Strategi Perdagangan Pembalikan Berdasarkan Sokongan/Pemberantasan Umum

Penulis:ChaoZhang, Tarikh: 2023-10-30 11:23:25Tag:

Ringkasan

Strategi ini mengamalkan perdagangan pembalikan berdasarkan faktor kenaikan / penurunan, dengan tahap mengambil keuntungan yang telah ditetapkan. Inti faktor adalah corak lanjutan

Logika Strategi

-

Mengenali faktor bullish/bearish berdasarkan

Support/Resistance Umum dengan jumlah -

Menggunakan corak candlestick untuk mengenal pasti tahap S / R klasik, disaring oleh jumlah yang signifikan

-

S / R umum mempunyai liputan yang lebih baik daripada corak klasik

-

Pecahkan isyarat sokongan umum faktor panjang, pecahkan isyarat rintangan umum faktor pendek

-

-

Perdagangan pembalikan

-

Ambil kedudukan terbalik apabila isyarat faktor mencetuskan

-

Jika sudah berada di kedudukan, mengurangkan atau menambah kedudukan belakang

-

-

Menetapkan paras sasaran keuntungan

-

Set stop loss berdasarkan ATR

-

Tetapkan pelbagai tahap keuntungan seperti 1R, 2R, 3R

-

Mengambil keuntungan separa apabila mencapai sasaran yang berbeza

-

Kelebihan

-

Menangkap pembalikan jangka menengah yang baik

Penembusan S/R mewakili isyarat pembalikan yang kuat dengan beberapa kebolehpercayaan, mampu menangkap pembalikan jangka menengah

-

Keuntungan cepat, pengeluaran kecil

Dengan menetapkan stop loss dan pelbagai sasaran keuntungan, boleh mencapai keuntungan cepat dan had drawdowns

-

Sesuai untuk saham dengan wang institusi yang signifikan dan turun naik

Strategi ini bergantung pada jumlah, memerlukan penyertaan institusi yang besar; juga memerlukan turun naik untuk membuat keuntungan

Risiko

-

Terjebak dalam pasaran yang terhad

Keluar stop loss yang kerap dan masuk semula ke arah yang bertentangan boleh menyebabkan whipsaws

-

Kegagalan sokongan / rintangan

S / R umum tidak benar-benar boleh dipercayai, beberapa kegagalan wujud

-

Risiko pegangan satu sisi

Logik pembalikan murni mungkin terlepas peluang tren besar

-

Pengurusan Risiko:

-

Kondisi faktor longgar, tidak berbalik pada setiap pecah

-

Tambah penapis lain, contohnya perbezaan harga/volume

-

Mengoptimumkan strategi stop loss untuk mengurangkan perangkap

-

Arahan Peningkatan

-

Mengoptimumkan parameter S/R

Cari faktor yang lebih boleh dipercayai dengan mengubah tetapan S / R umum

-

Mengoptimumkan keuntungan

Tambah lebih banyak tahap keuntungan, atau gunakan sasaran yang tidak tetap

-

Mengoptimumkan Stop Loss

Sesuaikan parameter ATR atau gunakan istics stop loss untuk mengurangkan berhenti yang tidak perlu

-

Menggabungkan trend dan faktor lain

Tambah penapis trend seperti purata bergerak untuk mengelakkan konflik trend besar; juga tambah faktor-faktor yang membantu lain

Ringkasan

Inti strategi adalah untuk menangkap perubahan jangka menengah yang baik melalui perdagangan pembalikan. Logiknya mudah dan langsung, dan boleh praktikal dengan penyesuaian parameter. Tetapi sifat agresif pembalikan membawa kepada beberapa penurunan dan risiko perangkap. Penambahbaikan lanjut dalam hentian kerugian, mengambil keuntungan dan penyelarasan trend akan membantu mengurangkan kerugian yang tidak perlu.

