概述

这是一个结合了Supertrend、指数移动平均线(EMA)和相对强弱指标(RSI)的多指标交易策略。策略通过这三个技术指标的交叉信号和超买超卖水平来识别市场趋势、动量和潜在的反转点,从而在市场中寻找理想的交易机会。该策略充分利用了多个指标的优势,通过不同维度的市场分析来提高交易的准确性和可靠性。

策略原理

策略的核心逻辑基于三个主要技术指标的组合分析: 1. Supertrend指标用于确定整体趋势方向,利用ATR波动率来动态调整趋势线。 2. 短期(9周期)和长期(21周期)EMA的交叉用于捕捉价格动量的变化。 3. RSI指标用于识别市场是否处于超买或超卖状态。

买入信号需要同时满足以下条件: - Supertrend指标显示多头趋势(价格位于Supertrend线上方) - 短期EMA向上穿过长期EMA - RSI未达到超买水平(低于70)

卖出信号需要同时满足以下条件: - Supertrend指标显示空头趋势(价格位于Supertrend线下方) - 短期EMA向下穿过长期EMA - RSI未达到超卖水平(高于30)

策略优势

- 多指标交叉验证提高了信号可靠性

- 结合了趋势跟踪和动量分析的优点

- 通过RSI过滤掉潜在的虚假信号

- 策略参数可以根据不同市场情况灵活调整

- 清晰的进场和出场规则,降低了主观判断的影响

- 具有良好的风险控制机制

策略风险

- 在震荡市场中可能产生频繁的假信号

- 多个指标的滞后性可能导致入场和出场时机略有延迟

- 参数选择不当可能影响策略表现

- 市场突发性变化可能导致较大回撤

- 需要考虑交易成本对策略收益的影响

策略优化方向

- 引入自适应参数机制,根据市场波动度动态调整指标参数

- 添加量价分析指标,提高信号的可靠性

- 开发市场环境识别模块,在不同市场环境下使用不同的参数组合

- 增加止损和止盈机制,优化资金管理

- 考虑添加波动率过滤器,避免在低波动率环境下过度交易

总结

这是一个结构完整、逻辑清晰的多指标量化交易策略,通过结合趋势跟踪、动量分析和超买超卖指标,构建了一个相对全面的交易系统。策略的优势在于多指标交叉验证提高了信号可靠性,同时具有清晰的风险控制机制。虽然存在一些固有的风险,但通过持续优化和完善,策略有望在不同市场环境下保持稳定的表现。

