多要素量的な取引戦略

作者: リン・ハーンチャオチャン,日付: 2023年10月24日 11:15:54タグ:

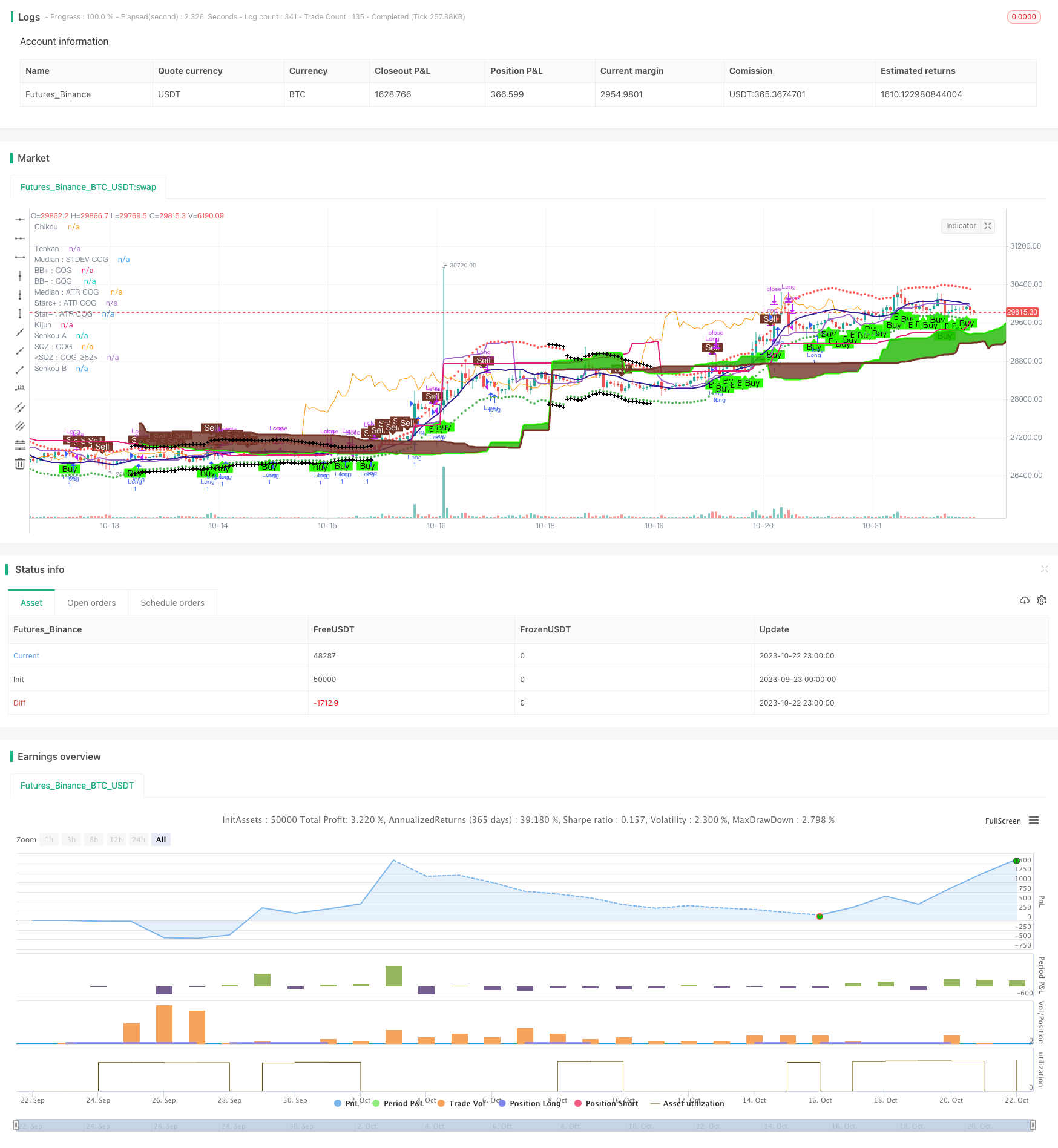

これは,長/短の決定のための複数の技術指標を組み合わせる定量的な取引戦略である.最終的な購入/売却判断を形成するために,モメント指標,トレンド指標,イチモククラウド,その他の要因を考慮する.戦略は強い安定性とリスク耐性を持っている.

原則分析

戦略は以下の主要な要素で構成されています.

