Strategi Ichimoku Cloud Nine yang berorientasi pada perdagangan

Penulis:ChaoZhang, Tanggal: 2024-02-19 11:35:05Tag:

Gambaran umum

Strategi Ichimoku Cloud Nine dibangun di atas indikator Ichimoku Cloud dikombinasikan dengan penggunaan Fraktal Williams. Ini adalah strategi berorientasi perdagangan yang memanfaatkan beberapa sinyal perdagangan dari Ichimoku Cloud.

Logika Strategi

Strategi ini terutama menggunakan sinyal Ichimoku berikut untuk memasuki perdagangan:

- Kumo Breakout: menghasilkan sinyal ketika harga ditutup di atas atau di bawah awan

- TK Cross: menghasilkan sinyal ketika Tenkan melintasi Kijun

- Kumo Twist: menghasilkan sinyal ketika Senkou Span A melintasi Senkou Span B

- Edge to Edge: menghasilkan sinyal ketika harga memasuki kedua sisi Cloud

Strategi akan keluar dari perdagangan dalam situasi berikut:

- Penutupan harga di dalam Cloud

- TK Melalui ke arah yang berlawanan

- Pelanggaran fraktal Williams ke arah yang berlawanan

Strategi ini menggabungkan beberapa sinyal Ichimoku untuk meningkatkan keandalan sambil menggunakan fraktal sebagai stop loss untuk mengendalikan risiko.

Keuntungan

Dibandingkan dengan strategi sinyal tunggal, strategi ini menyaring sinyal melalui beberapa sinyal Ichimoku, meningkatkan akurasi.

Penggunaan fraktal sebagai stop loss secara aktif mengontrol risiko dan mengunci keuntungan.

Risiko

Risiko utama yang dihadapi:

- Sifat keterlambatan Awan Ichimoku

- Beberapa sinyal mungkin terlalu konservatif kehilangan kesempatan

- Fraktal stop loss bisa dihapus

Pengurangan: menyesuaikan parameter atau menghapus beberapa sinyal. menyetel fraktal periode waktu atau hanya parsial stop loss pada fraktur.

Peluang Peningkatan

Bidang utama untuk optimasi:

- Sesuaikan parameter Ichimoku untuk produk yang berbeda

- Menghilangkan beberapa sinyal, mempertahankan aturan inti

- Tune fraktal parameter untuk menggunakan jangka waktu yang lebih tinggi atau hanya berhenti sebagian

- Tambahkan indikator lain seperti volume

Kesimpulan

Strategi Ichimoku Cloud Nine meningkatkan perdagangan Ichimoku dengan menggabungkan sinyal untuk meningkatkan akurasi dan tingkat kemenangan. Penggunaan fraktal mengelola risiko. Parameter dan sinyal dapat dioptimalkan untuk perdagangan otomatis di berbagai produk.

