Multi Timeframe MACD Heatmap Strategi

Penulis:ChaoZhang, Tanggal: 2023-10-25 15:21:39Tag:

Gambaran umum

Ide inti dari strategi ini adalah menggunakan sinyal kombinasi indikator MACD dari beberapa kerangka waktu yang berbeda untuk menentukan waktu perubahan tren dan menerapkan tren berisiko rendah setelah perdagangan.

Logika Strategi

-

Strategi ini menggunakan 5 indikator MACD dari kerangka waktu yang berbeda, termasuk 60 menit, 120 menit, 240 menit, 480 menit dan Daily, membentuk kombinasi indikator MACD multi-timeframe.

-

Ketika semua 5 MACD positif (atau negatif) dan bar sebelumnya tidak semua positif (atau negatif) MACD, itu ditentukan sebagai sinyal panjang (atau pendek) dan pergi panjang (atau pendek).

-

Metode stop loss adalah pips stop loss tetap.

-

Metode mengambil keuntungan adalah stop trailing dua tingkat, menutup sebagian dan semua posisi secara terpisah.

-

Ketika indikator MACD menunjukkan satu posisi panjang dan satu posisi pendek, itu dinilai sebagai pembalikan sinyal dan menutup posisi saat ini.

-

TsL juga digunakan untuk trailing stop loss.

-

Fitur stop loss to break-even digunakan. Ketika mencapai target keuntungan tertentu, stop loss akan bergerak untuk break-even, mengunci keuntungan.

-

Sintaks Pineconector digunakan untuk secara dinamis menghasilkan peringatan sinyal perdagangan.

Keuntungan

-

Kombinasi MACD multi-frame dapat meningkatkan akurasi sinyal, menangkap tren besar dan menyaring beberapa kebisingan.

-

Dua tingkat mengambil keuntungan memungkinkan mengambil keuntungan parsial beberapa kali selama tren besar.

-

Stop loss pips tetap dapat mengontrol jumlah kerugian perdagangan tunggal.

-

Penutupan ketika MACD tidak konsisten dapat mewujudkan stop loss tepat waktu dan menghindari stop loss break.

-

TsL trailing stop mengikuti perubahan harga secara real time.

-

SL ke BE mengunci beberapa keuntungan setelah mengubah posisi yang kalah menjadi posisi yang menang.

-

Peringatan perdagangan dinamis dapat terhubung ke MT4/5 untuk perdagangan otomatis.

Risiko dan Solusi

-

Sinyal MACD mungkin memiliki kegagalan yang salah, menyebabkan kerugian yang tidak perlu.

-

Pips stop loss tetap mungkin terlalu besar atau terlalu kecil. Uji tingkat yang berbeda untuk menemukan parameter optimal.

-

Dua tingkat mengambil keuntungan mungkin terlalu dekat atau terlalu jauh.

-

Trigger BE mungkin terlalu awal atau terlalu terlambat. Uji titik pemicu BE yang berbeda untuk menemukan parameter optimal.

-

Jarak penghentian pengemudi mungkin terlalu besar atau terlalu kecil. Uji jarak yang berbeda untuk menemukan parameter optimal.

Arahan Optimasi

-

Uji lebih banyak jangka waktu kombinasi MACD untuk menemukan kombinasi terbaik untuk menangkap tren pasar.

-

Memperkenalkan lebih banyak indikator untuk menentukan kondisi pasar, menghindari membuka posisi selama kondisi yang tidak menguntungkan.

-

Penelitian perbedaan parameter antara produk, merancang adaptif stop loss dan mengambil keuntungan sistem.

-

Menggabungkan teknik pembelajaran mesin untuk optimasi dinamis parameter.

-

Memperkenalkan ukuran posisi untuk penyesuaian dinamis ukuran posisi dan pengendalian risiko.

