Trend RSI Mengikuti Strategi Henti Kerugian

Gambaran keseluruhan

Ini adalah strategi perdagangan kuantitatif yang menggunakan RSI untuk menentukan trend dan menetapkan stop loss. Strategi ini menggabungkan RSI untuk menentukan arah trend pasaran, dan menetapkan stop loss dinamik untuk mengunci keuntungan, meminimumkan risiko.

Prinsip Strategi

Strategi ini digunakan untuk membuat keputusan untuk melakukan lebih banyak shorting dengan menilai arah trend pasaran melalui indikator RSI. Apabila penunjuk RSI menembusi garis rendah, penunjuk RSI memutuskan bahawa pasaran berada dalam trend naik, melakukan lebih banyak shorting; Apabila penunjuk RSI menembusi garis tinggi, penunjuk RSI memutuskan bahawa pasaran berada dalam trend menurun, melakukan shorting.

Pada masa yang sama, strategi menetapkan hentian kerugian terapung dengan mengesan harga pembukaan setiap satu. Untuk membuat banyak pesanan, menetapkan peratusan harga pembukaan sebagai garis hentian, dan untuk membuat pesanan kosong, menetapkan peratusan harga pembukaan sebagai garis hentian. Apabila harga menyentuh garis hentian hentian, strategi akan secara automatik menghentikan atau menghentikan.

Kelebihan Strategik

- Menggunakan RSI untuk menentukan arah trend pasaran dan mengelakkan perdagangan dalam tempoh penutupan;

- Tetapkan hentian kerugian terapung untuk mengunci keuntungan secara fleksibel dan mengawal risiko dengan berkesan;

- Parameter RSI dan nisbah stop loss boleh disesuaikan dan dioptimumkan melalui input luaran.

Risiko Strategik

- Indeks RSI terlewat dan mungkin terlepas titik peralihan trend jangka pendek;

- Terlalu dekat dengan barisan penghadang kemusnahan boleh menyebabkan penembusan.

Arah pengoptimuman

- Ia boleh menguji kesesuaian RSI untuk tempoh yang berbeza.

- Kombinasi parameter yang berbeza boleh diuji untuk mencari nisbah stop loss yang optimum;

- Tanda penapis boleh ditambah dengan penunjuk tambahan.

ringkaskan

Strategi ini secara keseluruhan adalah strategi perdagangan kuantitatif yang menggunakan indikator RSI untuk menjejaki trend dan dilengkapi dengan stop loss yang mengambang. Strategi ini melakukan lebih baik dalam mengawal risiko dan dapat mengunci keuntungan dengan lebih berkesan daripada strategi perdagangan indikator tunggal.