-

動力指標:パラボリックSAR,レレドc,カウフマン適応移動平均等

-

トレンドインジケーター:ラフル・モヒンダール オシレーター トレンド・マジック

-

イチモク・クラウド:テンカン・セン,キジョン・センなど

-

容量指標:容量流量指標

-

波動性指標:波動傾向オシレーター

-

TD シーケンス

これらの指標は,異なる視点から市場動向と勢いを判断する.パラボリックSARはトレンド逆転点を検知し,Leledcは勢いを測定し,Ichimoku Cloudはサポート/レジスタンスレベルを識別する.ほとんどの指標が方向に同意するときに購入/販売信号が生成される.

戦略は,月/日ごとに指定された日付範囲外での非効率な取引を避けるためにフィルター条件も設定します.

利点分析

-

複数の要因が正確性とリスク耐性を向上させる

-

異なる指標タイプとの交差検証は失敗リスクを回避する

-

フィルター条件では,不適切な時期に非効率な取引を避ける

-

パインスクリプトの実装により,TradingViewで簡単に使用できます.

-

カスタマイズ可能なパラメータは,異なる市場のために最適化することができます

-

視覚信号は直感的な市場構造判断を提供する

リスク分析

-

複数の要素の組み合わせはパラメータ調整と重量最適化が必要です

-

特定の市場条件では個々の指標が失敗する可能性があります

-

不適切なフィルター設定は機会を逃す可能性があります

-

過剰な最適化 を 避ける 必要 が あり ます

-

トレーダーは指標の失敗リスクに注意し,それに応じて戦略を調整する必要があります

対策:

-

現在の市場における指標の有効性のパラメータを最適化

-

効果的指標を拡大し,非効果的指標を減らすために重みを調整する

-

機会とリスクのバランスをとる 精細なフィルター

オプティマイゼーションの方向性

-

自動調整指標重量に機械学習アルゴリズムを追加する

-

感情や資金流等なども考慮します

-

製品と時間枠の間で最適パラメータをテストする

-

保持期間における異なる業績を評価する

-

季節性や経済データなどのフィルターを組み合わせます

-

ストップ損失戦略を追加

結論

この戦略は,より強いリスク耐性を高めるために複数の指標を組み合わせています. しかし,指標の失敗リスクは監視され,パラメータは継続的に最適化する必要があります.将来の強化には,指標の重量最適化,より多くの要因を追加し,最適な保持期間をテストするなどが含まれます.

//@version=2

persistent_bull = nz(persistent_bull[1],0)

persistent_bear = nz(persistent_bear[1],0)

strategy("Strategy for The Bitcoin Buy/Sell Indicator", overlay=true, calc_on_every_tick=true)

// ****************************************Inputs***************************************************************

//@fixme if there is a buy and sell signal on the same bar, then it displays the first one and skips the second one. Fix this issue

buySellSignal = true // Make this false if you do not want to show Buy/Sell signal

inputIndividualSiganlPlot = true // = input (false, "Do you want to display each individual indicator's signal on the chart?")

sp = input (false, "Do you want to display Parabolic SAR?")

spLines = input (false, "Do you want to display Parabolic SAR on the chart?")

sCloud = input(false, "Do you want to display the Tenkan and Kijun lines of Ichimoku lines on the chart?")

sL = input (false, "Do you want to display Leledec Exhausion - Leledc on the chart?")

sTD = false

sRMO = input(false, "Do you want to display Rahul Mohindar Oscillator - RMO on the chart?")

inputAma = input(false, title="Do you want to display Kaufman AMA wave - AMA on the chart?")

tm = input (false, "Do you want to display Trend Magic signals on the chart?")

wtoLB = input (false, "Do you want to display WaveTrend Oscillator - WTO on the chart?")

vfiLB = input (false, "Do you want to display Volume Flow Indicator - VFI on the chart?")

cogRegionFillTransp = 100 // input(false, "Do you want to display COG Region Fill and ATR Starc+/-")

inputNeutralMinorSignals = input (false, title="Do you want to not display the minor or the not so strong signals from Ichimoku")

maj=true // input(true,title="Show Major Leledc Exhausion Bar signal")

min=input(false,title="Show Minor Leledc Exhausion Bar signal")

tenkanPeriods = input(20, minval=9, title="Tenkan Period - Ichimoku [9 or 10 or 20]")

kijunPeriods = input(60, minval=26, title="Kijun Period - Ichimoku [26 or 30 or 60]")

chikouPeriods = input(120, minval=52, title="Chikou - Ichimoku [52 or 60 or 120]")

displacement = input(30, minval=26, title="Displacement - Ichimoku [26 or 30]")

