作者: リン・ハーンチャオチャン開催日:2024年01月25日 15:53:06

タグ:

タグ:

概要

戦略原則

- 間違った取引を避けるためにトレンド信号を判断するのに役立つキャンドルスタイクパターン認識を導入します.

- SMA線はトレンド方向を決定するのに役立ちます.短期のSMAが長期の上部SMAを突破すると上向きです.

利点分析

- STOパラメータの最適化,スムーズな調整 騒音をフィルタリングし,信号の質を向上させます

- ハイキン・アシ技術が導入され ろうそくの方向の変化を認識し 正確な取引信号を確保しました

- SMA線は主要なトレンド方向を判断するのに役立ちます トレンドに反する取引を避けます

- ストップロスの戦略は,取引ごとに最大利益を得る.

リスク分析

- 高い取引頻度は,取引コストとスライプコストを増加させます.

戦略の最適化

- RSIのパラメータを調整し 過剰購入過剰販売判断を最適化します

- STO パラメーター,スムーズ度,周期を調整して信号の質を向上させる

- 信号の正確性を向上させるための より多くの技術指標を導入する

結論

この戦略は,複数の主流の技術指標の優位性を統合している.パラメータ最適化と論理精製を通じて,取引シグナル品質とストップ損失をバランスする.一定の汎用性と安定した収益性.さらなる最適化は,勝利率と収益性を向上させる.

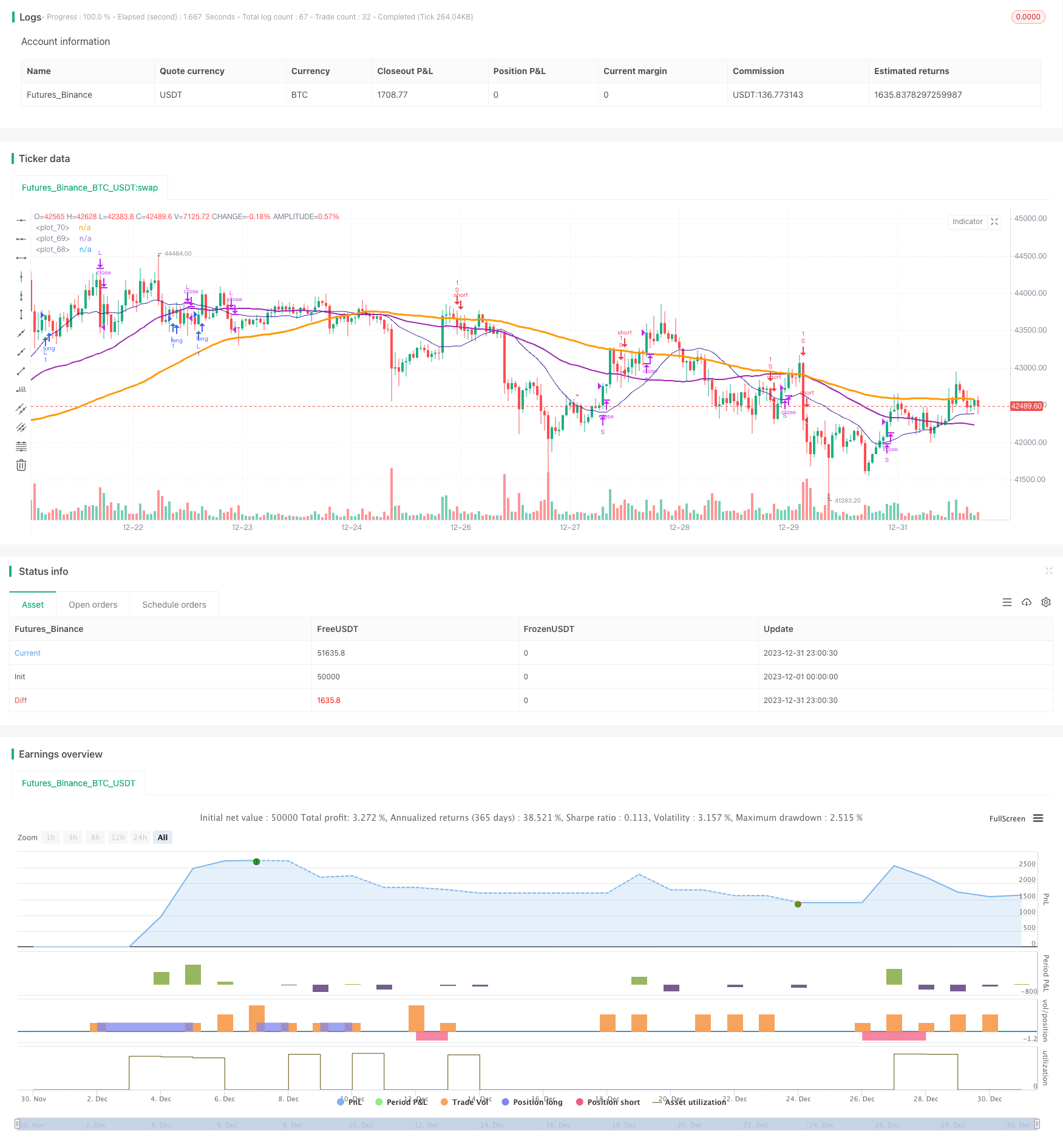

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true)

strategy(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true )

