Double Inside Bar & Trend Strategi

Penulis:ChaoZhang, Tarikh: 2024-01-30 15:11:48Tag:

Double Inside Bar & Trend Strategi

Ringkasan

Strategi Double Inside Bar & Trend adalah strategi perdagangan kuantitatif yang menggunakan corak bar dalaman berganda yang digabungkan dengan purata bergerak untuk menentukan trend.

Logika Strategi

- Gunakan Hull Moving Average (HMA) sebagai penunjuk untuk penilaian trend.

- Apabila corak bar dalam berganda berlaku, ia dianggap sebagai isyarat perdagangan kebarangkalian tinggi.

- Jika harga penutupan berada di atas MA dan bar dalam bentuk bullish, letakkan pesanan berhenti beli di sekitar paras tertinggi bar dalam.

- Setelah perintah berhenti diaktifkan, tetapkan stop loss dan ambil keuntungan berdasarkan peratusan stop loss yang telah ditentukan dan mengambil nisbah keuntungan.

Analisis Kelebihan

- Bar dalaman memberikan isyarat pembalikan kebarangkalian tinggi. Kejadian bar dalaman berganda mungkin menunjukkan pembalikan harga jangka pendek.

- Digunakan dengan purata bergerak untuk mengikuti arah trend utama, ia meningkatkan kebarangkalian keuntungan.

- Menggunakan perintah berhenti di sekitar titik terobosan dalam trend menikmati peluang kemasukan yang baik.

Analisis Risiko

- Dalam pasaran yang berbeza, isyarat dagangan dari dalam bar sering boleh membawa kepada kerugian.

- Purata bergerak sebagai penunjuk trend juga boleh memberikan isyarat palsu, mengakibatkan kerugian daripada perdagangan kontra-trend.

- Jika stop loss ditetapkan terlalu ketat, ia mungkin dicetuskan oleh slip harga yang kecil.

Arahan pengoptimuman

- Uji parameter purata bergerak yang berbeza sebagai penunjuk penilaian trend.

- Gabungkan penunjuk lain untuk menapis pasaran yang berbeza, mengelakkan perdagangan buta tanpa trend yang jelas.

- Mendapatkan kombinasi parameter yang lebih optimum melalui analisis data besar, seperti tempoh purata bergerak, pengganda stop loss, nisbah mengambil keuntungan dll.

- Tambah penapis pada sesi dagangan dan produk untuk menyesuaikan diri dengan jangka masa dan ciri produk yang berbeza.

Ringkasan

Strategi Double Inside Bar & Trend menggunakan isyarat perdagangan kebarangkalian tinggi dari bar dalaman berganda, dibantu oleh purata bergerak untuk menentukan arah trend utama untuk pergi panjang atau pendek, menjadikannya strategi breakout yang agak stabil. Melalui pengoptimuman parameter dan pengoptimuman logik, kemampuan beradaptasi dan keuntungan strategi ini dapat ditingkatkan.

