Villa Dinamic Pivot Supertrend Strategi

Penulis:ChaoZhang, Tanggal: 2022-05-13 17:45:05Tag:EMASMAATRPivot

Strategi ini bekerja lebih baik pada AUD/USD dalam jangka waktu 15 menit. Ini menggunakan Pivot Supertrend untuk memasukkan perdagangan berdasarkan filter yang berbeda seperti:

- Filter EMA sederhana: bahwa 3 EMA harus dalam urutan

- DEMA sudut: Anda dapat memilih DEMA sudut ambang dan melihat kembali untuk memeriksa sudut hanya perdagangan perdagangan dengan DEMA pada sudut tertentu

- Filter DEMA sederhana: hanya memeriksa apakah dekat di atas atau di bawah DEMA

- Ambil Setiap Sinyal Supertrend: ini berarti mengambil setiap sinyal supertrend normal untuk tidak hanya menunggu sinyal supertrend pivot untuk memasuki perdagangan (terutama pada periode supertrend pivot yang panjang)

- Stop Loss di Supertrend: ini berarti bahwa stop loss akan berada di Normal Supertrend, jika false stop loss akan ditempatkan di level ATR yang dipilih.

- 2 Langkah Ambil Keuntungan: ini berarti jika Anda ingin menutup persentase posisi segera setelah supertrend normal melintasi harga masuk, Anda dapat memilih % pada input

