Estratégia de acompanhamento dos preços oscilantes com indicador duplo de MA

Autora:ChaoZhang, Data: 2024-02-05 12:10:18Tags:

A estratégia é chamada de

Estratégia geral: A estratégia constrói três grupos de linhas de indicadores MA com parâmetros diferentes, representando as tendências rápidas, médias e lentas do mercado. Enquanto isso, os indicadores de filtro são usados para filtrar sinais falsos e formar a base para julgamentos longos e curtos. A estratégia tem diversos métodos de otimização e filtragem lógica, usando indicadores técnicos como cruzamento de média móvel, RSI sobrecomprado e sobrevendido e breakouts de Bollinger Bands para julgamento composto. Pode determinar efetivamente os pontos de compra e venda de extremos de preço e capturar tendências oscilantes, reduzindo os riscos do mercado. A estratégia tem vantagens significativas.

Princípios de estratégia:

- Estabelecer um grupo de três linhas de indicadores MA rápidas (21 períodos), médias (55 períodos) e lentas (89 períodos) que representem níveis médios de preços de diferentes períodos de tempo;

- Determinar se a tendência actual está numa fase ascendente ou descendente julgando a relação de arranjo das três linhas de indicadores MA (rápidas > médias > lentas ou rápidas < médias < lentas);

- Ajudar com julgamentos como o SuperTrend para aumentar a precisão do sinal;

- Emissão de sinais de compra/venda com base em alterações no estado desses sinais e indicadores de filtro.

Vantagens da Estratégia:

- Usar múltiplas combinações de MA para avaliar as tendências de mercado a longo e curto prazo para obter avaliações mais precisas;

- Adotar métodos de filtragem múltipla para otimizar a seleção dos pontos de compra e venda e aumentar a probabilidade de lucro;

- Aplicar indicadores técnicos como as bandas de Bollinger e o RSI para auxiliar os breakouts e captar os principais níveis de suporte e oportunidades de reversão;

- Selecionar a direção de compra e venda de acordo com a mudança de direção da MA rápida sem a necessidade de ser ganancioso por reversões, perseguir tendências oscilantes e obter lucros;

- Os sinais de negociação apresentados claramente através de setas e marcas visíveis, fáceis de compreender e convenientes de operar.

Riscos e prevenção:

- As estratégias de MA têm uma resistência mais fraca às probabilidades de falha de ruptura;

- Podem existir diferenças de tempo entre os indicadores combinados, o que leva a riscos de sinal atrasado;

- Após uma compra de ruptura, é necessário um julgamento mais aprofundado da força do mercado subsequente para evitar ser preso;

- Considere adicionar stop loss e take profit na negociação ao vivo para controlar a perda máxima por negociação.

Optimização da estratégia:

- Ensaiar diferentes tipos e parâmetros de MA para encontrar a combinação ideal;

- Melhorar os módulos de avaliação da reversão, como a melhoria da utilização do indicador KD;

- Incorporar indicadores de volume de negociação para determinar as verdadeiras tendências;

- Expandir os indicadores BIAS para determinar as áreas de sobrecompra e sobrevenda.

Conclusão:

No mercado de criptomoedas em constante flutuação, esta estratégia aproveita a oportunidade para fazer negociações frequentes durante os altos e baixos das ondas de mercado. Ao definir os indicadores de MA e julgamentos de filtragem auxiliares para alternar entre posições longas e curtas, ele capta o momento chave de reversão do mercado. Também pode ser otimizado adicionando módulos de stop loss para reduzir perdas individuais e obter retornos positivos de longo prazo através da automação da estratégia.

