Strategi Trading Tren Multi-Timeframe Berdasarkan Indikator yang Dikompres

Penulis:ChaoZhang, Tanggal: 2024-02-27 17:40:03Tag:

Gambaran umum

Strategi ini menggabungkan indikator Boom Hunter, Hull Suite, dan Volatility Oscillator untuk menerapkan strategi kuantitatif untuk pelacakan tren dan perdagangan breakout di beberapa kerangka waktu.

Prinsip-prinsip

Logika inti dari strategi ini didasarkan pada tiga indikator berikut:

-

Boom Hunter: Sebuah osilator yang menggunakan teknik kompresi indikator untuk menghasilkan sinyal perdagangan dari persilangan antara dua kuozien (Quotient1 dan Quotient2).

-

Suite Hull: Satu set garis rata-rata bergerak yang halus yang menentukan arah tren berdasarkan hubungan antara garis tengah dan band atas/bawah.

-

Osilator Volatilitas: Indikator osilator yang mengukur volatilitas harga.

Logika masuk dari strategi ini adalah ketika dua indikator Quotient dari Boom Hunter menyeberang naik atau turun, harga menembus garis tengah Hull dan menyimpang dari band atas atau bawah, sementara itu Volatility Oscillator berada di area overbought/oversold. Hal ini menyaring beberapa sinyal breakout palsu dan meningkatkan akurasi masuk.

Stop loss ditetapkan dengan menemukan lembah terendah atau puncak tertinggi selama periode tertentu (default 20 bar), dan mengambil keuntungan diperoleh dengan mengalikan persentase stop loss dengan faktor keuntungan yang dikonfigurasi (default 3x).

Keuntungan

- Mengekstrak sinyal perdagangan utama dari harga menggunakan teknik kompresi indikator, meningkatkan profitabilitas

- Kombinasi dari beberapa indikator mencegah pecah palsu dan secara akurat menentukan arah tren

- Pengaturan stop loss dan take profit yang dinamis memungkinkan tren yang dikendalikan risiko mengikuti

- Memastikan perdagangan di lingkungan volatilitas tinggi menggunakan Volatility Oscillator

- Meningkatkan stabilitas strategi melalui analisis multi-frame waktu

Risiko

- Indikator Boom Hunter dapat memiliki distorsi kompresi, menghasilkan sinyal yang salah

- Hull midline mungkin tertinggal dan tidak dapat melacak perubahan harga secara real time

- Kesempatan perdagangan yang hilang atau likuidasi paksa selama kontraksi volatilitas

Solusi:

- Sesuaikan parameter indikator kompresi untuk menyeimbangkan sensitivitas

- Cobalah rata-rata bergerak eksponensial bukan garis tengah

- Tambahkan indikator penilaian lainnya untuk menghindari salah arah volatilitas

Optimalisasi

Strategi ini dapat dioptimalkan dalam aspek berikut:

-

Optimasi Parameter: Dapatkan kombinasi parameter terbaik dengan tweaking pengaturan indikator seperti periode dan koefisien kompresi

-

Optimalisasi Kerangka Waktu: Uji periode yang berbeda (1 menit, 5 menit, 30 menit dll) untuk menemukan kerangka waktu perdagangan yang optimal

-

Optimasi Ukuran Posisi: Perubahan per ukuran dan rasio posisi perdagangan untuk menemukan rencana pemanfaatan modal yang ideal

-

Optimasi Stop Loss: Sesuaikan penempatan stop loss berdasarkan instrumen perdagangan yang berbeda untuk mencapai rasio risiko-imbalan optimal

-

Optimasi Kondisi: Tambahkan/kurangi filter indikator untuk mendapatkan sinyal masuk yang lebih akurat

Kesimpulan

Strategi ini menggabungkan Boom Hunter, Hull Suite dan Volatility Oscillator untuk menerapkan perdagangan pelacakan tren multi-frame timeframe, secara efektif mengidentifikasi perilaku harga tiba-tiba yang cocok untuk aset digital yang sangat volatile.

