Strategi Perdagangan Algoritma Crossover Dual Moving Average

Penulis:ChaoZhang, Tanggal: 2023-10-30 15:27:34Tag:

Gambaran umum

Strategi ini terutama memanfaatkan prinsip crossover rata-rata bergerak, dikombinasikan dengan sinyal pembalikan indikator RSI dan algoritma crossover rata-rata bergerak ganda khusus untuk menerapkan perdagangan tren. Strategi ini melacak dua rata-rata bergerak dari periode yang berbeda, dengan MA yang lebih cepat melacak tren jangka pendek dan MA yang lebih lambat melacak tren jangka panjang. Ketika MA yang lebih cepat melintasi MA yang lebih lambat ke atas, itu menandakan tren naik dan kesempatan untuk membeli. Ketika MA yang lebih cepat melintasi di bawah MA yang lebih lambat, itu menandakan akhir tren jangka pendek dan kesempatan untuk menutup posisi.

Logika Strategi

-

Menghitung dua kelompok rata-rata bergerak VWAP dengan parameter yang berbeda, yang mewakili tren jangka panjang dan jangka pendek masing-masing.

- Slow Tenkansen dan Kijunsen menghitung tren jangka panjang

- Fast Tenkansen dan Kijunsen menghitung tren jangka pendek

-

Ambil rata-rata Tenkansen dan Kijunsen sebagai rata-rata bergerak lambat dan cepat.

-

Menghitung Bollinger Bands untuk mengidentifikasi konsolidasi dan breakout.

- Garis tengah adalah rata-rata MA cepat dan lambat

- Band atas dan bawah digunakan untuk mendeteksi pecah

-

Menghitung TSV untuk menentukan energi volume

- TSV lebih besar dari 0 menunjukkan volume bullish

- TSV yang lebih besar dari EMA menunjukkan momentum penguatan

-

Menghitung RSI untuk mengidentifikasi kondisi overbought dan oversold

- RSI di bawah 30 adalah zona oversold untuk membeli

- RSI di atas 70 adalah zona overbought untuk menjual

-

Ketentuan masuk:

- MA cepat melintasi MA lambat

- Menutup persilangan di atas Upper Bollinger Band

- TSV lebih besar dari 0 dan EMA

- RSI di bawah 30

-

Kondisi keluar:

- MA cepat melintasi MA lambat

- RSI lebih dari 70

Analisis Keuntungan

-

Sistem rata-rata bergerak ganda menangkap tren jangka panjang dan jangka pendek

-

RSI menghindari membeli zona overbought dan menjual zona oversold

-

TSV memastikan volume yang cukup untuk mendukung tren

-

Bollinger Bands mengidentifikasi titik-titik penting dari penembusan

-

Kombinasi indikator membantu menyaring terobosan palsu

Analisis Risiko

-

Sistem MA rentan terhadap sinyal palsu, perlu disaring dengan indikator lain

-

Parameter RSI perlu dioptimalkan, jika tidak mungkin kehilangan titik beli/jual

-

TSV juga sangat sensitif terhadap parameter, membutuhkan pengujian yang cermat

-

Pecahkan BB band atas mungkin palsu breakout, perlu verifikasi

-

Sulit untuk mengoptimalkan banyak indikator, risiko overfit

-

Data kereta api/ujian yang tidak cukup dapat menyebabkan penyesuaian kurva

Arahan Optimasi

-

Uji lebih banyak periode untuk menemukan kombinasi parameter terbaik

-

Cobalah indikator lain seperti MACD, KD untuk mengganti atau menggabungkan dengan RSI

-

Menggunakan analisis berjalan maju untuk optimasi parameter

-

Tambahkan stop loss untuk mengendalikan kerugian perdagangan tunggal

-

Pertimbangkan model pembelajaran mesin untuk membantu prediksi sinyal

-

Sesuaikan parameter untuk pasar yang berbeda, jangan terlalu cocok dengan satu parameter set