backtest

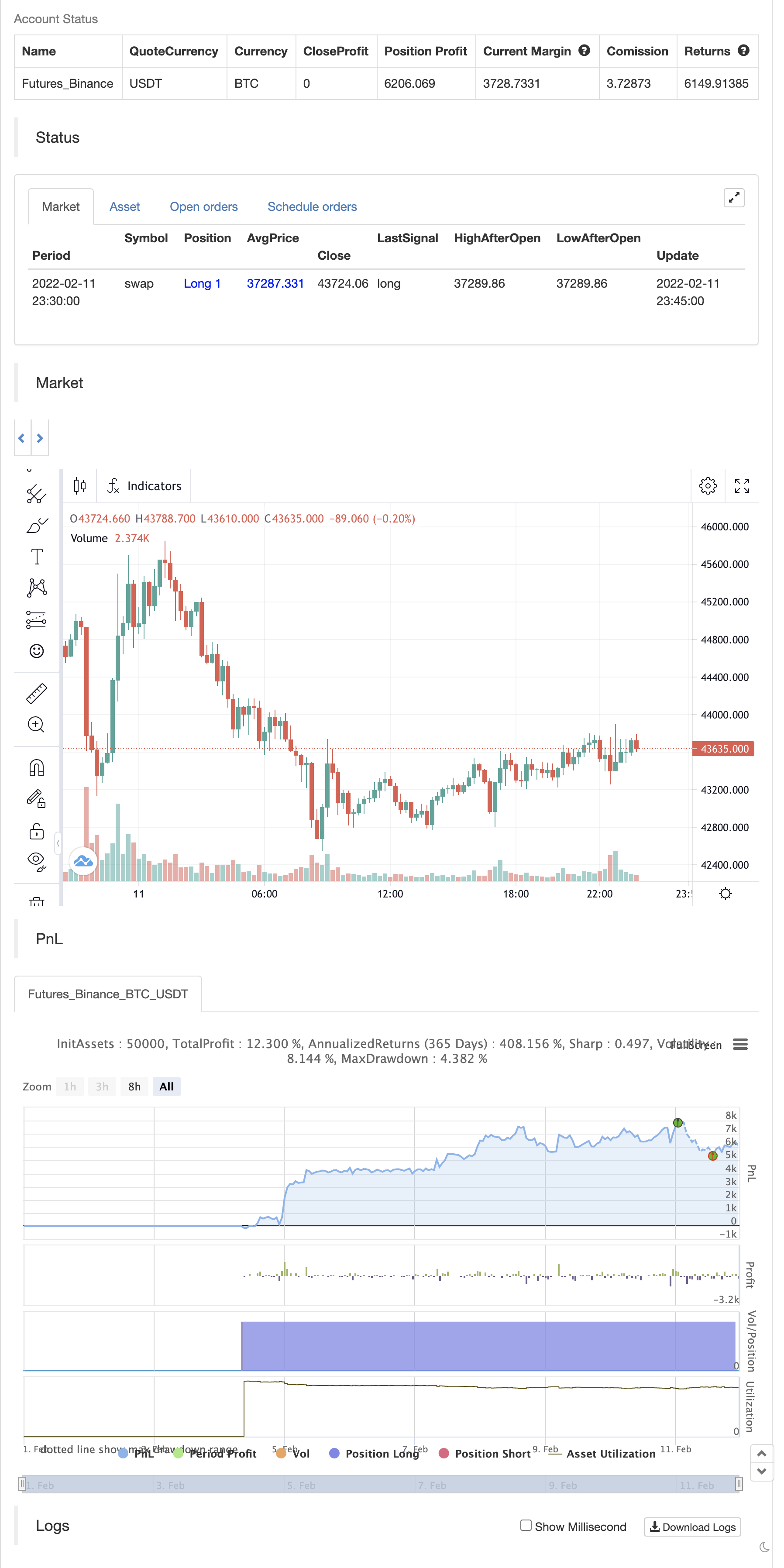

/*backtest

start: 2022-02-01 00:00:00

end: 2022-02-11 23:59:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © evillalobos1123

//@version=5

strategy("Villa Dinamic Pivot Supertrend Strategy", overlay=true, calc_on_every_tick = true)

//INPUTS

ema_b = input.bool(false, "Use Simple EMA Filter", group = "Strategy Inputs")

ema_b_ang = input.bool(true, "Use DEMA Angle Filter", group = "Strategy Inputs")

dema_b = input.bool(true, "Use DEMA Filter", group = "Strategy Inputs")

st_sig = input.bool(false, "Take Every Supertrend Signal" , group = "Strategy Inputs")

take_p = input.bool(true, "Stop Loss at Supertrend", group = "Strategy Inputs")

din_tp = input.bool(false, "2 Steps Take Profit", group = "Strategy Inputs")

move_sl = input.bool(true, "Move SL", group = "Strategy Inputs")

sl_atr = input.float(2.5, "Stop Loss ATR Multiplier", group = "Strategy Inputs")

tp_atr = input.float(4, "Take Profit ATR Multiplier", group = "Strategy Inputs")

din_tp_qty = input.int(50, "2 Steps TP qty%", group = "Strategy Inputs")

dema_a_filter = input.float(0, "DEMA Angle Threshold (+ & -)", group = "Strategy Inputs")

dema_a_look = input.int(1, "DEMA Angle Lookback", group = "Strategy Inputs")

dr_test = input.string("All", "Testing", options = ["Backtest", "Forwardtest", "All"], group = "Strategy Inputs")

test_act = input.string('Forex', 'Market', options = ['Forex', 'Stocks'], group = "Strategy Inputs")

not_in_trade = strategy.position_size == 0

//Backtesting date range

start_year = input.int(2021, "Backtesting start year", group = "BT Date Range")

start_month = input.int(1, "Backtesting start month", group = "BT Date Range")

start_date = input.int(1, "Backtesting start day", group = "BT Date Range")

end_year = input.int(2021, "Backtesting end year", group = "BT Date Range")

end_month = input.int(12, "Backtesting end month", group = "BT Date Range")

end_date = input.int(31, "Backtesting end day", group = "BT Date Range")

bt_date_range = (time >= timestamp(syminfo.timezone, start_year,

start_month, start_date, 0, 0)) and

(time < timestamp(syminfo.timezone, end_year, end_month, end_date, 0, 0))

//Forward testing date range

start_year_f = input.int(2022, "Forwardtesting start year", group = "FT Date Range")

start_month_f = input.int(1, "Forwardtesting start month", group = "FT Date Range")

start_date_f = input.int(1, "Forwardtesting start day", group = "FT Date Range")

end_year_f = input.int(2022, "Forwardtesting end year", group = "FT Date Range")

end_month_f = input.int(03, "Forwardtesting end month", group = "FT Date Range")

end_date_f = input.int(26, "Forwardtesting end day", group = "FT Date Range")

ft_date_range = (time >= timestamp(syminfo.timezone, start_year_f,

start_month_f, start_date_f, 0, 0)) and

(time < timestamp(syminfo.timezone, end_year_f, end_month_f, end_date_f, 0, 0))