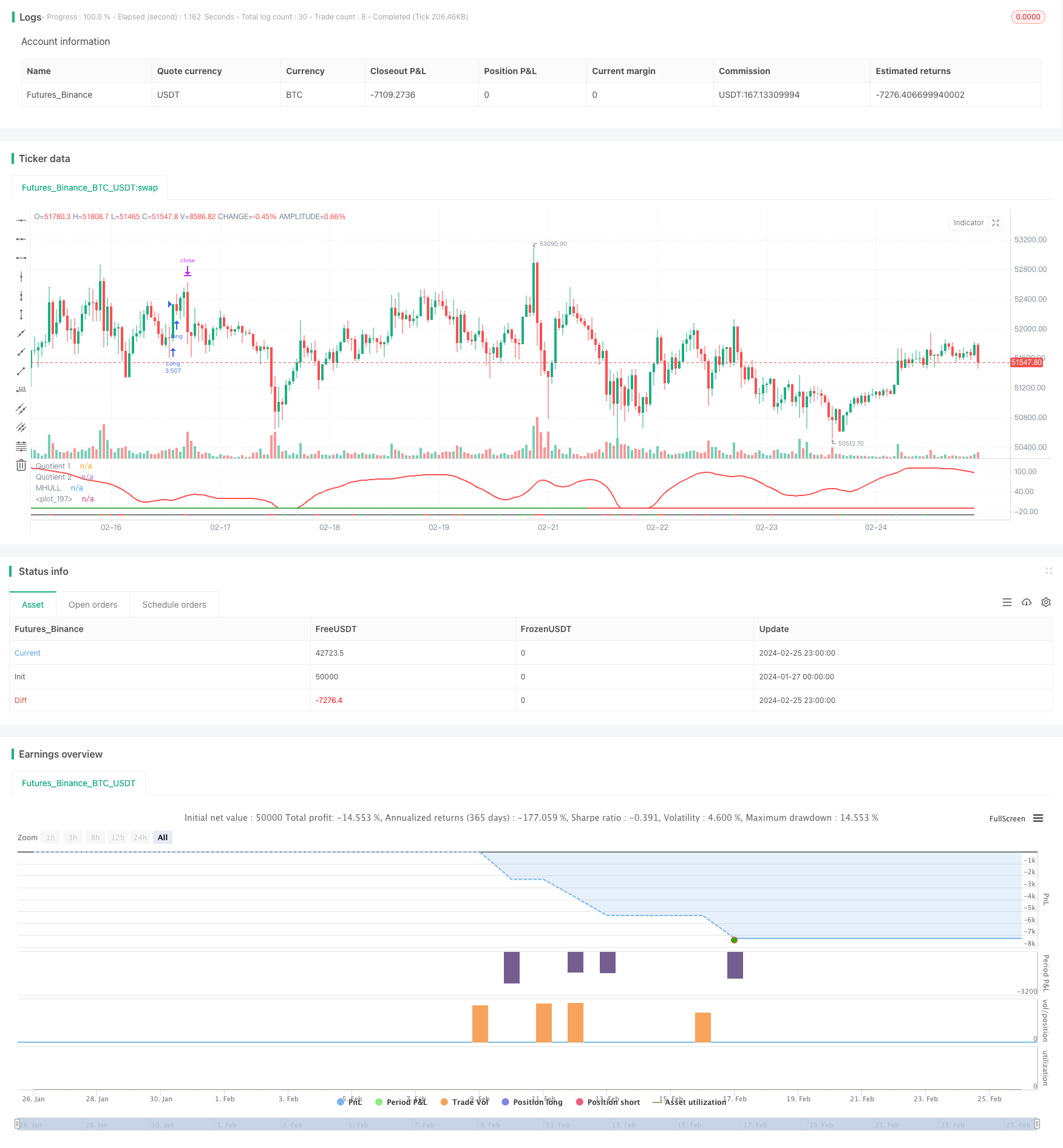

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - Boom Hunter Pro

// - Hull Suite

// - Volatility Oscillator

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - Boom Hunter Pro: veryfid (https://www.tradingview.com/u/veryfid/)

