Strategi osilasi dukungan dan resistensi kuantitatif

Penulis:ChaoZhangTag:

Gambaran umum

Strategi ini menggabungkan strategi RSI crossover dengan strategi stop loss yang dioptimalkan untuk mencapai kontrol logika yang tepat dan stop loss yang akurat dan mengambil keuntungan. Sementara itu, dengan memperkenalkan optimasi sinyal, dapat lebih memahami tren dan mencapai manajemen modal yang wajar.

Prinsip Strategi

- Memperkenalkan pengenalan pola candlestick untuk membantu menilai sinyal tren untuk menghindari perdagangan yang salah.

- Garis SMA membantu menentukan arah tren. Uptrend ketika SMA jangka pendek pecah SMA jangka panjang atas.

Analisis Keuntungan

- Optimasi parameter STO, penyesuaian kelancaran menyaring kebisingan dan meningkatkan kualitas sinyal.

- Teknologi Heikin-Ashi diperkenalkan untuk mengenali perubahan arah lilin dan memastikan sinyal perdagangan yang akurat.

Analisis Risiko

- Menghadapi risiko yang lebih besar ketika pasar terus turun.

- Frekuensi perdagangan yang tinggi meningkatkan biaya perdagangan dan biaya slip.

Optimasi Strategi

- Menyesuaikan parameter RSI, mengoptimalkan penilaian overbought oversold.

- Sesuaikan parameter STO, kelancaran dan periode untuk meningkatkan kualitas sinyal.

- Memperkenalkan lebih banyak indikator teknis untuk meningkatkan akurasi sinyal.

- Optimalkan stop loss ratio untuk mengurangi risiko perdagangan tunggal.

Kesimpulan

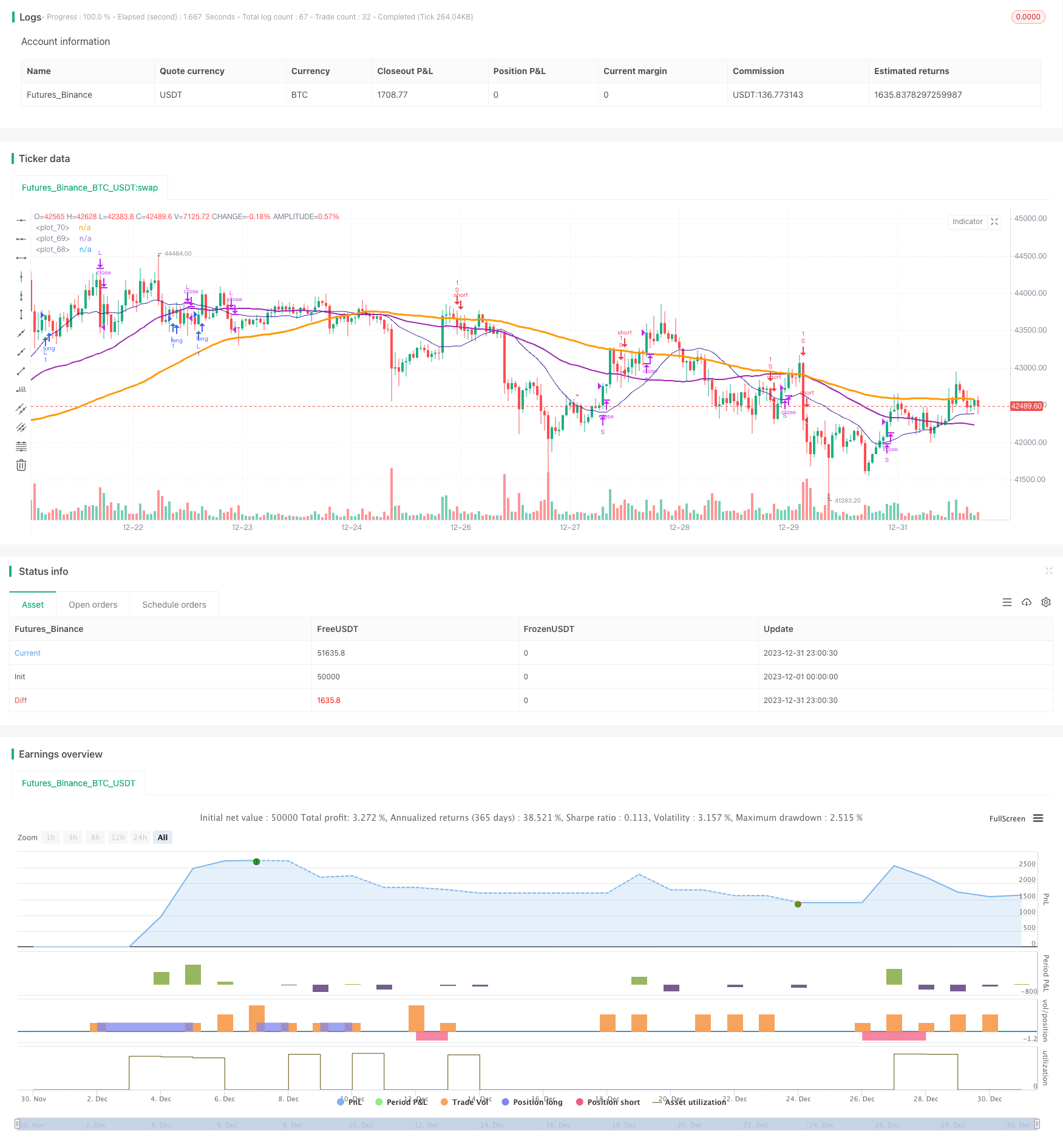

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true)

strategy(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true )

