Estratégias de negociação quantitativa de múltiplos fatores

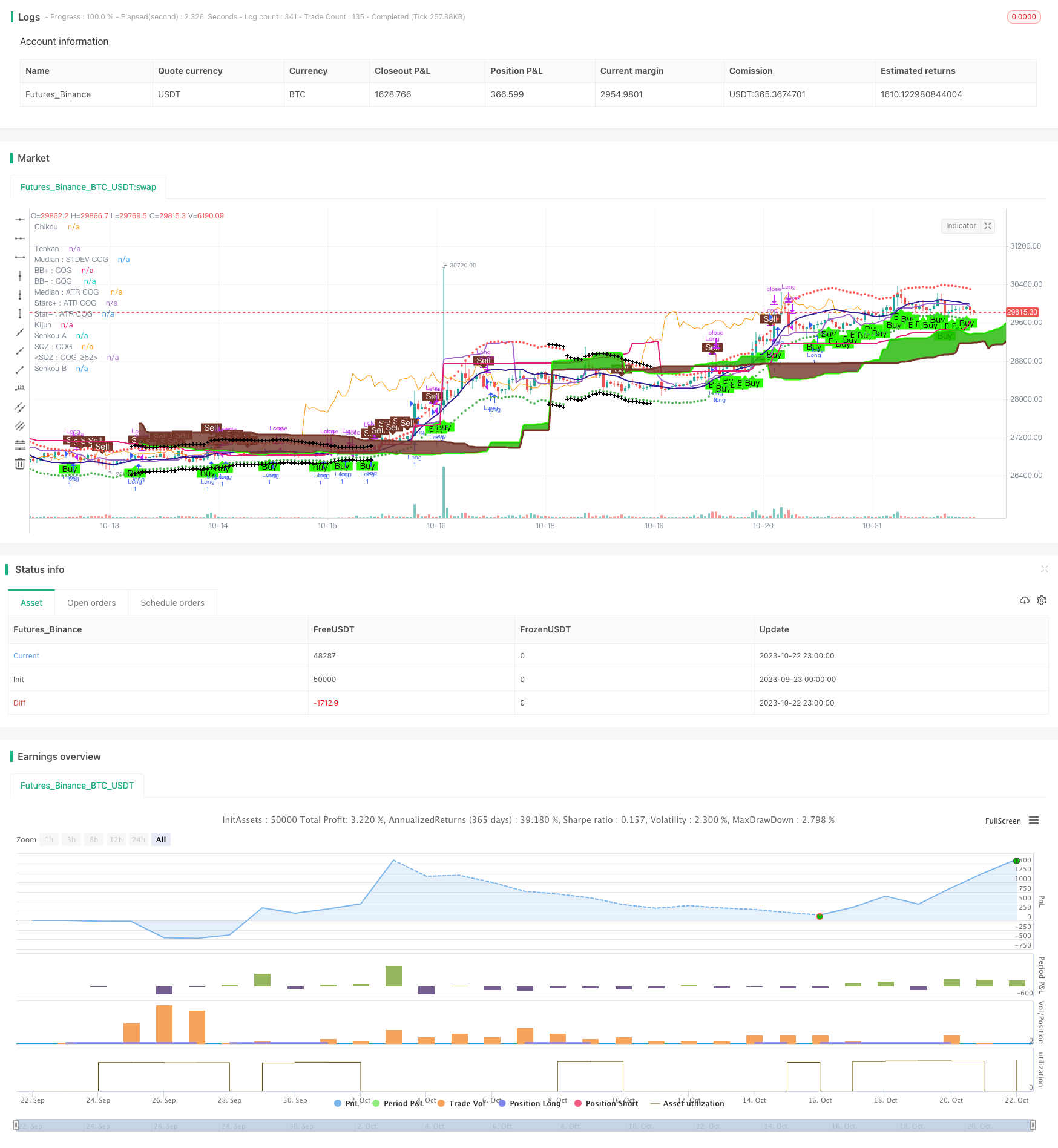

Trata-se de uma estratégia de negociação quantitativa que combina vários indicadores técnicos para fazer um julgamento sobre o vazio. A estratégia considera integralmente vários fatores, como indicadores de dinâmica, indicadores de tendência e gráficos de nuvem de Ichimoku, para formar o julgamento final de compra e venda. A estratégia tem uma forte estabilidade e resistência ao risco.