/*backtest

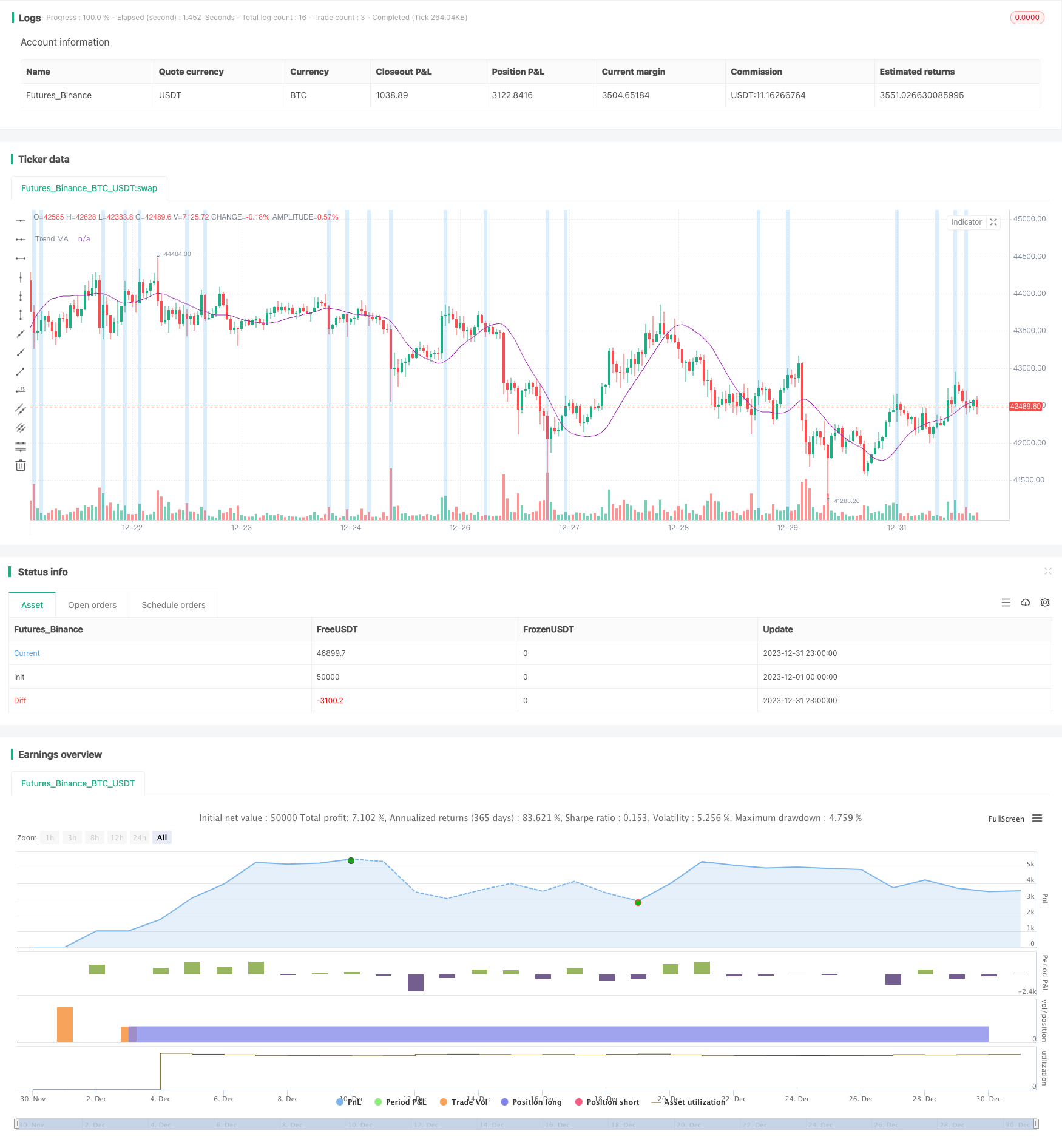

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Kaspricci

//@version=5

strategy(

title = "Double Inside Bar & Trend Strategy - Kaspricci",

shorttitle = "Double Inside Bar & Trend",

overlay=true,

initial_capital = 100000,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

calc_on_every_tick = true,

close_entries_rule = "ANY")

// ================================================ Entry Inputs ======================================================================

headlineEntry = "Entry Seettings"

maSource = input.source(defval = close, group = headlineEntry, title = "MA Source")

maType = input.string(defval = "HMA", group = headlineEntry, title = "MA Type", options = ["EMA", "HMA", "SMA", "SWMA", "VWMA", "WMA"])

maLength = input.int( defval = 45, minval = 1, group = headlineEntry, title = "HMA Length")

float ma = switch maType

"EMA" => ta.ema(maSource, maLength)

"HMA" => ta.hma(maSource, maLength)

"SMA" => ta.sma(maSource, maLength)

"SWMA" => ta.swma(maSource)

"VWMA" => ta.vwma(maSource, maLength)

"WMA" => ta.wma(maSource, maLength)

plot(ma, "Trend MA", color.purple)

// ================================================ Trade Inputs ======================================================================

headlineTrade = "Trade Seettings"

stopLossType = input.string(defval = "ATR", group = headlineTrade, title = "Stop Loss Type", options = ["ATR", "FIX"])

atrLength = input.int( defval = 50, minval = 1, group = headlineTrade, inline = "ATR", title = " ATR: Length ")

atrFactor = input.float( defval = 2.5, minval = 0, step = 0.05, group = headlineTrade, inline = "ATR", title = "Factor ", tooltip = "multiplier for ATR value")

takeProfitRatio = input.float( defval = 2.0, minval = 0, step = 0.05, group = headlineTrade, title = " TP Ration", tooltip = "Multiplier for Take Profit calculation")

fixStopLoss = input.float( defval = 10.0, minval = 0, step = 0.5, group = headlineTrade, inline = "FIX", title = " FIX: Stop Loss ") * 10 // need this in ticks

fixTakeProfit = input.float( defval = 20.0, minval = 0, step = 0.5, group = headlineTrade, inline = "FIX", title = "Take Profit", tooltip = "in pips") * 10 // need this in ticks

useRiskMagmt = input.bool( defval = true, group = headlineTrade, inline = "RM", title = "")

riskPercent = input.float( defval = 1.0, minval = 0., step = 0.5, group = headlineTrade, inline = "RM", title = "Risk in % ", tooltip = "This will overwrite quantity from startegy settings and calculate the trade size based on stop loss and risk percent") / 100

