Indeks Aliran Wang Strategi 5 Minit Melalui Masa dan Ruang

Penulis:ChaoZhang, Tarikh: 2024-01-23 14:46:55Tag:

Ringkasan

Ini adalah strategi kuantitatif mudah yang menggunakan Indeks Aliran Wang untuk mengenal pasti

Prinsip Strategi

Strategi ini menggunakan Indeks Aliran Wang 3 tempoh dengan tahap overbought ditetapkan pada 100 dan tahap oversold ditetapkan pada 0. Strategi ini menunggu Indeks Aliran Wang untuk mencapai tahap overbought, menunjukkan kehadiran

Pendaftaran panjang diambil apabila Indeks Aliran Wang = 100 dan lilin seterusnya adalah lilin bullish dengan lilin pendek. Stop loss ditetapkan di bawah paras terendah hari dagangan dan keuntungan diambil dalam masa 60 minit selepas kemasukan.

Logik di atas boleh digunakan dengan cara cermin untuk mengambil entri pendek juga.

Kelebihan Strategi

-

Menggunakan Indeks Aliran Wang dapat dengan berkesan mengenal pasti tingkah laku pengumpulan oleh

hai besar di pasaran, saham dengan potensi kesinambungan. -

Penapis candlestick membantu mengesahkan pecah yang lebih kuat, mengelakkan banyak pecah palsu.

-

Penapis SMA mengelakkan membeli trend menurun, secara berkesan mengurangkan risiko.

-

Penarikan berdasarkan masa 60 minit dengan cepat mengunci keuntungan, mengurangkan pengeluaran.

Risiko Strategi

-

Indeks Aliran Wang boleh menghasilkan isyarat palsu, membawa kepada kerugian yang tidak perlu. Parameter boleh diselaraskan atau penapis tambahan ditambah.

-

Penarikan 60 minit mungkin terlalu agresif untuk saham turun naik tinggi. Masa mengambil keuntungan atau pergerakan stop loss boleh dioptimumkan.

-

Peristiwa makro utama yang boleh memberi kesan kepada pasaran tidak dipertimbangkan.

Peluang Peningkatan

-

Uji kombinasi parameter yang berbeza seperti panjang MFI, tempoh SMA dll.

-

Tambah penunjuk lain seperti Bollinger Bands, RSI untuk meningkatkan ketepatan isyarat.

-

Peningkatan ujian berhenti untuk membolehkan sasaran keuntungan yang lebih besar.

-

Membangunkan versi untuk jangka masa lain seperti 15 atau 30 minit berdasarkan prinsip yang sama.

Kesimpulan

Strategi ini adalah mudah dan mudah difahami, sejajar dengan pendekatan klasik mengesan

Jangka masa 60 minit membolehkan keuntungan cepat tetapi juga memperkenalkan risiko yang lebih tinggi. Secara keseluruhan templat strategi yang mendalam untuk penerokaan dan pengoptimuman, menyediakan rancangan untuk pembangunan sistematik.