//date condition

date_range_cond = if dr_test == "Backtest"

bt_date_range

else if dr_test == "Forwardtest"

ft_date_range

else

true

//INDICATORS

//PIVOT SUPERTREND

prd = input.int(2, "PVT ST Pivot Point Period", group = "Pivot Supertrend")

Factor=input.float(3, "PVT ST ATR Factor", group = "Pivot Supertrend")

Pd=input.int(9 , "PVT ST ATR Period", group = "Pivot Supertrend")

// get Pivot High/Low

float ph = ta.pivothigh(prd, prd)

float pl = ta.pivotlow(prd, prd)

// calculate the Center line using pivot points

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

//weighted calculation

center := (center * 2 + lastpp) / 3

// upper/lower bands calculation

Up = center - (Factor * ta.atr(Pd))

Dn = center + (Factor * ta.atr(Pd))

// get the trend

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// check and plot the signals

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

//get S/R levels using Pivot Points

float resistance = na

float support = na

support := pl ? pl : support[1]

resistance := ph ? ph : resistance[1]

//DEMA

dema_ln = input.int(200, "DEMA Len", group = 'D-EMAs')

dema_src = input.source(close, "D-EMAs Source", group = 'D-EMAs')

ema_fd = ta.ema(dema_src, dema_ln)

dema = (2*ema_fd)-(ta.ema(ema_fd,dema_ln))

//EMA

ema1_l = input.int(21, "EMA 1 Len", group = 'D-EMAs')

ema2_l = input.int(50, "EMA 2 Len", group = 'D-EMAs')

ema3_l = input.int(200, "EMA 3 Len", group = 'D-EMAs')

ema1 = ta.ema(dema_src, ema1_l)

ema2 = ta.ema(dema_src, ema2_l)

ema3 = ta.ema(dema_src, ema3_l)

//Supertrend

Periods = input.int(21, "ST ATR Period", group = "Normal Supertrend")

src_st = input.source(hl2, "ST Supertrend Source", group = "Normal Supertrend")

Multiplier = input.float(2.0 , "ST ATR Multiplier", group = "Normal Supertrend")

changeATR= true

atr2 = ta.sma(ta.tr, Periods)

atr3= changeATR ? ta.atr(Periods) : atr2

up=src_st-(Multiplier*atr3)

up1 = nz(up[1],up)

up := close[1] > up1 ? math.max(up,up1) : up

dn=src_st+(Multiplier*atr3)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

buySignal = trend == 1 and trend[1] == -1

sellSignal = trend == -1 and trend[1] == 1

//ATR

atr = ta.atr(14)

///CONDITIONS

//BUY

/// ema simple

ema_cond_b = if ema_b

ema1 > ema2 and ema2 > ema3

else

true

///ema angle

div_ang = if test_act == 'Forex'

0.0001

else

1

dema_angle_rad = math.atan((dema - dema[dema_a_look])/div_ang)

dema_angle = dema_angle_rad * (180/math.pi)

dema_ang_cond_b = if ema_b_ang

if dema_angle >= dema_a_filter

true

else

false

else

true

///ema distance

dema_cond_b = if dema_b

close > dema

else

true

//supertrends

///if pivot buy sig or (st buy sig and pivot. trend = 1)

pvt_cond_b = bsignal

st_cond_b = if st_sig

buySignal and Trend == 1

else

false

st_entry_cond = pvt_cond_b or st_cond_b

///stop loss tp

sl_b = if take_p

if trend == 1

up

else

close - (atr * sl_atr)

else

close - (atr * sl_atr)

tp_b = if take_p

if trend == 1

close + ((close - up) * (tp_atr / sl_atr))

else

close + (atr * tp_atr)

else

close + (atr * tp_atr)