Kesimpulan

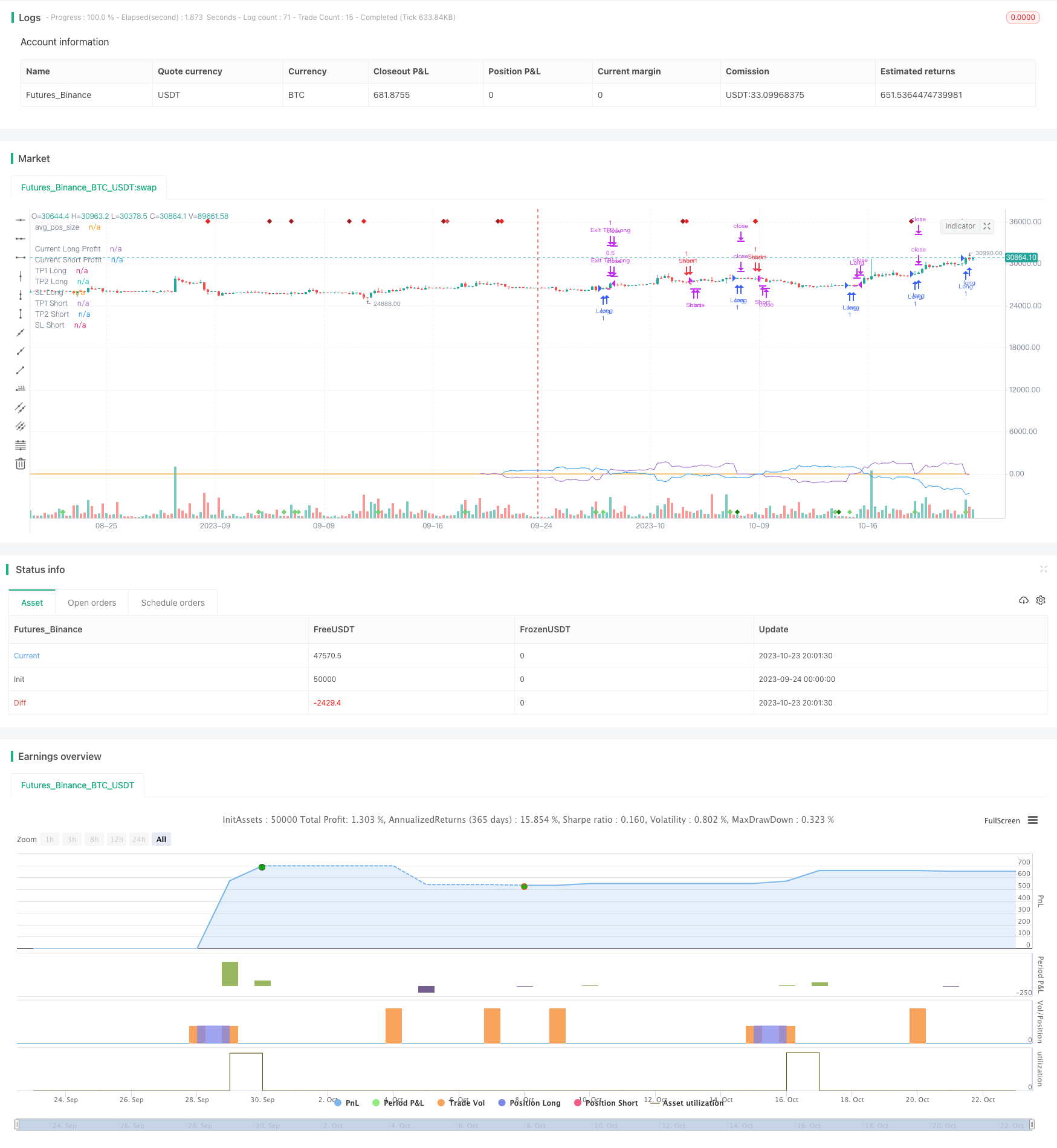

Singkatnya, strategi ini menggunakan MACD multi-frame untuk menentukan tren, dengan fitur dual trailing take profit, trailing stop loss dan BE untuk mengunci keuntungan, stop loss tetap untuk mengendalikan risiko. Ini adalah tren yang relatif stabil mengikuti strategi. Peningkatan lebih lanjut dalam stabilitas dan profitabilitas dapat dicapai melalui optimasi parameter dan perluasan fungsionalitas. Kuncinya adalah menemukan kombinasi parameter optimal untuk mencapai keseimbangan risiko-manfaat terbaik.