// ****************************************General Color Variables***************************************************************

colorLime = #006400 // Warning sign for long trade

colorBuy= #2DFF03 // Good sign for long trade

colorSell = #733629 // Good sign for short trade

colorMaroon =#8b0000 // Warning sign for short trade

colorBlue =#0000ff // No clear sign

colorGray = #a9a9a9 // Gray Color (For Squeeze momentum indicator)

colorBlack = #000000 // Black

colorWhite = #ffffff // White

colorTenkanViolet = #800000 // Tenkan-sen line color

colorKijun = #0000A6 // Kijun-sen line color

// TD Sequential bar colors

tdSell = #ff6666

tdSellOvershoot = #ff1a1a

tdSellOvershoot1 = #cc0000

tdSellOverShoot2 = #990000

tdSellOverShoot3 = #732626

tdBuy = #80ff80

tdBuyOverShoot = #33ff33

tdBuyOvershoot1 = #00cc00

tdBuyOverShoot2 = #008000

tdBuyOvershoot3 = #004d00

// ****************************************Icons***************************************************************

upSign = '↑' // indicates the indicator shows uptrend

downSign = '↓' // incicates the indicator showing downtrend

exitSign ='x' //indicates the indicator uptrend/downtrend ending

// diamond signals weakBullishSignal or weakBearishsignal

// flag signals neutralBullishSignal or neutralBearishSignal

// ****************************************Parabolic SAR code***************************************************************

start = 2

increment = 2

maximum = 2

sus = true

sds = true

disc = false

startCalc = start * .01

incrementCalc = increment * .01

maximumCalc = maximum * .10

sarUp = sar(startCalc, incrementCalc, maximumCalc)

sarDown = sar(startCalc, incrementCalc, maximumCalc)

colUp = spLines and close >= sarDown ? colorLime : na

colDown = spLines and close <= sarUp ? colorSell : na

//@fixme Does not display the correct values for up and down pSAR

plot(sp and sus and sarUp ? sarUp : na, title="↓ SAR", style=cross, linewidth=3,color=colUp)

plot(sp and sds and sarDown ? sarDown : na, title="↑ SAR", style=circles, linewidth=3,color=colDown)

startSAR = 0.02

incrementSAR = 0.02

maximumSAR = 0.2

psar = sar(startSAR, incrementSAR, maximumSAR)

bullishPSAR = psar < high and psar[1] > low

bearishPSAR= psar > low and psar[1] < high

//***********************Leledc Exhausion Bar***********************************************

maj_qual=6

maj_len=30

min_qual=5

min_len=5

lele(qual,len)=>

bindex=nz(bindex[1],0)

sindex=nz(sindex[1],0)

ret=0

if (close>close[4])

bindex:=bindex + 1

if(close<close[4])

sindex:=sindex + 1

if (bindex>qual) and (close<open) and high>=highest(high,len)

bindex:=0

ret:=-1

if ((sindex>qual) and (close>open) and (low<= lowest(low,len)))

sindex:=0

ret:=1

return=ret

major=lele(maj_qual,maj_len)

minor=lele(min_qual,min_len)

leledecMajorBullish = maj ? (major==1?low:na) : na

leledecMajorBearish = maj ? (major==-1?high:na) : na

//****************Ichimoku ************************************

donchian(len) => avg(lowest(len), highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement]

displacedSenkouB = senkouB[displacement]

bullishSignal = crossover(tenkan, kijun)

bearishSignal = crossunder(tenkan, kijun)

bullishSignalValues = iff(bullishSignal, tenkan, na)

bearishSignalValues = iff(bearishSignal, tenkan, na)

strongBullishSignal = crossover(tenkan, kijun) and bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB and low > tenkan and displacedSenkouA > displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB and high < tenkan and displacedSenkouA < displacedSenkouB

neutralBullishSignal = (bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB)

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

neutralBearishSignal = (bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB)

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

//*********************Kaufman AMA wave*********************//

src=close

lengthAMA=20

filterp = 10

d=abs(src-src[1])

s=abs(src-src[lengthAMA])

noise=sum(d, lengthAMA)

efratio=s/noise

fastsc=0.6022

slowsc=0.0645

smooth=pow(efratio*fastsc+slowsc, 2)

ama=nz(ama[1], close)+smooth*(src-nz(ama[1], close))

filter=filterp/100 * stdev(ama-nz(ama), lengthAMA)

amalow=ama < nz(ama[1]) ? ama : nz(amalow[1])

amahigh=ama > nz(ama[1]) ? ama : nz(amahigh[1])

bw=(ama-amalow) > filter ? 1 : (amahigh-ama > filter ? -1 : 0)

s_color=bw > 0 ? colorBuy : (bw < 0) ? colorSell : colorBlue

amaLongConditionEntry = s_color==colorBuy and s_color[1]!=colorBuy

amaShortConditionEntry = s_color==colorSell and s_color[1]!=colorSell

//***********************Rahul Mohindar Oscillator ******************************//