Análise de princípios

A estratégia é composta principalmente por:

Índice de força: Parabolic SAR, Índice de intensidade Leledc, Média móvel adaptada de Kaufman, etc.

Indicadores de tendência: O Vibrator Rahul Mohindar, o Trend Magic e outros

Mapa das nuvens de Ichimoku: incluindo as linhas Tenkan, Kijun e outras

Indicador de fluxo de volume

Indicador de oscilação: Wave Trend Oscillator

Sequência TD

Estes indicadores julgam a tendência e a força do mercado atual de diferentes ângulos. O SAR parabólico julga o ponto de reversão da tendência, o indicador de força Ledc julga o momento, o gráfico da nuvem Ichimoku julga a pressão de suporte. Quando a maioria dos indicadores dá sinais de isomers, forma-se o julgamento final de compra ou venda.

A estratégia, ao mesmo tempo, estabelece condições de filtragem para que as transações sejam feitas somente no intervalo de datas especificadas por mês e dia, reduzindo assim o número de transações inválidas.

Análise de vantagens

Julgamento integrado de múltiplos fatores, maior precisão e maior resistência ao risco

Utilização de diferentes tipos de indicadores para verificação cruzada, evitando o risco de falha de um único indicador

Configurar condições de filtragem para evitar transações inválidas em períodos impróprios

É escrito em Pine Script e pode ser usado diretamente na plataforma TradingView.

Parâmetros do indicador são ajustáveis e podem ser otimizados para diferentes mercados

Indicadores de sinais de visualização para intuir a estrutura do mercado

Análise de Riscos

A combinação de múltiplos fatores requer ajustes de peso e parâmetros, existindo certa dificuldade de otimização

Indicadores únicos podem falhar em determinadas circunstâncias de mercado

Se você não ajustar as condições de filtragem corretamente, você pode perder uma oportunidade.

Cuidado com o excesso de otimização

Os traders precisam estar atentos ao risco de falhas nos indicadores e ajustar suas estratégias em tempo hábil

Resposta:

Optimizar os parâmetros de ajuste do indicador para que sejam mais eficazes para o mercado atual

Ajustar o peso, aumentar o papel dos indicadores eficazes e reduzir o papel dos indicadores ineficazes

Ajustar as condições de filtragem de forma oportuna, para aproveitar oportunidades e evitar riscos

Otimização de ideias

Adição de algoritmos de aprendizagem de máquina para ajustar automaticamente o peso do indicador

Aumentar os índices de emoção, os índices de fluxo de capitais, etc.

Teste de variedade de transação, período de tempo e configuração de parâmetros ótimos

Testar o efeito de diferentes períodos de detenção

Combinação de mais filtros, como dados sazonais e econômicos

Adição de estratégias de stop loss

Resumir

Esta estratégia integra vários indicadores para formar o julgamento final, com uma forte capacidade de resistência ao risco. Ao mesmo tempo, também é necessário prestar atenção ao risco de falha de um único indicador, otimização contínua e ajuste de parâmetros. No futuro, pode-se otimizar ainda mais a configuração de peso do indicador, adicionar mais fatores, testar o melhor período de posse.

//@version=2

persistent_bull = nz(persistent_bull[1],0)

persistent_bear = nz(persistent_bear[1],0)

strategy("Strategy for The Bitcoin Buy/Sell Indicator", overlay=true, calc_on_every_tick=true)

// ****************************************Inputs***************************************************************

//@fixme if there is a buy and sell signal on the same bar, then it displays the first one and skips the second one. Fix this issue

buySellSignal = true // Make this false if you do not want to show Buy/Sell signal

inputIndividualSiganlPlot = true // = input (false, "Do you want to display each individual indicator's signal on the chart?")

sp = input (false, "Do you want to display Parabolic SAR?")

spLines = input (false, "Do you want to display Parabolic SAR on the chart?")

sCloud = input(false, "Do you want to display the Tenkan and Kijun lines of Ichimoku lines on the chart?")

sL = input (false, "Do you want to display Leledec Exhausion - Leledc on the chart?")

sTD = false

sRMO = input(false, "Do you want to display Rahul Mohindar Oscillator - RMO on the chart?")

inputAma = input(false, title="Do you want to display Kaufman AMA wave - AMA on the chart?")

tm = input (false, "Do you want to display Trend Magic signals on the chart?")

wtoLB = input (false, "Do you want to display WaveTrend Oscillator - WTO on the chart?")

vfiLB = input (false, "Do you want to display Volume Flow Indicator - VFI on the chart?")

