Estratégia de mapa de calor MACD multi-tempo

Autora:ChaoZhang, Data: 2023-10-25 15:21:39Tags:

Resumo

A ideia central desta estratégia consiste em utilizar os sinais combinados dos indicadores MACD de vários prazos diferentes para determinar o momento das mudanças de tendência e implementar uma tendência de baixo risco após a negociação.

Estratégia lógica

-

A estratégia utiliza 5 indicadores MACD de diferentes prazos, incluindo 60min, 120min, 240min, 480min e Daily, formando uma combinação de indicadores MACD de vários prazos.

-

Quando todos os 5 MACDs são positivos (ou negativos) e a barra anterior não era todos os MACDs positivos (ou negativos), é determinado como um sinal longo (ou curto) e vai longo (ou curto).

-

O método de stop loss é de pips fixos.

-

O método de take profit é de dois níveis, encerrando uma parte e todas as posições separadamente.

-

Quando os indicadores MACD mostram uma posição longa e uma curta, é julgado como uma inversão de sinal e fechar a posição atual.

-

O TSL também é utilizado para trailing stop loss.

-

O recurso stop loss para equilíbrio é usado. Ao atingir certa meta de lucro, o stop loss se moverá para equilíbrio, bloqueando os lucros.

-

A sintaxe Pineconector é usada para gerar alertas de sinais de negociação dinamicamente.

Vantagens

-

A combinação de MACD multi-tempo pode melhorar a precisão do sinal, capturando grandes tendências e filtrando algum ruído.

-

O retorno de lucro de dois níveis permite tirar lucros parciais várias vezes durante grandes tendências.

-

Pips fixos de stop loss podem controlar o valor de perda de uma única negociação.

-

Fechar quando os MACDs forem inconsistentes pode realizar o stop loss em tempo hábil e evitar o stop loss break.

-

O TsL trailing stop acompanha a mudança de preço em tempo real.

-

SL a BE obtém algum lucro depois de transformar posições perdedoras em posições vencedoras.

-

Os alertas de negociação dinâmicos podem ser conectados ao MT4/5 para negociação automática.

Riscos e soluções

-

Os sinais MACD podem ter falhas, causando perdas desnecessárias.

-

Testar diferentes níveis para encontrar o parâmetro ideal.

-

Testar níveis diferentes para encontrar o parâmetro ideal.

-

O gatilho BE pode ser muito cedo ou muito tarde. Teste diferentes pontos de gatilho BE para encontrar o parâmetro ideal.

-

A distância da paragem traseira pode ser muito grande ou muito pequena. Teste distâncias diferentes para encontrar o parâmetro ideal.

Orientações de otimização

-

Teste mais intervalos de tempo da combinação MACD para encontrar a melhor combinação para capturar as tendências do mercado.

-

Introduzir mais indicadores para determinar a condição do mercado, evitando a abertura de posições durante condições desfavoráveis.

-

Investigação de diferenças de parâmetros entre produtos, conceção de sistemas de stop loss e take profit adaptativos.

-

Incorporar técnicas de aprendizagem de máquina para otimização dinâmica de parâmetros.

-

Introduzir o dimensionamento das posições para ajustamento dinâmico do tamanho das posições e controlo do risco.

Conclusão

Em resumo, esta estratégia usa o MACD de vários prazos para determinar tendências, com características de duplo trailing take profit, trailing stop loss e BE para bloquear lucros, stop loss fixo para controlar o risco.