Kesimpulan

Strategi ini menangkap tren jangka panjang dan jangka pendek menggunakan rata-rata bergerak ganda, dan menyaring sinyal dengan RSI, TSV, Bollinger Bands dan banyak lagi. Keuntungannya adalah perdagangan sesuai dengan momentum kenaikan jangka panjang. Tetapi juga membawa risiko sinyal palsu, yang membutuhkan penyesuaian parameter lebih lanjut dan stop loss untuk mengurangi risiko. Secara keseluruhan, menggabungkan trend berikut dan reversi rata-rata menghasilkan hasil yang baik dalam tren kenaikan jangka panjang, tetapi parameter perlu disesuaikan untuk pasar yang berbeda.

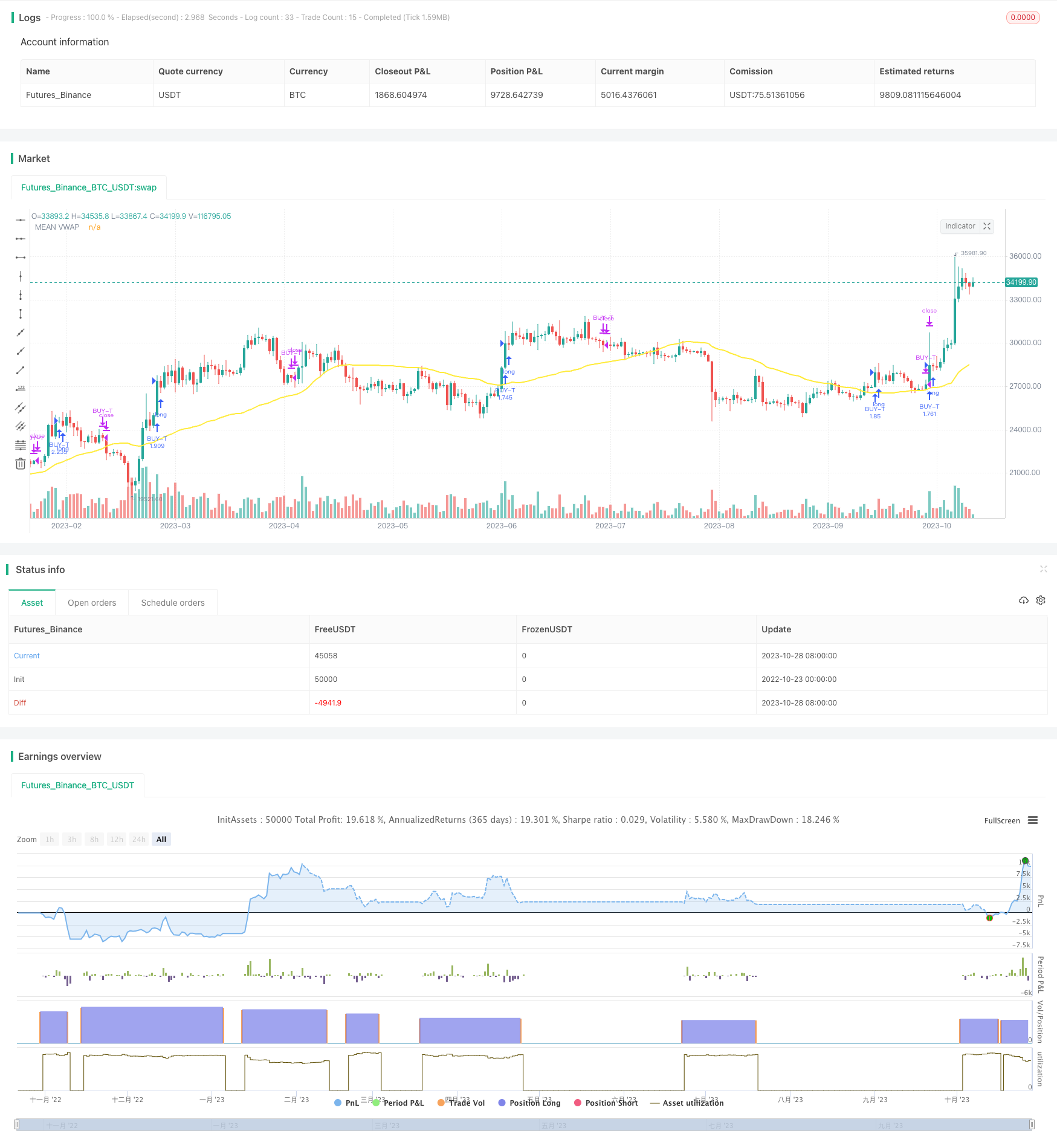

/*backtest

start: 2022-10-23 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Credits

// "Vwap with period" code which used in this strategy to calculate the leadLine was written by "neolao" active on https://tr.tradingview.com/u/neolao/

// "TSV" code which used in this strategy was written by "liw0" active on https://www.tradingview.com/u/liw0. The code is corrected by "vitelot" December 2018.

// "Vidya" code which used in this strategy was written by "everget" active on https://tr.tradingview.com/u/everget/

strategy("HYE Combo Market [Strategy] (Vwap Mean Reversion + Trend Hunter)", overlay = true, initial_capital = 1000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, commission_value = 0.025)

//Strategy inputs

source = input(title = "Source", defval = close, group = "Mean Reversion Strategy Inputs")

smallcumulativePeriod = input(title = "Small VWAP", defval = 8, group = "Mean Reversion Strategy Inputs")

bigcumulativePeriod = input(title = "Big VWAP", defval = 10, group = "Mean Reversion Strategy Inputs")

meancumulativePeriod = input(title = "Mean VWAP", defval = 50, group = "Mean Reversion Strategy Inputs")

percentBelowToBuy = input(title = "Percent below to buy %", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiPeriod = input(title = "Rsi Period", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiEmaPeriod = input(title = "Rsi Ema Period", defval = 5, group = "Mean Reversion Strategy Inputs")

