Strategi Perdagangan Musim Hibrid S&P500

Penulis:ChaoZhang, Tarikh: 2024-01-22 11:59:58Tag:

Ringkasan

Strategi Perdagangan Musim Hibrid S&P500 adalah strategi kuantitatif yang memperdagangkan saham berdasarkan corak bermusim. Ia menggabungkan sistem beli & tahan yang dipertingkatkan, keadaan penunjuk teknikal, dan penunjuk aliran jumlah untuk berputar antara bulan yang lebih baik dan paling buruk tahun ini.

Logika Strategi

Isyarat dan peraturan perdagangan utama adalah:

- Pergi panjang pada hari perdagangan pertama Oktober setiap tahun.

- Jika VIX melebihi 60% atau ATR 15 hari melebihi 90%, hentikan perdagangan bermusim sehingga turun naik berkurangan pada akhir bulan atau tahun.

- Keluar panjang/pendek di buka pada hari dagangan pertama bulan Ogos setiap tahun.

- Keluar panjang/pendek juga jika VIX melebihi 120% atau jika VFI melintasi di bawah -20 manakala MA 10 hari menunjuk ke bawah.

- Pilihan jualan pendek diaktifkan.

Strategi ini memanfaatkan prestasi pasaran saham yang tidak merata sepanjang tahun, pergi lama pada bulan Oktober-April yang secara statistik lebih baik dan mengambil keuntungan atau pendek pada bulan-bulan yang kurang baik pada bulan Mei-September. Risiko juga dikendalikan dengan menghentikan perdagangan apabila lonjakan turun naik, seperti yang diukur oleh penunjuk seperti VIX dan ATR.

Analisis Kelebihan

Strategi Dagangan Bermusim Hibrid S&P500 mempunyai kelebihan utama berikut:

- Leverage ditetapkan, corak bermusim yang stabil berdasarkan prestasi bulanan yang tidak rata yang diperhatikan secara empirikal dari indeks S&P500 sepanjang tahun.

- Menggabungkan pelbagai keadaan penapis seperti VIX, ATR dan VFI untuk menapis bunyi bising dengan berkesan dan menghasilkan isyarat perdagangan yang lebih boleh dipercayai.

- Peraturan dagangan yang boleh dikonfigurasikan untuk pergi panjang / pendek dan tempoh khusus untuk masuk dan keluar bermusim yang memudahkan ujian dan pengoptimuman.

- Mekanisme mengelakkan risiko tertanam melalui langkah-langkah turun naik seperti ambang VIX dan ATR untuk memintas kesan dari perubahan pasaran yang ganas.

- Masukan isyarat tambahan dari penunjuk aliran jumlah yang mencerminkan perubahan berpotensi dalam penyertaan pasaran.

Analisis Risiko

Beberapa risiko berpotensi termasuk:

- Risiko pembatalan corak sejarah. Pasaran berkembang secara stokastik jadi trend sejarah mungkin tidak selalu bertahan.

- Risiko isyarat yang salah dari penunjuk teknikal. VIX, ATR dan VFI juga boleh menghasilkan isyarat palsu.

- Risiko parameter suboptimal. Ujian parameter lanjut dan penyesuaian adalah mungkin kerana nilai semasa mungkin tidak optimum secara global.

- Risiko pendek tambahan seperti kerugian tanpa had.

Risiko boleh dikurangkan melalui kawalan risiko yang lebih ketat, gabungan penunjuk, penyesuaian parameter, pembelajaran mesin dll.

Peluang Peningkatan

Peluang pengoptimuman:

- Tempoh backtest yang lebih lama untuk lebih banyak data latihan.

- Memperkenalkan mekanisme stop loss untuk mengawal kerugian setiap perdagangan.

- Parameter yang halus seperti indikator VIX, ATR dan VFI untuk mencari kombinasi terbaik.

- Mengerahkan model pembelajaran mesin untuk membolehkan pengoptimuman adaptif.

- Menggabungkan strategi untuk mengurangkan risiko pasaran sistemik melalui bukan korelasi.

Kesimpulan

S&P500 Hybrid Seasonal Trading Strategy menghimpunkan trend bermusim yang mapan, penunjuk masa teknikal dan langkah aliran wang. Dengan mengelakkan bulan-bulan prestasi terburuk tahun ini dan kedudukan dalam bulan-bulan yang lebih kuat secara bermusim ditambah dengan gerbang turun naik yang berkesan, kerangka kerja dapat menghasilkan alpha yang konsisten. Struktur yang dapat disesuaikan juga menyediakan komponen modular yang berguna untuk para pengamal untuk menguji, mengoptimumkan dan membina. Data tambahan, hentian kerugian, penyesuaian parameter dan ensemble memberikan peluang lebih lanjut untuk meningkatkan prestasi.

