概述

该策略名为”周二反转策略(周末过滤)“,主要思路是基于均线和其他过滤条件,在满足条件的周一开盘买入,周三开盘卖出,以捕捉周二的反转行情。该策略通过对RSI、ATR等指标的过滤,排除5月份等特定时间,以提高策略胜率和收益风险比。

策略原理

- 使用30日均线作为趋势判断依据,当前一交易日收盘价低于30日均线时,认为趋势向下,符合买入条件之一。

- 使用3日RSI和10日ATR作为过滤条件,3日RSI小于51且收盘价相对10日ATR小于95%时,认为市场情绪悲观,但无极端行情,符合买入条件。

- 排除5月份,因为”Sell in May and go away”的效应,股市通常表现疲软。

- 综合以上条件,在周一且满足所有过滤条件时买入,周三开盘时卖出。

策略优势

- 基于均线和情绪指标的组合判断,能有效捕捉周二反转行情。

- 通过对RSI和ATR的双重过滤,排除了极端行情下的交易,提高了策略的胜率和收益风险比。

- 排除5月份,避开了通常表现不佳的时间段,提高了策略表现。

- 仅在周一买入周三卖出,交易频率低,手续费成本小。

策略风险

- 对于趋势很强的行情,反转不明显时,策略表现会不佳。

- 固定买卖时间可能错失更好的买卖时机,限制了策略的灵活性和收益空间。

- 依赖指标判断,在市场发生剧烈变化时,指标失效的风险。

- 月份判断基于历史经验,不代表未来情况一定相同,存在时效性风险。

策略优化方向

- 可以考虑引入更多有效的过滤指标,如成交量、波动率等,以提高策略的稳健性和适应性。

- 优化买卖时机的选择,如加入盘中突破确认等条件,提高策略的灵活性和收益空间。

- 对于持仓周期的优化,可以考虑更长的持仓时间,以更充分地捕捉趋势。

- 针对不同市场状态,设置不同的参数,提高策略的适应性。

- 加入仓位管理和风险控制模块,以应对市场的极端情况。

总结

周二反转策略(周末过滤)通过均线、RSI和ATR等指标的组合判断,在特定时间买卖标的,以捕捉周二的反转行情。策略交易频率低,手续费成本小,并通过时间段过滤和指标过滤,提高了策略的胜率和风险收益比。但是,策略也存在一定的局限性和风险,如趋势行情下表现不佳,以及买卖时机和持仓周期固定等。未来可以通过引入更多过滤条件,优化出场时机,动态调整参数,仓位管理和风控等方面进行优化和改进,使策略能够更好地适应多变的市场状态。