// - Hull Suite: InSilico (https://www.tradingview.com/u/InSilico/)

// - Volatility Oscillator: veryfid (https://www.tradingview.com/u/veryfid/)

//@version=5

strategy("Boom Hunter + Hull Suite + Volatility Oscillator Strategy", overlay=false, initial_capital=1000, currency=currency.NONE, max_labels_count=500, default_qty_type=strategy.cash, commission_type=strategy.commission.percent, commission_value=0.01)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(20, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(3, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

profitFactor = input.float(3, "Profit Factor (R:R Ratio)", step = 0.1, group='Strategy: Risk Management')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// ---------------

// Boom Hunter Pro

// ---------------

square = input.bool(true, title='Square Line?', group='Main Settings')

//Quotient

LPPeriod = input.int(6, title='Quotient | LPPeriod', inline='quotient', group='EOT 1 (Main Oscillator)')

K1 = input.int(0, title='K1', inline='quotient', group='EOT 1 (Main Oscillator)')

esize = 60 //, title = "Size", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

ey = 50 //, title = "Y axis", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

trigno = input.int(1, 'Trigger Length', group='EOT 1 (Main Oscillator)', inline='quotient2')

trigcol = input.color(color.white, title='Trigger Color:', group='EOT 1 (Main Oscillator)', inline='q2')

// EOT 2

//Inputs

LPPeriod2 = input.int(28, title='LPPeriod2', group='EOT 2 (Red Wave)', inline='q2')

K22 = input.float(0.3, title='K2', group='EOT 2 (Red Wave)', inline='q2')

//EOT 1

//Vars

alpha1 = 0.00

HP = 0.00

a1 = 0.00

b1 = 0.00

c1 = 0.00

c2 = 0.00

c3 = 0.00

Filt = 0.00

Peak = 0.00

X = 0.00

Quotient1 = 0.00

pi = 2 * math.asin(1)

//Highpass filter cyclic components

//whose periods are shorter than 100 bars

alpha1 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP := (1 - alpha1 / 2) * (1 - alpha1 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1) * nz(HP[1]) - (1 - alpha1) * (1 - alpha1) * nz(HP[2])

//SuperSmoother Filter

a1 := math.exp(-1.414 * pi / LPPeriod)

b1 := 2 * a1 * math.cos(1.414 * pi / LPPeriod)

c2 := b1

c3 := -a1 * a1

c1 := 1 - c2 - c3

Filt := c1 * (HP + nz(HP[1])) / 2 + c2 * nz(Filt[1]) + c3 * nz(Filt[2])

//Fast Attack - Slow Decay Algorithm

Peak := .991 * nz(Peak[1])

if math.abs(Filt) > Peak

Peak := math.abs(Filt)

Peak

//Normalized Roofing Filter

if Peak != 0

X := Filt / Peak

X

Quotient1 := (X + K1) / (K1 * X + 1)

// EOT 2

//Vars

alpha1222 = 0.00

HP2 = 0.00

a12 = 0.00

b12 = 0.00

c12 = 0.00

c22 = 0.00

c32 = 0.00

Filt2 = 0.00

Peak2 = 0.00

X2 = 0.00

Quotient4 = 0.00

alpha1222 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP2 := (1 - alpha1222 / 2) * (1 - alpha1222 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1222) * nz(HP2[1]) - (1 - alpha1222) * (1 - alpha1222) * nz(HP2[2])

//SuperSmoother Filter

a12 := math.exp(-1.414 * pi / LPPeriod2)

b12 := 2 * a12 * math.cos(1.414 * pi / LPPeriod2)

c22 := b12

c32 := -a12 * a12

c12 := 1 - c22 - c32

Filt2 := c12 * (HP2 + nz(HP2[1])) / 2 + c22 * nz(Filt2[1]) + c32 * nz(Filt2[2])

//Fast Attack - Slow Decay Algorithm

Peak2 := .991 * nz(Peak2[1])

if math.abs(Filt2) > Peak2

Peak2 := math.abs(Filt2)

