Pencari Blok Perintah

Penulis:ChaoZhang, Tarikh: 2022-05-23 13:54:22Tag:MTF

Selepas mencari sejumlah besar penggunaan dari pengguna TV

Jika anda ingin menyumbang kepada bahagian analisis MTF, itu akan memberi manfaat kepada banyak skrip lain dan membuka kemungkinan untuk lebih banyak penunjuk gaya MTF Panel.

Sila lawati halaman skrip asal (pautan di bahagian atas) untuk mengkaji bagaimana penunjuk digunakan dalam perdagangan.

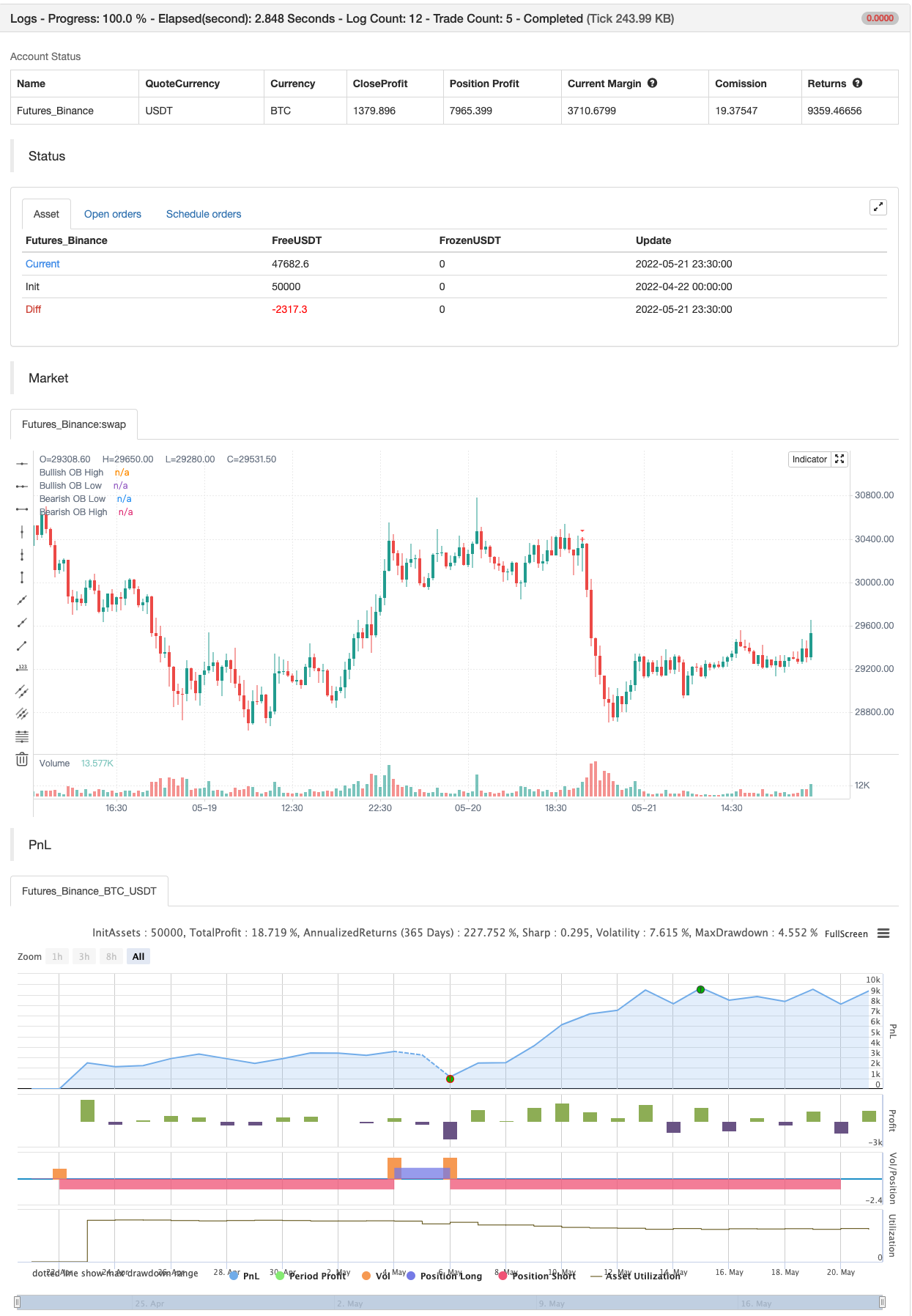

Ujian belakang

/*backtest

start: 2022-04-22 00:00:00

end: 2022-05-21 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

study("Order Block Finder", overlay = true)