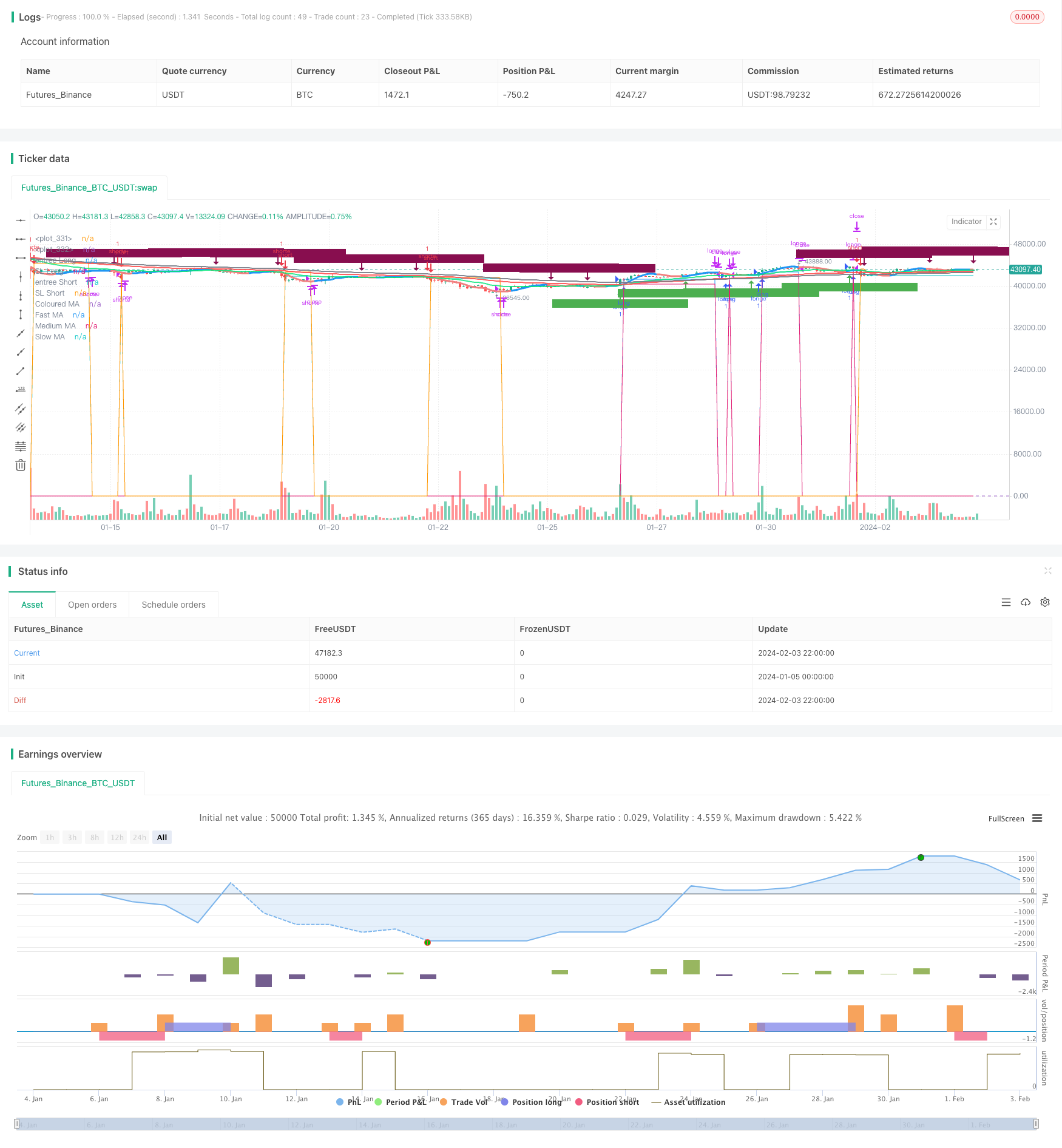

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// Bannos

// #NotTradingAdvice #DYOR

// Disclaimer.

// I AM NOT A FINANCIAL ADVISOR.

// THESE IDEAS ARE NOT ADVICE AND ARE FOR EDUCATION PURPOSES ONLY.

// ALWAYS DO YOUR OWN RESEARCH

//

// Author: Adaptation from JustUncleL Big Snapper by Bannos

// Date: May-2022

// Version: R1.0

//Description of this addon - Script using several new conditions to give Long/short and SL levels which was not proposed in the Big Snapper strategy "Big Snapper Alerts R3.0"

//"

//This strategy is based on the use of the Big Snapper outputs from the JustUncleL script and the addition of several conditions to define filtered conditions selecting signal synchrones with a trend and a rise of the volatility.

//Also the strategy proposes to define proportional stop losses and dynamic Take profit using an RSI strategy.

// After delivering the temporary ong/short signal and ploting a green or purple signal, several conditions are defined to consider a Signal is Long or short.

//Let s take the long signal as example(this is the same process with the opposite values for a short).