cogRegionFillTransp = 100 // input(false, "Do you want to display COG Region Fill and ATR Starc+/-")

inputNeutralMinorSignals = input (false, title="Do you want to not display the minor or the not so strong signals from Ichimoku")

maj=true // input(true,title="Show Major Leledc Exhausion Bar signal")

min=input(false,title="Show Minor Leledc Exhausion Bar signal")

tenkanPeriods = input(20, minval=9, title="Tenkan Period - Ichimoku [9 or 10 or 20]")

kijunPeriods = input(60, minval=26, title="Kijun Period - Ichimoku [26 or 30 or 60]")

chikouPeriods = input(120, minval=52, title="Chikou - Ichimoku [52 or 60 or 120]")

displacement = input(30, minval=26, title="Displacement - Ichimoku [26 or 30]")

// ****************************************General Color Variables***************************************************************

colorLime = #006400 // Warning sign for long trade

colorBuy= #2DFF03 // Good sign for long trade

colorSell = #733629 // Good sign for short trade

colorMaroon =#8b0000 // Warning sign for short trade

colorBlue =#0000ff // No clear sign

colorGray = #a9a9a9 // Gray Color (For Squeeze momentum indicator)

colorBlack = #000000 // Black

colorWhite = #ffffff // White

colorTenkanViolet = #800000 // Tenkan-sen line color

colorKijun = #0000A6 // Kijun-sen line color

// TD Sequential bar colors

tdSell = #ff6666

tdSellOvershoot = #ff1a1a

tdSellOvershoot1 = #cc0000

tdSellOverShoot2 = #990000

tdSellOverShoot3 = #732626

tdBuy = #80ff80

tdBuyOverShoot = #33ff33

tdBuyOvershoot1 = #00cc00

tdBuyOverShoot2 = #008000

tdBuyOvershoot3 = #004d00

// ****************************************Icons***************************************************************

upSign = '↑' // indicates the indicator shows uptrend

downSign = '↓' // incicates the indicator showing downtrend

exitSign ='x' //indicates the indicator uptrend/downtrend ending

// diamond signals weakBullishSignal or weakBearishsignal

// flag signals neutralBullishSignal or neutralBearishSignal

// ****************************************Parabolic SAR code***************************************************************

start = 2

increment = 2

maximum = 2

sus = true

sds = true

disc = false

startCalc = start * .01

incrementCalc = increment * .01

maximumCalc = maximum * .10

sarUp = sar(startCalc, incrementCalc, maximumCalc)

sarDown = sar(startCalc, incrementCalc, maximumCalc)

colUp = spLines and close >= sarDown ? colorLime : na

colDown = spLines and close <= sarUp ? colorSell : na

//@fixme Does not display the correct values for up and down pSAR

plot(sp and sus and sarUp ? sarUp : na, title="↓ SAR", style=cross, linewidth=3,color=colUp)

plot(sp and sds and sarDown ? sarDown : na, title="↑ SAR", style=circles, linewidth=3,color=colDown)

startSAR = 0.02

incrementSAR = 0.02

maximumSAR = 0.2

psar = sar(startSAR, incrementSAR, maximumSAR)

bullishPSAR = psar < high and psar[1] > low

bearishPSAR= psar > low and psar[1] < high

//***********************Leledc Exhausion Bar***********************************************

maj_qual=6

maj_len=30

min_qual=5

min_len=5

lele(qual,len)=>

bindex=nz(bindex[1],0)

sindex=nz(sindex[1],0)

ret=0

if (close>close[4])

bindex:=bindex + 1

if(close<close[4])

sindex:=sindex + 1

if (bindex>qual) and (close<open) and high>=highest(high,len)

bindex:=0

ret:=-1

if ((sindex>qual) and (close>open) and (low<= lowest(low,len)))

sindex:=0

ret:=1

return=ret

major=lele(maj_qual,maj_len)

minor=lele(min_qual,min_len)

leledecMajorBullish = maj ? (major==1?low:na) : na

leledecMajorBearish = maj ? (major==-1?high:na) : na

//****************Ichimoku ************************************

donchian(len) => avg(lowest(len), highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement]

displacedSenkouB = senkouB[displacement]

bullishSignal = crossover(tenkan, kijun)

bearishSignal = crossunder(tenkan, kijun)

bullishSignalValues = iff(bullishSignal, tenkan, na)

bearishSignalValues = iff(bearishSignal, tenkan, na)

strongBullishSignal = crossover(tenkan, kijun) and bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB and low > tenkan and displacedSenkouA > displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB and high < tenkan and displacedSenkouA < displacedSenkouB

neutralBullishSignal = (bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB)