/*backtest

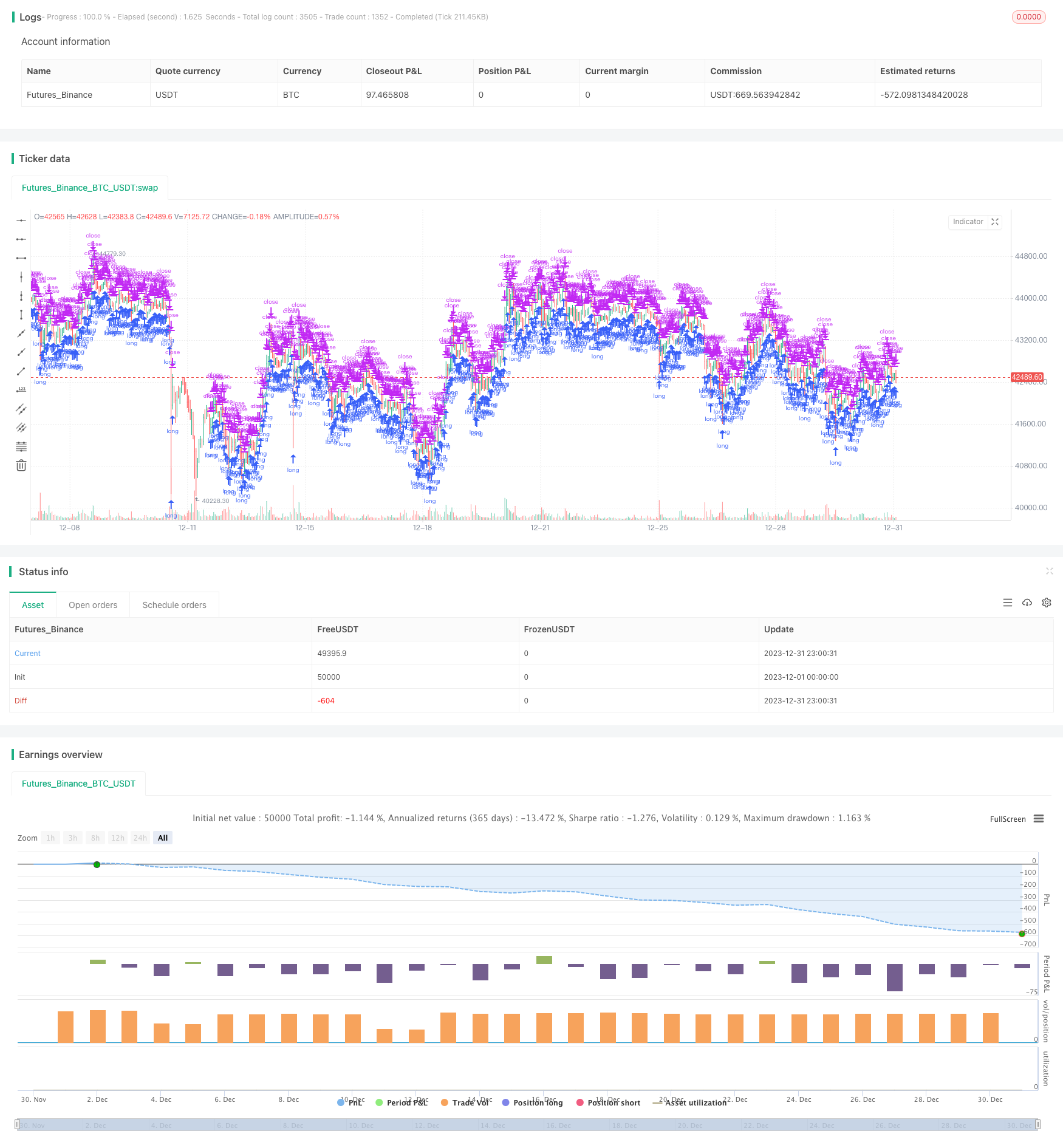

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// TASC Issue: April 2022 - Vol. 40, Issue 4

// Article: Sell In May? Stock Market Seasonality

// Article By: Markos Katsanos

// Language: TradingView's Pine Script v5

// Provided By: PineCoders, for tradingview.com

//@version=5

strategy(title = "TASC 2022.04 S&P500 Hybrid Seasonal System",

shorttitle = "HSS v2.0",

overlay = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 100000,

currency = currency.USD,

commission_type = strategy.commission.percent,

commission_value = 0.01

)

// Helper Functions:

// @function Returns the ratio to max/min of a sample period

// @param src float, data source.

