핵심 역전 역 테스트 전략

저자:차오장, 날짜: 2024-01-26 16:11:28태그:

전반적인 설명

전략 원칙

이점 분석

위험 분석

핵심 역전 백테스트 전략은 또한 몇 가지 위험을 가지고 있습니다:

최적화 방향

핵심 역전 역 테스트 전략의 주요 최적화 방향:

요약

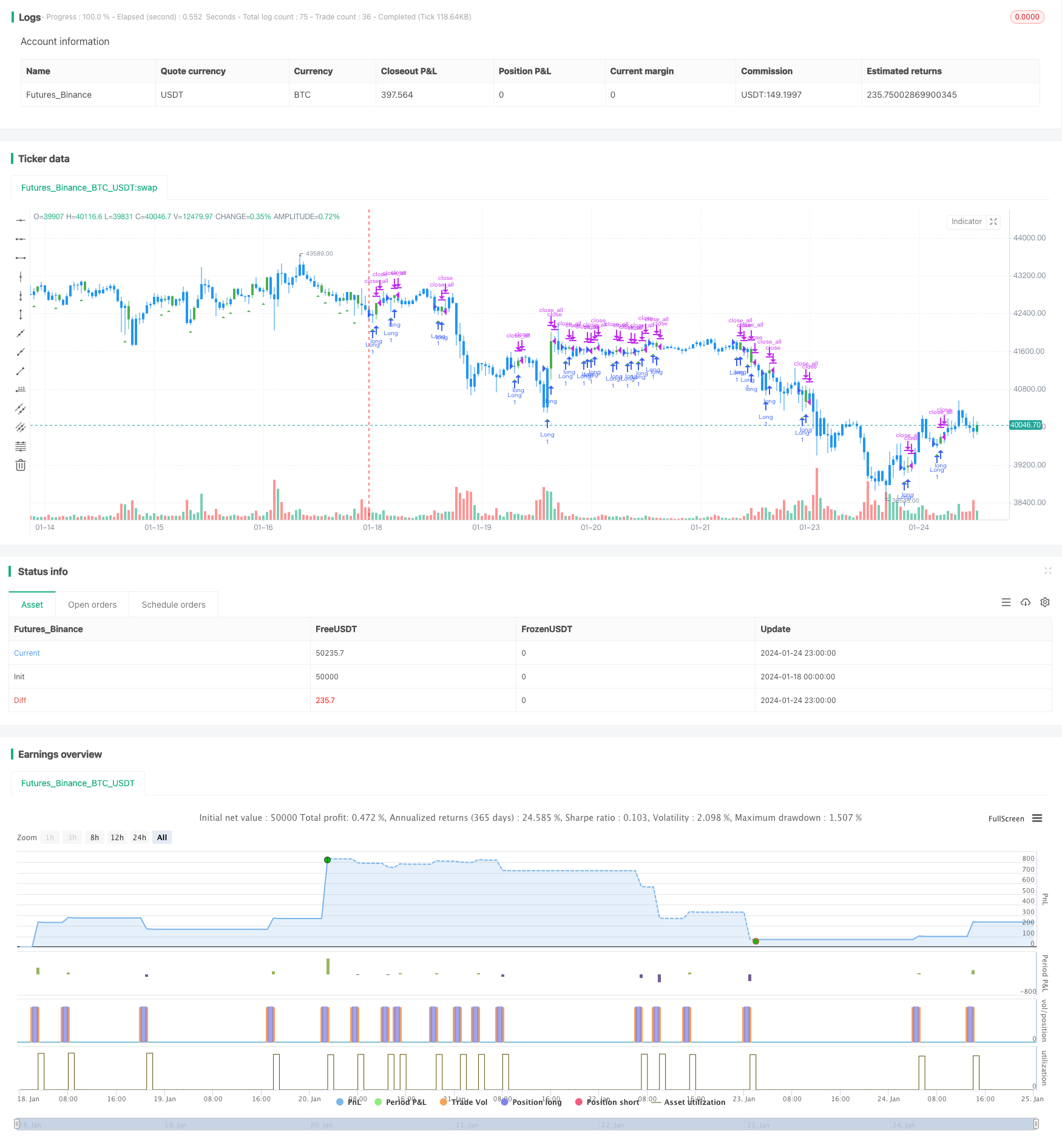

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/01/2020

//

// A key reversal is a one-day trading pattern that may signal the reversal of a trend.

// Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

// How Does a Key Reversal Work?

// Depending on which way the stock is trending, a key reversal day occurs when:

// In an uptrend -- prices hit a new high and then close near the previous day's lows.

// In a downtrend -- prices hit a new low, but close near the previous day's highs

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Key Reversal Up Backtest", shorttitle="KRU Backtest", overlay = true)

nLength = input(1, minval=1, title="Enter the number of bars over which to look for a new low in prices.")

input_takeprofit = input(20, title="Take Profit pip", step=0.01)

input_stoploss = input(10, title="Stop Loss pip", step=0.01)

xLL = lowest(low[1], nLength)

C1 = iff(low < xLL and close > close[1], true, false)

plotshape(C1, style=shape.triangleup, size = size.small, color=color.green, location = location.belowbar )

posprice = 0.0

pos = 0

barcolor(nz(pos[1], 0) == -1 ? color.red: nz(pos[1], 0) == 1 ? color.green : color.blue )

posprice := iff(C1== true, close, nz(posprice[1], 0))

pos := iff(posprice > 0, 1, 0)

if (pos == 0)

strategy.close_all()

if (pos == 1)

strategy.entry("Long", strategy.long)

posprice := iff(low <= posprice - input_stoploss and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

더 많은

- 크로스오버 EMA 단기 거래 전략

- 이중 EMA 크로스오버의 동적 스톱 로스 기반 전략에 따른 경향

- 황소 시장 파업 다르바스 상자 구매 전략

- 상대적 추진력 전략

- 양자 전략에 따른 파동 트렌드 및 VWMA 기반 트렌드

- 이중 이동 평균 및 윌리엄스 평균 조합 전략

- 이동 평균 크로스오버 전략

- 다중 지표량 거래 전략

- 시장 암호파 B 자동 거래 전략

- 반전 촛불 역 테스트 전략

- Ehlers-Smoothed 스토카스틱 RSI 전략

- Swing High Low Price 채널 전략 V.1

- 동력 역전 거래 전략

- 적응형 선형 회귀 채널 전략

- 이동 평균 차이 제로 크로스 전략

- 여러 지표가 전략을 따르고

- 전략에 따른 탄탄한 추세

- 전략에 따라 가격 이동 평균 트렌드를 넘기기