//step 1 - Long Definition:

// Snapper long signal stored in the buffer variable Longbuffer to say that in a close future, we could have all conditions for a long

// Now we need some conditions to combine with it:

//the second one is to be over the Ma_medium(55)

//and because this is not selective enough, the third one is a Volatility indicator "Chaikin Volatility" indicator giving an indication about the volatility of the price compared to the 10 last values

// -> Using the volatility indicator gives the possibility to increase the potential rise if the volatility is higher compared to the last periods.

//With these 3 signals, we get a robust indication about a potential long signal which is then stored in the variable "Longe"

//Now we have a long signal and can give a long signal with its Stop Loss

// The Long Signal is automatically given as the 3 conditions above are satisfied.

// The Stop loss is a function of the last Candle sizes giving a stop below the 70% of the overall candle which can be assimilated to a Fibonacci level. Below this level it makes sense to stop the trade as the chance to recover the complete Candle is more than 60%

//Now we are in an open Long and can use all the mentioned Stop loss condition but still need a Take Profit condition

//The take profit condition is based on a RSI strategy consisting in taking profit as soon as the RSI come back from the overbought area (which is here defined as a rsi over 70) and reaching the 63.5 level to trigger the Take Profit

//This TP condition is only active when Long is active and when an entry value as been defined.

//Entry and SL level appreas as soon as a Long or short arrow signal does appears. The Take profit will be conidtioned to the RSI.

//The final step in the cycle is a reinitialization of all the values giving the possibility to detect and treat any long new signal coming from the Big Snapper signal.

//-------------------------------------------------------------------------------------------------------

strategy(title='Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI', shorttitle='SNAPPER Bannos', overlay=true)

// === INPUTS ===

// Coloured MA - type, length, source

typeColoured = input.string(defval='HullMA', title='Coloured MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenColoured = input.int(defval=18, title='Coloured MA - Length', minval=1)

srcColoured = input(close, title='Coloured MA - Source')

// Fast MA - type, length

typeFast = input.string(defval='EMA', title='Fast MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenFast = input.int(defval=21, title='Fast MA - Length', minval=1)

// Medium MA - type, length

typeMedium = input.string(defval='EMA', title='Medium MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenMedium = input.int(defval=55, title='Medium MA - Length', minval=1)

// Slow MA - type, length

typeSlow = input.string(defval='EMA', title='Slow MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenSlow = input.int(defval=89, title='Slow MA Length', minval=1)

// 3xMA source

ma_src = input(close, title='3xMA and Bollinger Source')

//

filterOption = input.string('SuperTrend', title='Signal Filter Option : ', options=['3xMATrend', 'SuperTrend', 'SuperTrend+3xMA', 'ColouredMA', 'No Alerts', 'MACross', 'MACross+ST', 'MACross+3xMA', 'OutsideIn:MACross', 'OutsideIn:MACross+ST', 'OutsideIn:MACross+3xMA'])

//

hideMALines = input(false)

hideSuperTrend = input(true)

hideBollingerBands = input(true)

hideTrendDirection = input(true)

//

disableFastMAFilter = input(false)

disableMediumMAFilter = input(false)

disableSlowMAFilter = input(false)

//

uKC = false // input(false,title="Use Keltner Channel (KC) instead of Bollinger")

bbLength = input.int(20, minval=2, step=1, title='Bollinge Bands Length')

bbStddev = input.float(2.0, minval=0.5, step=0.1, title='Bollinger Bands StdDevs')

oiLength = input(8, title='Bollinger Outside In LookBack')

//

SFactor = input.float(3.618, minval=1.0, title='SuperTrend Factor')

SPd = input.int(5, minval=1, title='SuperTrend Length')

//

buyColour_ = input.string('Green', title='BUY Marker Colour: ', options=['Green', 'Lime', 'Aqua', 'DodgerBlue', 'Gray', 'Yellow'])

sellColour_ = input.string('Maroon', title='SELL Marker Colour: ', options=['Maroon', 'Red', 'Fuchsia', 'Blue', 'Black', 'Orange'])