//position size

init_cap = strategy.equity

pos_size_b = math.round((init_cap * .01) / (close - sl_b))

ent_price = strategy.opentrades.entry_price(strategy.opentrades - 1)

var sl_b_n = 0.0

var tp_b_n = 0.0

longCondition = (ema_cond_b and dema_cond_b and dema_ang_cond_b and st_entry_cond and date_range_cond and not_in_trade)

if (longCondition)

strategy.entry("Long", strategy.long, qty = pos_size_b)

sl_b_n := sl_b

tp_b_n := tp_b

ent_price := strategy.opentrades.entry_price(strategy.opentrades - 1)

if (up[1] < ent_price and up >= ent_price and trend[0] == 1)

if din_tp

strategy.close("Long", qty_percent = din_tp_qty)

if move_sl

sl_b_n := ent_price

strategy.exit("Exit", "Long", stop =sl_b_n, limit = tp_b_n)

//sell

///ema simple

ema_cond_s = if ema_b

ema1 < ema2 and ema2 < ema3

else

true

//ema distance

dema_cond_s = if dema_b

close < dema

else

true

//dema angle

dema_ang_cond_s = if ema_b_ang

if dema_angle <= -(dema_a_filter)

true

else

false

else

true

//supertrends

///if pivot buy sig or (st buy sig and pivot. trend = 1)

pvt_cond_s = ssignal

st_cond_s = if st_sig

sellSignal and Trend == -1

else

false

st_entry_cond_s = pvt_cond_s or st_cond_s

///stop loss tp

sl_s = if take_p

if trend == -1

dn

else

close + (atr * sl_atr)

else

close + (atr * sl_atr)

tp_s = if take_p

if trend == -1

close - ((dn - close) * (tp_atr / sl_atr))

else

close - (atr * tp_atr)

else

close - (atr * tp_atr)

shortCondition = (ema_cond_s and dema_cond_s and dema_ang_cond_s and date_range_cond and st_entry_cond_s and not_in_trade)

pos_size_s = math.round((init_cap * .01) / (sl_s - close))

var sl_s_n = 0.0

var tp_s_n = 0.0

if (shortCondition)

strategy.entry("Short", strategy.short, qty = pos_size_s)

sl_s_n := sl_s

tp_s_n := tp_s

if (dn[1] > ent_price and dn <= ent_price and trend[0] == -1)

if din_tp

strategy.close("Short", qty_percent = din_tp_qty)

if move_sl

sl_s_n := ent_price

strategy.exit("Exit", "Short", stop = sl_s_n, limit = tp_s_n)

- Strategi pelacakan gerak silang antara black swan dan equator

- Tren multi-indikator tinggi mengkonfirmasi strategi perdagangan

- Cithakan Alerts ML

- Strategi perdagangan multi-siklus tinggi Ichimoku berdasarkan grafik awan dinamis multi-dimensi

- Triple bottom rebound menembus strategi momentum

- Strategi volatilitas ATR multi-indikator dinamis

- Strategi RSI-EMA-ATR untuk perdagangan volatilitas multi-indikator

- SSL hibrida

- Strategi pengukuran lintas-indikator

- EMA, SMA, CCI, ATR, Strategi Peringkat Sederhana dan Trend Magic Indikator Sistem Perdagangan Otomatis

- Strategi OCC R5.1

- Selamat datang di BEARMARKET

- Sidboss

- Titik Pivot Tinggi Rendah Multi Time Frame

- Database Strategi Pelacakan Tren Hantu

- Ghoul Trends Track Strategi Perpustakaan Bisnis

- Strategi Pelacakan Tren Hantu

- Rainbow Oscillator

- Perdagangan kurva ekuitas Contoh Ukuran Posisi

- Demo KLineChart

- Crodl's Supertrend

- RSI oleh zdmre

- FTL - Range Filter X2 + EMA + UO

- Brahmastra

- Band Mobo

- SAR + 3SMMA dengan SL & TP

- SSS

- Templat Peringatan Peluncuran Bulan [Indikator]

- HALFTREND + HEMA + SMA (Strategi Sinyal Palsu)

- RSI Divergensi dengan Pivot, BB, SMA, EMA, SMMA, WMA, VWMA