Índice de Fluxo de Dinheiro Estratégia de 5 minutos através do tempo e do espaço

Autora:ChaoZhang, Data: 2024-01-23 14:46:55Tags:

Resumo

Esta é uma estratégia quantitativa simples que usa o Índice de Fluxo de Dinheiro para identificar os "grandes tubarões" no mercado.

Princípio da estratégia

A estratégia usa um Índice de Fluxo de Dinheiro de 3 períodos com um nível de sobrecompra definido em 100 e um nível de sobrevenda definido em 0. A estratégia espera que o Índice de Fluxo de Dinheiro atinja níveis de sobrecompra, indicando a presença de

Uma entrada longa é tomada quando o Índice de Fluxo de Dinheiro = 100 e a próxima vela é uma vela alta com mechas curtas.

A lógica acima pode ser usada de forma espelhada para tomar entradas curtas também.

Vantagens da estratégia

-

Usando o Índice de Fluxo de Dinheiro pode identificar efetivamente o comportamento de acumulação por "grandes tubarões" no mercado, ações com potencial de continuação.

-

Os filtros de velas ajudam a confirmar quebras mais fortes, evitando muitas quebras falsas.

-

O filtro SMA evita comprar tendências decrescentes, reduzindo efetivamente o risco.

-

As saídas baseadas em tempo de 60 minutos bloqueiam rapidamente os lucros, reduzindo os drawdowns.

Riscos da Estratégia

-

O Índice de Fluxo de Dinheiro pode gerar sinais falsos, levando a perdas desnecessárias.

-

As saídas de 60 minutos podem ser muito agressivas para ações de alta volatilidade.

-

A estratégia deve ser suspensa até que os mercados se estabilizem.

Oportunidades de melhoria

-

Teste diferentes combinações de parâmetros, como comprimento da IFM, períodos SMA, etc.

-

Adicione outros indicadores como Bandas de Bollinger, RSI para melhorar a precisão do sinal.

-

A expansão do teste pára para permitir metas de lucro maiores.

-

Desenvolver versões para outros prazos como 15 ou 30 minutos com base nos mesmos princípios.

Conclusão

A estratégia é simples e fácil de entender, alinhando-se com a abordagem clássica de rastreamento de "grandes tubarões".

O prazo de 60 minutos permite lucros rápidos, mas também introduz um risco maior.

