概述

这是一个结合了动量和趋势的交易策略,通过多条指数移动平均线(EMA)、相对强弱指数(RSI)和随机指标(Stochastic)来识别市场趋势和动量。该策略还整合了基于平均真实波幅(ATR)的风险管理系统,包括动态止损、获利目标和跟踪止损功能,同时采用基于风险的仓位管理方法。

策略原理

策略使用5条不同周期(8、13、21、34、55)的EMA来确定趋势方向。当较短周期EMA位于较长周期EMA之上时,识别为上涨趋势;反之则为下跌趋势。RSI用于确认动量,设定了不同的入场和出场阈值。随机指标作为第三重过滤器,帮助避免过度买入或卖出。风险管理系统使用ATR来设置动态止损(2倍ATR)和获利目标(4倍ATR),并采用1.5倍ATR的跟踪止损来保护利润。仓位规模基于账户权益的1%风险计算。

策略优势

- 多重确认机制:结合趋势和动量指标,降低假信号风险

- 动态风险管理:基于市场波动性自适应调整止损和获利目标

- 智能仓位管理:根据风险和波动性自动调整交易规模

- 完整的盈利保护:使用跟踪止损锁定已有利润

- 灵活的退出机制:多重条件组合确保及时离场

- 低风险暴露:每笔交易最多损失账户1%的资金

策略风险

- 震荡市场风险:多均线系统在横盘市场可能产生频繁假信号

- 滑点风险:高波动时期可能导致实际执行价格偏离预期

- 资金管理风险:虽然限制了单笔损失,但连续亏损仍可能显著影响资金

- 参数优化风险:过度优化可能导致过拟合

- 技术指标滞后性:均线和振荡器都具有一定滞后性

策略优化方向

- 市场环境过滤:添加波动率过滤器,在高波动期间调整策略参数

- 时间过滤:根据不同时间段的市场特征调整交易参数

- 动态参数调整:基于市场状况自动调整EMA周期和指标阈值

- 增加成交量确认:添加成交量分析以提高信号可靠性

- 优化退出机制:研究更优的跟踪止损倍数

- 引入机器学习:使用机器学习优化参数选择

总结

该策略通过结合多重技术指标和完善的风险管理系统,提供了一个全面的交易解决方案。其核心优势在于多层过滤机制和动态风险管理,但仍需要根据具体市场特征进行优化。策略的成功实施需要持续监控和调整,特别是在不同市场环境下的参数适应性。通过提出的优化方向,该策略有潜力进一步提升其稳定性和盈利能力。

