2つの移動平均のクロスオーバーアルゴリズム取引戦略

作者: リン・ハーンチャオチャン開催日:2023年10月30日 (月) 15:27:34タグ:

概要

この戦略は,主に移動平均クロスオーバー原理を活用し,RSI指標逆転信号とカスタムダブル移動平均クロスオーバーアルゴリズムを組み合わせてトレンドトレードを実装する.この戦略は,異なる期間の移動平均を2つ追跡し,短期のトレンドを追跡するMAが速く,長期のトレンドを追跡するMAが遅い.高速MAが緩やかなMAを上向きに越えると,上向きのトレンドと購入のチャンスが示される.高速MAが緩やかなMAを下回ると,短期トレンドの終わりとポジションを閉じるチャンスが示される.

戦略の論理

-

異なるパラメータを持つVWAP移動平均の2つのグループを計算し,それぞれ長期的な傾向と短期的な傾向を表します.

- スロー・テンカンセンとキジョンセンが長期的傾向を計算する

- ファスト・テンカンセンとキジュンセンが 短期的な傾向を計算する

-

テンカンセンとキジュンセンの平均を ゆっくりと速く動く平均としましょう

-

ボリンジャー帯を計算して 統合とブレイクを特定します

- 中間線は,速いMAsと遅いMAsの平均値です.

- 上部と下部帯は突破を検出するために使用されます

-

容量エネルギーを決定するためにTSVを計算する

- 0以上のTSVは,上昇傾向のボリュームを示す.

- TSV が EMA を上回るということは,勢いが強まることを示しています.

-

RSI を計算し,過剰購入と過剰販売の条件を特定する

- RSIが30未満なら,買い物のために過剰販売区域です.

- RSIが70を超えると,売り場が過剰に買いすぎます.

-

入国条件:

- 速度のMAが遅さのMAを横切る

- 上部ボリンジャー帯の横断を閉じる

- TSVは0以上で EMAは0以上

- RSI 30以下

-

出口条件:

- 速度のMAは,ゆっくりしたMAを下回る

- RSI 70以上

利点分析

-

二重移動平均系は,長期および短期間のトレンドの両方を把握する

-

RSIは過買い区分を買ったり過売り区分を売ったりしない

-

TSVは,トレンドを支える十分な量を確保する

-

ボリンジャー・バンドは主要なブレイクポイントを特定します

-

インディケーターの組み合わせは,偽のブレイクをフィルタリングするのに役立ちます

リスク分析

-

誤った信号に敏感なMAシステム,他の指標でフィルタリングする必要がある

-

RSI パラメータは最適化が必要で,そうでなければ買い/売点を見逃す可能性があります.

-

TSVもパラメータに敏感で 慎重に検査する必要があります

-

BB上部バンドを壊すのは,偽の突破かもしれない,検証が必要です

-

多くの指標を最適化するのは困難で,過剰なフィットメントのリスクがあります

-

列車/試験データが不十分である場合,曲線の固定が起こる

オプティマイゼーションの方向性

-

最適なパラメータ組み合わせを見つけるためにより多くの期間をテストする

-

MACD,KDなどの他の指標をRSIと置き換えたり組み合わせたりしてください.

-

パラメータ最適化のためにウォーク・フォワード分析を使用する

-

単一の取引損失を制御するためにストップロスを追加する

-

信号予測を助ける機械学習モデルを検討する

-

異なる市場のためのパラメータを調整し,単一のパラメータセットに過剰に適合しないでください

結論

この戦略は,二重移動平均値を使用して,長期および短期間のトレンドを捕捉し,RSI,TSV,ボリンジャーバンドなどでシグナルをフィルタリングする.利点は長期上向きのモメンタムに沿って取引することです.しかし,リスクを減らすためにさらなるパラメータ調整とストップ損失を必要とする偽信号リスクも伴います.全体として,トレンドフォローと平均逆転を組み合わせることで,長期上向きのトレンドで良い結果が得られますが,パラメータは異なる市場のために調整する必要があります.