rsiLevelforBuy = input(title = "Maximum Rsi Level for Buy", defval = 30, group = "Mean Reversion Strategy Inputs")

slowtenkansenPeriod = input(9, minval=1, title="Slow Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

slowkijunsenPeriod = input(13, minval=1, title="Slow Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fasttenkansenPeriod = input(3, minval=1, title="Fast Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fastkijunsenPeriod = input(7, minval=1, title="Fast Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

BBlength = input(20, minval=1, title= "Bollinger Band Length", group = "Trend Hunter Strategy Inputs")

BBmult = input(2.0, minval=0.001, maxval=50, title="Bollinger Band StdDev", group = "Trend Hunter Strategy Inputs")

tsvlength = input(20, minval=1, title="TSV Length", group = "Trend Hunter Strategy Inputs")

tsvemaperiod = input(7, minval=1, title="TSV Ema Length", group = "Trend Hunter Strategy Inputs")

length = input(title="Vidya Length", type=input.integer, defval=20, group = "Trend Hunter Strategy Inputs")

src = input(title="Vidya Source", type=input.source, defval= hl2 , group = "Trend Hunter Strategy Inputs")

// Vidya Calculation

getCMO(src, length) =>

mom = change(src)

upSum = sum(max(mom, 0), length)

downSum = sum(-min(mom, 0), length)

out = (upSum - downSum) / (upSum + downSum)

out

cmo = abs(getCMO(src, length))

alpha = 2 / (length + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group = "Strategy Date Range")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group = "Strategy Date Range")

startYear = input(title="Start Year", type=input.integer,

defval=2000, minval=1800, maxval=2100, group = "Strategy Date Range")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group = "Strategy Date Range")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group = "Strategy Date Range")

