실시간 K-라인 추적에 기반한 그리드 거래 전략

저자:차오장, 날짜: 2024-02-01 14:40:22태그:

전반적인 설명

이 전략은 K 라인 변화의 실시간 추적을 기반으로 한 양방향 그리드 거래 전략입니다. 황소 시장과 곰 시장에서 안정적인 이익을 창출 할 수 있습니다.

전략 논리

-

사용자에 의해 설정된 네트워크 수에 따라 가격 범위와 각 네트워크 가격을 자동으로 계산합니다.

-

가격이 그리드 가격을 넘어서면, 고정된 양으로 긴 포지션을 열고, 가격이 그리드 가격 아래로 떨어지면 긴 포지션을 닫고 짧은 포지션을 열어야 합니다.

-

가격변화를 추적함으로써, 가격 변동이 그리드 범위 내에서 발생하면 수익을 얻을 수 있습니다.

이점 분석

-

수동으로 지원 및 저항을 결정할 필요 없이 합리적인 그리드 범위를 자동으로 계산합니다.

-

쌍방향 거래는 변화하는 시장 조건에 적응합니다.

-

고정된 오픈 포지션 크기는 리스크 통제를 용이하게 합니다.

-

간단하고 직설적인 코드입니다. 이해하기 쉽고 수정하기 쉽죠.

위험 분석

-

중요한 가격 변동은 손실의 확장에 이어질 수 있습니다.

-

축적된 거래 수수료는 최종 이익에도 영향을 미칩니다.

-

그리드의 숫자를 합리적으로 결정해야 합니다. 더 많은 그리드는 더 많은 트레이드를 의미하지만 각각의 이익은 제한적입니다.

최적화 방향

-

손실을 제한하기 위해 스톱 로스 전략을 적용해야 합니다.

-

그리드 수의 동적 조정 추가.

-

거래량을 증폭시키기 위해 레버리지를 추가하는 것을 고려하십시오.

요약

이 전략은 양방향 그리드 거래를 통해 안정적인 수익을 창출하는 전반적인 명확하고 간단한 논리를 가지고 있지만 특정 거래 위험을 감수합니다. 추가 최적화는 더 나은 결과로 이어질 수 있습니다.