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

overbought = input(80, minval=1)

oversold = input(20, minval=1)

smaLengh = input(100, minval=1)

smaLengh2 = input(50, minval=1)

smaLengh3 = input(20, minval=1)

src = input(close, title="RSI Source")

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testPeriod() =>

time >= testPeriodStart ? true : false

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

crossBuy = crossover(k, d) and k < oversold

crossSell = crossunder(k, d) and k > overbought

dcLower = lowest(low, 10)

dcUpper = highest(high, 10)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashiPositive = heikinashi_close >= heikinashi_open

heikinashiBuy = heikinashiPositive == true and heikinashiPositive[1] == false and heikinashiPositive[2] == false

heikinashiSell = heikinashiPositive == false and heikinashiPositive[1] == true and heikinashiPositive[2] == true

//plotshape(heikinashiBuy, style=shape.arrowup, color=green, location=location.belowbar, size=size.tiny)

//plotshape(heikinashiSell, style=shape.arrowdown, color=red, location=location.abovebar, size=size.tiny)

buy = (crossBuy == true or crossBuy[1] == true or crossBuy[2] == true) and (heikinashiBuy == true or heikinashiBuy[1] == true or heikinashiBuy[2] == true)

sell = (crossSell == true or crossSell[1] == true or crossSell[2] == true) and (heikinashiSell == true or heikinashiSell[1] == true or heikinashiSell[2] == true)

mult = timeframe.period == '15' ? 4 : 1

mult2 = timeframe.period == '240' ? 0.25 : mult

movingAverage = sma(close, round(smaLengh))

movingAverage2 = sma(close, round(smaLengh2))

movingAverage3 = sma(close, round(smaLengh3))

uptrend = movingAverage < movingAverage2 and movingAverage2 < movingAverage3 and close > movingAverage

downtrend = movingAverage > movingAverage2 and movingAverage2 > movingAverage3 and close < movingAverage

signalBuy = (buy[1] == false and buy[2] == false and buy == true) and uptrend

signalSell = (sell[1] == false and sell[2] == false and sell == true) and downtrend

takeProfitSell = (buy[1] == false and buy[2] == false and buy == true) and uptrend == false

takeProfitBuy = (sell[1] == false and sell[2] == false and sell == true) and uptrend

plotshape(signalBuy, style=shape.triangleup, color=green, location=location.belowbar, size=size.tiny)

plotshape(signalSell, style=shape.triangledown, color=red, location=location.abovebar, size=size.tiny)

plot(movingAverage, linewidth=3, color=orange, transp=0)

plot(movingAverage2, linewidth=2, color=purple, transp=0)

plot(movingAverage3, linewidth=1, color=navy, transp=0)

alertcondition(signalBuy, title='Signal Buy', message='Signal Buy')

alertcondition(signalSell, title='Signal Sell', message='Signal Sell')

strategy.close("L", when=dcLower[1] > low)

strategy.close("S", when=dcUpper[1] < high)

strategy.entry("L", strategy.long, 1, when = signalBuy and testPeriod() and uptrend)

strategy.entry("S", strategy.short, 1, when = signalSell and testPeriod() and uptrend ==false)

//strategy.exit("Exit Long", from_entry = "L", loss = 25000000, profit=25000000)

//strategy.exit("Exit Short", from_entry = "S", loss = 25000000, profit=25000000)

Lebih banyak

- Strategi Tren Momentum

- Momentum Moving Average Crossover Quant Strategi

- Strategi kombinasi pembalikan rata-rata bergerak ganda dan ATR Trailing Stop

- Strategi perdagangan berjangka Martingale leveraged

- Strategi Pullback Momentum

- Dual Candlestick Prediksi Strategi Tutup

- Strategi Mengikuti Tren dengan 3 EMA, DMI dan MACD

- Strategi Terobosan Indikator Ganda

- Strategi Sistem Perdagangan Pete Wave

- Strategi Kuantitatif Berdasarkan Rata-rata Bergerak Eksponensial dan Berat Volume

- Strategi Origix Ashi Berdasarkan Rata-rata Gerak Lesu

- BlackBit Trader XO Makro Trend Scanner Strategi

- Tren ADX Minyak mentah Mengikuti Strategi

- MT-Koordinasi Strategi Perdagangan

- Strategi kombinasi pembalikan faktor ganda dan peningkatan tren volume harga

- Trend Angle Moving Average Crossover Strategi