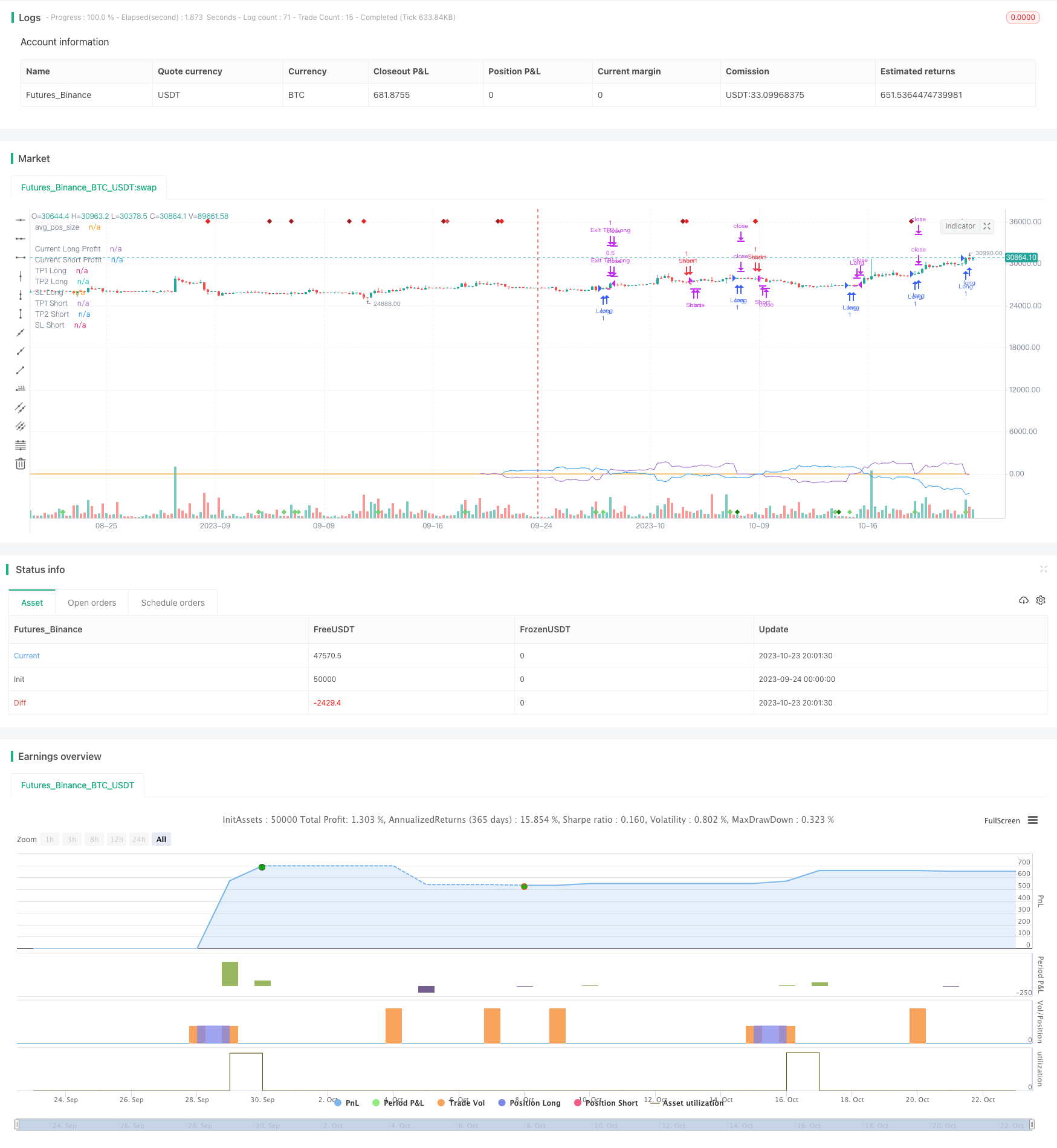

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@strategy_alert_message {{strategy.order.alert_message}}

SCRIPT_NAME = "Heatmap MACD Strategy - Pineconnector"

strategy(SCRIPT_NAME,

overlay= true,

process_orders_on_close = true,

calc_on_every_tick = true,

pyramiding = 1,

initial_capital = 100000,

default_qty_type = strategy.fixed,

default_qty_value = 1,

commission_type = strategy.commission.percent,

commission_value = 0.075,

slippage = 1

)

pineconnector_licence_ID = input.string(title = "Licence ID", defval = "123456789", group = "Pineconnector", tooltip = "Insert your Pineconnector Licence ID here")

pos_size = input.float(3, minval = 0, maxval = 100, title = "Position Size", group = "Position Size", tooltip = "Required to specify the position size here for Pineconnector to work properly")

res1 = input.timeframe('60', title='First Timeframe', group = "Timeframes")

res2 = input.timeframe('120', title='Second Timeframe', group = "Timeframes")

res3 = input.timeframe('240', title='Third Timeframe', group = "Timeframes")

res4 = input.timeframe('240', title='Fourth Timeframe', group = "Timeframes")

res5 = input.timeframe('480', title='Fifth Timeframe', group = "Timeframes")

macd_src = input.source(close, title="Source", group = "MACD")

fast_len = input.int(9, minval=1, title="Fast Length", group = "MACD")

slow_len = input.int(26, minval=1, title="Slow Length", group = "MACD")

sig_len = input.int(9, minval=1, title="Signal Length", group = "MACD")