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

neutralBearishSignal = (bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB)

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

//*********************Kaufman AMA wave*********************//

src=close

lengthAMA=20

filterp = 10

d=abs(src-src[1])

s=abs(src-src[lengthAMA])

noise=sum(d, lengthAMA)

efratio=s/noise

fastsc=0.6022

slowsc=0.0645

smooth=pow(efratio*fastsc+slowsc, 2)

ama=nz(ama[1], close)+smooth*(src-nz(ama[1], close))

filter=filterp/100 * stdev(ama-nz(ama), lengthAMA)

amalow=ama < nz(ama[1]) ? ama : nz(amalow[1])

amahigh=ama > nz(ama[1]) ? ama : nz(amahigh[1])

bw=(ama-amalow) > filter ? 1 : (amahigh-ama > filter ? -1 : 0)

s_color=bw > 0 ? colorBuy : (bw < 0) ? colorSell : colorBlue

amaLongConditionEntry = s_color==colorBuy and s_color[1]!=colorBuy

amaShortConditionEntry = s_color==colorSell and s_color[1]!=colorSell

//***********************Rahul Mohindar Oscillator ******************************//

C=close

cm2(x) => sma(x,2)

ma1=cm2(C)

ma2=cm2(ma1)

ma3=cm2(ma2)

ma4=cm2(ma3)

ma5=cm2(ma4)

ma6=cm2(ma5)

ma7=cm2(ma6)

ma8=cm2(ma7)

ma9=cm2(ma8)

ma10=cm2(ma9)

SwingTrd1 = 100 * (close - (ma1+ma2+ma3+ma4+ma5+ma6+ma7+ma8+ma9+ma10)/10)/(highest(C,10)-lowest(C,10))

SwingTrd2=ema(SwingTrd1,30)

SwingTrd3=ema(SwingTrd2,30)

RMO= ema(SwingTrd1,81)

Buy=cross(SwingTrd2,SwingTrd3)

Sell=cross(SwingTrd3,SwingTrd2)

Bull_Trend=ema(SwingTrd1,81)>0

Bear_Trend=ema(SwingTrd1,81)<0

Ribbon_kol=Bull_Trend ? colorBuy : (Bear_Trend ? colorSell : colorBlue)

Impulse_UP= SwingTrd2 > 0

Impulse_Down= RMO < 0

bar_kol=Impulse_UP ? colorBuy : (Impulse_Down ? colorSell : (Bull_Trend ? colorBuy : colorBlue))

rahulMohindarOscilllatorLongEntry = Ribbon_kol==colorBuy and Ribbon_kol[1]!=colorBuy and Ribbon_kol[1]==colorSell and bar_kol==colorBuy

rahulMohindarOscilllatorShortEntry = Ribbon_kol==colorSell and Ribbon_kol[1]!=colorSell and Ribbon_kol[1]==colorBuy and bar_kol==colorSell

//***********************TD Sequential code ******************************//

transp=0

Numbers=false

SR=false

Barcolor=true

TD = close > close[4] ?nz(TD[1])+1:0

TS = close < close[4] ?nz(TS[1])+1:0

TDUp = TD - valuewhen(TD < TD[1], TD , 1 )

TDDn = TS - valuewhen(TS < TS[1], TS , 1 )

priceflip = barssince(close<close[4])

sellsetup = close>close[4] and priceflip

sell = sellsetup and barssince(priceflip!=9)

sellovershoot = sellsetup and barssince(priceflip!=13)

sellovershoot1 = sellsetup and barssince(priceflip!=14)

sellovershoot2 = sellsetup and barssince(priceflip!=15)

sellovershoot3 = sellsetup and barssince(priceflip!=16)

priceflip1 = barssince(close>close[4])

buysetup = close<close[4] and priceflip1

buy = buysetup and barssince(priceflip1!=9)

buyovershoot = barssince(priceflip1!=13) and buysetup

buyovershoot1 = barssince(priceflip1!=14) and buysetup

buyovershoot2 = barssince(priceflip1!=15) and buysetup

buyovershoot3 = barssince(priceflip1!=16) and buysetup

TDbuyh = valuewhen(buy,high,0)

TDbuyl = valuewhen(buy,low,0)

