概述

该策略基于Wyckoff方法论,结合相对强弱指数(RSI)和成交量移动平均线(Volume MA)来识别市场的累积和分配阶段,从而产生买卖信号。同时,该策略采用动态回撤止损机制,通过设置最大回撤阈值来控制风险。

策略原理

- 计算RSI指标和成交量移动平均线。

- 当RSI从超卖区域向上穿越,且成交量大于成交量移动平均线时,识别为市场accumulation阶段,产生买入信号。

- 当RSI从超买区域向下穿越,且成交量大于成交量移动平均线时,识别为市场distribution阶段,产生卖出信号。

- 策略同时跟踪账户的最大净值和当前回撤。如果当前回撤超过设定的最大回撤阈值,策略将平仓所有头寸。

- 买入头寸在distribution阶段或回撤超过最大回撤时平仓,卖出头寸在accumulation阶段或回撤超过最大回撤时平仓。

策略优势

- 结合RSI和成交量指标,能够更准确地捕捉市场的accumulation和distribution阶段。

- 采用动态回撤止损机制,可以有效控制策略的最大回撤,降低策略的整体风险。

- 适用于5分钟的高频数据,可以快速响应市场变化,及时调整仓位。

策略风险

- RSI和成交量指标在某些市场情况下可能会产生误导性信号,导致策略产生错误的交易决策。

- 最大回撤阈值的设置需要根据市场特点和个人风险偏好进行调整,不恰当的设置可能导致策略过早平仓或承担过大风险。

- 策略在震荡市场中可能会频繁产生交易信号,增加交易成本。

策略优化方向

- 可以考虑引入其他技术指标,如MACD、布林带等,以提高策略的信号准确性。

- 对RSI和成交量指标的参数进行优化,如调整RSI的长度、超买超卖阈值等,以适应不同的市场状况。

- 在回撤止损之外,可以加入移动止损或利润保护机制,以进一步控制风险和锁定利润。

总结

RSI动态回撤止损策略通过结合RSI和成交量指标,识别市场的累积和分配阶段,同时采用动态回撤止损机制控制风险。该策略在把握市场趋势的同时,也兼顾了风险管理,具有一定的实用性。但是,策略的表现依赖于指标参数的选择和市场特点,需要通过不断的优化和调整来提高其稳定性和盈利能力。

