Indikator RSI Strategi perdagangan pemisahan jangka pendek panjang

Penulis:ChaoZhang, Tanggal: 2024-02-26 13:49:25Tag:

Gambaran umum

Strategi ini mengidentifikasi fenomena pemisahan panjang pendek melalui indikator RSI untuk membuat keputusan perdagangan. Ide utamanya adalah bahwa ketika harga mencapai titik terendah baru tetapi indikator RSI mencapai titik tertinggi baru, sinyal

Prinsip Strategi

Strategi ini terutama menggunakan indikator RSI untuk mengidentifikasi pemisahan panjang pendek antara harga dan RSI.

- Menggunakan parameter indikator RSI 13 dan harga penutupan sebagai data sumber

- Tentukan kisaran lookback kiri untuk pemisahan bullish sebagai 14 hari dan kisaran lookback kanan sebagai 2 hari

- Tentukan kisaran lookback kiri untuk pemisahan bearish sebagai 47 hari dan kisaran lookback kanan sebagai 1 hari

- Ketika harga mencapai titik terendah yang lebih rendah tetapi RSI mencapai titik terendah yang lebih tinggi, kondisi pemisahan panjang terpenuhi untuk menghasilkan sinyal panjang

- Ketika harga mencapai titik tertinggi yang lebih tinggi tetapi RSI mencapai titik tertinggi yang lebih rendah, kondisi pemisahan pendek dipenuhi untuk menghasilkan sinyal pendek

Dengan mengidentifikasi pemisahan panjang pendek antara harga dan RSI, dapat menangkap titik perubahan tren harga sebelumnya untuk pengambilan keputusan perdagangan.

Keuntungan dari Strategi

Keuntungan utama dari strategi ini adalah:

- Mengidentifikasi pemisahan harga/RSI dapat menilai pergeseran tren lebih awal untuk menangkap peluang perdagangan

- Gunakan analisis indikator sehingga kurang terpengaruh oleh emosi

- Menggunakan periode mundur yang tetap untuk mengidentifikasi pemisahan, menghindari pengaturan parameter yang sering

- Kondisi tambahan seperti RSI harian mengurangi sinyal palsu

Risiko dan Solusi

Masih ada beberapa risiko:

Divergensi RSI tidak selalu berarti pembalikan segera, keterlambatan waktu mungkin ada yang menyebabkan risiko stop loss. Solusi adalah untuk memungkinkan stop yang lebih luas untuk memberikan waktu untuk konfirmasi sinyal divergensi.

Penyelesaian adalah dengan menambahkan RSI harian atau mingguan jangka panjang sebagai kondisi filter.

Divergensi kecil mungkin tidak mengkonfirmasi pembalikan tren, perlu memperluas periode melihat kembali untuk menemukan divergensi RSI yang lebih signifikan.

Arahan Optimasi

Strategi ini dapat ditingkatkan dalam hal berikut:

Optimalkan parameter RSI untuk menemukan kombinasi parameter terbaik

Cobalah indikator teknis lain seperti MACD, KD untuk mengidentifikasi pemisahan

Tambahkan filter osilasi untuk mengurangi sinyal palsu di periode bergolak

Gabungkan RSI dari beberapa kerangka waktu untuk menemukan sinyal kombinasi terbaik

Kesimpulan

Strategi trading RSI long short separation menilai pergeseran tren dengan mengidentifikasi perbedaan antara harga dan RSI untuk menghasilkan sinyal trading. Strategi ini sederhana dan praktis. Memperbaiki parameter lebih lanjut dan menambahkan filter dapat meningkatkan profitabilitas. Secara keseluruhan strategi trading kuantitatif yang efektif.