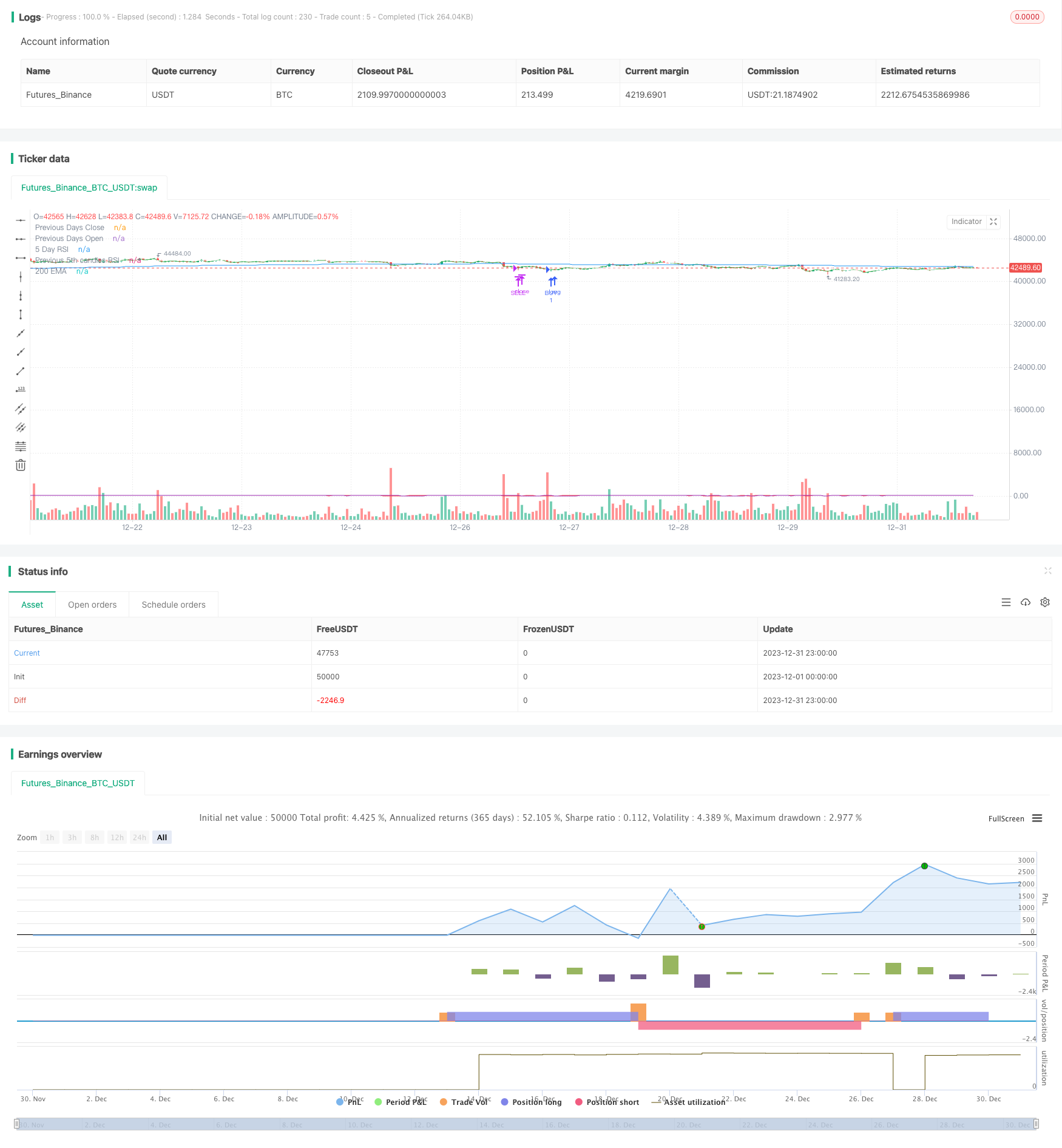

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©chewyScripts.

//@version=5

strategy("96er RSI+200EMA Strategy + Alerts", overlay=true, shorttitle = "The old 96er - RSI5 + 200 EMA")

//,use_bar_magnifier=false

// This works best on a small account $100, with 50% of equity and up to 10 max open trades.

// 96% Profitable, turns $100 into $350 in 1 month. very few losses. super happy with it.

// So far it triples the account on a 1m chart in 1 month back testing on the SEI-USD pair.

// I did not test on FX pairs or other instruments.

// had some issues with the inputs not working so had to hard code some, also the lastClose var sometimes breaks and starts following every candle, not sure why.

in_r1 = input.int(8,"5 day input or RSI1", group = "Signals")

in_lowerRSI = input.int(28,"RSI Lower", group = "Signals")

in_upperRSI = input.int(72,"RSI Upper ", group = "Signals")

in_emaperiod = input.int(200,"EMA Period", group = "Signals")

in_daysback = input.int(1,"Look back days for close/open", group = "Signals")

in_openOrders = input.int(5,"max open orders",tooltip = "Be careful, to high and you will get margin called!! 5 is probably the highest you should go", group = "Order Controls")

in_buybreakout = input.int(40,"Buy breakout range", group = "Order Controls")

in_buyTP = input.float(1.1500,"Buy TP: 1+TP %, .05 seems to work well.", group = "TPSL")

in_sellTP = input.float(0.9750, "Sell TP: 1-TP%. .025 seems to work well. ", group = "TPSL")

in_useAlerts = input.bool(false,"Turns on Buy/Sell Alerts",group = "Alerts")

in_useCustomAlertMSG = input.bool(false,"Use default Buy/Sell or the messages below",group = "Alerts")

in_alertBuySignalTxt = input("Buy","Buy signal API/TXT message template", tooltip = "Review the UserGuid on JSON varibles in alerts", group = "Alerts")

in_alertSellSignalTxt = input("Sell","Sell signal API/TXT message template", tooltip = "Review the UserGuid on JSON varibles in alerts", group = "Alerts")

simple int rsi5 = in_r1

// 3 rsi strategy , when all of them are overbought we sell, and vice versa

rsi7 = ta.rsi(close,rsi5)