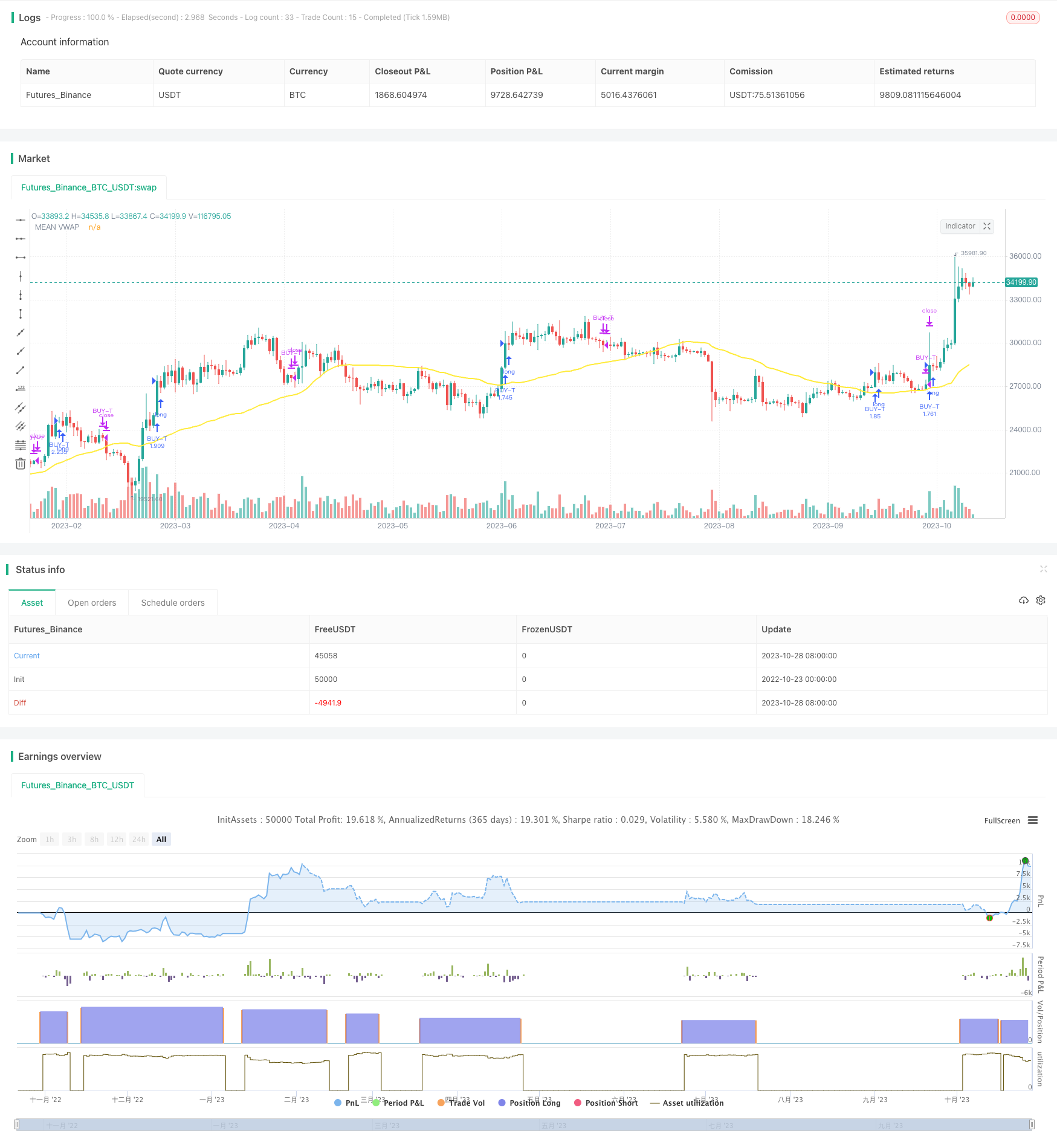

/*backtest

start: 2022-10-23 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Credits

// "Vwap with period" code which used in this strategy to calculate the leadLine was written by "neolao" active on https://tr.tradingview.com/u/neolao/

// "TSV" code which used in this strategy was written by "liw0" active on https://www.tradingview.com/u/liw0. The code is corrected by "vitelot" December 2018.

// "Vidya" code which used in this strategy was written by "everget" active on https://tr.tradingview.com/u/everget/

strategy("HYE Combo Market [Strategy] (Vwap Mean Reversion + Trend Hunter)", overlay = true, initial_capital = 1000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, commission_value = 0.025)

//Strategy inputs

source = input(title = "Source", defval = close, group = "Mean Reversion Strategy Inputs")

smallcumulativePeriod = input(title = "Small VWAP", defval = 8, group = "Mean Reversion Strategy Inputs")

bigcumulativePeriod = input(title = "Big VWAP", defval = 10, group = "Mean Reversion Strategy Inputs")

meancumulativePeriod = input(title = "Mean VWAP", defval = 50, group = "Mean Reversion Strategy Inputs")

percentBelowToBuy = input(title = "Percent below to buy %", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiPeriod = input(title = "Rsi Period", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiEmaPeriod = input(title = "Rsi Ema Period", defval = 5, group = "Mean Reversion Strategy Inputs")

rsiLevelforBuy = input(title = "Maximum Rsi Level for Buy", defval = 30, group = "Mean Reversion Strategy Inputs")

slowtenkansenPeriod = input(9, minval=1, title="Slow Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

slowkijunsenPeriod = input(13, minval=1, title="Slow Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fasttenkansenPeriod = input(3, minval=1, title="Fast Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fastkijunsenPeriod = input(7, minval=1, title="Fast Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