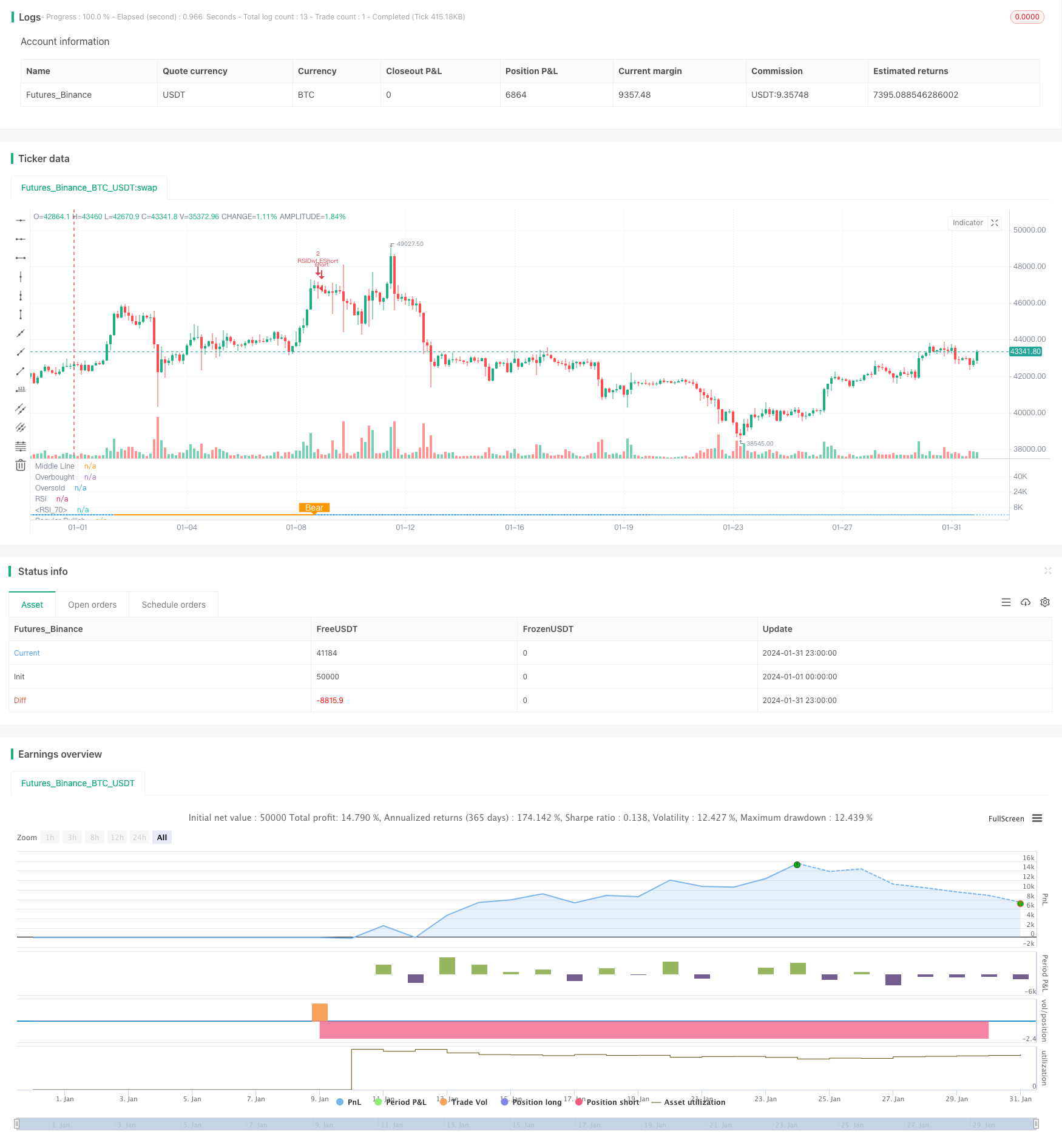

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Nextep

//@version=4

strategy(title="RSI top&bottom destroy ", overlay=false, pyramiding=4, default_qty_value=2, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

// INPUT Settings --------------------------------------------------------------------------------------------------------------------------------------------------

len = input(title="RSI Period", minval=1, defval=13)

src = input(title="RSI Source", defval=close)

// defining the lookback range for shorts

lbRshort = input(title="Short Lookback Right", defval=1)

lbLshort = input(title="Short Lookback Left", defval=47)

// defining the lookback range for longs

lbRlong = input(title="Long Lookback Right", defval=2)

lbLlong = input(title="Long Lookback Left", defval=14)

rangeUpper = input(title="Max of Lookback Range", defval=400)

rangeLower = input(title="Min of Lookback Range", defval=1)

// take profit levels

takeProfitLongRSILevel = input(title="Take Profit at RSI Level", minval=0, defval=75)

takeProfitShortRSILevel = input(title="Take Profit for Short at RSI Level", minval=0, defval=25)

