Buscador de blocos de ordem

Autora:ChaoZhang, Data: 23 de maio de 2022 13:54:22Tags:MTF

Depois de encontrar uma enorme quantidade de uso do usuário de TV

Se você quiser contribuir para a parte de análise MTF, que beneficiaria toneladas de outros scripts e abrir a possibilidade de mais indicadores de estilo

Por favor, visite a página do script original (link no topo) para rever como o indicador é usado na negociação.

backtest

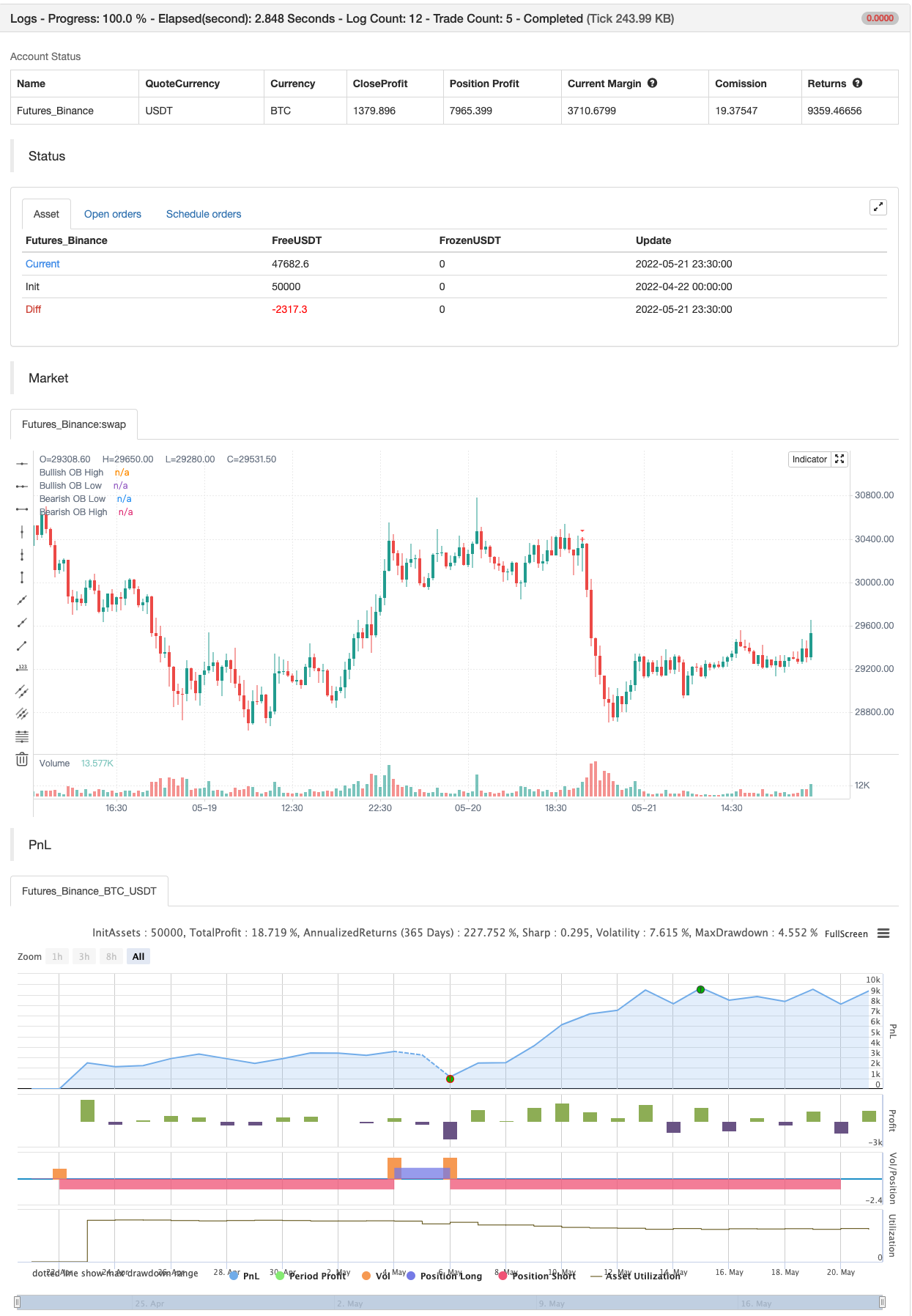

/*backtest

start: 2022-04-22 00:00:00

end: 2022-05-21 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

study("Order Block Finder", overlay = true)