// # ========================================================================= #

// # | Close on Opposite |

// # ========================================================================= #

use_close_opposite = input.bool(false, title = "Close on Opposite Signal?", group = "Close on Opposite", tooltip = "Close the position if 1 or more MACDs become bearish (for longs) or bullish (for shorts)")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.bool(true, title = "Use Stop Loss?", group = "Stop Loss")

sl_mode = "pips"//input.string("%", title = "Mode", options = ["%", "pips"], group = "Stop Loss")

sl_value = input.float(40, minval = 0, title = "Value", group = "Stop Loss", inline = "stoploss")// * 0.01

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

use_tsl = input.bool(false, title = "Use Trailing Stop Loss?", group = "Trailing Stop Loss")

tsl_input_pips = input.float(10, minval = 0, title = "Trailing Stop Loss (pips)", group = "Trailing Stop Loss")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp1 = input.bool(true, title = "Use Take Profit 1?", group = "Take Profit 1")

tp1_value = input.float(30, minval = 0, title = "Value (pips)", group = "Take Profit 1")// * 0.01

tp1_qty = input.float(50, minval = 0, title = "Quantity (%)", group = "Take Profit 1")// * 0.01

use_tp2 = input.bool(true, title = "Use Take Profit 2?", group = "Take Profit 2")

tp2_value = input.float(50, minval = 0, title = "Value (pips)", group = "Take Profit 2")// * 0.01

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

use_sl_be = input.bool(false, title = "Use Stop Loss to Breakeven Mode?", group = "Break Even")

sl_be_value = input.float(30, step = 0.1, minval = 0, title = "Value (pips)", group = "Break Even", inline = "breakeven")

sl_be_offset = input.int(1, step = 1, minval = 0, title = "Offset (pips)", group = "Break Even", tooltip = "Set the SL at BE price +/- offset value")

[_, _, MTF1_hist] = request.security(syminfo.tickerid, res1, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF2_hist] = request.security(syminfo.tickerid, res2, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF3_hist] = request.security(syminfo.tickerid, res3, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF4_hist] = request.security(syminfo.tickerid, res4, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF5_hist] = request.security(syminfo.tickerid, res5, ta.macd(macd_src, fast_len, slow_len, sig_len))

bull_hist1 = MTF1_hist > 0 and MTF1_hist[1] < 0

bull_hist2 = MTF2_hist > 0 and MTF2_hist[1] < 0

bull_hist3 = MTF3_hist > 0 and MTF3_hist[1] < 0

bull_hist4 = MTF4_hist > 0 and MTF4_hist[1] < 0

bull_hist5 = MTF5_hist > 0 and MTF5_hist[1] < 0

bear_hist1 = MTF1_hist < 0 and MTF1_hist[1] > 0

bear_hist2 = MTF2_hist < 0 and MTF2_hist[1] > 0

bear_hist3 = MTF3_hist < 0 and MTF3_hist[1] > 0

bear_hist4 = MTF4_hist < 0 and MTF4_hist[1] > 0

bear_hist5 = MTF5_hist < 0 and MTF5_hist[1] > 0

plotshape(bull_hist1, title = "Bullish MACD 1", location = location.bottom, style = shape.diamond, size = size.normal, color = #33e823)

plotshape(bull_hist2, title = "Bullish MACD 2", location = location.bottom, style = shape.diamond, size = size.normal, color = #1a7512)

plotshape(bull_hist3, title = "Bullish MACD 3", location = location.bottom, style = shape.diamond, size = size.normal, color = #479c40)

plotshape(bull_hist4, title = "Bullish MACD 4", location = location.bottom, style = shape.diamond, size = size.normal, color = #81cc7a)

plotshape(bull_hist5, title = "Bullish MACD 5", location = location.bottom, style = shape.diamond, size = size.normal, color = #76d66d)

plotshape(bear_hist1, title = "Bearish MACD 1", location = location.top, style = shape.diamond, size = size.normal, color = #d66d6d)

plotshape(bear_hist2, title = "Bearish MACD 2", location = location.top, style = shape.diamond, size = size.normal, color = #de4949)

plotshape(bear_hist3, title = "Bearish MACD 3", location = location.top, style = shape.diamond, size = size.normal, color = #cc2525)

plotshape(bear_hist4, title = "Bearish MACD 4", location = location.top, style = shape.diamond, size = size.normal, color = #a11d1d)

plotshape(bear_hist5, title = "Bearish MACD 5", location = location.top, style = shape.diamond, size = size.normal, color = #ed2424)

bull_count = (MTF1_hist > 0 ? 1 : 0) + (MTF2_hist > 0 ? 1 : 0) + (MTF3_hist > 0 ? 1 : 0) + (MTF4_hist > 0 ? 1 : 0) + (MTF5_hist > 0 ? 1 : 0)