// @param length int, period of the sample.

// @returns [float, float] tuple.

volatility (float src, int length) =>

[(src / ta.highest(src, length)[1] - 1.0) * 100.0,

(src / ta.lowest (src, length)[1] - 1.0) * 100.0]

// @function Volume Flow Indicator.

// @param Period int, period of the data sample.

// @param VCoef float, Volume Volatility Coefficient.

// @param Coef float, Cutoff Coefficient.

// @returns float.

// ref: https://mkatsanos.com/volume-flow-vfi-indicator/

vfi (int Period = 130, float VCoef = 2.5, float Coef = 0.2) =>

lastHLC3 = nz(hlc3[1], hlc3)

MF = hlc3 - lastHLC3

Vinter = ta.stdev(math.log(hlc3) - math.log(lastHLC3), 30)

Vave = ta.sma(volume, Period)[1]

Cutoff = Coef * close * Vinter

VC = math.min(volume, Vave * VCoef)

VCP = MF > Cutoff ? VC :

MF < -Cutoff ? -VC : 0.0

VFI1 = nz(math.sum(VCP, Period) / Vave)

VFI = ta.ema(VFI1, 3)

// inputs:

// optional strategy obserservation window parameters:

string ig_ow = 'Observation Window:'

bool i_Sdate = input( title = 'Start date:',

defval = timestamp('2021-01-01'),

inline = 'Sdate',

group = ig_ow

) < time //

bool i_useSdate = input.bool( title = '',

defval = false,

group = ig_ow,

inline = 'Sdate',

tooltip = 'Optional start date to clamp strategy observation window.'

) //

bool i_Edate = input( title = 'End date:',

defval = timestamp('2022-01-01'),

inline = 'Edate',

group = ig_ow

) > time //

bool i_useEdate = input.bool( title = '',

defval = false,

group = ig_ow,

inline = 'Edate',

tooltip = 'Optional end date to clamp strategy observation window.'

) //

//

string ig_ro = 'Lookback Options:'

int i_lback = input.int( title = 'Lookback Shift:',

defval = 0, minval = 0,

group = ig_ro,

tooltip = 'Optional, inspect previous signal values.'

) //

//

string ig_so = 'Signal Options:'

bool i_onlyL = input.bool( title = 'Long Only:',

defval = true,

group = ig_so,

tooltip = 'If switched off, short entries are initiated by sell signals.'

) //

int i_sMonth = input.int( title = 'Sell Month:',

defval = 8, minval = 1, maxval = 12, step = 1,

group = ig_so,

tooltip = 'The worst performing month, originally clamped between months 5 and 8.'

) //

int i_maxVI = input.int( title = 'Max VIX up:',

defval = 60, minval = 50, maxval = 60, step = 5,

group = ig_so,

tooltip = 'Volatility maximum threshold.'

) //

int i_critVFI = input.int( title = 'Critical VFI Sell:',

defval = -20, minval = -20, maxval = -15, step = 5,

group = ig_so,

tooltip = 'Critical money float (VFI) threshold for sell signal.'

) //

float i_K = input.float( title = 'ATR/VIX Ratio:',

defval = 1.5, minval = 1.3, maxval = 1.7, step = 0.2,

group = ig_so,

tooltip = 'ATR to VIX ratio for sell signal.'

) //

//

string i_VIticker = input( title = 'Volatility Index:',

defval = 'VIX',

group = ig_so,

tooltip = 'Volatility Index Ticker.'

) //

string i_VItf = input.timeframe( title = '',

defval = 'D',

group = ig_so,

tooltip = 'Volatility Index Timeframe.'

) //

int i_VIiperiod = input.int( title = 'Implied Volatility period:',

defval = 25,

group = ig_so

) //

int i_VIhperiod = input.int( title = 'Historical Volatility period:',

defval = 15,

group = ig_so

) //

//

int i_VFIperiod = input.int( title = 'VFI period:',

defval = 130,

group = ig_so, inline = 'VFI1'

) //

int i_VFIMperiod = input.int( title = 'MA:',

defval = 10,

group = ig_so, inline = 'VFI1',

tooltip = 'VFI and Moving Average sampling period.'