tip1 = "Indicator to help identify instituational Order Blocks (OB). OBs often signal the beginning of a strong move. There is a high probability that OB price levels will be revisited in the future and are interesting levels to place limit orders. Bullish Order block is the last down candle before a sequence of up candles. Bearish Order Block is the last up candle before a sequence of down candles."

tip2 = "!Experimental!\nFind Order Blocks from different timeframes. Channels prices are accurate, but arrow position is not. Most useful when selecting a timeframe higher than the chart."

tip3 = "Required number of subsequent candles in the same direction to identify Order Block"

tip4 = "Measured from from potential OB close to close of first candle in sequence"

dummy = input(true,"Hover over ( ! ) for documentation", tooltip = tip1)

colors = input("LIGHT","Color Scheme", options=["DARK", "LIGHT"])

//res = input("","Order Block Timeframe",input.resolution,tooltip=tip2)

periods = input(7, "Relevant Periods to identify OB",tooltip=tip3) // Required number of subsequent candles in the same direction to identify Order Block

threshold = input(0.0, "Min. Percent move for valid OB", step = 0.1, tooltip=tip4) // Required minimum % move (from potential OB close to last subsequent candle to identify Order Block)

bull_channels = input(2, "Number of Bullish Channels to show") // Num of channels

bear_channels = input(2, "Number of Bearish Channels to show") // Num of channels

//Data Curation

res = ""

[copen,chigh,clow,cclose] = security(syminfo.tickerid,res,[open,high,low,close],barmerge.gaps_on, barmerge.lookahead_off)

ob_period = periods + 1 // Identify location of relevant Order Block candle

absmove = ((abs(cclose[ob_period] - cclose[1]))/cclose[ob_period]) * 100 // Calculate absolute percent move from potential OB to last candle of subsequent candles

relmove = absmove >= threshold // Identify "Relevant move" by comparing the absolute move to the threshold

// Color Scheme

bullcolor = colors == "DARK"? color.white : color.green

bearcolor = colors == "DARK"? color.blue : color.red

// Bullish Order Block Identification

bullishOB = cclose[ob_period] < copen[ob_period] // Determine potential Bullish OB candle (red candle)

int upcandles = 0

for i = 1 to periods

upcandles := upcandles + (cclose[i] > copen[i]? 1 : 0) // Determine color of subsequent candles (must all be green to identify a valid Bearish OB)

OB_bull = bullishOB and (upcandles == (periods)) and relmove // Identification logic (red OB candle & subsequent green candles)

OB_bull_chigh = OB_bull? chigh[ob_period] : na // Determine OB upper limit (Open or High depending on input)

OB_bull_clow = OB_bull? clow[ob_period] : na // Determine OB clower limit (Low)

OB_bull_avg = (OB_bull_chigh + OB_bull_clow)/2 // Determine OB middle line

// Bearish Order Block Identification

bearishOB = cclose[ob_period] > copen[ob_period] // Determine potential Bearish OB candle (green candle)

int downcandles = 0

for i = 1 to periods

downcandles := downcandles + (cclose[i] < copen[i]? 1 : 0) // Determine color of subsequent candles (must all be red to identify a valid Bearish OB)

OB_bear = bearishOB and (downcandles == (periods)) and relmove // Identification logic (green OB candle & subsequent green candles)

OB_bear_chigh = OB_bear? chigh[ob_period] : na // Determine OB upper limit (High)

OB_bear_clow = OB_bear? clow[ob_period] : na // Determine OB clower limit (Open or Low depending on input)

