最良のトレードビュー戦略

作者: リン・ハーンチャオチャン, 日付: 2022-05-09 21:08:17タグ:RSIマルチ

脚本は完全に勢い,量,価格に基づいています. 1:ボリンガー帯は 突破が起こるのを 知るために圧縮します. 2: 移動平均値 (SMA と EMA) を使って方向を把握する. 3: 成功率 この戦略の成功率は75%を超え,価格アクションが少し加えられれば,90%の成功率を容易に上回ることができます. 4:引き上げについて心配しないでください. 我々はSLを落とし込むことを実施しました. 5つ目:私はこの戦略を41日間 250ドル口座でテストし,現在2700ドルを持っています.

バックテスト

/*backtest

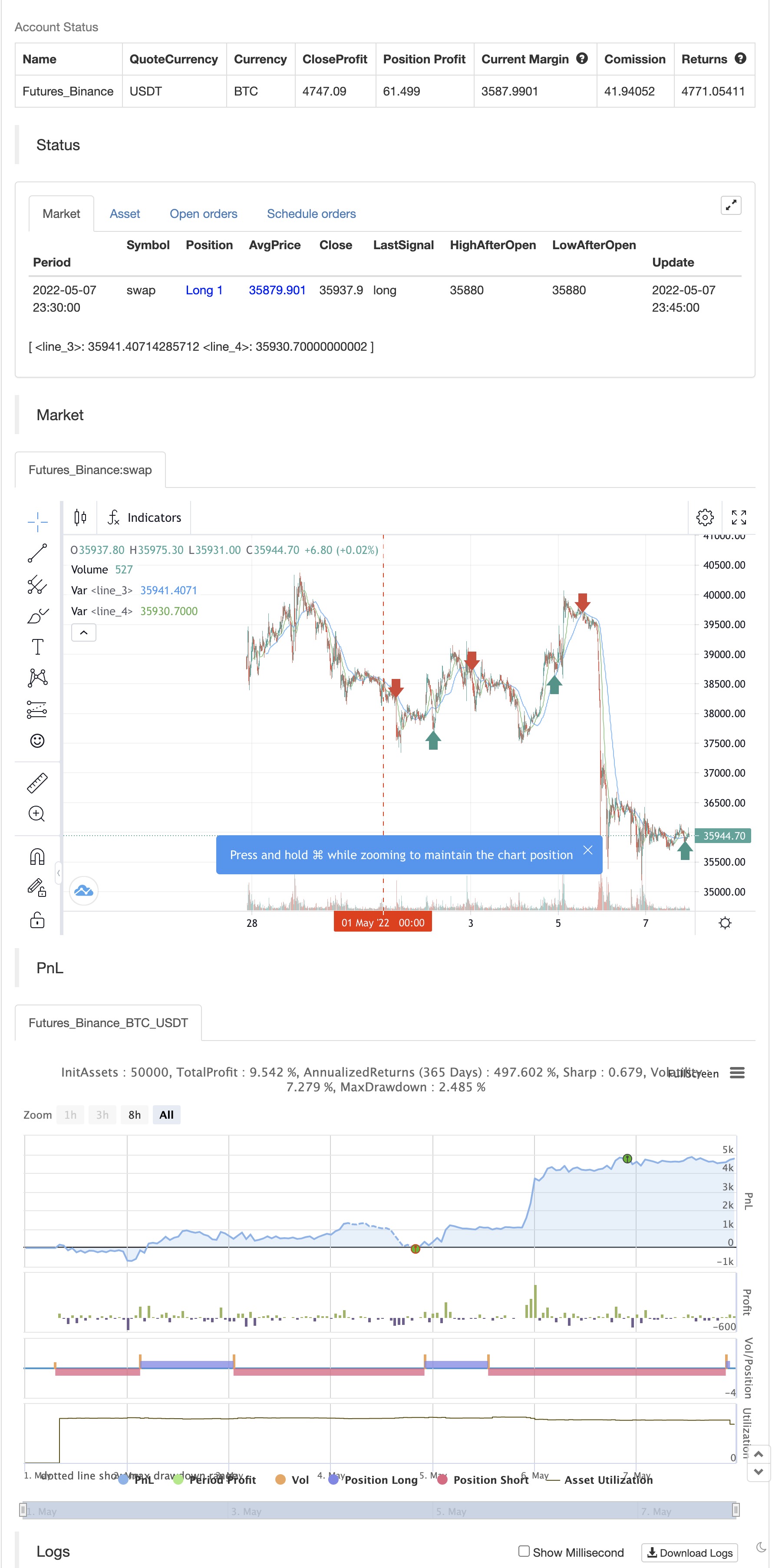

start: 2022-05-01 00:00:00

end: 2022-05-07 23:59:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © The_Bigger_Bull

//@version=5

strategy("Best TradingView Strategy", overlay=true, margin_long=0, margin_short=0)

//Bollinger Bands

source1 = close

length1 = input.int(15, minval=1)

mult1 = input.float(2.0, minval=0.001, maxval=50)

basis1 = ta.sma(source1, length1)

dev1 = mult1 * ta.stdev(source1, length1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

//buyEntry = ta.crossover(source1, lower1)

//sellEntry = ta.crossunder(source1, upper1)

//RSI

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

//plot(rsi, "RSI", color=#7E57C2)

//plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

//fill(rsiUpperBand, rsiLowerBand, color=color.rgb(126, 87, 194, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

//fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up1 = ta.change(high)

down1 = -ta.change(low)

plusDM = na(up1) ? na : (up1 > down1 and up1 > 0 ? up1 : 0)

minusDM = na(down1) ? na : (down1 > up1 and down1 > 0 ? down1 : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