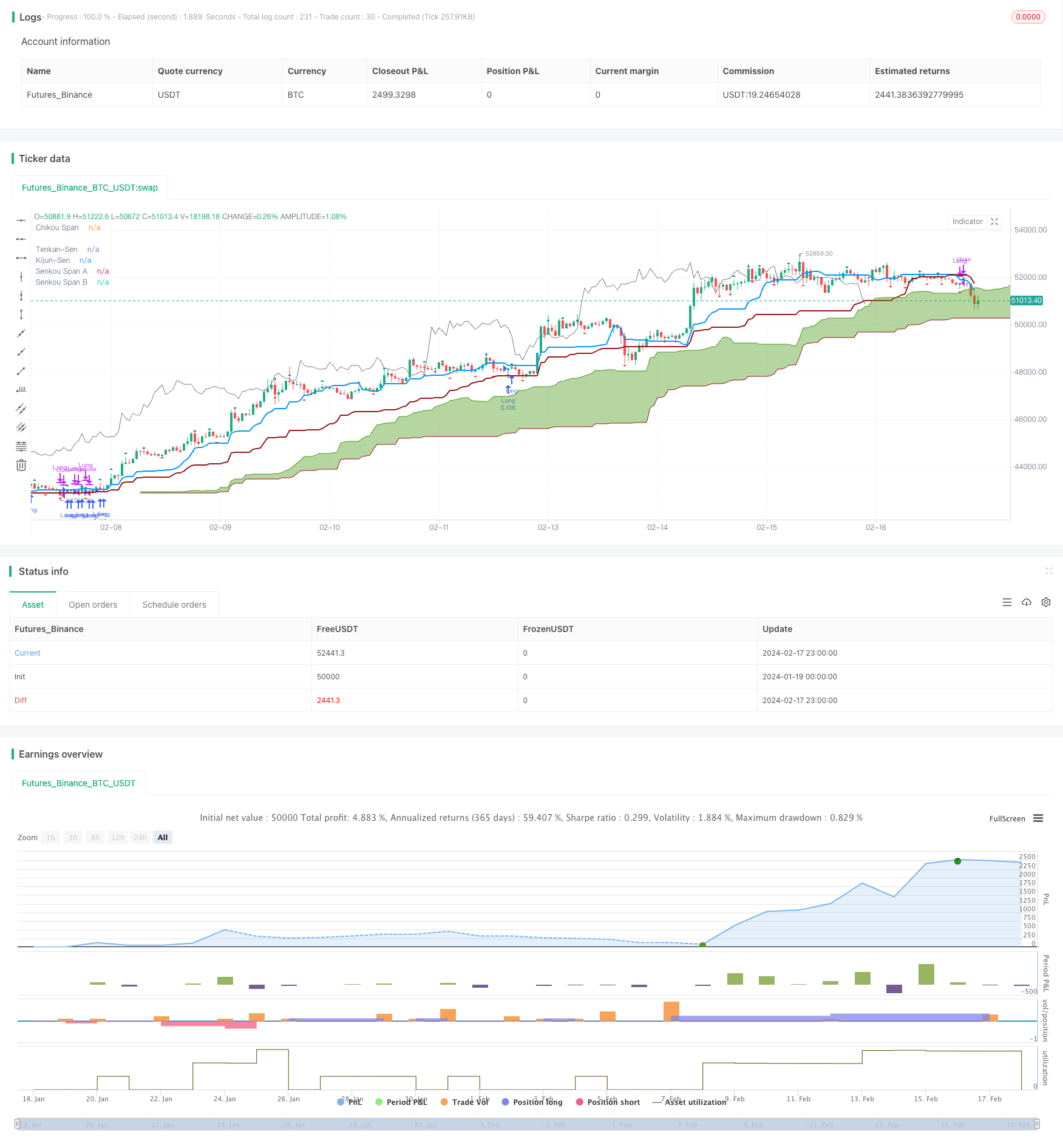

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud Nine", shorttitle="Ichimoku Cloud Nine", overlay=true, calc_on_every_tick = true, calc_on_order_fills = false, initial_capital = 5000, currency = "USD", default_qty_type = "percent_of_equity", default_qty_value = 10, pyramiding = 3, process_orders_on_close = true)

color green = #459915

color red = #991515

// --------

// Fractals

// --------

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

close_on_fractal = input.bool(false, title="Use William Fractals for SL?", group = "Fractals")

n = input.int(title="Periods", defval=2, minval=2, group = "Fractals")

fractal_close_percentage = input.int(100, minval=1, maxval=100, title="Position % to close on fractal breach", group = "Fractals")

selected_fractals_timeframe = input.timeframe('Current', "Timeframe", options=["Current", "1D", "12H", "8H", "4H", "1H"], group = "Fractals", tooltip = "Timeframe to use to look for fractals. Example: if 12H is selected, it will close positions when the last 12H fractal is breached.")

string fractals_timeframe = switch selected_fractals_timeframe

"1D" => "1D"

"12H" => "720"

"8H" => "480"

"4H" => "240"

"1H" => "60"

// Default used when the three first cases do not match.