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100, group = "Strategy Date Range")

inDateRange = true

// Mean Reversion Strategy Calculation

typicalPriceS = (high + low + close) / 3

typicalPriceVolumeS = typicalPriceS * volume

cumulativeTypicalPriceVolumeS = sum(typicalPriceVolumeS, smallcumulativePeriod)

cumulativeVolumeS = sum(volume, smallcumulativePeriod)

smallvwapValue = cumulativeTypicalPriceVolumeS / cumulativeVolumeS

typicalPriceB = (high + low + close) / 3

typicalPriceVolumeB = typicalPriceB * volume

cumulativeTypicalPriceVolumeB = sum(typicalPriceVolumeB, bigcumulativePeriod)

cumulativeVolumeB = sum(volume, bigcumulativePeriod)

bigvwapValue = cumulativeTypicalPriceVolumeB / cumulativeVolumeB

typicalPriceM = (high + low + close) / 3

typicalPriceVolumeM = typicalPriceM * volume

cumulativeTypicalPriceVolumeM = sum(typicalPriceVolumeM, meancumulativePeriod)

cumulativeVolumeM = sum(volume, meancumulativePeriod)

meanvwapValue = cumulativeTypicalPriceVolumeM / cumulativeVolumeM

rsiValue = rsi(source, rsiPeriod)

rsiEMA = ema(rsiValue, rsiEmaPeriod)

buyMA = ((100 - percentBelowToBuy) / 100) * bigvwapValue[0]

inTrade = strategy.position_size > 0

notInTrade = strategy.position_size <= 0

if(crossunder(smallvwapValue, buyMA) and rsiEMA < rsiLevelforBuy and close < meanvwapValue and inDateRange and notInTrade)

strategy.entry("BUY-M", strategy.long)

if(close > meanvwapValue or not inDateRange)

strategy.close("BUY-M")

// Trend Hunter Strategy Calculation

// Slow Tenkan Sen Calculation

typicalPriceTS = (high + low + close) / 3

typicalPriceVolumeTS = typicalPriceTS * volume

cumulativeTypicalPriceVolumeTS = sum(typicalPriceVolumeTS, slowtenkansenPeriod)

cumulativeVolumeTS = sum(volume, slowtenkansenPeriod)

slowtenkansenvwapValue = cumulativeTypicalPriceVolumeTS / cumulativeVolumeTS

// Slow Kijun Sen Calculation

typicalPriceKS = (high + low + close) / 3

typicalPriceVolumeKS = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKS = sum(typicalPriceVolumeKS, slowkijunsenPeriod)

cumulativeVolumeKS = sum(volume, slowkijunsenPeriod)

slowkijunsenvwapValue = cumulativeTypicalPriceVolumeKS / cumulativeVolumeKS

// Fast Tenkan Sen Calculation

typicalPriceTF = (high + low + close) / 3

typicalPriceVolumeTF = typicalPriceTF * volume

cumulativeTypicalPriceVolumeTF = sum(typicalPriceVolumeTF, fasttenkansenPeriod)

cumulativeVolumeTF = sum(volume, fasttenkansenPeriod)

fasttenkansenvwapValue = cumulativeTypicalPriceVolumeTF / cumulativeVolumeTF

// Fast Kijun Sen Calculation

typicalPriceKF = (high + low + close) / 3

typicalPriceVolumeKF = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKF = sum(typicalPriceVolumeKF, fastkijunsenPeriod)

cumulativeVolumeKF = sum(volume, fastkijunsenPeriod)

fastkijunsenvwapValue = cumulativeTypicalPriceVolumeKF / cumulativeVolumeKF

// Slow LeadLine Calculation

lowesttenkansen_s = lowest(slowtenkansenvwapValue, slowtenkansenPeriod)

highesttenkansen_s = highest(slowtenkansenvwapValue, slowtenkansenPeriod)

lowestkijunsen_s = lowest(slowkijunsenvwapValue, slowkijunsenPeriod)

highestkijunsen_s = highest(slowkijunsenvwapValue, slowkijunsenPeriod)

slowtenkansen = avg(lowesttenkansen_s, highesttenkansen_s)

slowkijunsen = avg(lowestkijunsen_s, highestkijunsen_s)

slowleadLine = avg(slowtenkansen, slowkijunsen)