// Stop loss settings

longStopLossType = input("PERC", title="Long Stop Loss Type", options=['ATR','PERC', 'FIB', 'NONE'])

shortStopLossType = input("PERC", title="Short Stop Loss Type", options=['ATR','PERC', 'FIB', 'NONE'])

longStopLossValue = input(title="Long Stop Loss Value", defval=14, minval=0)

shortStopLossValue = input(title="Short Stop Loss Value", defval=5, minval=-10)

// PLOTTING THE CHARTS --------------------------------------------------------------------------------------------------------------------------------------------------

// Plotting the Divergence

plotBull = input(title="Plot Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

bearColor = color.orange

bullColor = color.green

textColor = color.white

noneColor = color.new(color.white, 100)

// Adding the RSI oscillator

osc = rsi(src, len)

ma_len = 14 // Length for the moving average

rsi_ma = sma(osc, ma_len) // Calculate the moving average of RSI

plot(osc, title="RSI", linewidth=1, color=color.purple)

plot(rsi_ma, color=color.blue, title="RSI MA") // Plot the RSI MA

// Adding the lines of the RSI oscillator

plot(osc, title="RSI", linewidth=1, color=color.purple)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(75, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(25, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=color.purple, transp=80)

atrLength = input(14, title="ATR Length (for Trailing stop loss)")

atrMultiplier = input(3.5, title="ATR Multiplier (for Trailing stop loss)")

// RSI PIVOTS --------------------------------------------------------------------------------------------------------------------------------------------------

// Define a condition for RSI pivot low

isFirstPivotLowlong = not na(pivotlow(osc, lbLlong, lbRlong))

// Define a condition for RSI pivot high

isFirstPivotHighlong = not na(pivothigh(osc, lbLlong, lbRlong))

// Define a condition for the first RSI value

firstPivotRSIValuelong = isFirstPivotLowlong ? osc[lbRlong] : na

// Define a condition for the second RSI value

secondPivotRSIValuelong = isFirstPivotLowlong ? valuewhen(isFirstPivotLowlong, osc[lbRlong], 1) : na

// Define a condition for RSI pivot low

isFirstPivotLowshort = not na(pivotlow(osc, lbLshort, lbRshort))

// Define a condition for RSI pivot high

isFirstPivotHighshort = not na(pivothigh(osc, lbLshort, lbRshort))

// Define a condition for the first RSI value

firstPivotRSIValueshort = isFirstPivotLowshort ? osc[lbRshort] : na

// Define a condition for the second RSI value

secondPivotRSIValueshort = isFirstPivotLowshort ? valuewhen(isFirstPivotLowshort, osc[lbRshort], 1) : na

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

// ADDITIONAL ENTRY CRITERIA --------------------------------------------------------------------------------------------------------------------------------------------------

// RSI crosses RSI MA up by more than 2 points and subsequently down

rsiUpCross = crossover(osc, rsi_ma + 1)

rsiDownCross = crossunder(osc, rsi_ma - 1)

// Calculate the daily RSI

rsiDaily = security(syminfo.ticker, "D", rsi(src, 14))

// BULLISH CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// LOWER LOW PRICE & HIGHER LOW OSC

// Price: Lower Low

priceLL = na(isFirstPivotLowlong[1]) ? false : (low[lbRlong] < valuewhen(isFirstPivotLowlong, low[lbRlong], 1))

// Osc: Higher Low

oscHL = na(isFirstPivotLowlong[1]) ? false : (osc[lbRlong] > valuewhen(isFirstPivotLowlong, osc[lbRlong], 1) and _inRange(isFirstPivotLowlong[1]))

// BULLISH PLOT

bullCond = plotBull and priceLL and oscHL and isFirstPivotLowlong

plot(

isFirstPivotLowlong ? osc[lbRlong] : na,

offset=-lbRlong,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? osc[lbRlong] : na,

offset=-lbRlong,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

// BEARISH CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// HIGHER HIGH PRICE & LOWER LOW OSC

// Osc: Lower High

oscLH = na(isFirstPivotHighshort[1]) ? false : (osc[lbRshort] < valuewhen(isFirstPivotHighshort, osc[lbRshort], 1) and _inRange(isFirstPivotHighshort[1]))

