RSI动量和ADX趋势强度的资金管理系统

- 高斯交叉EMA趋势滑点追踪策略

- 趋势跟随可变仓位网格策略

- 三重均线趋势追踪多指标组合量化交易策略

- 基于多重技术指标的高频交易动态优化策略

- 多指标动态止损动量趋势交易策略

- 多重滤网趋势突破智能均线交易策略

- 多层级多周期指数均线交叉动态盈利优化策略

更多内容

- 增强型多周期动态自适应趋势跟踪交易系统

- 大幅波动突破型双向交易策略:基于点位阈值的多空进场系统

- 强化波林格均值回归量化策略

- 动态达瓦斯箱体突破与均线趋势确认交易系统

- EMA双均线交叉动态止盈止损量化交易策略

- 多重EMA交叉趋势跟踪与动态止盈止损优化策略

- 双均线交叉自适应动态止盈止损策略

- 双平台对冲平衡策略

- 双均线交叉动态止盈止损量化策略

- 多重均线趋势强度捕捉与波动获利策略

- 多级均线结合蜡烛图形态识别交易系统

- 多周期均线趋势动量跟踪交易策略

- 智能时间周期多空轮动均衡交易策略

- MACD动态趋势量化交易策略进阶版

- 趋势突破交易系统(移动平均线突破策略)

- 基于ATR的多重趋势跟踪策略与止盈止损优化系统

- 基于 RSI 动量和多层级止盈止损的智能自适应交易系统

- 自适应RSI震荡阈值动态交易策略

- RSI与AO协同趋势追踪型量化交易策略

- 适应性趋势动量RSI策略结合均线过滤系统