策略源码

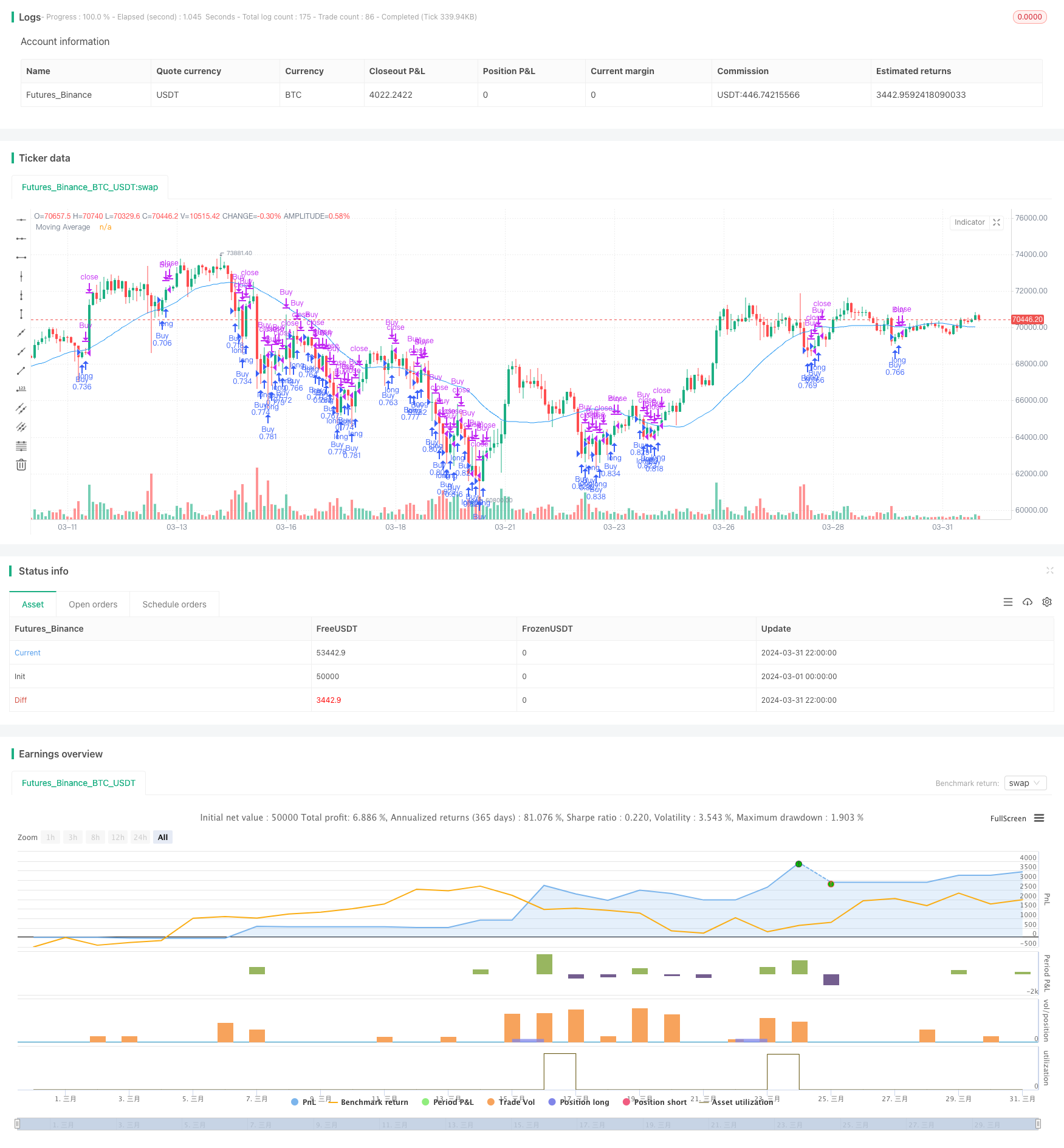

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © muikol

//@version=5

strategy("Turnaround Tuesday", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.035)

// Inputs for MA period, filter_1, filter_2, month filter, and testing period

ma_period = input(30, title="Moving Average Period")

use_filter_1 = input(true, title="Use RSI Filter")

use_filter_2 = input(true, title="Use ATR Filter")

use_month_filter = input(true, title="Exclude May")

start_date = input(defval=timestamp("2009-01-01 00:00:00"), title="Start Backtest")

end_date = input(defval=timestamp("2025-01-01 00:00:00"), title="End Backtest")

// Data calculations

MA_tt = ta.sma(close, ma_period)

atr10 = ta.atr(10)

rsi3 = ta.rsi(close, 3)

c_1 = close[1]

// Entry conditions

isMonday = dayofweek == dayofweek.monday

bear = close[1] < MA_tt[1]

filter_1 = use_filter_1 ? rsi3[1] < 51 : true

filter_2 = use_filter_2 ? c_1/atr10[1] < 95 : true

notMay = use_month_filter ? month != 5 : true

entryCondition = isMonday and bear and notMay and filter_1 and filter_2

// Date check

inTestPeriod = true

// Exit conditions

isWednesdayOpen = dayofweek == dayofweek.wednesday

// Entry and exit triggers

if entryCondition and inTestPeriod

strategy.entry("Buy", strategy.long)

if isWednesdayOpen and strategy.position_size > 0 and inTestPeriod

strategy.close("Buy")

// Plot the moving average

plot(MA_tt, title="Moving Average", color=color.blue)

相关推荐