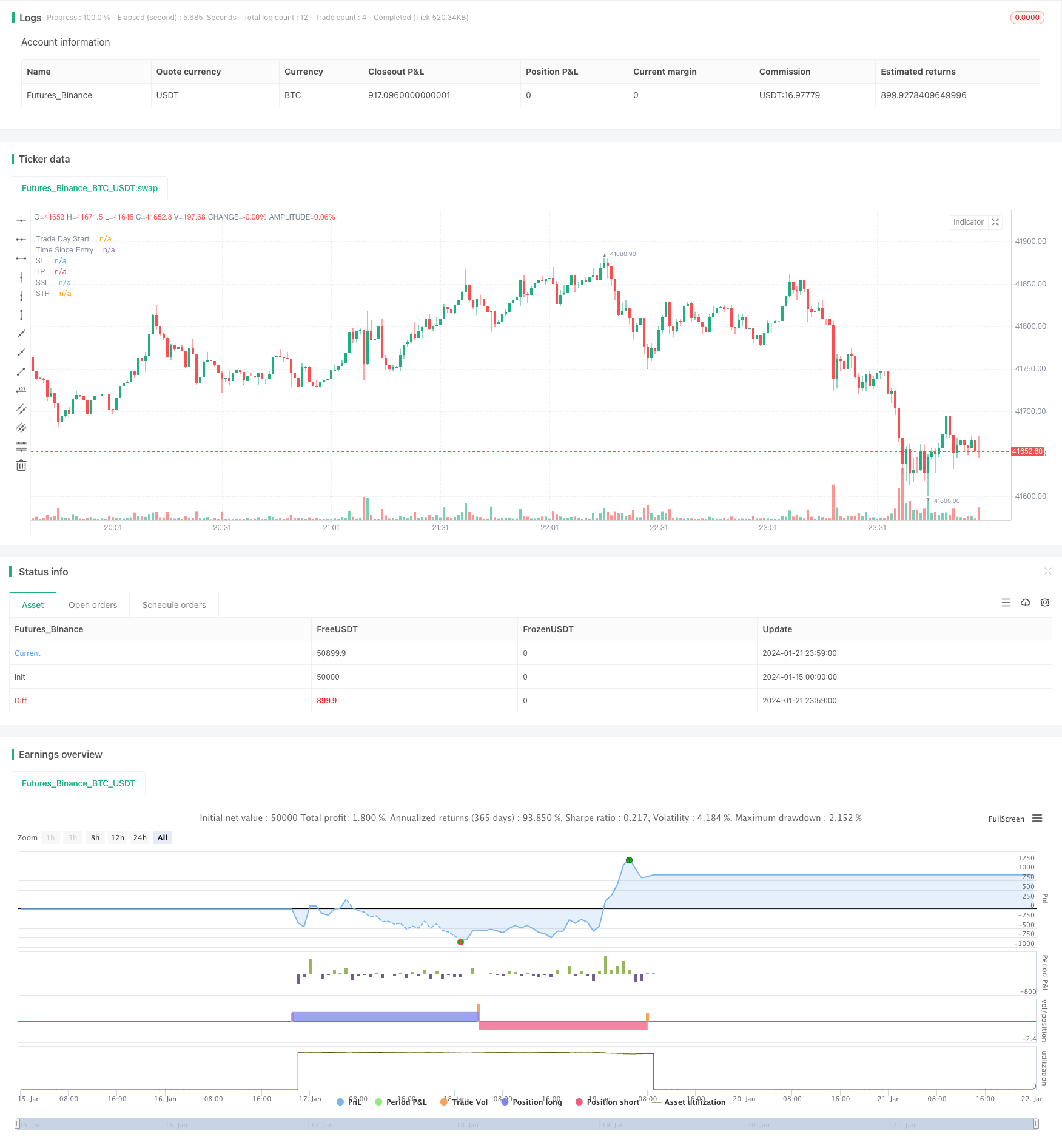

/*backtest

start: 2024-01-15 00:00:00

end: 2024-01-22 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// From "Crypto Day Trading Strategy" PDF file.

// * I'm using a SMA filter to avoid buying when the price is declining. Time frame was better at 15 min according to my test.

// 1 - Apply the 3 period Money Flow Index indicator to the 5 minute chart, using 0 and 100 as our oversold and overbought boundaries

// 2 - Wait for the MFI to reach overbought levels, that indicates the presence of "big sharks" in the market. Price needs to hold up

// the first two MFI overbought occurrences of the day to be considered as a bullish entry signal.*

// 3 - We buy when the MFI = 100 and the next candle is a bullish candle with short wicks.

// 4 - We place our Stop Loss below the low of the trading day and we Take Profit during the first 60 minutes after taking the trade.

// The logic above can be used in a mirrored fashion to take short entries, this is a custom parameter that can be modified from

// the strategy Inputs panel.

// © tweakerID

//@version=4

strategy("Money Flow Index 5 min Strategy",

overlay=true )

direction = input(0, title = "Strategy Direction", type=input.integer, minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

/////////////////////// STRATEGY INPUTS ////////////////////////////////////////

title1=input(true, "-----------------Strategy Inputs-------------------")

i_MFI = input(3, title="MFI Length")

OB=input(100, title="Overbought Level")

OS=input(0, title="Oversold Level")

barsizeThreshold=input(.5, step=.05, minval=.1, maxval=1, title="Bar Body Size, 1=No Wicks")

i_MAFilter = input(true, title="Use MA Trend Filter")

i_MALen = input(80, title="MA Length")

i_timedexit=input(false, title="Use 60 minutes exit rule")

short=input(true, title="Use Mirrored logic for Shorts")