// Fast LeadLine Calculation

lowesttenkansen_f = lowest(fasttenkansenvwapValue, fasttenkansenPeriod)

highesttenkansen_f = highest(fasttenkansenvwapValue, fasttenkansenPeriod)

lowestkijunsen_f = lowest(fastkijunsenvwapValue, fastkijunsenPeriod)

highestkijunsen_f = highest(fastkijunsenvwapValue, fastkijunsenPeriod)

fasttenkansen = avg(lowesttenkansen_f, highesttenkansen_f)

fastkijunsen = avg(lowestkijunsen_f, highestkijunsen_f)

fastleadLine = avg(fasttenkansen, fastkijunsen)

// BBleadLine Calculation

BBleadLine = avg(fastleadLine, slowleadLine)

// Bollinger Band Calculation

basis = sma(BBleadLine, BBlength)

dev = BBmult * stdev(BBleadLine, BBlength)

upper = basis + dev

lower = basis - dev

// TSV Calculation

tsv = sum(close>close[1]?volume*(close-close[1]):close<close[1]?volume*(close-close[1]):0,tsvlength)

tsvema = ema(tsv, tsvemaperiod)

// Rules for Entry & Exit

if(fastleadLine > fastleadLine[1] and slowleadLine > slowleadLine[1] and tsv > 0 and tsv > tsvema and close > upper and close > vidya and inDateRange and notInTrade)

strategy.entry("BUY-T", strategy.long)

if((fastleadLine < fastleadLine[1] and slowleadLine < slowleadLine[1]) or not inDateRange)

strategy.close("BUY-T")

// Plots

plot(meanvwapValue, title="MEAN VWAP", linewidth=2, color=color.yellow)

//plot(vidya, title="VIDYA", linewidth=2, color=color.green)

//colorsettingS = input(title="Solid Color Slow Leadline", defval=false, type=input.bool)

//plot(slowleadLine, title = "Slow LeadLine", color = colorsettingS ? color.aqua : slowleadLine > slowleadLine[1] ? color.green : color.red, linewidth=3)

//colorsettingF = input(title="Solid Color Fast Leadline", defval=false, type=input.bool)

//plot(fastleadLine, title = "Fast LeadLine", color = colorsettingF ? color.orange : fastleadLine > fastleadLine[1] ? color.green : color.red, linewidth=3)

//p1 = plot(upper, "Upper BB", color=#2962FF)

//p2 = plot(lower, "Lower BB", color=#2962FF)

//fill(p1, p2, title = "Background", color=color.blue)

//plot(smallvwapValue, color=#13C425, linewidth=2)

//plot(bigvwapValue, color=#CA1435, linewidth=2)

- RSI Strategi perdagangan otomatis jangka pendek panjang

- Strategi MACD Tanpa Tren

- Strategi VB Berdasarkan Saldo Volume

- Strategi perdagangan volatility breakout

- Strategi Crossover Rata-rata Bergerak Tiga

- Strategi Dukungan & Resistensi dengan MACD LONG

- Strategi Trading Trend Berdasarkan Moving Average

- RSI Strategi perdagangan saldo pendek panjang

- Tesla Supertrend Strategi

- Tiga Strategi Pembalikan Dari Dalam Ke Atas

- Tren Mengikuti Strategi dengan Trailing Stop Loss

- Strategi perdagangan ambang RSI

- Strategi Trend Breakout yang Kuat

- ZigZag Berbasis Tren Mengikuti Strategi

- Strategi Keseimbangan Ichimoku

- Golden Cross Death Cross Strategi Perdagangan Rata-rata Bergerak

- Strategi Tren Berdasarkan HULL SMA dan EMA Crossover

- Strategi Crossover EMA Dual

- Strategi Mengikuti Tren Berdasarkan Rata-rata Bergerak

- MACD Menutup Strategi Hybrid Turtle