MTF RSI & STOCH 전략

저자:차오장, 날짜: 2022-05-10 10:41:43태그:SMA

이 공유는 다른 시간 프레임의 평균을 볼 수 있는 지표입니다.

RSI는 파란색 선입니다. 주식은 노란색 선입니다.

매개 변수에서 시간 프레임을 관리할 수 있습니다.

이 전략은 두 라인이 과잉 구매되거나 과잉 판매되면 포지션을 취하고 주식과 RSI가 중간에 갈 때 닫는 것입니다.

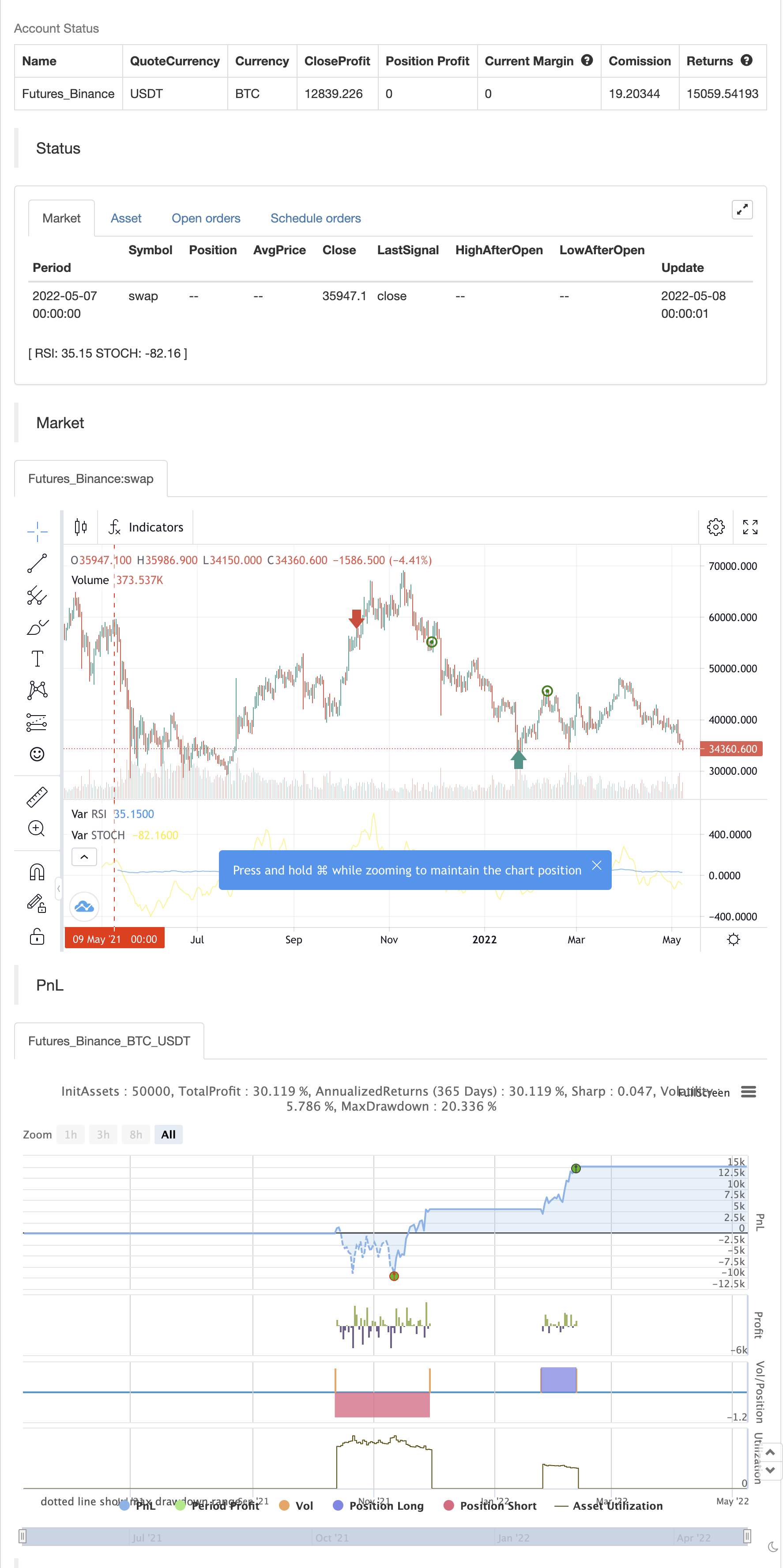

백테스트

/*backtest

start: 2021-05-09 00:00:00

end: 2022-05-08 23:59:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////// MTF Stochastic & RSI Strategy ©️ bykzis /////////////////////////////////////////

//

// *** Inspired by "Binance CHOP Dashboard" from @Cazimiro and "RSI MTF Table" from @mobester16 *** and LOT OF COPY of Indicator-Jones MTF Scanner

//

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

//@version=5

//strategy('MTF RSI & STOCH Strategy', overlay=false,initial_capital=100, currency=currency.USD, commission_value=0.01, commission_type=strategy.commission.percent)

// Pair list

var string GRP1 = '══════════ General ══════════'

overbought = input.int(80, 'Overbought Level', minval=1, group=GRP1)

oversold = input.int(20, 'Oversold Level', minval=1, group=GRP1)

/// Timeframes

var string GRP2 = '══════════ Timeframes ══════════'

timeframe1 = input.timeframe(title="Timeframe 1", defval="W", group=GRP2)

timeframe2 = input.timeframe(title="Timeframe 2", defval="D", group=GRP2)

timeframe3 = input.timeframe(title="Timeframe 3", defval="240", group=GRP2)

timeframe4 = input.timeframe(title="Timeframe 4", defval="60", group=GRP2)