C=close

cm2(x) => sma(x,2)

ma1=cm2(C)

ma2=cm2(ma1)

ma3=cm2(ma2)

ma4=cm2(ma3)

ma5=cm2(ma4)

ma6=cm2(ma5)

ma7=cm2(ma6)

ma8=cm2(ma7)

ma9=cm2(ma8)

ma10=cm2(ma9)

SwingTrd1 = 100 * (close - (ma1+ma2+ma3+ma4+ma5+ma6+ma7+ma8+ma9+ma10)/10)/(highest(C,10)-lowest(C,10))

SwingTrd2=ema(SwingTrd1,30)

SwingTrd3=ema(SwingTrd2,30)

RMO= ema(SwingTrd1,81)

Buy=cross(SwingTrd2,SwingTrd3)

Sell=cross(SwingTrd3,SwingTrd2)

Bull_Trend=ema(SwingTrd1,81)>0

Bear_Trend=ema(SwingTrd1,81)<0

Ribbon_kol=Bull_Trend ? colorBuy : (Bear_Trend ? colorSell : colorBlue)

Impulse_UP= SwingTrd2 > 0

Impulse_Down= RMO < 0

bar_kol=Impulse_UP ? colorBuy : (Impulse_Down ? colorSell : (Bull_Trend ? colorBuy : colorBlue))

rahulMohindarOscilllatorLongEntry = Ribbon_kol==colorBuy and Ribbon_kol[1]!=colorBuy and Ribbon_kol[1]==colorSell and bar_kol==colorBuy

rahulMohindarOscilllatorShortEntry = Ribbon_kol==colorSell and Ribbon_kol[1]!=colorSell and Ribbon_kol[1]==colorBuy and bar_kol==colorSell

//***********************TD Sequential code ******************************//

transp=0

Numbers=false

SR=false

Barcolor=true

TD = close > close[4] ?nz(TD[1])+1:0

TS = close < close[4] ?nz(TS[1])+1:0

TDUp = TD - valuewhen(TD < TD[1], TD , 1 )

TDDn = TS - valuewhen(TS < TS[1], TS , 1 )

priceflip = barssince(close<close[4])

sellsetup = close>close[4] and priceflip

sell = sellsetup and barssince(priceflip!=9)

sellovershoot = sellsetup and barssince(priceflip!=13)

sellovershoot1 = sellsetup and barssince(priceflip!=14)

sellovershoot2 = sellsetup and barssince(priceflip!=15)

sellovershoot3 = sellsetup and barssince(priceflip!=16)

priceflip1 = barssince(close>close[4])

buysetup = close<close[4] and priceflip1

buy = buysetup and barssince(priceflip1!=9)

buyovershoot = barssince(priceflip1!=13) and buysetup

buyovershoot1 = barssince(priceflip1!=14) and buysetup

buyovershoot2 = barssince(priceflip1!=15) and buysetup

buyovershoot3 = barssince(priceflip1!=16) and buysetup

TDbuyh = valuewhen(buy,high,0)

TDbuyl = valuewhen(buy,low,0)

TDsellh = valuewhen(sell,high,0)

TDselll = valuewhen(sell,low,0)

//***********************Volume Flow Indicator [LazyBear] ******************************//

lengthVFI = 130

coefVFI = 0.2

vcoefVFI = 2.5

signalLength= 5

smoothVFI=true

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coefVFI * vinter * close

vave = sma( volume, lengthVFI )[1]

vmax = vave * vcoefVFI

vc = iff(volume < vmax, volume, vmax)