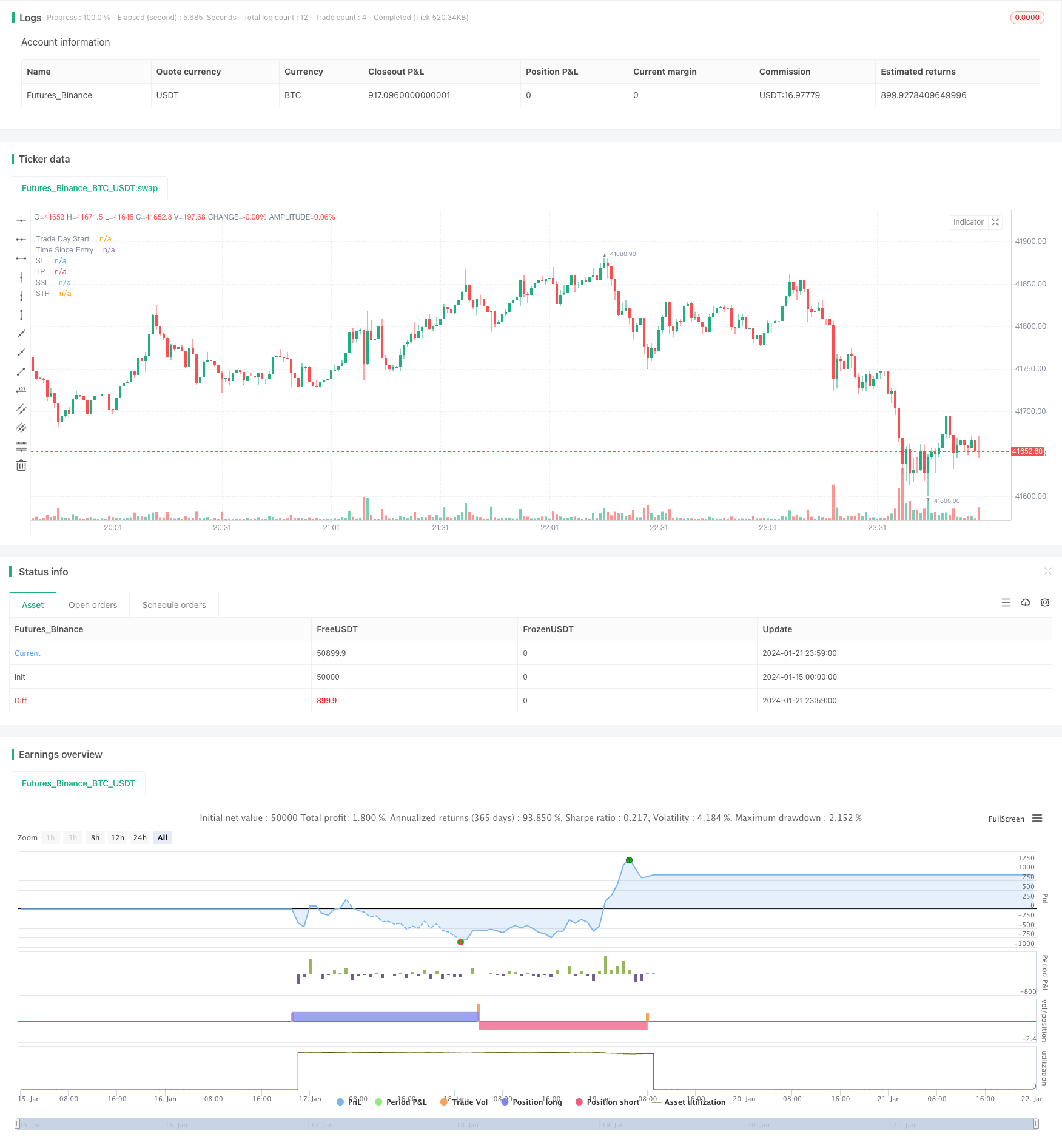

/*backtest

start: 2024-01-15 00:00:00

end: 2024-01-22 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// From "Crypto Day Trading Strategy" PDF file.

// * I'm using a SMA filter to avoid buying when the price is declining. Time frame was better at 15 min according to my test.

// 1 - Apply the 3 period Money Flow Index indicator to the 5 minute chart, using 0 and 100 as our oversold and overbought boundaries

// 2 - Wait for the MFI to reach overbought levels, that indicates the presence of "big sharks" in the market. Price needs to hold up

// the first two MFI overbought occurrences of the day to be considered as a bullish entry signal.*

// 3 - We buy when the MFI = 100 and the next candle is a bullish candle with short wicks.

// 4 - We place our Stop Loss below the low of the trading day and we Take Profit during the first 60 minutes after taking the trade.

// The logic above can be used in a mirrored fashion to take short entries, this is a custom parameter that can be modified from

// the strategy Inputs panel.