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@strategy_alert_message {{strategy.order.alert_message}}

SCRIPT_NAME = "Heatmap MACD Strategy - Pineconnector"

strategy(SCRIPT_NAME,

overlay= true,

process_orders_on_close = true,

calc_on_every_tick = true,

pyramiding = 1,

initial_capital = 100000,

default_qty_type = strategy.fixed,

default_qty_value = 1,

commission_type = strategy.commission.percent,

commission_value = 0.075,

slippage = 1

)

pineconnector_licence_ID = input.string(title = "Licence ID", defval = "123456789", group = "Pineconnector", tooltip = "Insert your Pineconnector Licence ID here")

pos_size = input.float(3, minval = 0, maxval = 100, title = "Position Size", group = "Position Size", tooltip = "Required to specify the position size here for Pineconnector to work properly")

res1 = input.timeframe('60', title='First Timeframe', group = "Timeframes")

res2 = input.timeframe('120', title='Second Timeframe', group = "Timeframes")

res3 = input.timeframe('240', title='Third Timeframe', group = "Timeframes")

res4 = input.timeframe('240', title='Fourth Timeframe', group = "Timeframes")

res5 = input.timeframe('480', title='Fifth Timeframe', group = "Timeframes")

macd_src = input.source(close, title="Source", group = "MACD")

fast_len = input.int(9, minval=1, title="Fast Length", group = "MACD")

slow_len = input.int(26, minval=1, title="Slow Length", group = "MACD")

sig_len = input.int(9, minval=1, title="Signal Length", group = "MACD")

// # ========================================================================= #

// # | Close on Opposite |

// # ========================================================================= #

use_close_opposite = input.bool(false, title = "Close on Opposite Signal?", group = "Close on Opposite", tooltip = "Close the position if 1 or more MACDs become bearish (for longs) or bullish (for shorts)")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.bool(true, title = "Use Stop Loss?", group = "Stop Loss")

sl_mode = "pips"//input.string("%", title = "Mode", options = ["%", "pips"], group = "Stop Loss")

sl_value = input.float(40, minval = 0, title = "Value", group = "Stop Loss", inline = "stoploss")// * 0.01

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

use_tsl = input.bool(false, title = "Use Trailing Stop Loss?", group = "Trailing Stop Loss")

tsl_input_pips = input.float(10, minval = 0, title = "Trailing Stop Loss (pips)", group = "Trailing Stop Loss")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp1 = input.bool(true, title = "Use Take Profit 1?", group = "Take Profit 1")

tp1_value = input.float(30, minval = 0, title = "Value (pips)", group = "Take Profit 1")// * 0.01

tp1_qty = input.float(50, minval = 0, title = "Quantity (%)", group = "Take Profit 1")// * 0.01

use_tp2 = input.bool(true, title = "Use Take Profit 2?", group = "Take Profit 2")

tp2_value = input.float(50, minval = 0, title = "Value (pips)", group = "Take Profit 2")// * 0.01

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

use_sl_be = input.bool(false, title = "Use Stop Loss to Breakeven Mode?", group = "Break Even")

sl_be_value = input.float(30, step = 0.1, minval = 0, title = "Value (pips)", group = "Break Even", inline = "breakeven")

sl_be_offset = input.int(1, step = 1, minval = 0, title = "Offset (pips)", group = "Break Even", tooltip = "Set the SL at BE price +/- offset value")