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

overbought = input(80, minval=1)

oversold = input(20, minval=1)

smaLengh = input(100, minval=1)

smaLengh2 = input(50, minval=1)

smaLengh3 = input(20, minval=1)

src = input(close, title="RSI Source")

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testPeriod() =>

time >= testPeriodStart ? true : false

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

crossBuy = crossover(k, d) and k < oversold

crossSell = crossunder(k, d) and k > overbought

dcLower = lowest(low, 10)

dcUpper = highest(high, 10)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashiPositive = heikinashi_close >= heikinashi_open

heikinashiBuy = heikinashiPositive == true and heikinashiPositive[1] == false and heikinashiPositive[2] == false

heikinashiSell = heikinashiPositive == false and heikinashiPositive[1] == true and heikinashiPositive[2] == true

//plotshape(heikinashiBuy, style=shape.arrowup, color=green, location=location.belowbar, size=size.tiny)

//plotshape(heikinashiSell, style=shape.arrowdown, color=red, location=location.abovebar, size=size.tiny)

buy = (crossBuy == true or crossBuy[1] == true or crossBuy[2] == true) and (heikinashiBuy == true or heikinashiBuy[1] == true or heikinashiBuy[2] == true)

sell = (crossSell == true or crossSell[1] == true or crossSell[2] == true) and (heikinashiSell == true or heikinashiSell[1] == true or heikinashiSell[2] == true)

mult = timeframe.period == '15' ? 4 : 1

mult2 = timeframe.period == '240' ? 0.25 : mult

movingAverage = sma(close, round(smaLengh))

movingAverage2 = sma(close, round(smaLengh2))

movingAverage3 = sma(close, round(smaLengh3))

uptrend = movingAverage < movingAverage2 and movingAverage2 < movingAverage3 and close > movingAverage

downtrend = movingAverage > movingAverage2 and movingAverage2 > movingAverage3 and close < movingAverage

signalBuy = (buy[1] == false and buy[2] == false and buy == true) and uptrend

signalSell = (sell[1] == false and sell[2] == false and sell == true) and downtrend

takeProfitSell = (buy[1] == false and buy[2] == false and buy == true) and uptrend == false

takeProfitBuy = (sell[1] == false and sell[2] == false and sell == true) and uptrend

plotshape(signalBuy, style=shape.triangleup, color=green, location=location.belowbar, size=size.tiny)

plotshape(signalSell, style=shape.triangledown, color=red, location=location.abovebar, size=size.tiny)

plot(movingAverage, linewidth=3, color=orange, transp=0)

plot(movingAverage2, linewidth=2, color=purple, transp=0)

plot(movingAverage3, linewidth=1, color=navy, transp=0)

alertcondition(signalBuy, title='Signal Buy', message='Signal Buy')

alertcondition(signalSell, title='Signal Sell', message='Signal Sell')

strategy.close("L", when=dcLower[1] > low)

strategy.close("S", when=dcUpper[1] < high)

strategy.entry("L", strategy.long, 1, when = signalBuy and testPeriod() and uptrend)

strategy.entry("S", strategy.short, 1, when = signalSell and testPeriod() and uptrend ==false)

//strategy.exit("Exit Long", from_entry = "L", loss = 25000000, profit=25000000)

//strategy.exit("Exit Short", from_entry = "S", loss = 25000000, profit=25000000)

もっと

- モメント トレンド 戦略

- モメント移動平均クロスオーバー量子戦略

- 2つの移動平均逆転とATRトライルストップの組み合わせ戦略

- マルティンゲールフューチャー取引戦略

- モメント・プルバック・戦略

- ダブルキャンドルスタイク予測 接近戦略

- ストカスティック・スーパートレンド・トラッキング・ストップ・ロスの取引戦略

- 戦略をフォローする二重逆転振動帯の傾向

- 3つの EMA,DMI,MACD を含むトレンドフォロー戦略

- 二重指標の突破戦略

- ピート・ウェーブ・トレーディング・システム戦略

- 指数関数移動平均と量重量化に基づいた定量戦略

- オリジックス・アシ戦略 滑らかな移動平均値に基づく

- BlackBit Trader XO マクロトレンドスキャナー戦略

- 原油ADXの動向 戦略をフォローする

- MT-調整取引戦略

- 双重要因の逆転と価格量の改善のコンボ戦略

- トレンドアングル移動平均クロスオーバー戦略