// © tweakerID

//@version=4

strategy("Money Flow Index 5 min Strategy",

overlay=true )

direction = input(0, title = "Strategy Direction", type=input.integer, minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

/////////////////////// STRATEGY INPUTS ////////////////////////////////////////

title1=input(true, "-----------------Strategy Inputs-------------------")

i_MFI = input(3, title="MFI Length")

OB=input(100, title="Overbought Level")

OS=input(0, title="Oversold Level")

barsizeThreshold=input(.5, step=.05, minval=.1, maxval=1, title="Bar Body Size, 1=No Wicks")

i_MAFilter = input(true, title="Use MA Trend Filter")

i_MALen = input(80, title="MA Length")

i_timedexit=input(false, title="Use 60 minutes exit rule")

short=input(true, title="Use Mirrored logic for Shorts")

/////////////////////// BACKTESTER /////////////////////////////////////////////

title2=input(true, "-----------------General Inputs-------------------")

// Backtester General Inputs

i_SL=input(true, title="Use Stop Loss and Take Profit")

i_SLType=input(defval="Strategy Stop", title="Type Of Stop", options=["Strategy Stop", "Swing Lo/Hi", "ATR Stop"])

i_SPL=input(defval=10, title="Swing Point Lookback")

i_PercIncrement=input(defval=3, step=.1, title="Swing Point SL Perc Increment")*0.01

i_ATR = input(14, title="ATR Length")

i_ATRMult = input(5, step=.1, title="ATR Multiple")

i_TPRRR = input(2.2, step=.1, title="Take Profit Risk Reward Ratio")

TS=input(false, title="Trailing Stop")

// Bought and Sold Boolean Signal

bought = strategy.position_size > strategy.position_size[1]

or strategy.position_size < strategy.position_size[1]

// Price Action Stop and Take Profit

LL=(lowest(i_SPL))*(1-i_PercIncrement)

HH=(highest(i_SPL))*(1+i_PercIncrement)

LL_price = valuewhen(bought, LL, 0)

HH_price = valuewhen(bought, HH, 0)

entry_LL_price = strategy.position_size > 0 ? LL_price : na

entry_HH_price = strategy.position_size < 0 ? HH_price : na

tp=strategy.position_avg_price + (strategy.position_avg_price - entry_LL_price)*i_TPRRR

stp=strategy.position_avg_price - (entry_HH_price - strategy.position_avg_price)*i_TPRRR

// ATR Stop

ATR=atr(i_ATR)*i_ATRMult

ATRLong = ohlc4 - ATR

ATRShort = ohlc4 + ATR

ATRLongStop = valuewhen(bought, ATRLong, 0)

ATRShortStop = valuewhen(bought, ATRShort, 0)

LongSL_ATR_price = strategy.position_size > 0 ? ATRLongStop : na

ShortSL_ATR_price = strategy.position_size < 0 ? ATRShortStop : na

ATRtp=strategy.position_avg_price + (strategy.position_avg_price - LongSL_ATR_price)*i_TPRRR

ATRstp=strategy.position_avg_price - (ShortSL_ATR_price - strategy.position_avg_price)*i_TPRRR

// Strategy Stop

DayStart = time == timestamp("UTC", year, month, dayofmonth, 0, 0, 0)

plot(DayStart ? 1e9 : na, style=plot.style_columns, color=color.silver, transp=80, title="Trade Day Start")

float LongStop = valuewhen(DayStart,low,0)*(1-i_PercIncrement)

float ShortStop = valuewhen(DayStart,high,0)*(1+i_PercIncrement)

float StratTP = strategy.position_avg_price + (strategy.position_avg_price - LongStop)*i_TPRRR

float StratSTP = strategy.position_avg_price - (ShortStop - strategy.position_avg_price)*i_TPRRR

/////////////////////// STRATEGY LOGIC /////////////////////////////////////////

MFI=mfi(close,i_MFI)

barsize=high-low

barbodysize=close>open?(open-close)*-1:(open-close)

shortwicksbar=barbodysize>barsize*barsizeThreshold

SMA=sma(close, i_MALen)

MAFilter=close > SMA

timesinceentry=(time - valuewhen(bought, time, 0)) / 60000

timedexit=timesinceentry == 60

BUY = MFI[1] == OB and close > open and shortwicksbar and (i_MAFilter ? MAFilter : true)

bool SELL = na

if short

SELL := MFI[1] == OS and close < open and shortwicksbar and (i_MAFilter ? not MAFilter : true)

//Debugging Plots

plot(timesinceentry, transp=100, title="Time Since Entry")

//Trading Inputs

DPR=input(true, "Allow Direct Position Reverse")

reverse=input(false, "Reverse Trades")

