Berbagai Indikator Mengikuti Strategi

Penulis:ChaoZhangTanggal: 2024-01-26 15:42:36Tag:

Gambaran umum

Logika Strategi

Strategi ini terdiri dari dua bagian:

- 123 Indikator Pembalikan

- Indikator Qstick

Jika Qstick melintasi di atas garis nol, itu menunjukkan peningkatan momentum bullish dan menghasilkan sinyal beli. Jika Qstick melintasi di bawah garis nol, itu menunjukkan peningkatan momentum bearish dan menghasilkan sinyal jual.

Analisis Keuntungan

Risiko dan Solusi

Hal ini dapat diselesaikan dengan optimasi parameter, menyesuaikan parameter dari dua indikator untuk mengkoordinasikan frekuensi dan ritme generasi sinyal mereka.

- Perbedaan abnormal antara indikator yang menyebabkan perdagangan berlebihan

Arahan Optimasi

-

Mengoptimalkan parameter panjang dari kedua indikator untuk menemukan kombinasi parameter optimal

-

Tambahkan strategi stop loss

Kesimpulan

Dengan menggabungkan keuntungan dari beberapa indikator dasar, strategi Multiple Indicators Follow dapat meningkatkan kualitas sinyal. Sementara mengendalikan risiko, ia dapat mencapai pengembalian yang relatif lebih tinggi. Ada ruang untuk parameter lebih lanjut dan optimasi strategi untuk strategi ini. Melalui pengujian, strategi dapat dibuat lebih stabil dan dapat diandalkan.

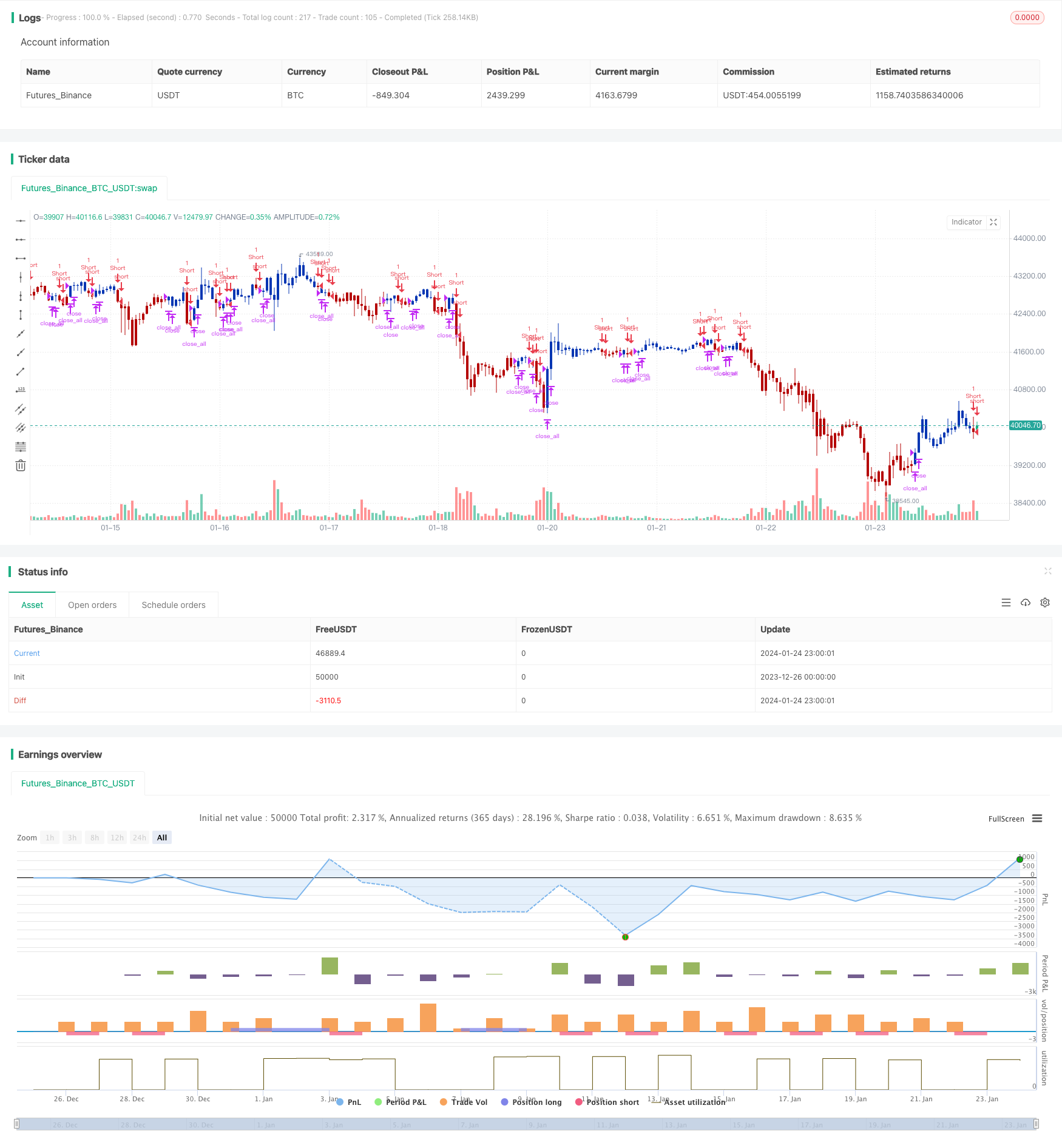

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 24/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// A technical indicator developed by Tushar Chande to numerically identify

// trends in candlestick charting. It is calculated by taking an 'n' period

// moving average of the difference between the open and closing prices. A

// Qstick value greater than zero means that the majority of the last 'n' days

// have been up, indicating that buying pressure has been increasing.

// Transaction signals come from when the Qstick indicator crosses through the

// zero line. Crossing above zero is used as the entry signal because it is indicating

// that buying pressure is increasing, while sell signals come from the indicator

// crossing down through zero. In addition, an 'n' period moving average of the Qstick

// values can be drawn to act as a signal line. Transaction signals are then generated

// when the Qstick value crosses through the trigger line.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Qstick(Length) =>

pos = 0.0

xR = close - open

xQstick = sma(xR, Length)

pos:= iff(xQstick > 0, 1,

iff(xQstick < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Qstick Indicator", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Qstick Indicator ----")

LengthQ = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posQstick = Qstick(LengthQ)

pos = iff(posReversal123 == 1 and posQstick == 1 , 1,

iff(posReversal123 == -1 and posQstick == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Market Cypher Wave B Strategi Perdagangan Otomatis

- Strategi Pembalikan Kunci Backtest

- Reversal Candlestick Backtesting Strategi

- Swing High Low Price Channel Strategy V.1

- Strategi Perdagangan Pembalikan Momentum

- Strategi Saluran Regresi Linear Adaptif

- Perbedaan Rata-rata Gerak Strategi Zero Cross

- Tren yang Kuat Mengikuti Strategi

- Harga Menembus Moving Average Trend Mengikuti Strategi

- Dual EMA Golden Cross Breakout Strategi

- Strategi Tren BB KC bertahap

- Strategi Pelacakan Otomatis SMA Ganda

- Strategi Trading Posisi Bitcoin Futures

- EMA harga dengan optimasi stokastik berdasarkan pembelajaran mesin

- Strategi Bollinger Dynamic Breakout

- Dua Tahun Baru Tinggi Retracement Moving Average Strategi

- Strategi Perdagangan Rata-rata Bergerak Ganda