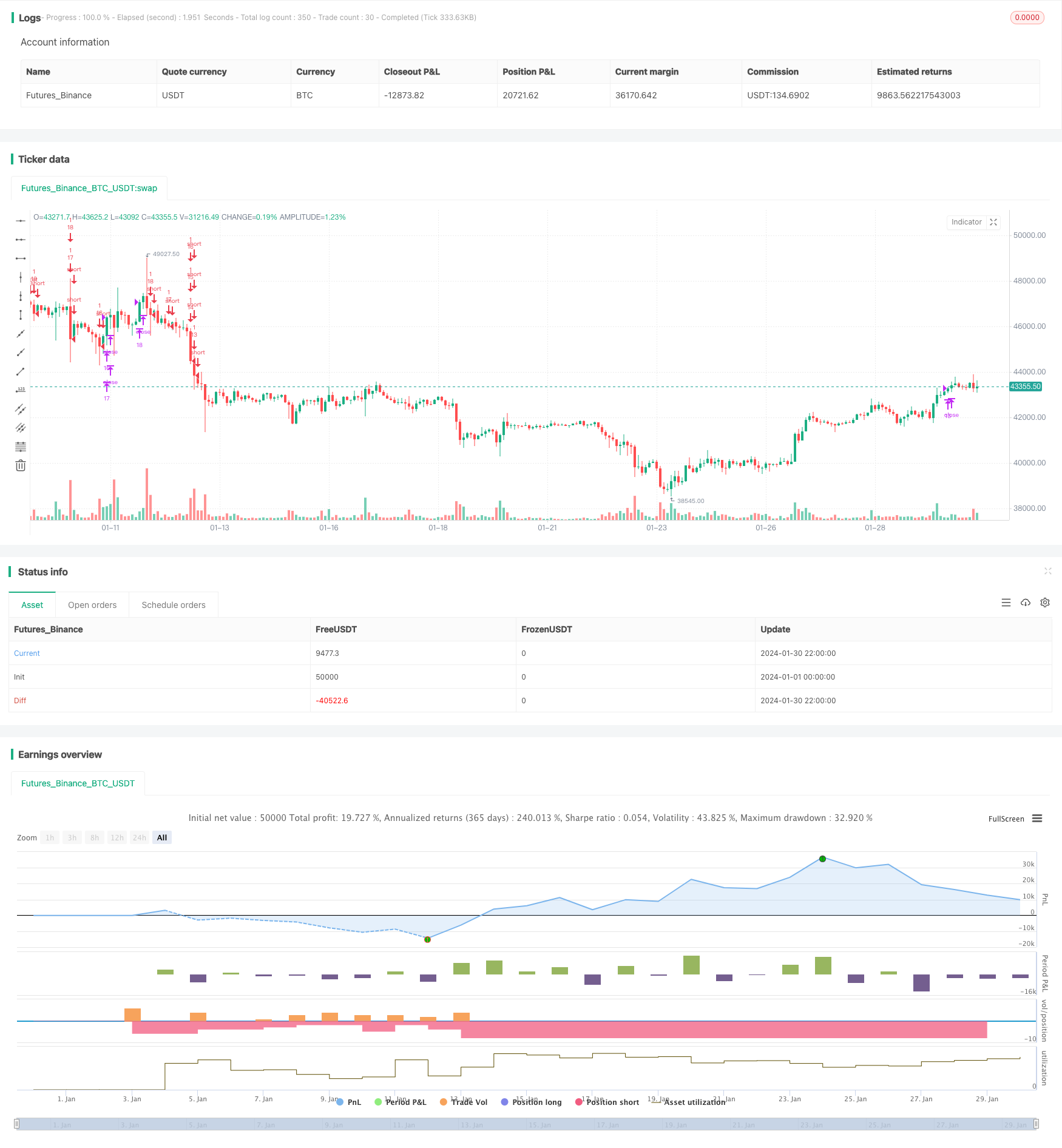

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//hk4jerry

strategy("Grid Bot Backtesting", overlay=false, pyramiding=3000, close_entries_rule="ANY", default_qty_type=strategy.cash, initial_capital=100.0, currency="USD", commission_type=strategy.commission.percent, commission_value=0.025)

i_autoBounds = input(group="Grid Bounds", title="Use Auto Bounds?", defval=true, type=input.bool) // calculate upper and lower bound of the grid automatically? This will theorhetically be less profitable, but will certainly require less attention

i_boundSrc = input(group="Grid Bounds", title="(Auto) Bound Source", defval="Hi & Low", options=["Hi & Low", "Average"]) // should bounds of the auto grid be calculated from recent High & Low, or from a Simple Moving Average

i_boundLookback = input(group="Grid Bounds", title="(Auto) Bound Lookback", defval=250, type=input.integer, maxval=500, minval=0) // when calculating auto grid bounds, how far back should we look for a High & Low, or what should the length be of our sma

i_boundDev = input(group="Grid Bounds", title="(Auto) Bound Deviation", defval=0.10, type=input.float, maxval=1, minval=-1) // if sourcing auto bounds from High & Low, this percentage will (positive) widen or (negative) narrow the bound limits. If sourcing from Average, this is the deviation (up and down) from the sma, and CANNOT be negative.

i_upperBound = input(group="Grid Bounds", title="(Manual) Upper Boundry(상단 가격)", defval=0.285, type=input.float) // for manual grid bounds only. The upperbound price of your grid

i_lowerBound = input(group="Grid Bounds", title="(Manual) Lower Boundry(하단 가격)", defval=0.225, type=input.float) // for manual grid bounds only. The lowerbound price of your grid.

i_gridQty = input(group="Grid Lines", title="Grid Line Quantity(그리드 수)", defval=30, maxval=999, minval=1, type=input.integer) // how many grid lines are in your grid

initial_balance = input(group="Trading option", title="Initial balance(투자금액)", defval=100, step=0.01)

start_time = input(group="Trading option",defval=timestamp('15 March 2023 06:00'), title='Start Time', type = input.time)

end_time = input(group="Trading option",defval=timestamp('31 Dec 2035 20:00'), title='End Time', type = input.time)

isAfterStartDate = true

tradingtime= (timenow - start_time)/(86400000*30)

yeartime=tradingtime/12

f_getGridBounds(_bs, _bl, _bd, _up) =>

if _bs == "Hi & Low"

_up ? highest(close, _bl) * (1 + _bd) : lowest(close, _bl) * (1 - _bd)

else

avg = sma(close, _bl)

_up ? avg * (1 + _bd) : avg * (1 - _bd)

f_buildGrid(_lb, _gw, _gq) =>

gridArr = array.new_float(0)

for i=0 to _gq-1

array.push(gridArr, _lb+(_gw*i))

gridArr

f_getNearGridLines(_gridArr, _price) =>

arr = array.new_int(3)

for i = 0 to array.size(_gridArr)-1

if array.get(_gridArr, i) > _price

array.set(arr, 0, i == array.size(_gridArr)-1 ? i : i+1)

array.set(arr, 1, i == 0 ? i : i-1)

break

arr

var upperBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true) : i_upperBound // upperbound of our grid

var lowerBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false) : i_lowerBound // lowerbound of our grid

var gridWidth = (upperBound - lowerBound)/(i_gridQty-1) // space between lines in our grid

var gridLineArr = f_buildGrid(lowerBound, gridWidth, i_gridQty) // an array of prices that correspond to our grid lines

var orderArr = array.new_bool(i_gridQty, false) // a boolean array that indicates if there is an open order corresponding to each grid line

var closeLineArr = f_getNearGridLines(gridLineArr, close) // for plotting purposes - an array of 2 indices that correspond to grid lines near price