OB_bear_avg = (OB_bear_clow + OB_bear_chigh)/2 // Determine OB middle line

// Plotting

plotshape(OB_bull, title="Bullish OB", style = shape.triangleup, color = bullcolor, textcolor = bullcolor, size = size.tiny, location = location.belowbar, offset = -ob_period, text = "Bull") // Bullish OB Indicator

bull1 = plot(OB_bull_chigh, title="Bullish OB High", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 2) // Bullish OB Upper Limit

bull2 = plot(OB_bull_clow, title="Bullish OB Low", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 2) // Bullish OB Lower Limit

fill(bull1, bull2, color=bullcolor, transp = 50, title = "Bullish OB fill") // Fill Bullish OB

plotshape(OB_bull_avg, title="Bullish OB Average", style = shape.cross, color = bullcolor, size = size.small, location = location.absolute, offset = -ob_period) // Bullish OB Average

plotshape(OB_bear, title="Bearish OB", style = shape.triangledown, color = bearcolor, textcolor = bearcolor, size = size.tiny, location = location.abovebar, offset = -ob_period, text = "Bear") // Bearish OB Indicator

bear1 = plot(OB_bear_clow, title="Bearish OB Low", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 2) // Bearish OB Lower Limit

bear2 = plot(OB_bear_chigh, title="Bearish OB High", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 2) // Bearish OB Upper Limit

fill(bear1, bear2, color=bearcolor, transp = 50, title = "Bearish OB fill") // Fill Bearish OB

plotshape(OB_bear_avg, title="Bearish OB Average", style = shape.cross, color = bearcolor, size = size.small, location = location.absolute, offset = -ob_period) // Bullish OB Average

// Alerts for Order Blocks Detection

alertcondition(OB_bull, title='New Bullish OB detected', message='New Bullish OB detected - This is NOT a BUY signal!')

alertcondition(OB_bear, title='New Bearish OB detected', message='New Bearish OB detected - This is NOT a SELL signal!')

if OB_bull

strategy.entry("Enter Long", strategy.long)

else if OB_bear

strategy.entry("Enter Short", strategy.short)

Berkaitan

- Strategi Pivot Heatmap Kecairan Berbilang Jangka Masa

- Strategi Perdagangan Squeeze EMA-Stop-Loss Dinamis Berbilang Jangka Masa

- Trend Heikin Ashi Berbilang Jangka Masa yang Dihapuskan Mengikut Sistem Dagangan Kuantitatif

- Strategi Bollinger Momentum Breakout Multi-Timeframe dengan Purata Bergerak Hull

- Strategi Perdagangan Volatiliti Dinamik Berdasarkan Bollinger Bands dan Corak Candlestick

- Trend Pelbagai Jangka Masa Mengikut Strategi dengan Pengurusan Volatiliti ATR

- Sistem Dagangan Mengikut Trend Multi-Timeframe dengan Integrasi ATR dan MACD

- Strategi Dagangan Trend RSI dan Purata Bergerak Berbilang Jangka Masa

Lebih lanjut

- Amaran rentas rata-rata bergerak, pelbagai jangka masa (MTF)

- MACD Reloaded STRATEGY

- Purata Bergerak SuperTrended

- Perdagangan ABC

- 15MIN BTCUSDTPERP BOT

- Shannon Entropy V2

- SUPERTREND ATR Dengan Pengangkutan Hentikan Hilang

- Aliran Volume v3

- Crypto niaga hadapan scalping jam dengan ma & rsi - ogcheckers

- ATR dihaluskan

- TrendScalp-FractalBox-3EMA

- Isyarat QQE

- U-bit grid amplitude penyaringan

- CM MACD Indikator Sesuai - Kerangka Masa Berbilang - V2

- HODL LINE

- 2 Pengesanan Arah Rata-rata Bergerak Warna

- Scalping PullBack Tool R1

- Strategi Beli&Jual bergantung kepada AO+Stoch+RSI+ATR

- EMA TREND CLOUD

- Rasio Tenaga Arah RedK Volume-Pengcepat