// Price: Higher High

priceHH = na(isFirstPivotHighshort[1]) ? false : (high[lbRshort] > valuewhen(isFirstPivotHighshort, high[lbRshort], 1))

// BEARISH PLOT

bearCond = plotBear and priceHH and oscLH and isFirstPivotHighshort

plot(

isFirstPivotHighshort ? osc[lbRshort] : na,

offset=-lbRshort,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? osc[lbRshort] : na,

offset=-lbRshort,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

// ENTRY CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

longCondition = false

shortCondition = false

// Entry Conditions

longCondition := bullCond

shortCondition := bearCond

// Conditions to prevent entering trades based on daily RSI

longCondition := longCondition and rsiDaily >= 23

shortCondition := shortCondition and rsiDaily <= 80

// STOPLOSS CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// Stoploss Conditions

long_sl_val =

longStopLossType == "ATR" ? longStopLossValue * atr(atrLength)

: longStopLossType == "PERC" ? close * longStopLossValue / 100 : 0.00

long_trailing_sl = 0.0

long_trailing_sl := strategy.position_size >= 1 ? max(low - long_sl_val, nz(long_trailing_sl[1])) : na

// Calculate Trailing Stop Loss for Short Entries

short_sl_val =

shortStopLossType == "ATR" ? 1 - shortStopLossValue * atr(atrLength)

: shortStopLossType == "PERC" ? close * (shortStopLossValue / 100) : 0.00 //PERC = shortstoplossvalue = -21300 * 5 / 100 = -1065

short_trailing_sl = 0.0

short_trailing_sl := strategy.position_size <= -1 ? max(high + short_sl_val, nz(short_trailing_sl[1])) : na

// RSI STOP CONDITION

rsiStopShort = (strategy.position_avg_price != 0.0 and close <= strategy.position_avg_price * 0.90) or (strategy.position_avg_price != 0.0 and rsi(src, 14) >= 75)

rsiStopLong = (strategy.position_avg_price != 0.0 and close >= strategy.position_avg_price * 1.10) or (strategy.position_avg_price != 0.0 and rsi(src, 14) <= 25)

// LONG CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

strategy.entry(id="RSIDivLELong", long=true, when=longCondition)

strategy.entry(id="RSIDivLEShort", long=false, when=shortCondition)

// Close Conditions

shortCloseCondition = bullCond // or cross(osc, takeProfitShortRSILevel)

strategy.close(id="RSIDivLEShort", comment="Close All="+tostring(-close + strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) <= -1 and shortStopLossType == "NONE" and shortCloseCondition )

strategy.close(id="RSIDivLEShort", comment="TSL="+tostring(-close + strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= -1 and ((shortStopLossType == "PERC" or shortStopLossType == "ATR") and cross(short_trailing_sl,high))) // or rsiStopShort)// or rsiStopShort)

longCloseCondition = bearCond

strategy.close(id="RSIDivLELong", comment="Close All="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= 1 and longStopLossType == "NONE" and longCloseCondition)

strategy.close(id="RSIDivLELong", comment="TSL="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= 1 and ((longStopLossType == "PERC" or longStopLossType == "ATR") and cross(long_trailing_sl,low))) //or rsiStopLong

- Strategi Breakout Range Rata-rata dengan Rasio Emas

- Adaptive Exponential Moving Average Range Strategi

- Strategi Penembusan Saluran Donchian

- Strategi Perdagangan Penyu Berdasarkan Saluran Donchian

- Sistem Perdagangan Dual Quant

- Strategi Trading Reversal StochRSI

- Empat Strategi Tren Multi Timeframe DEMA

- Ikuti Strategi Beruang

- Strategi Beli Akumulator Cerdas

- Strategi Swing Harga EMA Dual

- Tren Mengikuti Strategi Perdagangan Kuantum Berdasarkan Rata-rata Bergerak

- Dalam Bar Breakout Strategi

- Gold Standard Strategi Perdagangan Kuantitatif

- Strategi Pembalikan Ganda

- Strategi Pemecahan Momentum Order Block

- Strategi Pelacakan Cerdas Dual EMA

- Strategi Perdagangan Rata-rata Bergerak

- Dual Moving Average HullMA Strategi Tren Crossover

- Strategi Stop Trailing Trailing yang Dinamis

- Strategi indikator rata-rata bergerak