// --- Allocate Correct Filtering Choice

// Can only be one choice

uSuperTrendFilter = filterOption == 'SuperTrend' ? true : false

u3xMATrendFilter = filterOption == '3xMATrend' ? true : false

uBothTrendFilters = filterOption == 'SuperTrend+3xMA' ? true : false

//uOIFilter = filterOption == "OutsideIn:ClrMA" ? true : false

uOIMACrossFilter = filterOption == 'OutsideIn:MACross' ? true : false

uOI3xMAFilter = filterOption == 'OutsideIn:MACross+3xMA' ? true : false

uOISTFilter = filterOption == 'OutsideIn:MACross+ST' ? true : false

uMACrossFilter = filterOption == 'MACross' ? true : false

uMACrossSTFilter = filterOption == 'MACross+ST' ? true : false

uMACross3xMAFilter = filterOption == 'MACross+3xMA' ? true : false

// unless all 3 MAs disabled.

disable3xMAFilter = disableFastMAFilter and disableMediumMAFilter and disableSlowMAFilter

u3xMATrendFilter := disable3xMAFilter ? false : u3xMATrendFilter

// if no filters selected then must be "No Filters" option

disableAllFilters = u3xMATrendFilter or uSuperTrendFilter or uBothTrendFilters or uOI3xMAFilter or uOISTFilter or uOIMACrossFilter or uMACrossFilter or uMACrossSTFilter or uMACross3xMAFilter ? false : true

// if "No Alerts" option selected, then disable all selections

disableAllFilters := filterOption == 'No Alerts' ? false : disableAllFilters

uSuperTrendFilter := filterOption == 'No Alerts' ? false : uSuperTrendFilter

u3xMATrendFilter := filterOption == 'No Alerts' ? false : u3xMATrendFilter

uBothTrendFilters := filterOption == 'No Alerts' ? false : uBothTrendFilters

//uOIFilter := filterOption == "No Alerts"? false : uOIFilter

uOIMACrossFilter := filterOption == 'No Alerts' ? false : uOIMACrossFilter

uOI3xMAFilter := filterOption == 'No Alerts' ? false : uOI3xMAFilter

uOISTFilter := filterOption == 'No Alerts' ? false : uOISTFilter

uMACrossFilter := filterOption == 'No Alerts' ? false : uMACrossFilter

uMACrossSTFilter := filterOption == 'No Alerts' ? false : uMACrossSTFilter

uMACross3xMAFilter := filterOption == 'No Alerts' ? false : uMACross3xMAFilter

// --- CONSTANTS ---

dodgerblue = #1E90FF

lightcoral = #F08080

buyColour = color.green // for big Arrows, must be a constant.

sellColour = color.maroon // for big Arrows

// Colour Selectable for Big Fat Bars.

buyclr = buyColour_ == 'Lime' ? color.lime : buyColour_ == 'Aqua' ? color.aqua : buyColour_ == 'DodgerBlue' ? dodgerblue : buyColour_ == 'Gray' ? color.gray : buyColour_ == 'Yellow' ? color.yellow : color.green

sellclr = sellColour_ == 'Red' ? color.red : sellColour_ == 'Fuchsia' ? color.fuchsia : sellColour_ == 'Blue' ? color.blue : sellColour_ == 'Black' ? color.black : sellColour_ == 'Orange' ? color.orange : color.maroon

// === /INPUTS ===

// === FUNCTIONS ===

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = ta.sma(src, len) // Simple

v2 = ta.ema(src, len) // Exponential

v3 = ta.wma(src, len) // Weighted

v4 = ta.vwma(src, len) // Volume Weighted

v5 = 0.0

sma_1 = ta.sma(src, len) // Smoothed

v5 := na(v5[1]) ? sma_1 : (v5[1] * (len - 1) + src) / len

v6 = 2 * v2 - ta.ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ta.ema(v2, len)) + ta.ema(ta.ema(v2, len), len) // Triple Exponential

v8 = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len))) // Hull WMA = (2*WMA (n/2) − WMA (n)), sqrt (n))

v11 = ta.sma(ta.sma(src, len), len) // Triangular

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = math.exp(-1.414 * 3.14159 / len)

b1 = 2 * a1 * math.cos(1.414 * 3.14159 / len)

c2 = b1

c3 = -a1 * a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1 * (src + nz(src[1])) / 2 + c2 * nz(v9[1]) + c3 * nz(v9[2])

// Zero Lag Exponential

e = ta.ema(v1, len)

v10 = v1 + v1 - e

// return variant, defaults to SMA if input invalid.