bear_count = (MTF1_hist < 0 ? 1 : 0) + (MTF2_hist < 0 ? 1 : 0) + (MTF3_hist < 0 ? 1 : 0) + (MTF4_hist < 0 ? 1 : 0) + (MTF5_hist < 0 ? 1 : 0)

bull = bull_count == 5 and bull_count[1] < 5 and barstate.isconfirmed

bear = bear_count == 5 and bear_count[1] < 5 and barstate.isconfirmed

signal_candle = bull or bear

entryLongPrice = ta.valuewhen(bull and strategy.position_size[1] <= 0, close, 0)

entryShortPrice = ta.valuewhen(bear and strategy.position_size[1] >= 0, close, 0)

plot(strategy.position_size, title = "avg_pos_size")

get_pip_size() =>

float _pipsize = 1.

if syminfo.type == "forex"

_pipsize := (syminfo.mintick * (str.contains(syminfo.ticker, "JPY") ? 100 : 10))

else if str.contains(syminfo.ticker, "XAU") or str.contains(syminfo.ticker, "XAG")

_pipsize := 0.1

_pipsize

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if signal_candle and use_sl

final_SL_Long := entryLongPrice - (sl_value * get_pip_size())

final_SL_Short := entryShortPrice + (sl_value * get_pip_size())

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

var MaxReached = 0.0

if signal_candle[1]

MaxReached := strategy.position_size > 0 ? high : low

MaxReached := strategy.position_size > 0

? math.max(nz(MaxReached, high), high)

: strategy.position_size < 0 ? math.min(nz(MaxReached, low), low) : na

if use_tsl and use_sl

if strategy.position_size > 0

stopValue = MaxReached - (tsl_input_pips * get_pip_size())

final_SL_Long := math.max(stopValue, final_SL_Long[1])

else if strategy.position_size < 0

stopValue = MaxReached + (tsl_input_pips * get_pip_size())

final_SL_Short := math.min(stopValue, final_SL_Short[1])

// # ========================================================================= #

// # | Take Profit 1 |

// # ========================================================================= #

var float final_TP1_Long = 0.

var float final_TP1_Short = 0.

final_TP1_Long := entryLongPrice + (tp1_value * get_pip_size())

final_TP1_Short := entryShortPrice - (tp1_value * get_pip_size())

plot(use_tp1 and strategy.position_size > 0 ? final_TP1_Long : na, title = "TP1 Long", color = color.aqua, linewidth=2, style=plot.style_linebr)

plot(use_tp1 and strategy.position_size < 0 ? final_TP1_Short : na, title = "TP1 Short", color = color.blue, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit 2 |

// # ========================================================================= #

var float final_TP2_Long = 0.

var float final_TP2_Short = 0.

final_TP2_Long := entryLongPrice + (tp2_value * get_pip_size())

final_TP2_Short := entryShortPrice - (tp2_value * get_pip_size())

plot(use_tp2 and strategy.position_size > 0 and tp1_qty != 100 ? final_TP2_Long : na, title = "TP2 Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(use_tp2 and strategy.position_size < 0 and tp1_qty != 100 ? final_TP2_Short : na, title = "TP2 Short", color = color.white, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

var bool SL_BE_REACHED = false

// Calculate open profit or loss for the open positions.

tradeOpenPL() =>

sumProfit = 0.0

for tradeNo = 0 to strategy.opentrades - 1

sumProfit += strategy.opentrades.profit(tradeNo)

result = sumProfit

//get_pip_size() =>

// syminfo.type == "forex" ? syminfo.pointvalue * 100 : 1

current_profit = tradeOpenPL()// * get_pip_size()

current_long_profit = (close - entryLongPrice) / (syminfo.mintick * 10)

current_short_profit = (entryShortPrice - close) / (syminfo.mintick * 10)

plot(current_short_profit, title = "Current Short Profit")

plot(current_long_profit, title = "Current Long Profit")

if use_sl_be

if strategy.position_size[1] > 0

if not SL_BE_REACHED

if current_long_profit >= sl_be_value

final_SL_Long := entryLongPrice + (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

else if strategy.position_size[1] < 0

if not SL_BE_REACHED

if current_short_profit >= sl_be_value

final_SL_Short := entryShortPrice - (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

plot(use_sl and strategy.position_size > 0 ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(use_sl and strategy.position_size < 0 ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Strategy Calls |

// # ========================================================================= #

string entry_long_limit_alert_message = ""

string entry_long_TP1_alert_message = ""

string entry_long_TP2_alert_message = ""

tp1_qty_perc = tp1_qty / 100

if use_tp1 and use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_limit_alert_message := entry_long_TP1_alert_message + "\n" + entry_long_TP2_alert_message