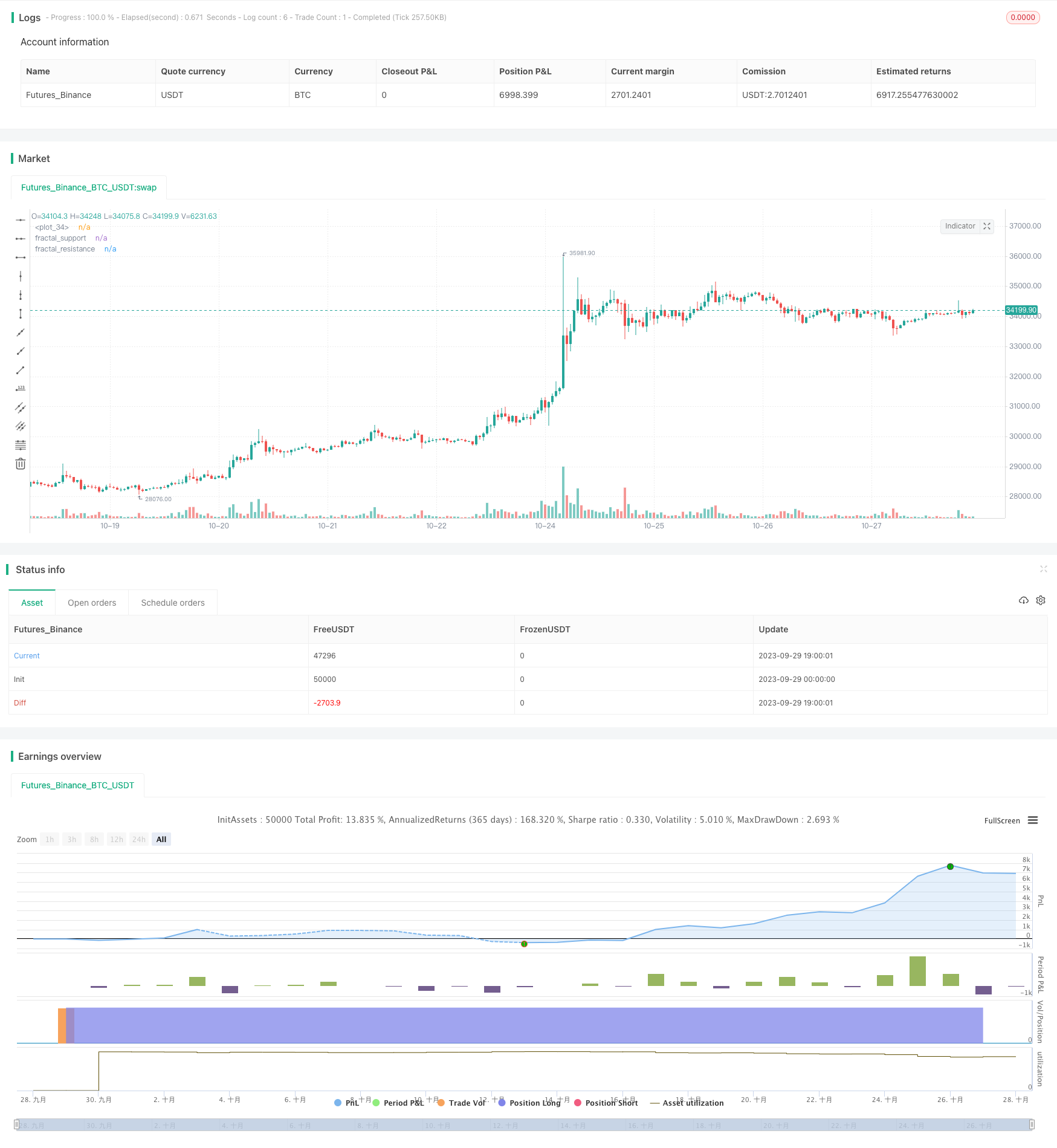

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//@version=5

strategy("Fractal Strat [KL] ", overlay=true, pyramiding=1, initial_capital=1000000000)

var string ENUM_LONG = "Long"

var string GROUP_ENTRY = "Entry"

var string GROUP_TSL = "Stop loss"

var string GROUP_TREND = "Trend prediction"

var string GROUP_ORDER = "Order size and Profit taking"