type == 'EMA' ? v2 : type == 'WMA' ? v3 : type == 'VWMA' ? v4 : type == 'SMMA' ? v5 : type == 'DEMA' ? v6 : type == 'TEMA' ? v7 : type == 'HullMA' ? v8 : type == 'SSMA' ? v9 : type == 'ZEMA' ? v10 : type == 'TMA' ? v11 : v1

// === /FUNCTIONS ===

// === SERIES VARIABLES ===

// MA's

ma_fast = variant(typeFast, ma_src, lenFast)

ma_medium = variant(typeMedium, ma_src, lenMedium)

ma_slow = variant(typeSlow, ma_src, lenSlow)

ma_coloured = variant(typeColoured, srcColoured, lenColoured)

// Get Direction of Coloured Moving Average

clrdirection = 1

falling_1 = ta.falling(ma_coloured, 2)

clrdirection := ta.rising(ma_coloured, 2) ? 1 : falling_1 ? -1 : nz(clrdirection[1], 1)

// get 3xMA trend direction based on selections.

madirection = ma_fast > ma_medium and ma_medium > ma_slow ? 1 : ma_fast < ma_medium and ma_medium < ma_slow ? -1 : 0

madirection := disableSlowMAFilter ? ma_fast > ma_medium ? 1 : ma_fast < ma_medium ? -1 : 0 : madirection

madirection := disableMediumMAFilter ? ma_fast > ma_slow ? 1 : ma_fast < ma_slow ? -1 : 0 : madirection

madirection := disableFastMAFilter ? ma_medium > ma_slow ? 1 : ma_medium < ma_slow ? -1 : 0 : madirection

madirection := disableFastMAFilter and disableMediumMAFilter ? ma_coloured > ma_slow ? 1 : -1 : madirection

madirection := disableFastMAFilter and disableSlowMAFilter ? ma_coloured > ma_medium ? 1 : -1 : madirection

madirection := disableSlowMAFilter and disableMediumMAFilter ? ma_coloured > ma_fast ? 1 : -1 : madirection

//

// Supertrend Calculations

SUp = hl2 - SFactor * ta.atr(SPd)

SDn = hl2 + SFactor * ta.atr(SPd)

STrendUp = 0.0

STrendDown = 0.0

STrendUp := close[1] > STrendUp[1] ? math.max(SUp, STrendUp[1]) : SUp

STrendDown := close[1] < STrendDown[1] ? math.min(SDn, STrendDown[1]) : SDn

STrend = 0

STrend := close > STrendDown[1] ? 1 : close < STrendUp[1] ? -1 : nz(STrend[1], 1)

Tsl = STrend == 1 ? STrendUp : STrendDown

// Standard Bollinger or KC Bands

basis = ta.sma(ma_src, bbLength)

rangema = ta.sma(ta.tr, bbLength)

stdev_1 = ta.stdev(ma_src, bbLength)

dev = uKC ? bbStddev * rangema : bbStddev * stdev_1

// Calculate Bollinger or KC Channel

upper = basis + dev

lower = basis - dev

// Lookback for previous highest bar index

noiupper = math.abs(ta.highestbars(oiLength))

noilower = math.abs(ta.lowestbars(oiLength))

// ColouredMA OutsideIn

//oiupper = clrdirection<0 and noiupper>0 and highest(oiLength)>upper[noiupper]? 1 : 0

//oilower = clrdirection>0 and noilower>0 and lowest(oiLength)<lower[noilower]? 1 : 0

// MACross OutsideIN

oiMACrossupper = ta.crossunder(ma_fast, ma_coloured) and noiupper > 0 and ta.highest(oiLength) > upper[noiupper] ? 1 : 0

oiMACrosslower = ta.crossover(ma_fast, ma_coloured) and noilower > 0 and ta.lowest(oiLength) < lower[noilower] ? 1 : 0

// === /SERIES VARIABLES ===

// === PLOTTING ===

// All the MA's

plot(ma_coloured, title='Coloured MA', color=clrdirection < 0 ? lightcoral : color.blue, linewidth=3, transp=20)

plot(hideMALines ? na : ma_fast, title='Fast MA', color=color.new(color.lime, 20), linewidth=2)

plot(hideMALines ? na : ma_medium, title='Medium MA', color=color.new(color.red, 10), linewidth=2)

plot(hideMALines ? na : ma_slow, title='Slow MA', color=color.new(color.gray, 10), linewidth=2)