//entry_long_limit_alert_message = pineconnector_licence_ID + ",buystop," + syminfo.ticker + ",price=" + str.tostring(buy_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Long) + ",sl=" + str.tostring(final_SL_Long)

//entry_short_market_alert_message = pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + (use_tp1 ? ",tp=" + str.tostring(final_TP1_Short) : "")

// + (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "")

//entry_short_limit_alert_message = pineconnector_licence_ID + ",sellstop," + syminfo.ticker + ",price=" + str.tostring(sell_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Short) + ",sl=" + str.tostring(final_SL_Short)

string entry_short_limit_alert_message = ""

string entry_short_TP1_alert_message = ""

string entry_short_TP2_alert_message = ""

if use_tp1 and use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_limit_alert_message := entry_short_TP1_alert_message + "\n" + entry_short_TP2_alert_message

long_update_sl_alert_message = pineconnector_licence_ID + ",newsltplong," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Long)

short_update_sl_alert_message = pineconnector_licence_ID + ",newsltpshort," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Short)

cancel_long = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

cancel_short = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

close_long = pineconnector_licence_ID + ",closelong," + syminfo.ticker

close_short = pineconnector_licence_ID + ",closeshort," + syminfo.ticker

if bull and strategy.position_size <= 0

alert(close_short, alert.freq_once_per_bar_close)

strategy.entry("Long", strategy.long)

alert(entry_long_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_long_TP2_alert_message, alert.freq_once_per_bar_close)

else if bear and strategy.position_size >= 0

alert(close_long, alert.freq_once_per_bar_close)

strategy.entry("Short", strategy.short)

alert(entry_short_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_short_TP2_alert_message, alert.freq_once_per_bar_close)

if strategy.position_size[1] > 0

if low <= final_SL_Long and use_sl

strategy.close("Long", alert_message = close_long)

else

strategy.exit("Exit TP1 Long", "Long", limit = final_TP1_Long, comment_profit = "Exit TP1 Long", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Long", "Long", limit = final_TP2_Long, comment_profit = "Exit TP2 Long", alert_message = close_long)

if bull_count[1] == 5 and bull_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Long", comment = "1 or more MACDs became bearish", alert_message = close_long)

else if strategy.position_size[1] < 0

if high >= final_SL_Short and use_sl

//strategy.exit("Exit SL Short", "Short", stop = final_SL_Short, comment_loss = "Exit SL Short")

strategy.close("Short", alert_message = close_short)

else

strategy.exit("Exit TP1 Short", "Short", limit = final_TP1_Short, comment_profit = "Exit TP1 Short", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Short", "Short", limit = final_TP2_Short, comment_profit = "Exit TP2 Short")

if bear_count[1] == 5 and bear_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Short", comment = "1 or more MACDs became bullish", alert_message = close_short)

// # ========================================================================= #

// # | Logs |

// # ========================================================================= #

// if bull and strategy.position_size <= 0

// log.info(entry_long_limit_alert_message)

// else if bear and strategy.position_size >= 0

// log.info(entry_short_limit_alert_message)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #

if (strategy.position_size > 0 and strategy.position_size[1] <= 0)

or (strategy.position_size < 0 and strategy.position_size[1] >= 0)

//is_TP1_REACHED := false

SL_BE_REACHED := false

- Estratégia de negociação quantitativa baseada em múltiplos indicadores

- Diferença de preços e tendência na sequência da estratégia de negociação

- Breakout Scalper - Capturando mudanças de tendência rapidamente

- Estratégia de acompanhamento cruzado da EMA

- Estratégia de ruptura do canal SSL com perda de parada de rastreamento

- Estratégia de acompanhamento do ímpeto da CCI

- Estratégia de negociação de ruptura de acumulação gradual

- Estratégia dinâmica de direção das velas

- RSI Divergência Estratégia de negociação

- Estratégia de tendência de curto prazo baseada em decisões com múltiplos indicadores

- Estratégia de cruzamento de média móvel dupla

- ATR Adjustable Trailing Stop Loss Strategy

- Estratégia de filtro de tendência de média móvel dupla

- Estratégia de stop loss para o seguimento do gradiente

- Bollinger Bands e estratégia dos indicadores RSI

- estratégia de negociação a curto prazo

- Tendência da Linha de Balanço de Ichimoku após a Estratégia

- Estratégia de ruptura do duplo spread da EMA

- Contrarian Breakout Trading Strategy (Estratégia de negociação de ruptura contrária)

- Williams VIX Fix Estratégia