// backtest_timeframe_start = input.time(defval=timestamp("01 Apr 2000 13:30 +0000"), title="Backtest Start Time")

within_timeframe = true

// TSL: calculate the stop loss price. {

_multiple = input(2.0, title="ATR Multiplier for trailing stop loss", group=GROUP_TSL)

ATR_TSL = ta.atr(input(14, title="Length of ATR for trailing stop loss", group=GROUP_TSL, tooltip="Initial risk amount = atr(this length) x multiplier")) * _multiple

TSL_source = low

TSL_line_color = color.green

TSL_transp = 100

var stop_loss_price = float(0)

var float initial_entry_p = float(0)

var float risk_amt = float(0)

var float initial_order_size = float(0)

if strategy.position_size == 0 or not within_timeframe

TSL_line_color := color.black

stop_loss_price := TSL_source - ATR_TSL

else if strategy.position_size > 0

stop_loss_price := math.max(stop_loss_price, TSL_source - ATR_TSL)

TSL_transp := 0

plot(stop_loss_price, color=color.new(TSL_line_color, TSL_transp))

// } end of "TSL" block

// Order size and profit taking {

pcnt_alloc = input.int(5, title="Allocation (%) of portfolio into this security", tooltip="Size of positions is based on this % of undrawn capital. This is fixed throughout the backtest period.", minval=0, maxval=100, group=GROUP_ORDER) / 100

// Taking profits at user defined target levels relative to risked amount (i.e 1R, 2R, 3R)

var bool tp_mode = input(true, title="Take profit and different levels", group=GROUP_ORDER)

var float FIRST_LVL_PROFIT = input.float(1, title="First level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking first level profit at 1R means taking profits at $11", group=GROUP_ORDER)

var float SECOND_LVL_PROFIT = input.float(2, title="Second level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking second level profit at 2R means taking profits at $12", group=GROUP_ORDER)

var float THIRD_LVL_PROFIT = input.float(3, title="Third level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking third level profit at 3R means taking profits at $13", group=GROUP_ORDER)

// }

// Fractals {

// Modified from synapticEx's implementation: https://www.tradingview.com/script/cDCNneRP-Fractal-Support-Resistance-Fixed-Volume-2/

rel_vol_len = 6 // Relative volume is used; the middle candle has to have volume above the average (say sma over prior 6 bars)

rel_vol = ta.sma(volume, rel_vol_len)

_up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>rel_vol[3]

_down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>rel_vol[3]

fractal_resistance = high[3], fractal_support = low[3] // initialize

fractal_resistance := _up ? high[3] : fractal_resistance[1]

fractal_support := _down ? low[3] : fractal_support[1]

plot(fractal_resistance, "fractal_resistance", color=color.new(color.red,50), linewidth=2, style=plot.style_cross, offset =-3, join=false)

plot(fractal_support, "fractal_support", color=color.new(color.lime,50), linewidth=2, style=plot.style_cross, offset=-3, join=false)

// }

// ATR diversion test {

// Hypothesis testing (2-tailed):

//

// Null hypothesis (H0) and Alternative hypothesis (Ha):

// H0 : atr_fast equals atr_slow

// Ha : atr_fast not equals to atr_slow; implies atr_fast is either too low or too high

len_fast = input(5,title="Length of ATR (fast) for diversion test", group=GROUP_ENTRY)

atr_fast = ta.atr(len_fast)

atr_slow = ta.atr(input(50,title="Length of ATR (slow) for diversion test", group=GROUP_ENTRY, tooltip="This needs to be larger than Fast"))