// show 3xMA Trend Direction State.

dcolour = madirection == 1 ? color.green : madirection == -1 ? color.red : color.yellow

plotshape(hideTrendDirection ? na : madirection, title='3xMA Trend Direction', location=location.bottom, style=shape.square, color=dcolour, transp=10)

// SuperTrend

plot(hideSuperTrend ? na : Tsl, color=STrend == 1 ? color.green : color.maroon, style=plot.style_line, linewidth=2, title='SuperTrend')

// Bollinger Bands

p1 = plot(hideBollingerBands ? na : upper, title='BB upper', color=color.new(dodgerblue, 20), linewidth=1)

p2 = plot(hideBollingerBands ? na : lower, title='BB lower', color=color.new(dodgerblue, 20), linewidth=1)

fill(p1, p2, color=color.new(dodgerblue, 96), title='BB fill')

// === /PLOTTING ===

// === ALERTING ===

// 3xMA Filtering

_3xmabuy = 0

_3xmasell = 0

_3xmabuy := clrdirection == 1 and close > ma_fast and madirection == 1 ? nz(_3xmabuy[1]) + 1 : clrdirection == 1 and madirection == 1 ? nz(_3xmabuy[1]) > 0 ? nz(_3xmabuy[1]) + 1 : 0 : 0

_3xmasell := clrdirection == -1 and close < ma_fast and madirection == -1 ? nz(_3xmasell[1]) + 1 : clrdirection == -1 and madirection == -1 ? nz(_3xmasell[1]) > 0 ? nz(_3xmasell[1]) + 1 : 0 : 0

//

// SuperTrend Filtering

stbuy = 0

stsell = 0

stbuy := clrdirection == 1 and STrend == 1 ? nz(stbuy[1]) + 1 : 0

stsell := clrdirection == -1 and STrend == -1 ? nz(stsell[1]) + 1 : 0

//

// 3xMA & SuperTrend Filtering

//

st3xmabuy = 0

st3xmasell = 0

st3xmabuy := (disable3xMAFilter or _3xmabuy > 0) and stbuy > 0 ? nz(st3xmabuy[1]) + 1 : 0

st3xmasell := (disable3xMAFilter or _3xmasell > 0) and stsell > 0 ? nz(st3xmasell[1]) + 1 : 0

// Bollinger Outside In using ColuredMA direction Filter.

//oibuy = 0

//oisell = 0

//oibuy := clrdirection == 1 and oilower==1? nz(oibuy[1])+1 : 0

//oisell := clrdirection ==-1 and oiupper==1? nz(oisell[1])+1 : 0

// Bollinger Outside In using MACross signal Filter

oiMACrossbuy = 0

oiMACrosssell = 0

oiMACrossbuy := oiMACrosslower == 1 ? nz(oiMACrossbuy[1]) + 1 : 0

oiMACrosssell := oiMACrossupper == 1 ? nz(oiMACrosssell[1]) + 1 : 0

// Bollinger Outside In + 3xMA Filter

oi3xmabuy = 0

oi3xmasell = 0

oi3xmabuy := oiMACrossbuy > 0 and (disable3xMAFilter or madirection == 1) ? nz(oi3xmabuy[1]) + 1 : 0

oi3xmasell := oiMACrosssell > 0 and (disable3xMAFilter or madirection == -1) ? nz(oi3xmasell[1]) + 1 : 0

// Bollinger Outside In + SuperTrend Filter

oistbuy = 0

oistsell = 0

oistbuy := oiMACrossbuy > 0 and STrend == 1 ? nz(oistbuy[1]) + 1 : 0

oistsell := oiMACrosssell > 0 and STrend == -1 ? nz(oistsell[1]) + 1 : 0

// FastMA crossover HullMA and SuperTrend

macrossSTbuy = 0

macrossSTsell = 0

macrossSTbuy := ta.crossover(ma_fast, ma_coloured) and STrend == 1 ? nz(macrossSTbuy[1]) + 1 : 0

macrossSTsell := ta.crossunder(ma_fast, ma_coloured) and STrend == -1 ? nz(macrossSTsell[1]) + 1 : 0