/////////////////////// BACKTESTER /////////////////////////////////////////////

title2=input(true, "-----------------General Inputs-------------------")

// Backtester General Inputs

i_SL=input(true, title="Use Stop Loss and Take Profit")

i_SLType=input(defval="Strategy Stop", title="Type Of Stop", options=["Strategy Stop", "Swing Lo/Hi", "ATR Stop"])

i_SPL=input(defval=10, title="Swing Point Lookback")

i_PercIncrement=input(defval=3, step=.1, title="Swing Point SL Perc Increment")*0.01

i_ATR = input(14, title="ATR Length")

i_ATRMult = input(5, step=.1, title="ATR Multiple")

i_TPRRR = input(2.2, step=.1, title="Take Profit Risk Reward Ratio")

TS=input(false, title="Trailing Stop")

// Bought and Sold Boolean Signal

bought = strategy.position_size > strategy.position_size[1]

or strategy.position_size < strategy.position_size[1]

// Price Action Stop and Take Profit

LL=(lowest(i_SPL))*(1-i_PercIncrement)

HH=(highest(i_SPL))*(1+i_PercIncrement)

LL_price = valuewhen(bought, LL, 0)

HH_price = valuewhen(bought, HH, 0)

entry_LL_price = strategy.position_size > 0 ? LL_price : na

entry_HH_price = strategy.position_size < 0 ? HH_price : na

tp=strategy.position_avg_price + (strategy.position_avg_price - entry_LL_price)*i_TPRRR

stp=strategy.position_avg_price - (entry_HH_price - strategy.position_avg_price)*i_TPRRR

// ATR Stop

ATR=atr(i_ATR)*i_ATRMult

ATRLong = ohlc4 - ATR

ATRShort = ohlc4 + ATR

ATRLongStop = valuewhen(bought, ATRLong, 0)

ATRShortStop = valuewhen(bought, ATRShort, 0)

LongSL_ATR_price = strategy.position_size > 0 ? ATRLongStop : na

ShortSL_ATR_price = strategy.position_size < 0 ? ATRShortStop : na

ATRtp=strategy.position_avg_price + (strategy.position_avg_price - LongSL_ATR_price)*i_TPRRR

ATRstp=strategy.position_avg_price - (ShortSL_ATR_price - strategy.position_avg_price)*i_TPRRR

// Strategy Stop

DayStart = time == timestamp("UTC", year, month, dayofmonth, 0, 0, 0)

plot(DayStart ? 1e9 : na, style=plot.style_columns, color=color.silver, transp=80, title="Trade Day Start")

float LongStop = valuewhen(DayStart,low,0)*(1-i_PercIncrement)

float ShortStop = valuewhen(DayStart,high,0)*(1+i_PercIncrement)

float StratTP = strategy.position_avg_price + (strategy.position_avg_price - LongStop)*i_TPRRR

float StratSTP = strategy.position_avg_price - (ShortStop - strategy.position_avg_price)*i_TPRRR

/////////////////////// STRATEGY LOGIC /////////////////////////////////////////

MFI=mfi(close,i_MFI)

barsize=high-low

barbodysize=close>open?(open-close)*-1:(open-close)

shortwicksbar=barbodysize>barsize*barsizeThreshold

SMA=sma(close, i_MALen)

MAFilter=close > SMA

timesinceentry=(time - valuewhen(bought, time, 0)) / 60000

timedexit=timesinceentry == 60

BUY = MFI[1] == OB and close > open and shortwicksbar and (i_MAFilter ? MAFilter : true)

bool SELL = na

if short

SELL := MFI[1] == OS and close < open and shortwicksbar and (i_MAFilter ? not MAFilter : true)

//Debugging Plots

plot(timesinceentry, transp=100, title="Time Since Entry")

//Trading Inputs

DPR=input(true, "Allow Direct Position Reverse")

reverse=input(false, "Reverse Trades")

