ストカスティック+RSI,ダブル戦略

作者: リン・ハーンチャオチャン, 日時: 2022-05-25 16:12:14タグ:ストックRSI

この戦略は,RSIが70を超えると売る (または30を下回ると購入する) 伝統的なRSI戦略と,ストカスティック・スロー戦略を組み合わせて,ストカスティック・オシレーターが80を超えると売る (そして20を下回ると購入する) 伝統的なストカスティック・スロー戦略を組み合わせています.

この簡単な戦略は,RSI とストカスティックが両方が過買いまたは過売状態にある場合にのみ起動します.S&P 500の1時間チャートは最近この二重戦略でかなりうまく機能しました.

この戦略は,RSIのみを測定する"ストカスティックRSI"と混同すべきではありません.

すべての取引には高いリスクが伴う.過去の業績は必ずしも将来の結果を示すものではない.

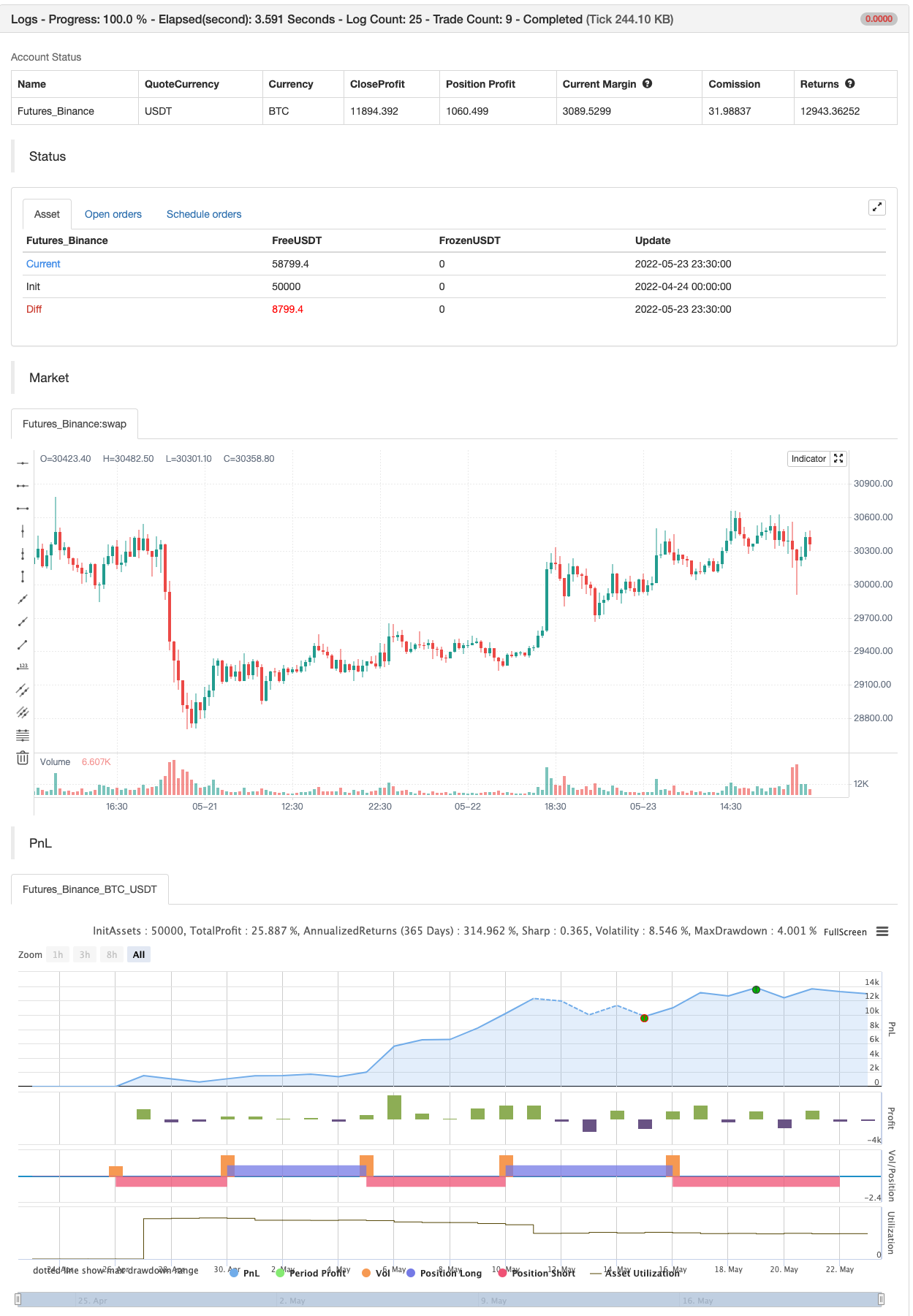

バックテスト

/*backtest

start: 2022-04-24 00:00:00

end: 2022-05-23 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Stochastic + RSI, Double Strategy (by ChartArt)", shorttitle="CA_-_RSI_Stoch_Strat", overlay=true)

// ChartArt's Stochastic Slow + Relative Strength Index, Double Strategy

//

// Version 1.0

// Idea by ChartArt on October 23, 2015.

//

// This strategy combines the classic RSI

// strategy to sell when the RSI increases

// over 70 (or to buy when it falls below 30),

// with the classic Stochastic Slow strategy

// to sell when the Stochastic oscillator

// exceeds the value of 80 (and to buy when

// this value is below 20).

//

// This simple strategy only triggers when

// both the RSI and the Stochastic are together

// in overbought or oversold conditions.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

///////////// Stochastic Slow

Stochlength = input(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input(80, title="Stochastic overbought condition")