// FastMA crossover HullMA and 3xMA

macross3xMAbuy = 0

macross3xMAsell = 0

macross3xMAbuy := ta.crossover(ma_fast, ma_coloured) and (disable3xMAFilter or madirection == 1) ? nz(macross3xMAbuy[1]) + 1 : 0

macross3xMAsell := ta.crossunder(ma_fast, ma_coloured) and (disable3xMAFilter or madirection == -1) ? nz(macross3xMAsell[1]) + 1 : 0

//

// Check any Alerts set

long = u3xMATrendFilter and _3xmabuy == 1 or uSuperTrendFilter and stbuy == 1 or uBothTrendFilters and st3xmabuy == 1 or uOI3xMAFilter and oi3xmabuy == 1 or uOISTFilter and oistbuy == 1 or uOIMACrossFilter and oiMACrossbuy == 1 or uMACrossSTFilter and macrossSTbuy == 1 or uMACross3xMAFilter and macross3xMAbuy == 1

short = u3xMATrendFilter and _3xmasell == 1 or uSuperTrendFilter and stsell == 1 or uBothTrendFilters and st3xmasell == 1 or uOI3xMAFilter and oi3xmasell == 1 or uOISTFilter and oistsell == 1 or uOIMACrossFilter and oiMACrosssell == 1 or uMACrossSTFilter and macrossSTsell == 1 or uMACross3xMAFilter and macross3xMAsell == 1

//

// If Alert Detected, then Draw Big fat liner

plotshape(long ? long : na, title='Long Line Marker', location=location.belowbar, style=shape.arrowup, color=buyclr, size=size.auto, text='████████████████', textcolor=buyclr, transp=20)

plotshape(short ? short : na, title='Short Line Marker', location=location.abovebar, style=shape.arrowdown, color=sellclr, size=size.auto, text='████████████████', textcolor=sellclr, transp=20)

// --- Arrow style signals

// No Filters only Hull Signals

hbuy = 0

hsell = 0

hbuy := clrdirection == 1 ? nz(hbuy[1]) + 1 : 0

hsell := clrdirection == -1 ? nz(hsell[1]) + 1 : 0

// FastMA crossover HullMA

macrossbuy = 0

macrosssell = 0

macrossbuy := ta.crossover(ma_fast, ma_coloured) ? nz(macrossbuy[1]) + 1 : 0

macrosssell := ta.crossunder(ma_fast, ma_coloured) ? nz(macrosssell[1]) + 1 : 0

//

along = disableAllFilters and hbuy == 1 or uMACrossFilter and macrossbuy == 1

ashort = disableAllFilters and hsell == 1 or uMACrossFilter and macrosssell == 1

//

// If ColouredMA or MACross then draw big arrows

plotarrow(along ? 1 : ashort ? -1 : na, title='ColouredMA or MACross Arrow', colorup=color.new(buyColour, 20), colordown=color.new(sellColour, 20), maxheight=100, minheight=50)

//----------Input Bannos----------------------------------------------------------------------------------------------------------//

var triggerlong = 0

var triggershort = 0

var up = 0

var down = 0

var bool longe = 0

var bool shorte = 0

var SL = 0

var entryvalueup = 0.00

var entryvaluedown = 0.00

var SLfactor = 0.5/100

var SLup = 0.00

var SLdown = 0.00

var longbuffer = 0

var shortbuffer = 0

//RSI parameters

overbought = input(70, title="overbought value")

oversold = input(30, title="oversold value")

sellRsi = ta.rsi(close, 11) > overbought

buyRsi = ta.rsi(close, 11) < oversold

var tampon_overbought = 0

var tampon_oversold = 0

//condition to use RSI

if sellRsi

tampon_overbought := 1

if buyRsi

tampon_oversold := 1

//close condition SL

if entryvalueup > 0 and low < SLup

SL := 1

//Chaikin Volatility Strategy indicator if Volatility > 0 then Long or short, otherweise no

Length = input.int(10, '', minval=1)

ROCLength = input.int(12, '',minval=1)

Trigger = input.int(0, '',minval=0)

hline(0)

hline(Trigger)

xPrice1 = high

xPrice2 = low

xPrice = xPrice1 - xPrice2

xROC_EMA = ta.roc(ta.ema(xPrice, Length), ROCLength)

var pos = 0

if xROC_EMA < Trigger

pos := 1

nz(pos[1], 0)

if xROC_EMA > Trigger

pos := -1

nz(pos[1], 0)

//-----------------------------------------------------------------------------

// plot(xROC_EMA, title="Chaikin Volatility Strategy")