TDsellh = valuewhen(sell,high,0)

TDselll = valuewhen(sell,low,0)

//***********************Volume Flow Indicator [LazyBear] ******************************//

lengthVFI = 130

coefVFI = 0.2

vcoefVFI = 2.5

signalLength= 5

smoothVFI=true

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coefVFI * vinter * close

vave = sma( volume, lengthVFI )[1]

vmax = vave * vcoefVFI

vc = iff(volume < vmax, volume, vmax)

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , lengthVFI )/vave, 3)

vfima=ema( vfi, signalLength )

dVFI=vfi-vfima

bullishVFI = vfi > 0 and vfi[1] <=0

bearishVFI = vfi < 0 and vfi[1] >=0

//***********************WaveTrend Oscillator [WT] ******************************//

n1 = 10

n2 = 21

obLevel1 = 60

obLevel2 = 53

osLevel1 = -60

osLevel2 = -53

ap = hlc3

esa = ema(ap, n1)

dWTI = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * dWTI)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

wtiSignal = wt1-wt2

bullishWTI = wt1 > osLevel1 and wt1[1] <= osLevel1 and wtiSignal > 0

bearishWTI = wt1 < obLevel1 and wt1[1] >= obLevel1 and wtiSignal < 0

// **************** Trend Magic code adapted from Glaz ********************* /

CCI = 20 // input(20)

ATR = 5 // input(5)

Multiplier=1 // input(1,title='ATR Multiplier')

original=true // input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?lime:red

swap3=thisCCI >=0 ?lime:red

swap4=original?swap3:swap2

bullTrendMagic = swap4 == lime and swap4[1] == red

bearTrendMagic = swap4 == red and swap4[1] == lime

// ************ Indicator: Custom COG channel by Lazy Bear **************** //

srcCOG = close

lengthCOG = 34

median=0

multCOG= 2.5 // input(2.5)

offset = 20 //input(20)

tr_custom() =>

x1=high-low

x2=abs(high-close[1])

x3=abs(low-close[1])

max(x1, max(x2,x3))

atr_custom(x,y) =>

sma(x,y)

dev = (multCOG * stdev(srcCOG, lengthCOG))

basis=linreg(srcCOG, lengthCOG, median)

ul = (basis + dev)

ll = (basis - dev)

tr_v = tr_custom()

acustom=(2*atr_custom(tr_v, lengthCOG))

uls=basis+acustom

lls=basis-acustom

// Plot STDEV channel

plot(basis, linewidth=1, color=navy, style=line, linewidth=1, title="Median : STDEV COG")

lb=plot(ul, color=red, linewidth=1, title="BB+ : COG", style=hline.style_dashed)

tb=plot(ll, color=green, linewidth=1, title="BB- : COG ", style=hline.style_dashed)

fill(tb,lb, silver, title="Region fill: STDEV COG", transp=cogRegionFillTransp)

// Plot ATR channel

plot(basis, linewidth=2, color=navy, style=line, linewidth=2, title="Median : ATR COG ")

ls=plot(uls, color=red, linewidth=1, title="Starc+ : ATR COG", style=circles, transp=cogRegionFillTransp)

ts=plot(lls, color=green, linewidth=1, title="Star- : ATR COG", style=circles, transp=cogRegionFillTransp)

fill(ts,tb, green, title="Region fill : ATR COG", transp=cogRegionFillTransp)

fill(ls,lb, red, title="Region fill : ATR COG", transp=cogRegionFillTransp)

// Mark SQZ

plot_offs_high=0.002

plot_offs_low=0.002

sqz_f=(uls>ul) and (lls<ll)

b_color=sqz_f ? colorBlack : na

plot(sqz_f ? lls - (lls * plot_offs_low) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

plot(sqz_f ? uls + (uls * plot_offs_high) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

// ****************************************All the plots and coloring of bars***************************************************************

// Trend Magic

plotchar(tm and bullTrendMagic, title="TM", char=upSign, location=location.belowbar, color=colorBuy, transp=0, text="TM", textcolor=colorBuy, size=size.auto)

plotchar(tm and bearTrendMagic, title="TM", char=downSign, location=location.abovebar, color=colorSell, transp=0, text="TM", textcolor=colorSell, size=size.auto)

// WaveTrend Oscillator

plotshape(wtoLB and bullishWTI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="WTI", location=location.belowbar, transp=0)

plotshape(wtoLB and bearishWTI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="WTI", location=location.abovebar, transp=0)