策略源码

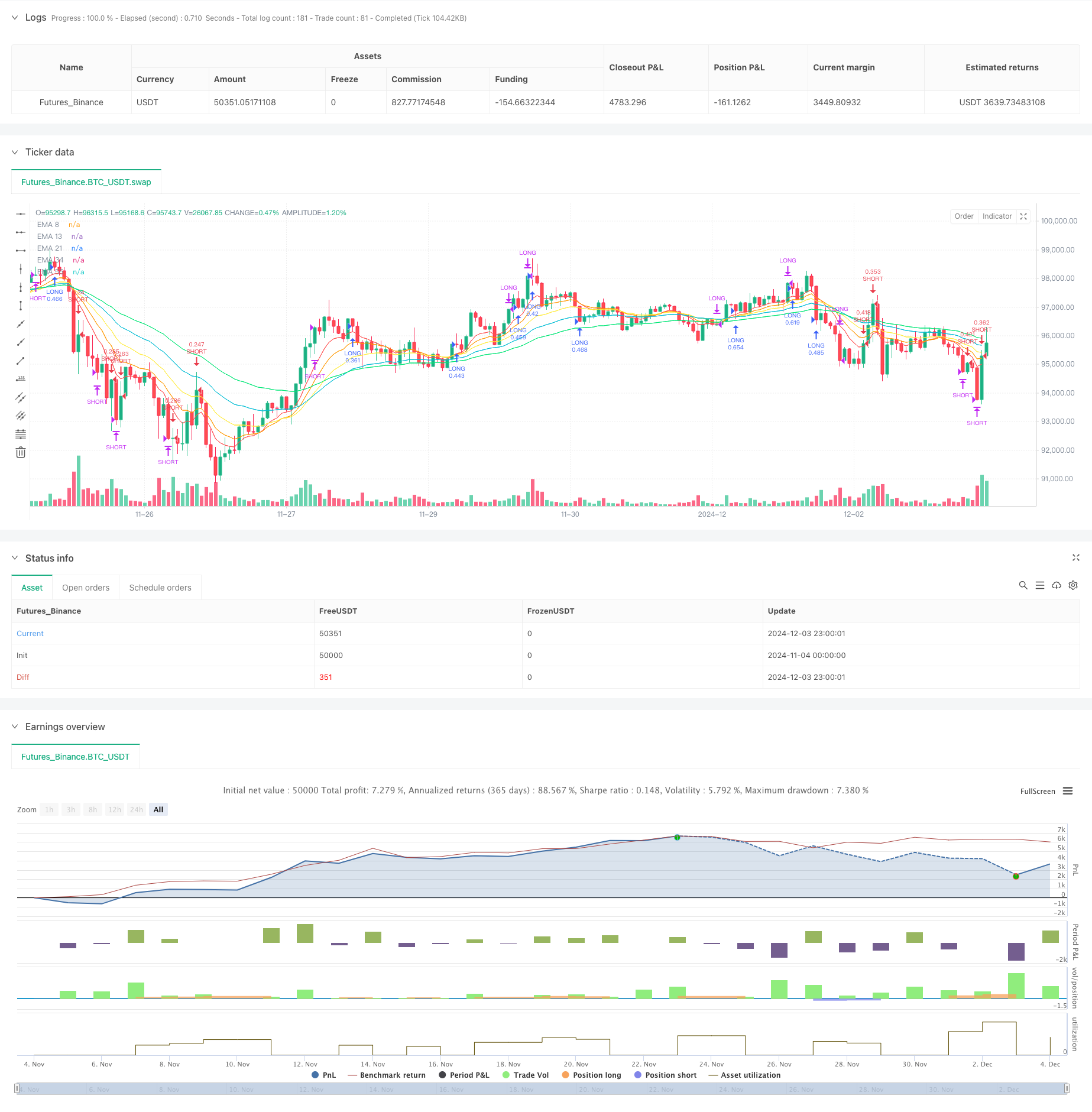

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined Strategy (Modernized)", overlay = true)

//----------//

// MOMENTUM //

//----------//

ema8 = ta.ema(close, 8)

ema13 = ta.ema(close, 13)

ema21 = ta.ema(close, 21)

ema34 = ta.ema(close, 34)

ema55 = ta.ema(close, 55)

// Plotting EMAs for visualization

plot(ema8, color=color.red, title="EMA 8", linewidth=1)

plot(ema13, color=color.orange, title="EMA 13", linewidth=1)

plot(ema21, color=color.yellow, title="EMA 21", linewidth=1)

plot(ema34, color=color.aqua, title="EMA 34", linewidth=1)

plot(ema55, color=color.lime, title="EMA 55", linewidth=1)

longEmaCondition = ema8 > ema13 and ema13 > ema21 and ema21 > ema34 and ema34 > ema55

exitLongEmaCondition = ema13 < ema55

shortEmaCondition = ema8 < ema13 and ema13 < ema21 and ema21 < ema34 and ema34 < ema55

exitShortEmaCondition = ema13 > ema55

// ---------- //

// OSCILLATORS //

// ----------- //

rsi = ta.rsi(close, 14)

longRsiCondition = rsi < 70 and rsi > 40

exitLongRsiCondition = rsi > 70

shortRsiCondition = rsi > 30 and rsi < 60

exitShortRsiCondition = rsi < 30

// Stochastic

k = ta.stoch(close, high, low, 14)

d = ta.sma(k, 3)

longStochasticCondition = k < 80

exitLongStochasticCondition = k > 95

shortStochasticCondition = k > 20

exitShortStochasticCondition = k < 5

//----------//

// STRATEGY //

//----------//

// ATR for dynamic stop loss and take profit

atr = ta.atr(14)

stopLossMultiplier = 2

takeProfitMultiplier = 4

stopLoss = atr * stopLossMultiplier

takeProfit = atr * takeProfitMultiplier

// Trailing stop settings

trailStopMultiplier = 1.5

trailOffset = atr * trailStopMultiplier

// Risk management: dynamic position sizing

riskPerTrade = 0.01 // 1% risk per trade

positionSize = strategy.equity * riskPerTrade / stopLoss

longCondition = longEmaCondition and longRsiCondition and longStochasticCondition and strategy.position_size == 0

exitLongCondition = (exitLongEmaCondition or exitLongRsiCondition or exitLongStochasticCondition) and strategy.position_size > 0

if (longCondition)

strategy.entry("LONG", strategy.long, qty=positionSize)

strategy.exit("Take Profit Long", "LONG", stop=close - stopLoss, limit=close + takeProfit, trail_offset=trailOffset)

if (exitLongCondition)

strategy.close("LONG")

shortCondition = shortEmaCondition and shortRsiCondition and shortStochasticCondition and strategy.position_size == 0

exitShortCondition = (exitShortEmaCondition or exitShortRsiCondition or exitShortStochasticCondition) and strategy.position_size < 0

if (shortCondition)

strategy.entry("SHORT", strategy.short, qty=positionSize)

strategy.exit("Take Profit Short", "SHORT", stop=close + stopLoss, limit=close - takeProfit, trail_offset=trailOffset)

if (exitShortCondition)

strategy.close("SHORT")

相关推荐