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , lengthVFI )/vave, 3)

vfima=ema( vfi, signalLength )

dVFI=vfi-vfima

bullishVFI = vfi > 0 and vfi[1] <=0

bearishVFI = vfi < 0 and vfi[1] >=0

//***********************WaveTrend Oscillator [WT] ******************************//

n1 = 10

n2 = 21

obLevel1 = 60

obLevel2 = 53

osLevel1 = -60

osLevel2 = -53

ap = hlc3

esa = ema(ap, n1)

dWTI = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * dWTI)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

wtiSignal = wt1-wt2

bullishWTI = wt1 > osLevel1 and wt1[1] <= osLevel1 and wtiSignal > 0

bearishWTI = wt1 < obLevel1 and wt1[1] >= obLevel1 and wtiSignal < 0

// **************** Trend Magic code adapted from Glaz ********************* /

CCI = 20 // input(20)

ATR = 5 // input(5)

Multiplier=1 // input(1,title='ATR Multiplier')

original=true // input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?lime:red

swap3=thisCCI >=0 ?lime:red

swap4=original?swap3:swap2

bullTrendMagic = swap4 == lime and swap4[1] == red

bearTrendMagic = swap4 == red and swap4[1] == lime

// ************ Indicator: Custom COG channel by Lazy Bear **************** //

srcCOG = close

lengthCOG = 34

median=0

multCOG= 2.5 // input(2.5)

offset = 20 //input(20)

tr_custom() =>

x1=high-low

x2=abs(high-close[1])

x3=abs(low-close[1])

max(x1, max(x2,x3))

atr_custom(x,y) =>

sma(x,y)

dev = (multCOG * stdev(srcCOG, lengthCOG))

basis=linreg(srcCOG, lengthCOG, median)

ul = (basis + dev)

ll = (basis - dev)

tr_v = tr_custom()

acustom=(2*atr_custom(tr_v, lengthCOG))

uls=basis+acustom

lls=basis-acustom

// Plot STDEV channel

plot(basis, linewidth=1, color=navy, style=line, linewidth=1, title="Median : STDEV COG")

lb=plot(ul, color=red, linewidth=1, title="BB+ : COG", style=hline.style_dashed)

tb=plot(ll, color=green, linewidth=1, title="BB- : COG ", style=hline.style_dashed)

fill(tb,lb, silver, title="Region fill: STDEV COG", transp=cogRegionFillTransp)

// Plot ATR channel

plot(basis, linewidth=2, color=navy, style=line, linewidth=2, title="Median : ATR COG ")

ls=plot(uls, color=red, linewidth=1, title="Starc+ : ATR COG", style=circles, transp=cogRegionFillTransp)

ts=plot(lls, color=green, linewidth=1, title="Star- : ATR COG", style=circles, transp=cogRegionFillTransp)

fill(ts,tb, green, title="Region fill : ATR COG", transp=cogRegionFillTransp)

fill(ls,lb, red, title="Region fill : ATR COG", transp=cogRegionFillTransp)

// Mark SQZ

plot_offs_high=0.002

plot_offs_low=0.002

sqz_f=(uls>ul) and (lls<ll)

b_color=sqz_f ? colorBlack : na

plot(sqz_f ? lls - (lls * plot_offs_low) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

plot(sqz_f ? uls + (uls * plot_offs_high) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

// ****************************************All the plots and coloring of bars***************************************************************

// Trend Magic

plotchar(tm and bullTrendMagic, title="TM", char=upSign, location=location.belowbar, color=colorBuy, transp=0, text="TM", textcolor=colorBuy, size=size.auto)

plotchar(tm and bearTrendMagic, title="TM", char=downSign, location=location.abovebar, color=colorSell, transp=0, text="TM", textcolor=colorSell, size=size.auto)

// WaveTrend Oscillator

plotshape(wtoLB and bullishWTI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="WTI", location=location.belowbar, transp=0)

plotshape(wtoLB and bearishWTI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="WTI", location=location.abovebar, transp=0)

// VFI

plotshape(vfiLB and bullishVFI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="VFI", location=location.belowbar, transp=0)

plotshape(vfiLB and bearishVFI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="VFI", location=location.abovebar, transp=0)

// PSAR

plotshape(inputIndividualSiganlPlot and sp and bullishPSAR, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Sar", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sp and bearishPSAR, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Sar", location=location.abovebar, transp=0)

// Leledec

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBearish, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Leledec", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBullish, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Leledec", location=location.belowbar, transp=0)

plotshape(min ? (minor==1?low:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Leledec", color=colorLime)

plotshape(min ? (minor==-1?high:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Leleded", color=colorSell)