[_, _, MTF1_hist] = request.security(syminfo.tickerid, res1, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF2_hist] = request.security(syminfo.tickerid, res2, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF3_hist] = request.security(syminfo.tickerid, res3, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF4_hist] = request.security(syminfo.tickerid, res4, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF5_hist] = request.security(syminfo.tickerid, res5, ta.macd(macd_src, fast_len, slow_len, sig_len))

bull_hist1 = MTF1_hist > 0 and MTF1_hist[1] < 0

bull_hist2 = MTF2_hist > 0 and MTF2_hist[1] < 0

bull_hist3 = MTF3_hist > 0 and MTF3_hist[1] < 0

bull_hist4 = MTF4_hist > 0 and MTF4_hist[1] < 0

bull_hist5 = MTF5_hist > 0 and MTF5_hist[1] < 0

bear_hist1 = MTF1_hist < 0 and MTF1_hist[1] > 0

bear_hist2 = MTF2_hist < 0 and MTF2_hist[1] > 0

bear_hist3 = MTF3_hist < 0 and MTF3_hist[1] > 0

bear_hist4 = MTF4_hist < 0 and MTF4_hist[1] > 0

bear_hist5 = MTF5_hist < 0 and MTF5_hist[1] > 0

plotshape(bull_hist1, title = "Bullish MACD 1", location = location.bottom, style = shape.diamond, size = size.normal, color = #33e823)

plotshape(bull_hist2, title = "Bullish MACD 2", location = location.bottom, style = shape.diamond, size = size.normal, color = #1a7512)

plotshape(bull_hist3, title = "Bullish MACD 3", location = location.bottom, style = shape.diamond, size = size.normal, color = #479c40)

plotshape(bull_hist4, title = "Bullish MACD 4", location = location.bottom, style = shape.diamond, size = size.normal, color = #81cc7a)

plotshape(bull_hist5, title = "Bullish MACD 5", location = location.bottom, style = shape.diamond, size = size.normal, color = #76d66d)

plotshape(bear_hist1, title = "Bearish MACD 1", location = location.top, style = shape.diamond, size = size.normal, color = #d66d6d)

plotshape(bear_hist2, title = "Bearish MACD 2", location = location.top, style = shape.diamond, size = size.normal, color = #de4949)

plotshape(bear_hist3, title = "Bearish MACD 3", location = location.top, style = shape.diamond, size = size.normal, color = #cc2525)

plotshape(bear_hist4, title = "Bearish MACD 4", location = location.top, style = shape.diamond, size = size.normal, color = #a11d1d)

plotshape(bear_hist5, title = "Bearish MACD 5", location = location.top, style = shape.diamond, size = size.normal, color = #ed2424)

bull_count = (MTF1_hist > 0 ? 1 : 0) + (MTF2_hist > 0 ? 1 : 0) + (MTF3_hist > 0 ? 1 : 0) + (MTF4_hist > 0 ? 1 : 0) + (MTF5_hist > 0 ? 1 : 0)

bear_count = (MTF1_hist < 0 ? 1 : 0) + (MTF2_hist < 0 ? 1 : 0) + (MTF3_hist < 0 ? 1 : 0) + (MTF4_hist < 0 ? 1 : 0) + (MTF5_hist < 0 ? 1 : 0)

bull = bull_count == 5 and bull_count[1] < 5 and barstate.isconfirmed

bear = bear_count == 5 and bear_count[1] < 5 and barstate.isconfirmed

signal_candle = bull or bear

entryLongPrice = ta.valuewhen(bull and strategy.position_size[1] <= 0, close, 0)

entryShortPrice = ta.valuewhen(bear and strategy.position_size[1] >= 0, close, 0)

plot(strategy.position_size, title = "avg_pos_size")

get_pip_size() =>

float _pipsize = 1.

if syminfo.type == "forex"

_pipsize := (syminfo.mintick * (str.contains(syminfo.ticker, "JPY") ? 100 : 10))

else if str.contains(syminfo.ticker, "XAU") or str.contains(syminfo.ticker, "XAG")

_pipsize := 0.1

_pipsize

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if signal_candle and use_sl

final_SL_Long := entryLongPrice - (sl_value * get_pip_size())

final_SL_Short := entryShortPrice + (sl_value * get_pip_size())