// ================================================ Filter Inputs =====================================================================

headlineFilter = "Filter Setings"

// date filter

filterDates = input.bool(defval = false, group = headlineFilter, title = "Filter trades by dates")

startDateTime = input(defval = timestamp("2022-01-01T00:00:00+0000"), group = headlineFilter, title = " Start Date & Time")

endDateTime = input(defval = timestamp("2099-12-31T23:59:00+0000"), group = headlineFilter, title = " End Date & Time ")

dateFilter = not filterDates or (time >= startDateTime and time <= endDateTime)

// session filter

filterSession = input.bool(title = "Filter trades by session", defval = false, group = headlineFilter)

session = input(title = " Session", defval = "0045-2245", group = headlineFilter)

sessionFilter = not filterSession or time(timeframe.period, session, timezone = "CET")

// ================================================ Trade Entries and Exits =====================================================================

// calculate stop loss

stopLoss = switch stopLossType

"ATR" => nz(math.round(ta.atr(atrLength) * atrFactor / syminfo.mintick, 0), 0)

"FIX" => fixStopLoss

// calculate take profit

takeProfit = switch stopLossType

"ATR" => math.round(stopLoss * takeProfitRatio, 0)

"FIX" => fixTakeProfit

doubleInsideBar = high[2] > high[1] and high[2] > high[0] and low[2] < low[1] and low[2] < low[0]

// highlight mother candel and inside bar candles

bgcolor(doubleInsideBar ? color.rgb(33, 149, 243, 80) : na)

bgcolor(doubleInsideBar ? color.rgb(33, 149, 243, 80) : na, offset = -1)

bgcolor(doubleInsideBar ? color.rgb(33, 149, 243, 80) : na, offset = -2)

var float buyStopPrice = na

var float sellStopPrice = na

if (strategy.opentrades == 0 and doubleInsideBar and barstate.isconfirmed)

buyStopPrice := high[0] // high of recent candle (second inside bar)

sellStopPrice := low[0] // low of recent candle (second inside bar)

tradeID = str.tostring(strategy.closedtrades + strategy.opentrades + 1)

quantity = useRiskMagmt ? math.round(strategy.equity * riskPercent / stopLoss, 2) / syminfo.mintick : na

commentTemplate = "{0} QTY: {1,number,#.##} SL: {2} TP: {3}"

if (close > ma)

longComment = str.format(commentTemplate, tradeID + "L", quantity, stopLoss / 10, takeProfit / 10)

strategy.entry(tradeID + "L", strategy.long, qty = quantity, stop = buyStopPrice, comment = longComment)

strategy.exit(tradeID + "SL", tradeID + "L", profit = takeProfit, loss = stopLoss, comment_loss = "SL", comment_profit = "TP")

if (close < ma)

shortComment = str.format(commentTemplate, tradeID + "S", quantity, stopLoss / 10, takeProfit / 10)

strategy.entry(tradeID + "S", strategy.short, qty = quantity, stop = sellStopPrice, comment = shortComment)

strategy.exit(tradeID + "SL", tradeID + "S", profit = takeProfit, loss = stopLoss, comment_loss = "SL", comment_profit = "TP")

// as soon as the first pending order has been entered the remaing pending order shall be cancelled

if strategy.opentrades > 0

currentTradeID = str.tostring(strategy.closedtrades + strategy.opentrades)

strategy.cancel(currentTradeID + "S")

strategy.cancel(currentTradeID + "L")

Lebih lanjut

- Strategi Penembusan Fractal Berganda

- Noro Bertukar Strategi Stop Loss Moving Average

- Strategi Dagangan RSI Rata-rata Bergerak Eksponensial Berganda

- Strategi silang purata bergerak mudah

- Strategi Scalping Berdasarkan Kecairan dan Trend Pasaran

- Strategy 5EMA untuk Peralihan Penembusan Jangka Pendek Salib

- Strategi Perdagangan Saham Berasaskan Penunjuk RSI

- Semua tentang Strategi Perdagangan Saluran EMA

- Strategi Perdagangan RSI Double Decker

- Bollinger Bands dan Strategi Gabungan RSI

- Strategi Penembusan Harga Luar Biasa

- Strategi Pelancongan Trend yang Kuat

- Strategi Crossover Purata Bergerak Pengesanan Trend

- Model Pembalikan Penembusan Berdasarkan Strategi Perdagangan Penyu

- Strategi Trend Momentum

- Peanut 123 Peralihan dan Julat Penembusan Strategi Dagangan Jangka Pendek

- Strategi Perdagangan Saham Berasaskan RSI yang Dihapuskan

- Strategi Band Volatiliti yang lancar

- Strategi Perdagangan Pembalikan Indeks Saluran Komoditi

- Strategi berasaskan masa dengan ATR mengambil keuntungan