tip1 = "Indicator to help identify instituational Order Blocks (OB). OBs often signal the beginning of a strong move. There is a high probability that OB price levels will be revisited in the future and are interesting levels to place limit orders. Bullish Order block is the last down candle before a sequence of up candles. Bearish Order Block is the last up candle before a sequence of down candles."

tip2 = "!Experimental!\nFind Order Blocks from different timeframes. Channels prices are accurate, but arrow position is not. Most useful when selecting a timeframe higher than the chart."

tip3 = "Required number of subsequent candles in the same direction to identify Order Block"

tip4 = "Measured from from potential OB close to close of first candle in sequence"

dummy = input(true,"Hover over ( ! ) for documentation", tooltip = tip1)

colors = input("LIGHT","Color Scheme", options=["DARK", "LIGHT"])

//res = input("","Order Block Timeframe",input.resolution,tooltip=tip2)

periods = input(7, "Relevant Periods to identify OB",tooltip=tip3) // Required number of subsequent candles in the same direction to identify Order Block

threshold = input(0.0, "Min. Percent move for valid OB", step = 0.1, tooltip=tip4) // Required minimum % move (from potential OB close to last subsequent candle to identify Order Block)

bull_channels = input(2, "Number of Bullish Channels to show") // Num of channels

bear_channels = input(2, "Number of Bearish Channels to show") // Num of channels

//Data Curation

res = ""

[copen,chigh,clow,cclose] = security(syminfo.tickerid,res,[open,high,low,close],barmerge.gaps_on, barmerge.lookahead_off)

ob_period = periods + 1 // Identify location of relevant Order Block candle

absmove = ((abs(cclose[ob_period] - cclose[1]))/cclose[ob_period]) * 100 // Calculate absolute percent move from potential OB to last candle of subsequent candles

relmove = absmove >= threshold // Identify "Relevant move" by comparing the absolute move to the threshold

// Color Scheme

bullcolor = colors == "DARK"? color.white : color.green

bearcolor = colors == "DARK"? color.blue : color.red

// Bullish Order Block Identification

bullishOB = cclose[ob_period] < copen[ob_period] // Determine potential Bullish OB candle (red candle)

int upcandles = 0

for i = 1 to periods

upcandles := upcandles + (cclose[i] > copen[i]? 1 : 0) // Determine color of subsequent candles (must all be green to identify a valid Bearish OB)

OB_bull = bullishOB and (upcandles == (periods)) and relmove // Identification logic (red OB candle & subsequent green candles)

OB_bull_chigh = OB_bull? chigh[ob_period] : na // Determine OB upper limit (Open or High depending on input)

OB_bull_clow = OB_bull? clow[ob_period] : na // Determine OB clower limit (Low)

OB_bull_avg = (OB_bull_chigh + OB_bull_clow)/2 // Determine OB middle line

// Bearish Order Block Identification

bearishOB = cclose[ob_period] > copen[ob_period] // Determine potential Bearish OB candle (green candle)

int downcandles = 0

for i = 1 to periods

downcandles := downcandles + (cclose[i] < copen[i]? 1 : 0) // Determine color of subsequent candles (must all be red to identify a valid Bearish OB)

OB_bear = bearishOB and (downcandles == (periods)) and relmove // Identification logic (green OB candle & subsequent green candles)

OB_bear_chigh = OB_bear? chigh[ob_period] : na // Determine OB upper limit (High)

OB_bear_clow = OB_bear? clow[ob_period] : na // Determine OB clower limit (Open or Low depending on input)