) //

float i_VFIcoef = input.float( title = 'VFI Coef Cuttoff:',

defval = 0.2,

group = ig_so, inline = 'VFI2'

) //

float i_VFIvcoef = input.float( title = 'Volat.:',

defval = 2.5,

group = ig_so, inline = 'VFI2',

tooltip = 'VFI Cutoff and Volatility coefficient.'

) //

int i_ATRperiod = input.int( title = 'ATR length:',

defval = 15,

group = ig_so, inline = 'ATR',

tooltip = 'ATR length.'

) //

//

string ig_to = 'Table Options:'

bool i_showT = input.bool( title = 'Show Table:',

defval = false,

group = ig_to,

tooltip = 'Optional toggle.'

) //

string i_Tpos = input.string(title = 'Position:',

defval = position.middle_right,

options = [ position.top_left, position.top_center, position.top_right,

position.middle_left, position.middle_center, position.middle_right,

position.bottom_left, position.bottom_center, position.bottom_right ],

group = ig_to) //

int i_Ttransp = input.int( title = 'Transparency:',

defval = 0, minval = 1, maxval = 99,

group = ig_to

) //

//

color i_Tcframe = input.color( title = 'Table Colors:',

defval = #000000,

group = ig_to, inline = 'table color'

) //

color i_Tcrowe = input.color( title = '',

defval = #d6dae3,

group = ig_to, inline = 'table color'

) //

color i_Tcrowo = input.color( title = '',

defval = #cccccc,

group = ig_to, inline = 'table color',

tooltip = 'Table background colors, in order: frame, even row, odd row.'

) //

string i_Ttsize = input.string(title = 'Table Text:',

defval = size.small,

options = [size.auto, size.huge, size.large, size.normal, size.small, size.tiny],

group = ig_to, inline = 'table text'

) //

color i_Tcdeft = input.color( title = 'Text Colors:',

defval = #000000,

group = ig_to, inline = 'table text'

) //

color i_Tcsigt = input.color( title = '',

defval = color.red,

group = ig_to, inline = 'table text'

) //

color i_Tctitt = input.color( title = '',

defval = color.navy,

group = ig_to, inline = 'table text',

tooltip = 'Table text size and colors, in order: default, short signal, title.'

) //

// Comparison Index

float VIX = request.security(i_VIticker, i_VItf, close)

[VIdn, VIup] = volatility(VIX, i_VIiperiod) // Implied

[ATRdn, ATRup] = volatility(ta.atr(i_VIhperiod), i_VIiperiod) // Historical

float VFI = vfi(i_VFIperiod, i_VFIvcoef, i_VFIcoef)

float VFI10 = ta.sma(VFI, i_VFIMperiod)

//

bool VFIatCrit = VFI > i_critVFI

bool lowVolat = (VIup < i_maxVI) or (ATRup < (i_K * i_maxVI))

bool VolatC = VFIatCrit ? lowVolat : false

bool Long = ((month >= 10) or (month < i_sMonth)) and VolatC[1]

bool Sseasonal = month == i_sMonth // SEASONAL EXIT/SHORT

bool Svol = VIup > (2.0 * i_maxVI) // VOLATILITY EXIT/SHORT

bool Scrit = ta.cross(i_critVFI, VFI) and (VFI10 < VFI10[1]) // VFI EXIT/SHORT

bool Short = Sseasonal or Svol[1] or Scrit[1]

bool withinObsWindow = true

//

if withinObsWindow and strategy.equity > 0

_L = strategy.long

_S = strategy.short

strategy.entry('L' , direction = _L, when = Long )

if i_onlyL

strategy.close('L', comment = 'EXIT SEASONAL' , when = Sseasonal )

strategy.close('L', comment = 'EXIT VOLATILITY', when = Svol[1] )

strategy.close('L', comment = 'EXIT MF' , when = Scrit[1] )

else

strategy.entry('S Seasonal' , direction = _S, when = Sseasonal )

strategy.entry('S Volatility', direction = _S, when = Svol[1] )

strategy.entry('S MF Crit.' , direction = _S, when = Scrit[1] )

else

strategy.close_all()

string SIGNAL = switch

(Long) => 'Long Seasonal'

(Sseasonal and i_onlyL) => 'Exit Seasonal'

(Svol[1] and i_onlyL) => 'Exit Volatility'

(Scrit[1] and i_onlyL) => 'Exit Money Flow'

(Sseasonal and not i_onlyL) => 'Short Seasonal'

(Svol[1] and not i_onlyL) => 'Short Volatility'

(Scrit[1] and not i_onlyL) => 'Short Money Flow Bearish'