[lastOpen, lastClose] = request.security(syminfo.tickerid, "D", [open,close], lookahead = barmerge.lookahead_on)

rsi3 = ta.rsi(close[5],rsi5)

ma = ta.ema(close,in_emaperiod)

plot(rsi7,"5 Day RSI",color.red)

plot(lastClose,"Previous Days Close",color.green)

plot(lastOpen,"Previous Days Open",color.white)

plot(rsi3,"Previous 5th candles RSI",color.purple)

plot(ma,"200 EMA",color.blue)

//sell = ta.crossunder(rsi7,70) and ta.crossunder(rsi14,70) and ta.crossunder(rsi21,70)

//buy = ta.crossover(rsi7,in_lowerRSI) and close < ma and rsi3 <= in_upperRSI and strategy.opentrades < in_openOrders

//sell = ta.crossunder(rsi7,in_upperRSI) and close > ma and rsi3 >= in_lowerRSI3 and strategy.opentrades < in_openOrders

//buy condition

buy = ta.crossover(rsi7,in_lowerRSI) and close < ma and close < lastClose and strategy.opentrades < in_openOrders

// sell condition

sell = ta.crossunder(rsi7,in_upperRSI) and close > ma and close > lastClose and strategy.opentrades < in_openOrders

var lastBuy = close

var lastSell = close

//var buyLabel = label.new(na,na,yloc = yloc.belowbar, style = label.style_none, textcolor = color.green, size = size.normal)

//var sellLabel = label.new(na,na,yloc = yloc.abovebar, style = label.style_none, textcolor = color.red, size = size.normal)

if (buy)

strategy.entry("BUY", strategy.long,alert_message = "Buy @"+str.tostring(close))

lastBuy := close

//buyLabel := label.new(na,na,yloc = yloc.belowbar, style = label.style_none, textcolor = color.green, size = size.normal)

//label.set_x(buyLabel,bar_index)

//label.set_y(buyLabel,low)

//label.set_text(buyLabel,"Buy!!@ " +str.tostring(lastBuy) + "\n TP: " + str.tostring(lastBuy*in_buyTP) + "\n↑")

if(not in_useAlerts)

alert("Buy")

//label.delete(buyLabel)

if ((close >= lastBuy*in_buyTP ) or (rsi7 > in_buybreakout) and close >= lastClose and (close >= lastClose*in_buyTP or close >= lastBuy*in_buyTP ) )

//label.new(bar_index,na,"TP!!@ " +str.tostring(close), yloc = yloc.abovebar, style = label.style_none, textcolor = color.green, size = size.normal)

strategy.close("BUY", "BUY Exit",alert_message = "Buy Exit: TP @" +str.tostring(close) + " OR TP: " + str.tostring(lastBuy*in_buyTP))

if(not in_useAlerts)

alert("Buy Exit")

if (sell)

strategy.entry("SELL", strategy.short, alert_message = "Sell @ " + str.tostring(close))

lastSell := close

//sellLabel := label.new(na,na,yloc = yloc.abovebar, style = label.style_none, textcolor = color.red, size = size.normal)

//label.set_x(sellLabel,bar_index)

//label.set_y(sellLabel,high)

//label.set_text(sellLabel,"Sell!!@ " +str.tostring(lastSell) + "\n TP: " + str.tostring(lastSell*in_sellTP) + "\n🠇")

if(not in_useAlerts)

alert("Sell")

//label.delete(sellLabel)

if ( close < ma and (close <= lastSell*in_sellTP ) or (close < lastClose*in_sellTP) )

//label.new(bar_index,na,"TP!!@ " +str.tostring(close), yloc = yloc.belowbar, style = label.style_none, textcolor = color.red, size = size.normal)

strategy.close("SELL", "Sell Exit", alert_message = "Sell Exit TP @" +str.tostring(close) + " OR TP: " + str.tostring(lastSell*in_sellTP))

if(not in_useAlerts)

alert("Sell Exit")

alertcondition(buy and in_useAlerts,"Buy Alert","test")