OB_bear_avg = (OB_bear_clow + OB_bear_chigh)/2 // Determine OB middle line

// Plotting

plotshape(OB_bull, title="Bullish OB", style = shape.triangleup, color = bullcolor, textcolor = bullcolor, size = size.tiny, location = location.belowbar, offset = -ob_period, text = "Bull") // Bullish OB Indicator

bull1 = plot(OB_bull_chigh, title="Bullish OB High", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 2) // Bullish OB Upper Limit

bull2 = plot(OB_bull_clow, title="Bullish OB Low", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 2) // Bullish OB Lower Limit

fill(bull1, bull2, color=bullcolor, transp = 50, title = "Bullish OB fill") // Fill Bullish OB

plotshape(OB_bull_avg, title="Bullish OB Average", style = shape.cross, color = bullcolor, size = size.small, location = location.absolute, offset = -ob_period) // Bullish OB Average

plotshape(OB_bear, title="Bearish OB", style = shape.triangledown, color = bearcolor, textcolor = bearcolor, size = size.tiny, location = location.abovebar, offset = -ob_period, text = "Bear") // Bearish OB Indicator

bear1 = plot(OB_bear_clow, title="Bearish OB Low", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 2) // Bearish OB Lower Limit

bear2 = plot(OB_bear_chigh, title="Bearish OB High", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 2) // Bearish OB Upper Limit

fill(bear1, bear2, color=bearcolor, transp = 50, title = "Bearish OB fill") // Fill Bearish OB

plotshape(OB_bear_avg, title="Bearish OB Average", style = shape.cross, color = bearcolor, size = size.small, location = location.absolute, offset = -ob_period) // Bullish OB Average

// Alerts for Order Blocks Detection

alertcondition(OB_bull, title='New Bullish OB detected', message='New Bullish OB detected - This is NOT a BUY signal!')

alertcondition(OB_bear, title='New Bearish OB detected', message='New Bearish OB detected - This is NOT a SELL signal!')

if OB_bull

strategy.entry("Enter Long", strategy.long)

else if OB_bear

strategy.entry("Enter Short", strategy.short)

Relacionado

- Algoritmos de portfólio dinâmico de estratégias de negociação de tendências de Supertrend de vários ciclos de tempo

- Estratégias de quantificação do gráfico térmico do núcleo de mobilidade multiciclo de tempo

- Múltiplos ciclos de tempo estratégia de negociação EMA-Squeeze

- Sistema de negociação quantitativo de rastreamento de tendências Heikin Ashi

- A estratégia de ruptura de movimentos de Bollinger em múltiplos momentos combinada com a estratégia de equilíbrio de Hull

- Estratégias de negociação de volatilidade dinâmica baseadas em gráficos de faixa de brinquedos e arcos

- Métodos de rastreamento de tendências multicíclicas e gestão de volatilidade do ATR

- MTF-ATR-MACD sistema de rastreamento de tendências de vários quadros de tempo

- Média móvel confirmada por vários ciclos e estratégia de negociação de tendências do RSI

Mais informações

- Alerta cruzada média móvel, multi-tempo (MTF)

- Estratégia de recarga do MACD

- Média móvel supertrendada

- Comércio ABC

- 15 MIN BTCUSDTPERP BOT

- Entropia de Shannon V2

- Supertrend ATR COM TRAILING STOP LOSS

- Fluxo de volume v3

- Scalping horário de futuros de criptomoedas com ma & rsi - ogcheckers

- ATR suavizado

- TendênciaScalp-FractalBox-3EMA

- Sinais QQE

- Filtragem de amplitude de grelha de bits U

- Indicador MACD personalizado CM - Quadro de tempo múltiplo - V2

- LÍNIA HODL

- 2 Detecção da direção da média móvel de cores

- Instrumento de recuperação de scalping R1

- A estratégia de compra e venda depende de AO+Stoch+RSI+ATR

- EMA TREND CLOUD

- RedK Relação volume-aceleração da energia direcional