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

var MaxReached = 0.0

if signal_candle[1]

MaxReached := strategy.position_size > 0 ? high : low

MaxReached := strategy.position_size > 0

? math.max(nz(MaxReached, high), high)

: strategy.position_size < 0 ? math.min(nz(MaxReached, low), low) : na

if use_tsl and use_sl

if strategy.position_size > 0

stopValue = MaxReached - (tsl_input_pips * get_pip_size())

final_SL_Long := math.max(stopValue, final_SL_Long[1])

else if strategy.position_size < 0

stopValue = MaxReached + (tsl_input_pips * get_pip_size())

final_SL_Short := math.min(stopValue, final_SL_Short[1])

// # ========================================================================= #

// # | Take Profit 1 |

// # ========================================================================= #

var float final_TP1_Long = 0.

var float final_TP1_Short = 0.

final_TP1_Long := entryLongPrice + (tp1_value * get_pip_size())

final_TP1_Short := entryShortPrice - (tp1_value * get_pip_size())

plot(use_tp1 and strategy.position_size > 0 ? final_TP1_Long : na, title = "TP1 Long", color = color.aqua, linewidth=2, style=plot.style_linebr)

plot(use_tp1 and strategy.position_size < 0 ? final_TP1_Short : na, title = "TP1 Short", color = color.blue, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit 2 |

// # ========================================================================= #

var float final_TP2_Long = 0.

var float final_TP2_Short = 0.

final_TP2_Long := entryLongPrice + (tp2_value * get_pip_size())

final_TP2_Short := entryShortPrice - (tp2_value * get_pip_size())

plot(use_tp2 and strategy.position_size > 0 and tp1_qty != 100 ? final_TP2_Long : na, title = "TP2 Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(use_tp2 and strategy.position_size < 0 and tp1_qty != 100 ? final_TP2_Short : na, title = "TP2 Short", color = color.white, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

var bool SL_BE_REACHED = false

// Calculate open profit or loss for the open positions.

tradeOpenPL() =>

sumProfit = 0.0

for tradeNo = 0 to strategy.opentrades - 1

sumProfit += strategy.opentrades.profit(tradeNo)

result = sumProfit

//get_pip_size() =>

// syminfo.type == "forex" ? syminfo.pointvalue * 100 : 1

current_profit = tradeOpenPL()// * get_pip_size()

current_long_profit = (close - entryLongPrice) / (syminfo.mintick * 10)

current_short_profit = (entryShortPrice - close) / (syminfo.mintick * 10)

plot(current_short_profit, title = "Current Short Profit")

plot(current_long_profit, title = "Current Long Profit")

if use_sl_be

if strategy.position_size[1] > 0

if not SL_BE_REACHED

if current_long_profit >= sl_be_value

final_SL_Long := entryLongPrice + (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

else if strategy.position_size[1] < 0

if not SL_BE_REACHED

if current_short_profit >= sl_be_value

final_SL_Short := entryShortPrice - (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

plot(use_sl and strategy.position_size > 0 ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(use_sl and strategy.position_size < 0 ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Strategy Calls |

// # ========================================================================= #

string entry_long_limit_alert_message = ""

string entry_long_TP1_alert_message = ""

string entry_long_TP2_alert_message = ""

tp1_qty_perc = tp1_qty / 100

if use_tp1 and use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_limit_alert_message := entry_long_TP1_alert_message + "\n" + entry_long_TP2_alert_message

//entry_long_limit_alert_message = pineconnector_licence_ID + ",buystop," + syminfo.ticker + ",price=" + str.tostring(buy_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Long) + ",sl=" + str.tostring(final_SL_Long)

//entry_short_market_alert_message = pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + (use_tp1 ? ",tp=" + str.tostring(final_TP1_Short) : "")

// + (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "")