// RSI settings

var string GRP3 = '══════════ RSI settings ══════════'

rsiLength = input.int(14, minval=1, title='RSI length', group=GRP3)

rsiSource = input(close, 'RSI Source', group=GRP3)

rsioverbought = input.int(70, 'RSI Overbought Level', minval=1, group=GRP3)

rsioversold = input.int(30, 'RSI Oversold Level', minval=1, group=GRP3)

/// Get RSI values of each timeframe /////////////////////////////////////////////////////

rsi = ta.rsi(rsiSource, rsiLength)

callRSI(id,timeframe) =>

rsiValue = request.security(id, str.tostring(timeframe), rsi, gaps=barmerge.gaps_off)

rsiValue

RSI_TF1 = callRSI(syminfo.tickerid, timeframe1)

RSI_TF2 = callRSI(syminfo.tickerid, timeframe2)

RSI_TF3 = callRSI(syminfo.tickerid, timeframe3)

RSI_TF4 = callRSI(syminfo.tickerid, timeframe4)

/////// Calculate Averages /////////////////////////////////////////////////////////////////

calcAVG(valueTF1, valueTF2, valueTF3, valueTF4) =>

math.round((valueTF1 + valueTF2 + valueTF3 + valueTF4) / 4, 2)

AVG=calcAVG(RSI_TF1, RSI_TF2, RSI_TF3, RSI_TF4)

// Stochastic settings

var string GRP4 = '══════════ Stochastic settings ══════════'

periodK = input.int(14, '%K length', minval=1, group=GRP4)

smoothK = input.int(3, 'Smooth K', minval=1, group=GRP4)

stochSource = input(close, 'Stochastic Source', group=GRP4)

stochoverbought = input.int(70, 'Stochastic Overbought Level', minval=1, group=GRP4)

stochoversold = input.int(30, 'Stochastic Oversold Level', minval=1, group=GRP4)

/// Get Stochastic values of each timeframe ////////////////////////////////////////////////

stoch = ta.sma(ta.stoch(stochSource, high, low, periodK), smoothK)

getStochastic(id,timeframe) =>

stochValue = request.security(id, str.tostring(timeframe), stoch, gaps=barmerge.gaps_off)

stochValue

Stoch_TF1 = getStochastic(syminfo.tickerid, timeframe1)

Stoch_TF2 = getStochastic(syminfo.tickerid, timeframe2)

Stoch_TF3 = getStochastic(syminfo.tickerid, timeframe3)

Stoch_TF4 = getStochastic(syminfo.tickerid, timeframe4)

AVG_STOCH=calcAVG(Stoch_TF1, Stoch_TF2, Stoch_TF3, Stoch_TF4)

plot(AVG, color = color.blue, title='RSI')

plot(AVG_STOCH, color = color.yellow,title='STOCH')

hline(rsioverbought,color=color.red)

hline(rsioversold, color=color.lime)

hline(50, color=color.white)

//============ signal Generator ==================================//

if AVG <= rsioversold and AVG_STOCH <=stochoversold

strategy.entry('Buy_Long', strategy.long)

strategy.close("Buy_Long",when=(AVG_STOCH >=70 and AVG >=50 and close >=strategy.position_avg_price),comment="Long_OK")

if AVG >=rsioverbought and AVG_STOCH >=stochoverbought

strategy.entry('Buy_Short', strategy.short)

strategy.close("Buy_Short",when=(AVG_STOCH <=30 and AVG <=50 and close <=strategy.position_avg_price),comment="Short_OK")

///////////////////////////////////////////////////////////////////////////////////////////

관련 내용

- 다차원적인 트렌드 판단과 ATR 동적 스톱 및 손실 전략

- 브린 벨트 트렌드에 적응하는 거래 전략

- 고도의 다지표 트렌드 확인 거래 전략

- 쌍평선-RSI 다중 신호 트렌드 거래 전략

- 적응 추세 추적 및 다중 확인 거래 전략

- 동적 조정 스톱 손실 코끼리 기둥 모양 트렌드 추적 전략

- 다일리얼 크로스 보조 RSI 동적 매개 변수 정량화 거래 전략

- 다차원 K 근접 알고리즘과

타이 형태의 양적 가격 분석 거래 전략 - 이동평균 및 일일 모형에 기반한 스마트 추적 중지 손실 전략

- 적응형 다전략 동적 스위치 시스템: 융합 트렌드 추적과 구간 격변에 대한 양적 거래 전략

- 다 지표 다 차원 트렌드 크로스 고급 정량화 전략

더 많은 내용

- 더 작은 프랙탈 (+ 투명성)

- BB-RSI-ADX 입구점

- 헬스-4에마

- 각 공격 후보 라인 표시기

- 키준센 선과 십자가

- AMACD - 모든 이동 평균 컨버전스 디버전스

- MA 하이브리드 BY RAJ

- 다이아몬드 트렌드

- 니크 스톡

- 스톡 슈퍼트르드 ATR 200ma

- EMA + AROON + ASH

- 모멘텀 2.0

- EHMA 범위 전략

- 이동 평균 구매 판매

- 미다스 Mk. II - 최고의 암호화 스윙

- TMA-레거시

- TV의 높고 낮은 전략

- 가장 좋은 트레이딩 뷰 전략

- 빅 스냅퍼 경고 R3.0 + Chaiking 변동성 상태 + TP RSI

데 크롤 스톱