策略源码

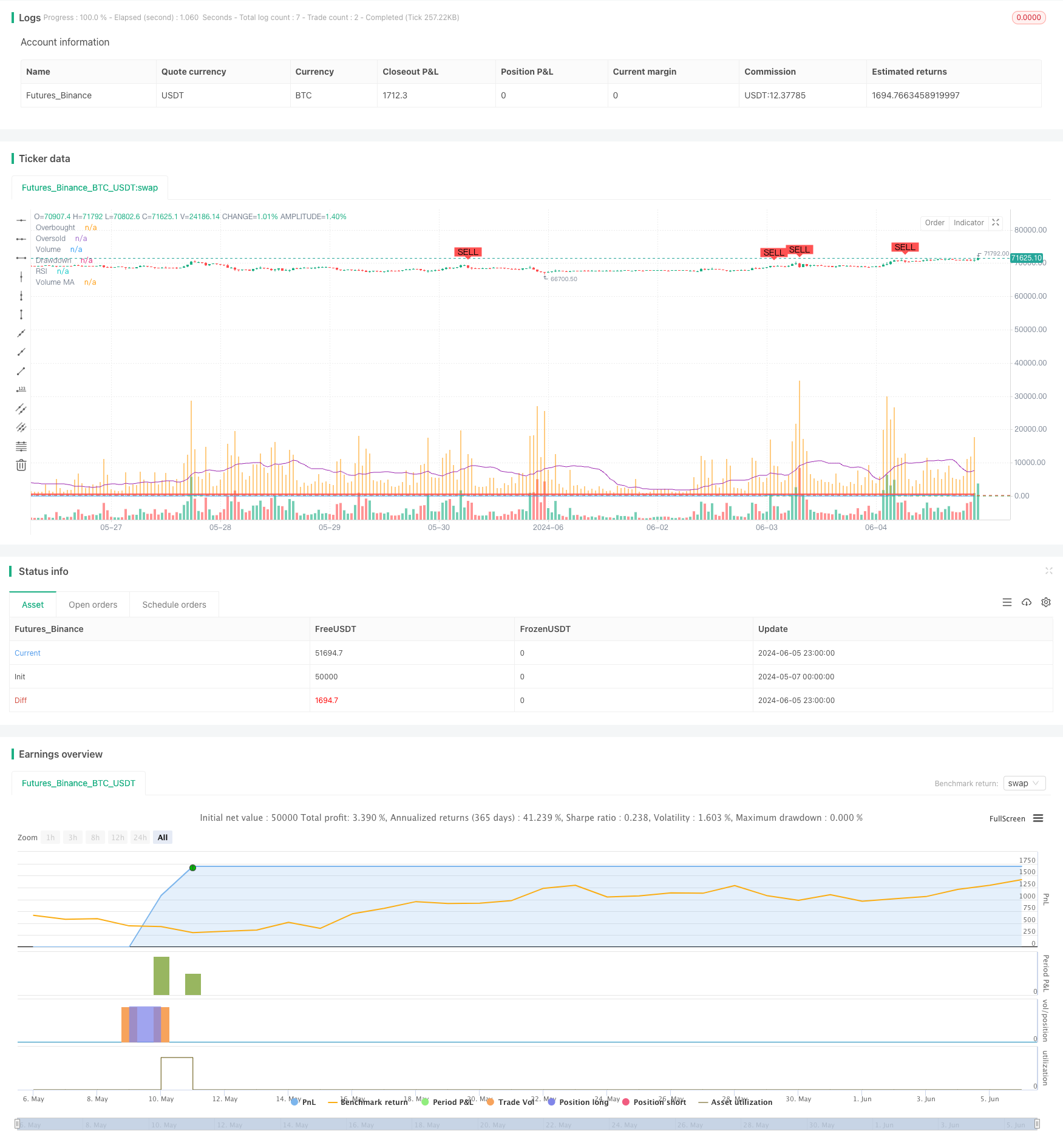

/*backtest

start: 2024-05-07 00:00:00

end: 2024-06-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Wyckoff Methodology Strategy with Max Drawdown", overlay=true)

// Define input parameters

length = input(14, title="RSI Length")

overbought = input(70, title="RSI Overbought Level")

oversold = input(30, title="RSI Oversold Level")

volume_length = input(20, title="Volume MA Length")

initial_capital = input(10000, title="Initial Capital")

max_drawdown = input(500, title="Max Drawdown")

// Calculate RSI

rsi = ta.rsi(close, length)

// Calculate Volume Moving Average

vol_ma = ta.sma(volume, volume_length)

// Identify Accumulation Phase

accumulation = ta.crossover(rsi, oversold) and volume > vol_ma

// Identify Distribution Phase

distribution = ta.crossunder(rsi, overbought) and volume > vol_ma

// Plot RSI

hline(overbought, "Overbought", color=color.red)

hline(oversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.blue)

// Plot Volume and Volume Moving Average

plot(volume, title="Volume", color=color.orange, style=plot.style_histogram)

plot(vol_ma, title="Volume MA", color=color.purple)

// Variables to track drawdown

var float max_equity = initial_capital

var float drawdown = 0.0

// Update max equity and drawdown

current_equity = strategy.equity

if (current_equity > max_equity)

max_equity := current_equity

drawdown := max_equity - current_equity

// Generate Buy and Sell Signals

if (accumulation and drawdown < max_drawdown)

strategy.entry("Buy", strategy.long)

if (distribution and drawdown < max_drawdown)

strategy.entry("Sell", strategy.short)

// Plot Buy and Sell signals on chart

plotshape(series=accumulation, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=distribution, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Close positions if drawdown exceeds max drawdown

if (drawdown >= max_drawdown)

strategy.close_all("Max Drawdown Exceeded")

// Set strategy exit conditions

strategy.close("Buy", when=distribution or drawdown >= max_drawdown)

strategy.close("Sell", when=accumulation or drawdown >= max_drawdown)

// Display drawdown on chart

plot(drawdown, title="Drawdown", color=color.red, linewidth=2, style=plot.style_stepline)

相关推荐