// Ichimoku

plot(tenkan, color=iff(sCloud, colorTenkanViolet, na), title="Tenkan", linewidth=2, transp=0)

plot(kijun, color=iff(sCloud, colorKijun, na), title="Kijun", linewidth=2, transp=0)

plot(close, offset = -displacement, color=iff(sCloud, colorLime, na), title="Chikou", linewidth=1)

p1 = plot(senkouA, offset=displacement, color=colorBuy, title="Senkou A", linewidth=3, transp=0)

p2 = plot(senkouB, offset=displacement, color=colorSell, title="Senkou B", linewidth=3, transp=0)

fill(p1, p2, color = senkouA > senkouB ? #1eb600 : colorSell)

plotshape(inputIndividualSiganlPlot and strongBearishSignal, color=colorSell, style=shape.labelup, textcolor=#000000, text="Ichimoku", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and strongBullishSignal, color=colorBuy, style=shape.labeldown, textcolor=#ffffff, text="Ichimoku", location=location.belowbar, transp=0)

plotshape(inputNeutralMinorSignals and neutralBullishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.belowbar, title="Neutral Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and weakBullishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and neutralBearishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.abovebar, title="Neutral Bearish Signals - Ichimoku", color=colorMaroon)

plotshape(inputNeutralMinorSignals and weakBearishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Ichimoku", color=colorMaroon)

// AMA

plotshape(inputIndividualSiganlPlot and inputAma and amaLongConditionEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="AMA", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and inputAma and amaShortConditionEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="AMA", location=location.abovebar, transp=0)

// RMO

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorLongEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="RMO", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorShortEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="RMO", location=location.abovebar, transp=0)

// TD

plot(sTD and SR?(TDbuyh ? TDbuyl: na):na,style=circles, linewidth=1, color=red)

plot(sTD and SR?(TDselll ? TDsellh : na):na,style=circles, linewidth=1, color=lime)

barColour = sell? tdSell : buy? tdBuy : sellovershoot? tdSellOvershoot : sellovershoot1? tdSellOvershoot1 : sellovershoot2?tdSellOverShoot2 : sellovershoot3? tdSellOverShoot3 : buyovershoot? tdBuyOverShoot : buyovershoot1? tdBuyOvershoot1 : buyovershoot2? tdBuyOverShoot2 : buyovershoot3? tdBuyOvershoot3 : na

barcolor(color=barColour, title ="TD Sequential Bar Colour")

// ****************************************BUY/SELL Signal ***************************************************************

bull = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

bear = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

if bull

persistent_bull := 1

persistent_bear := 0

if bear

persistent_bull := 0

persistent_bear := 1

plotshape(bull and persistent_bull[1] != 1, style=shape.labelup, location=location.belowbar, color=colorBuy, text="Buy", textcolor=#000000, transp=0)

plotshape(bear and persistent_bear[1] != 1, style=shape.labeldown, color=colorSell, text="Sell", location=location.abovebar, textcolor =#ffffff, transp=0)

// ****************************************Alerts***************************************************************

// For global buy/sell

alertcondition(bull and persistent_bull[1] != 1, title='Buy', message='Buy')

alertcondition(bear and persistent_bear[1] != 1, title='Sell', message='Sell')

// Strategy

longCondition = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

closeLongCondition = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

yearfrom=input(2017)

yearuntil=input(2020)

leverage=input(1)

if (longCondition )

strategy.entry("Long", strategy.long, leverage, comment="Enter Long")

else

strategy.close("Long", when=closeLongCondition)

//if (closeLongCondition and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth <= dayuntil and year <= yearuntil and year>=yearfrom)

// strategy.entry("Short", strategy.short, leverage, comment="Enter Short")

//else

// strategy.close("Short", when=longCondition)

- トレンド逆転波動性組み合わせ戦略

- 漸進的な利益戦略

- 二重ポジションの突破戦略

- トレンド 買って 落とし 売って ピーク 戦略

- 移動平均のクロスオーバーとMACDの組み合わせ戦略

- 戦略をフォローするモメンタム移動平均クロスオーバートレンド

- 動向平均のクロスオーバーに基づく戦略をフォローする傾向

- 2つの移動平均のターニングポイント戦略

- 急速なRSI突破戦略

- 移動平均追跡ストップ損失戦略

- 動向平均のクロスオーバーに基づく戦略をフォローする傾向

- ノロの価格チャネル戦略 v1.1

- 2つの移動平均逆転戦略

- トリプル パターン オシレーション 取引戦略

- トレンド逆転システム

- チャンネルブレイク SMA戦略

- RSIのトレンド逆転戦略

- RSI MACDクロスオーバー ダブルMA追跡戦略

- 複数のタイムフレームのトレンド戦略

- 双重RSI平均逆転戦略