StochOverSold = input(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = sma(stoch(close, high, low, Stochlength), smoothK)

d = sma(k, smoothD)

///////////// RSI

RSIlength = input( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input( 70 , title="RSI overbought condition")

RSIOverSold = input( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

if (not na(k) and not na(d))

if (crossover(k,d) and k < StochOverSold)

if (not na(vrsi)) and (crossover(vrsi, RSIOverSold))

strategy.entry("LONG", strategy.long, comment="StochLE + RsiLE")

if (crossunder(k,d) and k > StochOverBought)

if (crossunder(vrsi, RSIOverBought))

strategy.entry("SHORT", strategy.short, comment="StochSE + RsiSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

関連コンテンツ

- マルチ指標のスマートピラミッド戦略

- 多指標のクロストレンド追跡取引戦略: ランダムな相対強弱と平均線システムに基づく定量化分析

- ブリンズ帯のランダムRSI極値信号戦略

- 買・売戦略は AO+Stoch+RSI+ATRに依存する

- 双均線動的地域トレンド追跡戦略

- 多均線トレンド動力取引戦略をリスク管理システムと組み合わせた

- Bollinger Bands ストカスティックRSI エクストリーム戦略

- 多因子融合戦略 (Multi-factor Fusion Strategy) とは,

- EMA/SMA 多指標総合トレンド追跡戦略

- 増強動力波動とランダムな偏向量化取引戦略

もっと見る

- SSLチャネル

- ハル・スイート戦略

- パラボリック SAR 買って売る

- ピボットベース トレイリング マキシマ・ミニマ

- ニック・ライポック トレイリング・リバース (NRTR)

- ジグザグPA戦略 V4.1

- 日中の買い/売る

- 壊れたフラクタル: 誰かの壊れた夢はあなたの利益です!

- 利益の最大化 PMax

- 完璧 な 勝利 の 戦略

- スウィング・ハル/RSI/EMA戦略

- Scalping Swing Trading ツール R1-4

- 最良の飲み込み+脱出戦略

- Bollinger Awesome アラート R1

- マルチ取引所兼用プラグイン

- 三角利息 (小額通貨の格差)

- bybit逆契約動的格子 (特異格子)

- MT4 MT5 + ダイナミック変数へのTradingViewアラート

- マトリックスシリーズ

- スーパースカルパー - 5分 15分