// Entries

if reverse

if not DPR

strategy.entry("long", strategy.long, when=SELL and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=BUY and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=SELL)

strategy.entry("short", strategy.short, when=BUY)

else

if not DPR

strategy.entry("long", strategy.long, when=BUY and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=SELL and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=BUY)

strategy.entry("short", strategy.short, when=SELL)

if i_timedexit

strategy.close_all(when=timedexit)

SL= i_SLType == "Swing Lo/Hi" ? entry_LL_price : i_SLType == "ATR Stop" ? LongSL_ATR_price : LongStop

SSL= i_SLType == "Swing Lo/Hi" ? entry_HH_price : i_SLType == "ATR Stop" ? ShortSL_ATR_price : ShortStop

TP= i_SLType == "Swing Lo/Hi" ? tp : i_SLType == "ATR Stop" ? ATRtp : StratTP

STP= i_SLType == "Swing Lo/Hi" ? stp : i_SLType == "ATR Stop" ? ATRstp : StratSTP

//TrailingStop

dif=(valuewhen(strategy.position_size>0 and strategy.position_size[1]<=0, high,0))

-strategy.position_avg_price

trailOffset = strategy.position_avg_price - SL

var tstop = float(na)

if strategy.position_size > 0

tstop := high- trailOffset - dif

if tstop<tstop[1]

tstop:=tstop[1]

else

tstop := na

StrailOffset = SSL - strategy.position_avg_price

var Ststop = float(na)

Sdif=strategy.position_avg_price-(valuewhen(strategy.position_size<0

and strategy.position_size[1]>=0, low,0))

if strategy.position_size < 0

Ststop := low+ StrailOffset + Sdif

if Ststop>Ststop[1]

Ststop:=Ststop[1]

else

Ststop := na

strategy.exit("TP & SL", "long", limit=TP, stop=TS? tstop : SL, when=i_SL)

strategy.exit("TP & SL", "short", limit=STP, stop=TS? Ststop : SSL, when=i_SL)

/////////////////////// PLOTS //////////////////////////////////////////////////

plot(i_SL and strategy.position_size > 0 and not TS ? SL : i_SL and strategy.position_size > 0 and TS ? tstop : na , title='SL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size < 0 and not TS ? SSL : i_SL and strategy.position_size < 0 and TS ? Ststop : na , title='SSL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size > 0 ? TP : na, title='TP', style=plot.style_cross, color=color.green)

plot(i_SL and strategy.position_size < 0 ? STP : na, title='STP', style=plot.style_cross, color=color.green)

// Draw price action setup arrows

plotshape(BUY ? 1 : na, style=shape.triangleup, location=location.belowbar,

color=color.green, title="Bullish Setup", size=size.auto)

plotshape(SELL ? 1 : na, style=shape.triangledown, location=location.abovebar,

color=color.red, title="Bearish Setup", size=size.auto)

- Estratégia de negociação de inversão de tendência de múltiplos indicadores

- Estratégia de dupla diferença entre Bitcoin e Ouro

- Estratégia de cruzamento do MACD e do RSI

- Estratégia de recuperação de impulso

- Estratégia de cruzamento da média móvel

- Estratégia de grelha de lucros com oscilação

- Estratégia de avanço da oscilação baseada na média móvel

- Segmentação do valor de mercado

- Estratégia de rastreamento da volatilidade e da tendência através de prazos baseada no Williams VIX e no DEMA

- Estratégia de ruptura de momento baseada no julgamento do ciclo com médias móveis

- Estratégia de negociação de dupla EMA de tendência cruzada

- Estratégia de negociação de otimização MACD dinâmica

- Estratégia de combinação de VWAP e RSI

- A estratégia de negociação de bandas de Bollinger de Deus RSI

- Estratégia de negociação de curto prazo baseada no canal EMA e no MACD

- Estratégia de cruzamento do Índice de Impulso e Medo

- Estratégia automática de negociação longa/curta baseada em pontos pivô diários

- Estratégia de negociação quantitativa de média móvel tripla

- Uma estratégia de cruzamento de impulso baseada em média móvel exponencial

- Estratégia de negociação cruzada de média móvel adaptativa e média móvel ponderada