// VFI

plotshape(vfiLB and bullishVFI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="VFI", location=location.belowbar, transp=0)

plotshape(vfiLB and bearishVFI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="VFI", location=location.abovebar, transp=0)

// PSAR

plotshape(inputIndividualSiganlPlot and sp and bullishPSAR, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Sar", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sp and bearishPSAR, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Sar", location=location.abovebar, transp=0)

// Leledec

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBearish, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Leledec", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBullish, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Leledec", location=location.belowbar, transp=0)

plotshape(min ? (minor==1?low:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Leledec", color=colorLime)

plotshape(min ? (minor==-1?high:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Leleded", color=colorSell)

// Ichimoku

plot(tenkan, color=iff(sCloud, colorTenkanViolet, na), title="Tenkan", linewidth=2, transp=0)

plot(kijun, color=iff(sCloud, colorKijun, na), title="Kijun", linewidth=2, transp=0)

plot(close, offset = -displacement, color=iff(sCloud, colorLime, na), title="Chikou", linewidth=1)

p1 = plot(senkouA, offset=displacement, color=colorBuy, title="Senkou A", linewidth=3, transp=0)

p2 = plot(senkouB, offset=displacement, color=colorSell, title="Senkou B", linewidth=3, transp=0)

fill(p1, p2, color = senkouA > senkouB ? #1eb600 : colorSell)

plotshape(inputIndividualSiganlPlot and strongBearishSignal, color=colorSell, style=shape.labelup, textcolor=#000000, text="Ichimoku", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and strongBullishSignal, color=colorBuy, style=shape.labeldown, textcolor=#ffffff, text="Ichimoku", location=location.belowbar, transp=0)

plotshape(inputNeutralMinorSignals and neutralBullishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.belowbar, title="Neutral Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and weakBullishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and neutralBearishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.abovebar, title="Neutral Bearish Signals - Ichimoku", color=colorMaroon)

plotshape(inputNeutralMinorSignals and weakBearishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Ichimoku", color=colorMaroon)

// AMA

plotshape(inputIndividualSiganlPlot and inputAma and amaLongConditionEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="AMA", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and inputAma and amaShortConditionEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="AMA", location=location.abovebar, transp=0)

// RMO

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorLongEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="RMO", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorShortEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="RMO", location=location.abovebar, transp=0)

// TD

plot(sTD and SR?(TDbuyh ? TDbuyl: na):na,style=circles, linewidth=1, color=red)

plot(sTD and SR?(TDselll ? TDsellh : na):na,style=circles, linewidth=1, color=lime)

barColour = sell? tdSell : buy? tdBuy : sellovershoot? tdSellOvershoot : sellovershoot1? tdSellOvershoot1 : sellovershoot2?tdSellOverShoot2 : sellovershoot3? tdSellOverShoot3 : buyovershoot? tdBuyOverShoot : buyovershoot1? tdBuyOvershoot1 : buyovershoot2? tdBuyOverShoot2 : buyovershoot3? tdBuyOvershoot3 : na

barcolor(color=barColour, title ="TD Sequential Bar Colour")

// ****************************************BUY/SELL Signal ***************************************************************

bull = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

bear = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

if bull

persistent_bull := 1

persistent_bear := 0

if bear

persistent_bull := 0

persistent_bear := 1

plotshape(bull and persistent_bull[1] != 1, style=shape.labelup, location=location.belowbar, color=colorBuy, text="Buy", textcolor=#000000, transp=0)

plotshape(bear and persistent_bear[1] != 1, style=shape.labeldown, color=colorSell, text="Sell", location=location.abovebar, textcolor =#ffffff, transp=0)

// ****************************************Alerts***************************************************************

// For global buy/sell

alertcondition(bull and persistent_bull[1] != 1, title='Buy', message='Buy')

alertcondition(bear and persistent_bear[1] != 1, title='Sell', message='Sell')

// Strategy

longCondition = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

closeLongCondition = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

yearfrom=input(2017)

yearuntil=input(2020)

leverage=input(1)

if (longCondition )

strategy.entry("Long", strategy.long, leverage, comment="Enter Long")

else

strategy.close("Long", when=closeLongCondition)

//if (closeLongCondition and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth <= dayuntil and year <= yearuntil and year>=yearfrom)

// strategy.entry("Short", strategy.short, leverage, comment="Enter Short")

//else

// strategy.close("Short", when=longCondition)