BBlength = input(20, minval=1, title= "Bollinger Band Length", group = "Trend Hunter Strategy Inputs")

BBmult = input(2.0, minval=0.001, maxval=50, title="Bollinger Band StdDev", group = "Trend Hunter Strategy Inputs")

tsvlength = input(20, minval=1, title="TSV Length", group = "Trend Hunter Strategy Inputs")

tsvemaperiod = input(7, minval=1, title="TSV Ema Length", group = "Trend Hunter Strategy Inputs")

length = input(title="Vidya Length", type=input.integer, defval=20, group = "Trend Hunter Strategy Inputs")

src = input(title="Vidya Source", type=input.source, defval= hl2 , group = "Trend Hunter Strategy Inputs")

// Vidya Calculation

getCMO(src, length) =>

mom = change(src)

upSum = sum(max(mom, 0), length)

downSum = sum(-min(mom, 0), length)

out = (upSum - downSum) / (upSum + downSum)

out

cmo = abs(getCMO(src, length))

alpha = 2 / (length + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group = "Strategy Date Range")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group = "Strategy Date Range")

startYear = input(title="Start Year", type=input.integer,

defval=2000, minval=1800, maxval=2100, group = "Strategy Date Range")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group = "Strategy Date Range")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group = "Strategy Date Range")

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100, group = "Strategy Date Range")

inDateRange = true

// Mean Reversion Strategy Calculation

typicalPriceS = (high + low + close) / 3

typicalPriceVolumeS = typicalPriceS * volume

cumulativeTypicalPriceVolumeS = sum(typicalPriceVolumeS, smallcumulativePeriod)

cumulativeVolumeS = sum(volume, smallcumulativePeriod)

smallvwapValue = cumulativeTypicalPriceVolumeS / cumulativeVolumeS

typicalPriceB = (high + low + close) / 3

typicalPriceVolumeB = typicalPriceB * volume

cumulativeTypicalPriceVolumeB = sum(typicalPriceVolumeB, bigcumulativePeriod)

cumulativeVolumeB = sum(volume, bigcumulativePeriod)

bigvwapValue = cumulativeTypicalPriceVolumeB / cumulativeVolumeB

typicalPriceM = (high + low + close) / 3

typicalPriceVolumeM = typicalPriceM * volume

cumulativeTypicalPriceVolumeM = sum(typicalPriceVolumeM, meancumulativePeriod)

cumulativeVolumeM = sum(volume, meancumulativePeriod)

meanvwapValue = cumulativeTypicalPriceVolumeM / cumulativeVolumeM

rsiValue = rsi(source, rsiPeriod)

rsiEMA = ema(rsiValue, rsiEmaPeriod)

buyMA = ((100 - percentBelowToBuy) / 100) * bigvwapValue[0]

inTrade = strategy.position_size > 0

notInTrade = strategy.position_size <= 0

if(crossunder(smallvwapValue, buyMA) and rsiEMA < rsiLevelforBuy and close < meanvwapValue and inDateRange and notInTrade)

strategy.entry("BUY-M", strategy.long)

if(close > meanvwapValue or not inDateRange)

strategy.close("BUY-M")

// Trend Hunter Strategy Calculation

// Slow Tenkan Sen Calculation

typicalPriceTS = (high + low + close) / 3

typicalPriceVolumeTS = typicalPriceTS * volume

cumulativeTypicalPriceVolumeTS = sum(typicalPriceVolumeTS, slowtenkansenPeriod)

cumulativeVolumeTS = sum(volume, slowtenkansenPeriod)

slowtenkansenvwapValue = cumulativeTypicalPriceVolumeTS / cumulativeVolumeTS

// Slow Kijun Sen Calculation

typicalPriceKS = (high + low + close) / 3

typicalPriceVolumeKS = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKS = sum(typicalPriceVolumeKS, slowkijunsenPeriod)

cumulativeVolumeKS = sum(volume, slowkijunsenPeriod)

slowkijunsenvwapValue = cumulativeTypicalPriceVolumeKS / cumulativeVolumeKS

// Fast Tenkan Sen Calculation

typicalPriceTF = (high + low + close) / 3

typicalPriceVolumeTF = typicalPriceTF * volume

cumulativeTypicalPriceVolumeTF = sum(typicalPriceVolumeTF, fasttenkansenPeriod)

cumulativeVolumeTF = sum(volume, fasttenkansenPeriod)