=> ""

prev_high = request.security(syminfo.tickerid, fractals_timeframe, high)

prev_low = request.security(syminfo.tickerid, fractals_timeframe, low)

period_high=prev_high

period_low=prev_low

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (period_high[n-i] < period_high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (period_high[n+i] < period_high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (period_high[n+1] <= period_high[n] and period_high[n+i + 1] < period_high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+i + 2] < period_high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+i + 3] < period_high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+4] <= period_high[n] and period_high[n+i + 4] < period_high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

var float upFractalPrice = 0

if (upFractal)

upFractalPrice := period_high[n]

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (period_low[n-i] > period_low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (period_low[n+i] > period_low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (period_low[n+1] >= period_low[n] and period_low[n+i + 1] > period_low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+i + 2] > period_low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+i + 3] > period_low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+4] >= period_low[n] and period_low[n+i + 4] > period_low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

var float downFractalPrice = 0

if (downFractal)

downFractalPrice := period_low[n]

plotshape(downFractal, style=shape.triangledown, location=location.belowbar, offset=-n, color=#F44336, size = size.auto)

plotshape(upFractal, style=shape.triangleup, location=location.abovebar, offset=-n, color=#009688, size = size.auto)

// --------

// Ichimoku

// --------

previous_close = close[1]

conversionPeriods = input.int(20, minval=1, title="Conversion Line Periods", group = "Cloud Settings"),

basePeriods = input.int(60, minval=1, title="Base Line Periods", group = "Cloud Settings")

laggingSpan2Periods = input.int(120, minval=1, title="Lagging Span 2 Periods", group = "Cloud Settings"),

displacement = input.int(30, minval=1, title="Displacement", group = "Cloud Settings")

long_entry = input.bool(true, title="Longs", group = "Entries", tooltip = "Will look for longs")

short_entry = input.bool(true, title="Shorts", group = "Entries", tooltip = "Will look for shorts")

wait_for_twist = input.bool(true, title="Wait for kumo twist?", group = "Entries", tooltip = "Will wait for the Kumo to turn green (longs) or red (shorts)")

ignore_lagging_span = input.bool(true, title="Ignore Lagging Span Signal?", group = "Entries", tooltip = "Will not wait for lagging span to be above/below price and cloud")

bounce_entry = input.bool(true, title="Kijun Bounce", group = "Entries", tooltip = "Will enter position on a Kijun bounce")

e2e_entry = input.bool(true, title="Enable", group = "Edge 2 Edge", tooltip = "Will look for edge-to-edge trades")

e2e_entry_tk_confluence = input.bool(true, title="Require TK Confluence?", group = "Edge 2 Edge", tooltip = "Require confluent TK cross in order to enter an e2e trade")

min_cloud_thickness = input.float(10, minval=1, title="Minimun Cloud Thickness (%)", group = "Edge 2 Edge", tooltip = "Minimum cloud thickness for entering e2e trades")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(conversionPeriods)

kijun = donchian(basePeriods)

spanA = math.avg(tenkan, kijun)

spanB = donchian(laggingSpan2Periods)

plot(tenkan, color=#0496ff, title="Tenkan-Sen", linewidth = 2)

plot(kijun, color=red, title="Kijun-Sen", linewidth = 2)

plot(close, offset = -displacement, color=color.gray, title="Chikou Span")

p1 = plot(spanA, offset = displacement, color=green, title="Senkou Span A")

p2 = plot(spanB, offset = displacement, color=red, title="Senkou Span B")

fill(p1, p2, color = spanA > spanB ? color.new(green, 50) : color.new(red, 50))

cloud_high = math.max(spanA[displacement], spanB[displacement])

cloud_low = math.min(spanA[displacement], spanB[displacement])

lagging_span_above_price_and_cloud = (close > close[displacement] and close > cloud_high[displacement]) or ignore_lagging_span

lagging_span_below_price_and_cloud = (close < close[displacement] and close < cloud_low[displacement]) or ignore_lagging_span