out = ta.sma(close, 14)

sma1=ta.sma(close,42)

ema200=ta.ema(close,200)

longCondition = (out>sma1) and ta.crossover(source1, lower1)

if (longCondition )

strategy.entry("long", strategy.long)

shortCondition = (out<sma1) and ta.crossunder(source1, lower1)

if (shortCondition )

strategy.entry("short", strategy.short)

stopl=strategy.position_avg_price-50

tptgt=strategy.position_avg_price+100

stopshort=strategy.position_avg_price+50

tptgtshort=strategy.position_avg_price-100

strategy.exit("longclose","long",trail_offset=50,trail_points=100,when=ta.crossover(sma1,out))

strategy.exit("shortclose","short",trail_offset=50,trail_points=100,when=ta.crossover(out,sma1))

//if strategy.position_avg_price<0

plot(sma1 , color=color.blue)

plot(out, color=color.green)

//plot(ema200,color=color.red)

関連性

- 複数確認の逆購買戦略

- RSI ダイナミック・ドラウダウンストップ・ロスの戦略

- MA,SMA,MA傾斜,ストップ損失を後押しし,再入力

- 短期取引戦略 ボリンジャー帯,移動平均値,RSIをベースに

- 多レベルダイナミックトレンドフォローシステム

- ターンオーバー火曜日の戦略 (週末フィルター)

- 2つの移動平均RSIトレンドモメンタム戦略

- 2つの移動平均RSIモメントストラテジー EMAとトレンドラインブレイクに基づいて

- 動的サポート・レジスタンスのブレイク 移動平均クロスオーバー戦略

- 移動平均フィルター戦略による3回検証されたRSI平均逆転

もっと

- ニク・ストック

- ストックスーパーTRD ATR 200MA

- MTF RSI & STOCH戦略

- EMA + AROON + ASH

- モメント 2.0

- EHMAの範囲戦略

- 移動平均 買出 売出

- ミダス Mk.II - 究極の暗号スイング

- TMA-レガシー

- TVの高低戦略

- 大型スナッパーの警告 R3.0 + 変動状態の上昇 + TP RSI

- チャンデ・クロル ストップ

- CCI + EMAとRSIクロス戦略

- EMA バンド + leledc + ボリンガー バンド トレンドキャッチ戦略

- RSI MTF Ob+Os

- MACD ウィリー戦略

- RSI - 買って売るシグナル

- ハイキン・アシ 傾向

- HA 市場バイアス

- イチモク雲スムーズオシレーター