// Calculate test statistic (test_stat)

std_error = ta.stdev(ta.tr, len_fast) / math.pow(len_fast, 0.5)

test_stat = (atr_fast - atr_slow) / std_error

// Compare test_stat against critical value defined by user in settings

//critical_value = input.float(1.645,title="Critical value", tooltip="Strategy uses 2-tailed test to compare atr_fast vs atr_slow. Null hypothesis (H0) is that both should equal. Based on the computed test statistic value, if absolute value of it is +/- this critical value, then H0 will be rejected.", group=GROUP_ENTRY)

conf_interval = input.string(title="Confidence Interval", defval="95%", options=["90%","95%","99%"], tooltip="Critical values of 1.645, 1.96, 2.58, for CI=90%/95%/99%, respectively; Under 2-tailed test to compare atr_fast vs atr_slow. Null hypothesis (H0) is that both should equal. Based on the computed test statistic value, if absolute value of it is +/- critical value, then H0 will be rejected.")

critical_value = conf_interval == "90%" ? 1.645 : conf_interval == "95%" ? 1.96 : 2.58

reject_H0_lefttail = test_stat < -critical_value

reject_H0_righttail = test_stat > critical_value

// } end of "ATR diversion test" block

// Entry Signals

entry_signal_long = close >= fractal_support and reject_H0_lefttail

// MAIN {

// Update the stop limit if strategy holds a position.

if strategy.position_size > 0

strategy.exit(ENUM_LONG, comment="SL", stop=stop_loss_price)

// Entry

if within_timeframe and entry_signal_long and strategy.position_size == 0

initial_entry_p := close

risk_amt := ATR_TSL

initial_order_size := math.floor(pcnt_alloc * strategy.equity / close)

strategy.entry(ENUM_LONG, strategy.long, qty=initial_order_size)

var int TP_taken_count = 0

if tp_mode and close > strategy.position_avg_price

if close >= initial_entry_p + THIRD_LVL_PROFIT * risk_amt and TP_taken_count == 2

strategy.close(ENUM_LONG, comment="TP Lvl3", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

else if close >= initial_entry_p + SECOND_LVL_PROFIT * risk_amt and TP_taken_count == 1

strategy.close(ENUM_LONG, comment="TP Lvl2", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

else if close >= initial_entry_p + FIRST_LVL_PROFIT * risk_amt and TP_taken_count == 0

strategy.close(ENUM_LONG, comment="TP Lvl1", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

// Alerts

_atr = ta.atr(14)

alert_helper(msg) =>

prefix = "[" + syminfo.root + "] "

suffix = "(P=" + str.tostring(close, "#.##") + "; atr=" + str.tostring(_atr, "#.##") + ")"

alert(str.tostring(prefix) + str.tostring(msg) + str.tostring(suffix), alert.freq_once_per_bar)

if strategy.position_size > 0 and ta.change(strategy.position_size)

if strategy.position_size > strategy.position_size[1]

alert_helper("BUY")

else if strategy.position_size < strategy.position_size[1]

alert_helper("SELL")

// Clean up - set the variables back to default values once no longer in use

if ta.change(strategy.position_size) and strategy.position_size == 0

TP_taken_count := 0

initial_entry_p := float(0)

risk_amt := float(0)

initial_order_size := float(0)

stop_loss_price := float(0)

// } end of MAIN block

- Strategy Crossover EMA Berganda

- Strategi Mengikuti Trend Berdasarkan Penembusan Purata Bergerak

- MACD Penutupan Strategy Hybrid Turtle

- Multi Timeframe mengambil keuntungan strategi

- Strategi Rebound Point Low

- Strategi Kombo Pembalikan Momentum

- Strategi Perdagangan Osilator Siklus Delta Perbezaan Volume

- MA Trendline Strategi Terobosan

- Trend Momentum Berikutan Strategi

- RSI Box Grid Strategi

- Strategi Scalping Crossover dengan Purata Bergerak Berganda

- Strategi Pembalikan Julat Tidur

- Strategi Pembalikan Momentum Multi Timeframe

- Strategi Perdagangan Bitcoin Harian Berbilang Penunjuk

- Strategi Bulls dan Bear yang Seimbang

- Gandalf Mean Reversation Strategi Dagangan Kuantitatif

- Strategi Dagangan Pembalikan Pemindahan Momentum

- Osilator Stokastik Intraday dengan Strategi Crossover Purata Bergerak Berganda

- Multi Timeframe Beli strategi penurunan

- Bollinger Breakout Stop-Loss Strategi