step1=cloud_high-cloud_low

step2=(cloud_high+cloud_low)/2

cloud_thickness = (step1/step2)*100

// --------

// Trades

// --------

// LONGS

// kumo breakout

if (long_entry and ta.crossover(close, cloud_high) and tenkan > kijun and close > kijun and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - Kumo Breakout"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross above cloud

if (long_entry and close > cloud_high and ta.crossover(tenkan, kijun) and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - TK Cross"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (long_entry and close > cloud_high and tenkan > kijun and ta.crossover(spanA, spanB) and lagging_span_above_price_and_cloud)

comment = "Long - Kumo Twist"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossunder(close, cloud_high))

comment = "Close Long - Close inside cloud"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bearish tk cross

if (ta.crossunder(tenkan, kijun))

comment = "Close Long - TK Cross"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long - Fractal"

strategy.close("Long", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// SHORTS

// kumo breakout

if (short_entry and ta.crossunder(close, cloud_low) and tenkan < kijun and close < kijun and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - Kumo Breakout"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross below cloud

if (short_entry and close < cloud_low and ta.crossunder(tenkan, kijun) and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - TK Cross"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (short_entry and close < cloud_low and tenkan < kijun and lagging_span_below_price_and_cloud and ta.crossunder(spanA, spanB))

comment = "Short - Kumo Twist"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossover(close, cloud_low))

comment = "Close Short - Close inside cloud"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bullish tk cross

if (ta.crossover(tenkan, kijun))

comment = "Close Short - TK Cross"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short - Fractal"

strategy.close("Short", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BULL EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and tenkan > kijun and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(high, cloud_high))

comment = "Close Long e2e - Target Hit"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossunder(close, cloud_low))

comment = "Close Long e2e - Close below cloud"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long e2e - Fractal"

strategy.close("Long e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BEAR EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and tenkan < kijun and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(low, cloud_low))

comment = "Close Short e2e - Target Hit"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossover(close, cloud_high))

comment = "Close Short e2e - Close below cloud"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short e2e - Fractal"

strategy.close("Short e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// Kijun Bounce

if (bounce_entry and long_entry and open > cloud_high and open > kijun and ta.crossunder(low, kijun) and close > kijun and tenkan > kijun and kijun > cloud_high and lagging_span_above_price_and_cloud)

comment = "Long - Kijun Bounce"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (bounce_entry and short_entry and open < cloud_low and open < kijun and ta.crossover(high, kijun) and close < kijun and tenkan < kijun and kijun < cloud_low and lagging_span_below_price_and_cloud)

comment = "Short - Kijun Bounce"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

- Strategi perdagangan kuantitatif berbasis fraktal dan pola

- Strategi CAT Fluktuasi Reversal

- Strategi Perdagangan VWAP Saluran Harga

- Strategi Crossover Rata-rata Bergerak yang Terjalin

- Strategi Breakout Rata-rata Bergerak dan Breakout Bollinger Band

- Strategi Indikator Momentum Absolute

- Supertrend dan Moving Average Crossover Strategi

- Dual Trend Breakout Strategi

- Strategi Perdagangan Kuantitatif Saluran SSL dan Tren Gelombang

- Tren Super ATR Mengikuti Strategi

- LPB Microcycles Adaptive Oscillation Contour Tracking Strategi

- Strategi Perdagangan Pola ABCD Terbaik dengan Stop Loss dan Take Profit Tracking

- Indikator Tren Utama Panjang

- Strategi Multi Timeframe

- Strategi Investasi ETF dengan Leveraged Dynamic Balancing

- Strategi Perdagangan Crossover Indikator MACD Multi-Timeframe

- Gem Forest 1 Menit Breakout Strategi

- Tiga strategi pembalikan lilin tinggi

- MACD Moving Average Combination Cross-Period Dynamic Trend Strategy (Strategi Tren Dinamis lintas periode)

- Gem Forest Strategi Scalping Satu Menit