// Entries

if reverse

if not DPR

strategy.entry("long", strategy.long, when=SELL and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=BUY and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=SELL)

strategy.entry("short", strategy.short, when=BUY)

else

if not DPR

strategy.entry("long", strategy.long, when=BUY and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=SELL and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=BUY)

strategy.entry("short", strategy.short, when=SELL)

if i_timedexit

strategy.close_all(when=timedexit)

SL= i_SLType == "Swing Lo/Hi" ? entry_LL_price : i_SLType == "ATR Stop" ? LongSL_ATR_price : LongStop

SSL= i_SLType == "Swing Lo/Hi" ? entry_HH_price : i_SLType == "ATR Stop" ? ShortSL_ATR_price : ShortStop

TP= i_SLType == "Swing Lo/Hi" ? tp : i_SLType == "ATR Stop" ? ATRtp : StratTP

STP= i_SLType == "Swing Lo/Hi" ? stp : i_SLType == "ATR Stop" ? ATRstp : StratSTP

//TrailingStop

dif=(valuewhen(strategy.position_size>0 and strategy.position_size[1]<=0, high,0))

-strategy.position_avg_price

trailOffset = strategy.position_avg_price - SL

var tstop = float(na)

if strategy.position_size > 0

tstop := high- trailOffset - dif

if tstop<tstop[1]

tstop:=tstop[1]

else

tstop := na

StrailOffset = SSL - strategy.position_avg_price

var Ststop = float(na)

Sdif=strategy.position_avg_price-(valuewhen(strategy.position_size<0

and strategy.position_size[1]>=0, low,0))

if strategy.position_size < 0

Ststop := low+ StrailOffset + Sdif

if Ststop>Ststop[1]

Ststop:=Ststop[1]

else

Ststop := na

strategy.exit("TP & SL", "long", limit=TP, stop=TS? tstop : SL, when=i_SL)

strategy.exit("TP & SL", "short", limit=STP, stop=TS? Ststop : SSL, when=i_SL)

/////////////////////// PLOTS //////////////////////////////////////////////////

plot(i_SL and strategy.position_size > 0 and not TS ? SL : i_SL and strategy.position_size > 0 and TS ? tstop : na , title='SL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size < 0 and not TS ? SSL : i_SL and strategy.position_size < 0 and TS ? Ststop : na , title='SSL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size > 0 ? TP : na, title='TP', style=plot.style_cross, color=color.green)

plot(i_SL and strategy.position_size < 0 ? STP : na, title='STP', style=plot.style_cross, color=color.green)

// Draw price action setup arrows

plotshape(BUY ? 1 : na, style=shape.triangleup, location=location.belowbar,

color=color.green, title="Bullish Setup", size=size.auto)

plotshape(SELL ? 1 : na, style=shape.triangledown, location=location.abovebar,

color=color.red, title="Bearish Setup", size=size.auto)

- Strategi Dagangan Pembalikan Trend Berbilang Penunjuk

- Strategi Bitcoin dan Emas Gabungan Berganda

- MACD dan RSI Crossover Strategi

- Strategi Pullback Momentum

- Strategi Crossover Purata Bergerak

- Strategi Grid Keuntungan Dengan Osilasi

- Strategi Penembusan Osilasi Berdasarkan Purata Bergerak

- Strategi Dagangan Jangka Pendek Pengiktirafan corak ZigZag

- Strategi Volatiliti dan Pengesanan Trend Melalui Kerangka Masa Berdasarkan Williams VIX dan DEMA

- Strategi Pelanggaran Momentum Berdasarkan Penghakiman Kitaran dengan Purata Bergerak

- Strategi Dagangan Trend Silang EMA Berganda

- Strategi Dagangan Pengoptimuman MACD Dinamis

- Strategi Gabungan VWAP dan RSI

- God's Bollinger Bands RSI Strategi Dagangan

- Strategi Dagangan Jangka Pendek Berasaskan Saluran EMA dan MACD

- Strategi Perpindahan Indeks Momentum dan Takut

- Strategi Dagangan Panjang/Pendek Secara Automatik Berdasarkan Titik Pivot Harian

- Strategi Perdagangan Kepelbagaian Purata Bergerak

- Strategi Perpindahan Momentum Berdasarkan Purata Bergerak Eksponensial

- Adaptive Moving Average dan Strategi Dagangan Crossover Moving Average