// plot(longe ? 1 : 0, 'longe')

// plot(shorte ? 1 : 0, 'shorte')

plot(entryvalueup, 'entree Long')

plot(SLup, 'SL Long')

plot(entryvaluedown, 'entree Short')

plot(SLdown, 'SL Short')

// plot(entryvalueup, 'entrryvalueup')

// plot(entryvaluedown, 'entrryvaluedown')

// plot(up, 'up')

//plot(down, 'down')

// plot(ta.rsi(close, 11), 'RSI')

// plot(tampon_overbought, 'tampon Overbought')

// plot(tampon_oversold, 'tampon Oversold')

// plot( triggerlong, ' triggerlong')

//plot( triggershort, ' triggershort')

// plot(sellRsi ? 1 : 0, 'sellRsi')

//close condition TP

closelong = (tampon_overbought == 1 and ta.rsi(close, 11) < 63.8 or shorte or SL == 1)

closeshort = (tampon_oversold == 1 and ta.rsi(close, 11) > 36.2 or longe or SL == 1)

//reinit after long Close

if closelong

up := 0

longe := 0

tampon_overbought := 0

triggerlong := 0

SL := 0

entryvalueup := 0

SLup := 0

//reinit after short Close

if closeshort

down := 0

shorte := 0

tampon_oversold := 0

triggershort := 0

SL := 0

entryvaluedown := 0

SLdown := 0

//condition sous sur MA SLOW to start

if close < ma_medium

triggerlong := 0

triggershort := 1

if close > ma_medium

triggershort := 0

triggerlong := 1

// Update alarm conditions

if long or along

longbuffer := 1

if short or ashort

shortbuffer := 1

longe := longbuffer and triggerlong and xROC_EMA > 3.5

shorte := shortbuffer and triggershort and xROC_EMA > 3.5

// // var longe = long ? 1 : 0

// // var shorte = short ? 1 : 0

if longe == 1 and close > open

up := 1

down := 0

entryvalueup :=close

SLup := close - 0.7*(high - low)

SLdown := 0

longbuffer := 0

if shorte == 1 and close < open

down := 1

up := 0

entryvaluedown := close

SLdown := close + 0.7*(high - low)

SLup := 0

shortbuffer := 0

strategy.entry('longe', strategy.long, 1, when = up)

strategy.entry('shorte', strategy.short, 1, when = down)

strategy.close('longe', when= closelong)

strategy.close('shorte', when= closeshort)

// === /ALERTING ===

// === ALARMS ===

//

alertcondition(up or down or closelong or closeshort, title='Signal Alert', message='SIGNAL')

alertcondition(up, title='Long Alert', message='LONG')

alertcondition(down, title='Short Alert', message='SHORT')

alertcondition(closelong, title='close Long Alert', message='Close LONG')

alertcondition(closeshort, title='close Short Alert', message='Close SHORT')

// === /ALARMS ===

//EOF

- Tendência cruzada média móvel de acordo com a estratégia

- Estratégia de ruptura de média móvel de pirâmide gradual

- Estratégia de avanço de banda de Bollinger de dupla via

- Estratégia de retestamento de linhas de demarcação futuras

- Estratégia Quant Trading Baseada no Canal SuperTrend

- Teoria da taxa de lucro estratégia de quantificação do índice de volatilidade

- Índice de Força Relativa Estratégia Quântica a Longo Prazo

- Estratégia de paragem de perdas de média móvel dupla de rastreamento

- Estratégia de cruzamento entre RSI e WMA

- Estratégia de tendência cruzada dinâmica da SMA

- Estratégia de negociação quantitativa de média móvel dupla

- Tendência da estratégia quantitativa baseada nos indicadores Hull e LSMA

- Estratégia de cruzamento da média móvel e do RSI

- Estratégia de rastreamento de tendências de filtros de duplo alcance

- Super Tendência Seguindo a Estratégia Baseada em Médias Móveis

- Estratégia de negociação de RSI engulfing Candle

- Uma estratégia de rastreamento de tendências e banda de Bollinger baseada no RSI

- Robusta estratégia de negociação de média móvel dupla

- Estratégia de negociação de breakout de Bollinger Band Momentum

- Estratégia de negociação quantitativa baseada em bandas de média móvel de 5 dias e sinais de compra/venda GBS