fasttenkansenvwapValue = cumulativeTypicalPriceVolumeTF / cumulativeVolumeTF

// Fast Kijun Sen Calculation

typicalPriceKF = (high + low + close) / 3

typicalPriceVolumeKF = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKF = sum(typicalPriceVolumeKF, fastkijunsenPeriod)

cumulativeVolumeKF = sum(volume, fastkijunsenPeriod)

fastkijunsenvwapValue = cumulativeTypicalPriceVolumeKF / cumulativeVolumeKF

// Slow LeadLine Calculation

lowesttenkansen_s = lowest(slowtenkansenvwapValue, slowtenkansenPeriod)

highesttenkansen_s = highest(slowtenkansenvwapValue, slowtenkansenPeriod)

lowestkijunsen_s = lowest(slowkijunsenvwapValue, slowkijunsenPeriod)

highestkijunsen_s = highest(slowkijunsenvwapValue, slowkijunsenPeriod)

slowtenkansen = avg(lowesttenkansen_s, highesttenkansen_s)

slowkijunsen = avg(lowestkijunsen_s, highestkijunsen_s)

slowleadLine = avg(slowtenkansen, slowkijunsen)

// Fast LeadLine Calculation

lowesttenkansen_f = lowest(fasttenkansenvwapValue, fasttenkansenPeriod)

highesttenkansen_f = highest(fasttenkansenvwapValue, fasttenkansenPeriod)

lowestkijunsen_f = lowest(fastkijunsenvwapValue, fastkijunsenPeriod)

highestkijunsen_f = highest(fastkijunsenvwapValue, fastkijunsenPeriod)

fasttenkansen = avg(lowesttenkansen_f, highesttenkansen_f)

fastkijunsen = avg(lowestkijunsen_f, highestkijunsen_f)

fastleadLine = avg(fasttenkansen, fastkijunsen)

// BBleadLine Calculation

BBleadLine = avg(fastleadLine, slowleadLine)

// Bollinger Band Calculation

basis = sma(BBleadLine, BBlength)

dev = BBmult * stdev(BBleadLine, BBlength)

upper = basis + dev

lower = basis - dev

// TSV Calculation

tsv = sum(close>close[1]?volume*(close-close[1]):close<close[1]?volume*(close-close[1]):0,tsvlength)

tsvema = ema(tsv, tsvemaperiod)

// Rules for Entry & Exit

if(fastleadLine > fastleadLine[1] and slowleadLine > slowleadLine[1] and tsv > 0 and tsv > tsvema and close > upper and close > vidya and inDateRange and notInTrade)

strategy.entry("BUY-T", strategy.long)

if((fastleadLine < fastleadLine[1] and slowleadLine < slowleadLine[1]) or not inDateRange)

strategy.close("BUY-T")

// Plots

plot(meanvwapValue, title="MEAN VWAP", linewidth=2, color=color.yellow)

//plot(vidya, title="VIDYA", linewidth=2, color=color.green)

//colorsettingS = input(title="Solid Color Slow Leadline", defval=false, type=input.bool)

//plot(slowleadLine, title = "Slow LeadLine", color = colorsettingS ? color.aqua : slowleadLine > slowleadLine[1] ? color.green : color.red, linewidth=3)

//colorsettingF = input(title="Solid Color Fast Leadline", defval=false, type=input.bool)

//plot(fastleadLine, title = "Fast LeadLine", color = colorsettingF ? color.orange : fastleadLine > fastleadLine[1] ? color.green : color.red, linewidth=3)

//p1 = plot(upper, "Upper BB", color=#2962FF)

//p2 = plot(lower, "Lower BB", color=#2962FF)

//fill(p1, p2, title = "Background", color=color.blue)

//plot(smallvwapValue, color=#13C425, linewidth=2)

//plot(bigvwapValue, color=#CA1435, linewidth=2)

- RSI ロング・ショート 自動取引戦略

- トレンドレスMACD戦略

- 総量残高に基づくVB戦略

- 波動性ブレイク・トレード戦略

- 3つの移動平均のクロスオーバー戦略

- MACD LONG のサポート&レジスタンスの戦略

- 移動平均値に基づくトレンド取引戦略

- RSI 長期・短期残高取引戦略

- テスラのスーパートレンド戦略

- 3つの内側から逆転する戦略

- トレンドフォロー戦略とストップロスの追跡

- RSI 取引戦略

- 強いトレンドブレイク戦略

- シグザグ ベース トレンド フォロー 戦略

- イチモクバランス戦略

- 金十字 死十字 移動平均 取引戦略

- HULL SMA と EMA のクロスオーバーに基づいたトレンド戦略

- 双重EMAクロスオーバー戦略

- 移動平均のブレイクに基づいたトレンドフォロー戦略

- MACD 閉じる ハイブリッド カメ戦略