Peak2

//Normalized Roofing Filter

if Peak2 != 0

X2 := Filt2 / Peak2

X2

Quotient4 := (X2 + K22) / (K22 * X2 + 1)

q4 = Quotient4 * esize + ey

//Plot EOT

q1 = Quotient1 * esize + ey

trigger = ta.sma(q1, trigno)

Plot3 = plot(trigger, color=trigcol, linewidth=2, title='Quotient 1')

Plot44 = plot(q4, color=color.new(color.red, 0), linewidth=2, title='Quotient 2')

// ----------

// HULL SUITE

// ----------

//INPUT

src = input(close, title='Source')

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(200, title='Length(180-200 for floating S/R , 55 for swing entry)')

lengthMult = input(2.4, title='Length multiplier (Used to view higher timeframes with straight band)')

useHtf = input(false, title='Show Hull MA from X timeframe? (good for scalping)')

htf = input.timeframe('240', title='Higher timeframe')

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

_hull = Mode(modeSwitch, src, int(length * lengthMult))

HULL = useHtf ? request.security(syminfo.ticker, htf, _hull) : _hull

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = MHULL > SHULL ? color.green : color.red

//PLOT

///< Frame

Fi1 = plot(-10, title='MHULL', color=hullColor, linewidth=2)

// -----------------

// VOLUME OSCILLATOR

// -----------------

volLength = input(80)

spike = close - open

x = ta.stdev(spike, volLength)

y = ta.stdev(spike, volLength) * -1

volOscCol = spike > x ? color.green : spike < y ? color.red : color.gray

plot(-30, color=color.new(volOscCol, transp=0), linewidth=2)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// Boom Hunter Pro entry conditions

boomLong = ta.crossover(trigger, q4)

boomShort = ta.crossunder(trigger, q4)

// Hull Suite entry conditions

hullLong = MHULL > SHULL and close > MHULL

hullShort = MHULL < SHULL and close < SHULL

// Volatility Oscillator entry conditions

volLong = spike > x

volShort = spike < y

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = boomLong and hullLong and volLong and in_date_range

shortCondition = boomShort and hullShort and volShort and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

atr = ta.atr(14)

longSl = math.min(close - atr, swingLow)

shortSl = math.max(close + atr, swingHigh)

longStopPercent = math.abs((1 - (longSl / close)) * 100)

shortStopPercent = math.abs((1 - (shortSl / close)) * 100)

longTpPercent = longStopPercent * profitFactor

shortTpPercent = shortStopPercent * profitFactor

longTp = close + (close * (longTpPercent / 100))

shortTp = close - (close * (shortTpPercent / 100))

// Position sizing (default risk 3% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=longSl, limit=longTp, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=-40)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent) + " TP Percent: " + str.tostring(longTpPercent))

if (shortCondition and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=shortSl, limit=shortTp, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=-40)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent) + " TP Percent: " + str.tostring(shortTpPercent))

- Strategi Trend Crossover Rata-rata Bergerak

- Strategi Kotak Putih Robot Saluran Harga

- Sederhana Moving Average Tren Harga Strategi Kuantitatif

- Strategi pembelian stop loss ATR berbasis waktu

- Binomial Momentum Breakout Reversal Strategi

- Strategi Pembukaan Celah

- Strategi ATR Trailing Stop dengan Target Retracement Fibonacci

- Bollinger Bands Breakout Trend Trading Strategi

- Berdasarkan strategi pembalikan rata-rata bergerak

- Strategi Terobosan Jangka Pendek Berdasarkan Golden Crossover

- Momentum Line Crossover EMA Sembilan Strategi MACD Saham

- Strategi kombinasi indikator osilasi kuantitatif

- Ichimoku Cloud Trend Mengikuti Strategi

- Strategi perdagangan rata-rata bergerak ganda intraday

- Panduan Perburuan Harta Maya

- Strategi Pelacakan Tren Berdasarkan Moving Average

- EMA Cross Trend Mengikuti Strategi

- Strategi Crossover Rata-rata Bergerak Ganda

- Strategi Pelacakan Bollinger Band

- Strategi Crossover Rata-rata Bergerak Cepat dan Lambat