var nearTopGridLine = array.get(closeLineArr, 0) // for plotting purposes - the index (in our grid line array) of the closest grid line above current price

var nearBotGridLine = array.get(closeLineArr, 1) // for plotting purposes - the index (in our grid line array) of the closest grid line below current price

if isAfterStartDate

for i = 0 to (array.size(gridLineArr) - 1)

if close < array.get(gridLineArr, i) and not array.get(orderArr, i) and i < (array.size(gridLineArr) - 1)

buyId = i

array.set(orderArr, buyId, true)

strategy.entry(id=tostring(buyId), long=true, qty=(initial_balance/(i_gridQty-1))/close, comment="#"+tostring(buyId))

if close > array.get(gridLineArr, i) and i != 0

if array.get(orderArr, i-1)

sellId = i-1

array.set(orderArr, sellId, false)

strategy.close(id=tostring(sellId), comment="#"+tostring(sellId))

if i_autoBounds

upperBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true)

lowerBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false)

gridWidth := (upperBound - lowerBound)/(i_gridQty-1)

gridLineArr := f_buildGrid(lowerBound, gridWidth, i_gridQty)

closeLineArr := f_getNearGridLines(gridLineArr, close)

nearTopGridLine := array.get(closeLineArr, 0)

nearBotGridLine := array.get(closeLineArr, 1)

var table table = table.new(position.top_right,6,8, frame_color = color.rgb(255, 255, 255),frame_width = 2,border_width = 2, border_color=color.rgb(255, 255, 255))

//제목

table.cell(table,0,0,"Upper limit price :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,1,"Lower limit price :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,2,"Grids quantity :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,3,"Investment :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,0,4,"USDT per grid :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,1,0, tostring(upperBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,1, tostring(lowerBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,2, tostring(i_gridQty, '###'), bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,3, tostring(initial_balance,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,4, tostring(initial_balance/i_gridQty,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

//제목

table.cell(table,2,0,"Current position :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,1,"Position cost price :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,2,"Unrealized profit :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,3,"Unrealized profit % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,4,"Fee :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,3,0, tostring(strategy.position_size) + syminfo.basecurrency + "\n" + tostring(strategy.position_size*strategy.position_avg_price/1, '###.##') + "USDT" ,text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,1, text=strategy.position_size>0 ? tostring(strategy.position_avg_price,'###.####')+ " USDT" : "NOT TRADING",text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,2, tostring(strategy.openprofit, '###.##')+ " USDT",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,3, tostring(strategy.openprofit/initial_balance*100, '###.##')+ "%",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,4, "-" + tostring(strategy.position_avg_price*strategy.position_size*0.025/100,'###.##')+ " USDT",text_color =color.white,bgcolor=color.new(#5a637e, 0))

//제목

table.cell(table,4,0,"Grid profit :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,1,"Grid profit % :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,2,"Net profit :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,3,"Net profit % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,4,"Balance USDT :",bgcolor=color.new(color.black,0),text_color =color.white)

//수치

table.cell(table,5,0, tostring(strategy.netprofit, '###.#####')+ "USDT", text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,1, tostring((strategy.netprofit)/initial_balance*100/tradingtime, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,2, tostring(strategy.netprofit+strategy.openprofit, '###.##') + " USDT",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,3, tostring((strategy.netprofit+strategy.openprofit)/initial_balance*100, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,4, tostring(initial_balance+strategy.netprofit+strategy.openprofit, '###.##')+ " USDT", text_color =color.white,bgcolor=color.new(#3d4d7c, 0))

// plot(strategy.initial_capital+ strategy.netprofit+strategy.openprofit, "Current Balance",color=color.rgb(81, 137, 128))

// plot(initial_balance, "Investment",color=color.rgb(81, 137, 128))

더 많은

- 이동 평균 및 스토카스틱 거래 전략

- 지표 조합에 기반한 전략을 따라 이중 이동 평균 트렌드의 최적화

- 효율적인 양상 거래 전략

- 이중 이동 평균 크로스오버와 윌리엄스 지표 조합 전략

- 동력 돌파구 은선 전략

- RWI 변동성 반대 전략

- 패러볼릭 SAR 트렌드 추적 스톱 로스 역전 전략

- 동력 지표 크로스오버 전략

- 효율적인 오스실레이션 돌파구 두 개의 스톱 이윤 및 스톱 손실 전략

- 이중 채널 탈출 전략

- 브레이크아웃 풀백 전략

- 다주기 적응 트렌드 예측 전략

- 렌코 ATR 트렌드 역전 전략

- 이치모쿠 클라우드 양자 전략

- 범위에 기반한 양방향 트렌드 추적 전략

- MACD 및 스토카스틱 지표에 기초한 암호화폐 거래 전략

- 스윙 듀얼 이동 평균 및 RSI 크로스오버 전략

- 골든 볼링거 밴드 간격 회전 시스템

- 양적 추세 추적 전략

- 이동 평균 및 스토카스틱 RSI 전략