策略源码

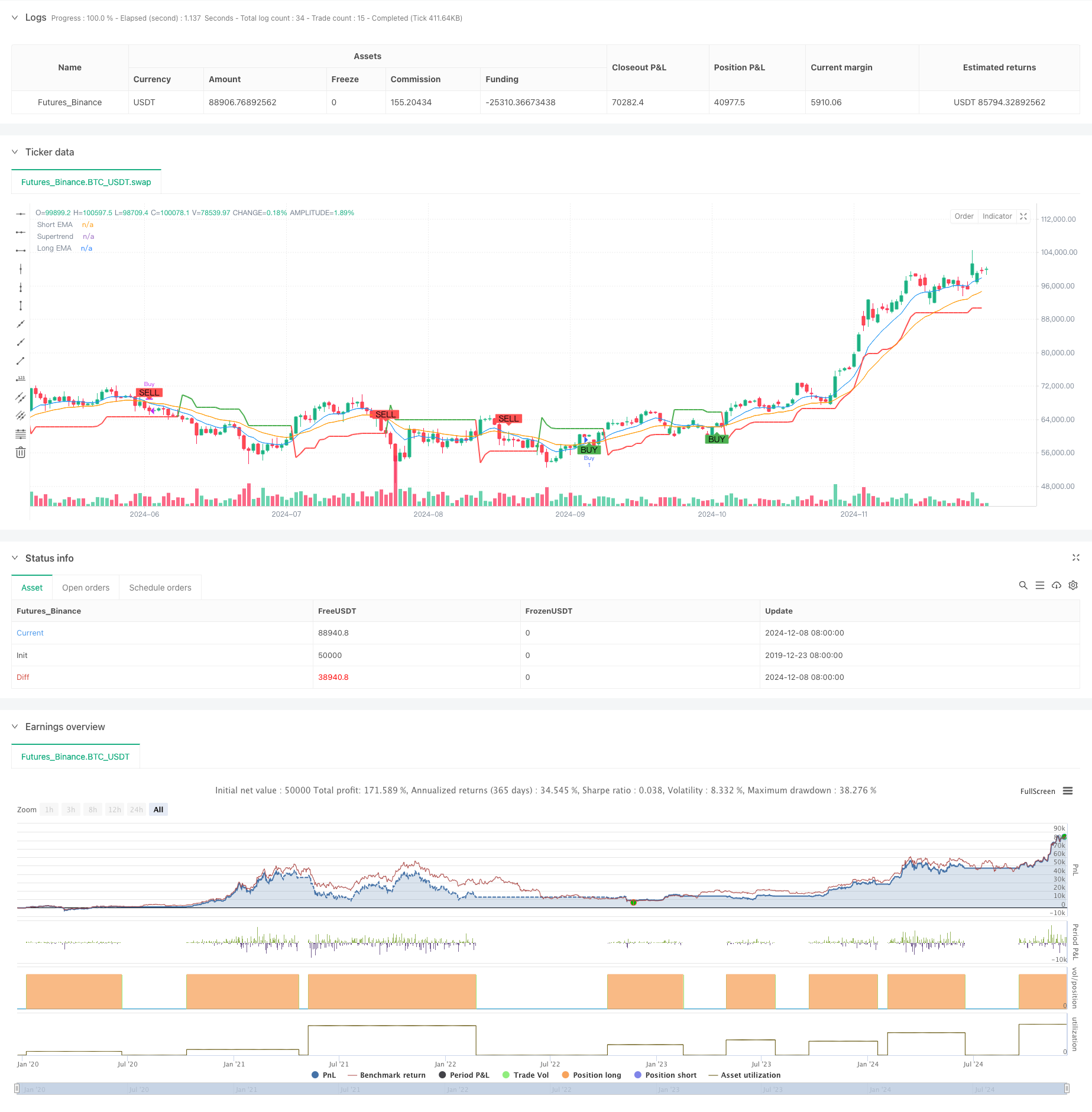

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © satyakipaul3744

//@version=6

//@version=6

strategy("Supertrend + EMA Crossover + RSI Strategy", overlay=true)

// --- Input Parameters ---

supertrend_length = input.int(10, title="Supertrend Length", minval=1)

supertrend_multiplier = input.float(3.0, title="Supertrend Multiplier", step=0.1)

short_ema_length = input.int(9, title="Short EMA Length")

long_ema_length = input.int(21, title="Long EMA Length")

rsi_length = input.int(14, title="RSI Length")

rsi_overbought = input.int(70, title="RSI Overbought Level")

rsi_oversold = input.int(30, title="RSI Oversold Level")

// --- Indicator Calculations ---

// Supertrend calculation

[supertrend, direction] = ta.supertrend(supertrend_multiplier, supertrend_length)

// EMA calculations

short_ema = ta.ema(close, short_ema_length)

long_ema = ta.ema(close, long_ema_length)

// RSI calculation

rsi = ta.rsi(close, rsi_length)

// --- Buy/Sell Conditions ---

// Buy condition: Supertrend bullish, EMA crossover, RSI not overbought

buy_condition = direction > 0 and ta.crossover(short_ema, long_ema) and rsi < rsi_overbought

// Sell condition: Supertrend bearish, EMA crossunder, RSI not oversold

sell_condition = direction < 0 and ta.crossunder(short_ema, long_ema) and rsi > rsi_oversold

// --- Plot Buy/Sell signals ---

plotshape(buy_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sell_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// --- Strategy Orders for Backtesting ---

if buy_condition

strategy.entry("Buy", strategy.long)

if sell_condition

strategy.close("Buy")

// --- Plot Supertrend ---

plot(supertrend, color=direction > 0 ? color.green : color.red, linewidth=2, title="Supertrend")

// --- Plot EMAs ---

plot(short_ema, color=color.blue, title="Short EMA")

plot(long_ema, color=color.orange, title="Long EMA")

// --- Strategy Performance ---

// You can see the strategy performance in the "Strategy Tester" tab.

相关推荐