=> 'none'

string date = str.format(

'{0,number,0000}-{1,number,00}-{2,number,00}',

year, month, dayofmonth

)

var table dTable = table.new(position = i_Tpos,

columns = 2,

rows = 17,

frame_color = color.new(#000000, i_Ttransp),

frame_width = 4

) //

// @function Helper to populate the table rows.

tRow(tableId, idx, left, right, tcol=0) =>

color _bg = color.new(idx % 2 ? i_Tcrowo : i_Tcrowe, i_Ttransp)

color _tx = switch (tcol)

(1) => color.new(i_Tcsigt, i_Ttransp)

(2) => color.new(i_Tctitt, i_Ttransp)

=> color.new(i_Tcdeft, i_Ttransp)

// table.cell( table_id=tableId,

// column=0, row=idx,

// text=left, text_color=_tx, text_halign=text.align_right, text_size=i_Ttsize,

// bgcolor=_bg) //

// table.cell( table_id=tableId,

// column=1, row=idx,

// text=str.tostring(right), text_color=_tx, text_halign=text.align_left, text_size=i_Ttsize,

// bgcolor=_bg) //

if i_showT

float _atr10 = ta.atr(10)[i_lback]

string _nf = '0.00'

string _aru = '🔼 ', string _ard = '🔽 '

// id | idx | left label | right label | conditional color |

tRow(dTable, 00, 'S&P500 Hybrid Seasonal ' , '' , 2 )

tRow(dTable, 01, 'Created By: Markos Katsanos' , '' , 2 )

tRow(dTable, 02, 'Date:' , date[i_lback] )

tRow(dTable, 03, 'Signal:' , SIGNAL[i_lback] )

tRow(dTable, 04, 'Price:' , open[i_lback] )

tRow(dTable, 05, 'VIX:' , str.tostring( VIX[i_lback], _nf) )

tRow(dTable, 06, 'VFI:' , str.tostring( VFI[i_lback], _nf) , VFIatCrit ? 1 : 0 )

tRow(dTable, 07, 'ATR:' , str.tostring( _atr10, _nf) )

tRow(dTable, 08, 'VIup%:' , str.tostring( VIup[i_lback], _nf) , VIup > i_maxVI ? 1 : 0 )

tRow(dTable, 09, 'ATRup%:' , str.tostring(ATRup[i_lback], _nf) , ATRup > i_K * i_maxVI ? 1 : 0 )

tRow(dTable, 10, 'VIdn%:' , str.tostring( VIdn[i_lback], _nf) )

tRow(dTable, 11, 'ATRdn%:' , str.tostring(ATRdn[i_lback], _nf) )

tRow(dTable, 12, _aru + 'Long Seasonal:' , Long[i_lback] )

tmp = 12

if not i_onlyL

tmp := 13

tRow(dTable, 13, _ard + 'Short:' , Short[i_lback] , Short[i_lback] ? 1 : 0 )

tRow(dTable, tmp+1, _ard + 'Seasonal:' , Sseasonal[i_lback] , Sseasonal[i_lback] ? 1 : 0 )

tRow(dTable, tmp+2, _ard + 'Volatility:' , Svol[1+i_lback] , Svol[1 + i_lback] ? 1 : 0 )

tRow(dTable, tmp+3, _ard + 'Money Flow:' , Scrit[i_lback] , Scrit[i_lback] ? 1 : 0 )

- Pengesanan Trend dan Strategi Dagangan Jangka Pendek Berdasarkan Indikator ADX

- Strategi dua arah

- Strategi sokongan dan rintangan CCI yang dinamik

- Strategi Perdagangan Momentum QQE

- Strategi Ramalan Gelombang Gauss

- Strategi kuant kombinasi EMA bergerak dinamik

- Tren Saluran Donchian Mengikuti Strategi

- Strategi Ribbon EMA

- Strategi crossover purata bergerak pembalikan trend yang tepat

- Strategi Trend Bullish Multi-EMA

- Strategi Pengesanan Trend Berasaskan Penyimpangan

- Strategi Perdagangan Divergensi RSI

- Strategi pokok keputusan pelbagai penunjuk: IMACD, EMA dan Ichimoku

- Strategi Dagangan Pengoptimuman Ganda MACD

- Strategy GOLDEN CROSS EMA Berganda

- RSI pelbagai jangka masa dan strategi perdagangan purata bergerak

- Strategi Perdagangan Swing Mingguan

- Strategi Dagangan MACD berasaskan EVWMA

- Bollinger Bands Channel Breakout Mean Reverssion Strategy

- Strategi Pengesanan Trend Kuantitatif Berdasarkan Pelbagai Penunjuk Teknikal