//entry_short_limit_alert_message = pineconnector_licence_ID + ",sellstop," + syminfo.ticker + ",price=" + str.tostring(sell_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Short) + ",sl=" + str.tostring(final_SL_Short)

string entry_short_limit_alert_message = ""

string entry_short_TP1_alert_message = ""

string entry_short_TP2_alert_message = ""

if use_tp1 and use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_limit_alert_message := entry_short_TP1_alert_message + "\n" + entry_short_TP2_alert_message

long_update_sl_alert_message = pineconnector_licence_ID + ",newsltplong," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Long)

short_update_sl_alert_message = pineconnector_licence_ID + ",newsltpshort," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Short)

cancel_long = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

cancel_short = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

close_long = pineconnector_licence_ID + ",closelong," + syminfo.ticker

close_short = pineconnector_licence_ID + ",closeshort," + syminfo.ticker

if bull and strategy.position_size <= 0

alert(close_short, alert.freq_once_per_bar_close)

strategy.entry("Long", strategy.long)

alert(entry_long_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_long_TP2_alert_message, alert.freq_once_per_bar_close)

else if bear and strategy.position_size >= 0

alert(close_long, alert.freq_once_per_bar_close)

strategy.entry("Short", strategy.short)

alert(entry_short_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_short_TP2_alert_message, alert.freq_once_per_bar_close)

if strategy.position_size[1] > 0

if low <= final_SL_Long and use_sl

strategy.close("Long", alert_message = close_long)

else

strategy.exit("Exit TP1 Long", "Long", limit = final_TP1_Long, comment_profit = "Exit TP1 Long", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Long", "Long", limit = final_TP2_Long, comment_profit = "Exit TP2 Long", alert_message = close_long)

if bull_count[1] == 5 and bull_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Long", comment = "1 or more MACDs became bearish", alert_message = close_long)

else if strategy.position_size[1] < 0

if high >= final_SL_Short and use_sl

//strategy.exit("Exit SL Short", "Short", stop = final_SL_Short, comment_loss = "Exit SL Short")

strategy.close("Short", alert_message = close_short)

else

strategy.exit("Exit TP1 Short", "Short", limit = final_TP1_Short, comment_profit = "Exit TP1 Short", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Short", "Short", limit = final_TP2_Short, comment_profit = "Exit TP2 Short")

if bear_count[1] == 5 and bear_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Short", comment = "1 or more MACDs became bullish", alert_message = close_short)

// # ========================================================================= #

// # | Logs |

// # ========================================================================= #

// if bull and strategy.position_size <= 0

// log.info(entry_long_limit_alert_message)

// else if bear and strategy.position_size >= 0

// log.info(entry_short_limit_alert_message)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #

if (strategy.position_size > 0 and strategy.position_size[1] <= 0)

or (strategy.position_size < 0 and strategy.position_size[1] >= 0)

//is_TP1_REACHED := false

SL_BE_REACHED := false

- Strategi Perdagangan Kuantitatif Berdasarkan Beberapa Indikator

- Kesenjangan Harga dan Tren Mengikuti Strategi Trading

- Breakout Scalper - Menangkap Perubahan Tren dengan Cepat

- Strategi pelacakan lintas EMA

- SSL Channel Breakout Strategy dengan Trailing Stop Loss

- Strategi Pelacakan Momentum CCI

- Strategi Perdagangan Breakout Akumulasi bertahap

- Strategi Arah Lilin Dinamis

- Strategi Perdagangan Divergensi RSI

- Strategi tren jangka pendek berdasarkan keputusan multi-indikator

- Strategi Crossover Rata-rata Bergerak Ganda

- ATR Adjustable Trailing Stop Loss Strategi

- Bollinger Band Width Scaling Strategi Filter Tren Rata-rata Bergerak Ganda

- Strategi Stop Loss Pengiringan Giring

- Strategi Bollinger Bands dan indikator RSI

- strategi perdagangan jangka pendek

- Ichimoku Balance Line tren mengikuti Strategi

- Strategi penyebaran EMA ganda

- Strategi Trading Breakout Contrarian

- Williams VIX Fix Strategi