Стратегия, основанная на kNN

Автор:Чао Чжан, Дата: 2023-12-08 11:33:31Тэги:

Обзор

Эта стратегия использует алгоритм машинного обучения kNN (k Ближайшие соседи), чтобы предсказать тенденции рынка и генерировать долгие и короткие сигналы соответственно.

Принцип стратегии

-

Собирать данные о обучении: собирать исторические данные, такие как цены закрытия, объемы торговли, а также технические показатели, такие как RSI, CCI с течением времени.

-

Предварительная обработка данных: нормализация показателей в диапазоне 0-100.

-

Подготовка к модели kNN: возьмите текущие две характеристики в модели kNN, вычислите евклидовые расстояния между этими векторами характеристик и историческими, выберите k самых близких соседей на основе расстояний и подсчитайте распределение этих k образцов.

-

Получить прогнозы: сделать прогнозы на текущей тенденции рынка на основе ярлыков k ближайших соседей. Если прогноз является бычьим, генерировать длинный сигнал. Если прогноз является медвежьим, генерировать короткий сигнал.

-

Торговля с использованием стоп-лосса, размещения позиций, фильтров скользящей средней.

Преимущества

-

Автоматическое распознавание технических закономерностей с помощью машинного обучения без ручного вмешательства.

-

Гибкость выбора различных технических показателей в качестве характеристик модели для оптимизации в реальном времени.

-

Интегрирует строгие механизмы управления рисками, такие как стоп-лосс, размещение позиций.

-

Визуализация линий остановки для ясности и интуиции.

Риски и решения

-

В машинном обучении могут существовать ошибки прогнозирования. Методы оптимизации включают корректировку k-значения, векторов характеристик, временного диапазона выборки.

-

Добавить разрешение на двустороннюю торговлю в коде для устранения ошибок.

-

Неправильные настройки параметров могут привести к переоценке.

Руководство по оптимизации

-

Испытать различные типы технических показателей в качестве входных характеристик kNN.

-

Попробуйте другие показатели расстояния, например, расстояние до Манхэттена.

-

Для корректировки размеров позиций используют расстояния выборки или качество классификации.

-

Добавить модель поезда/испытательный раздел для оптимизации проката.

Заключение

Эта стратегия реализует прогноз рыночных тенденций с использованием классического алгоритма kNN и выполняет тренд после торговли на основе предсказательных сигналов. Она имеет регулируемые параметры и контролируемые риски, обеспечивая эффективные автоматизированные торговые решения для пользователей. Пользователи могут постоянно улучшать производительность стратегии путем оптимизации комбинаций технических индикаторов, гиперпараметров моделей и многого другого.

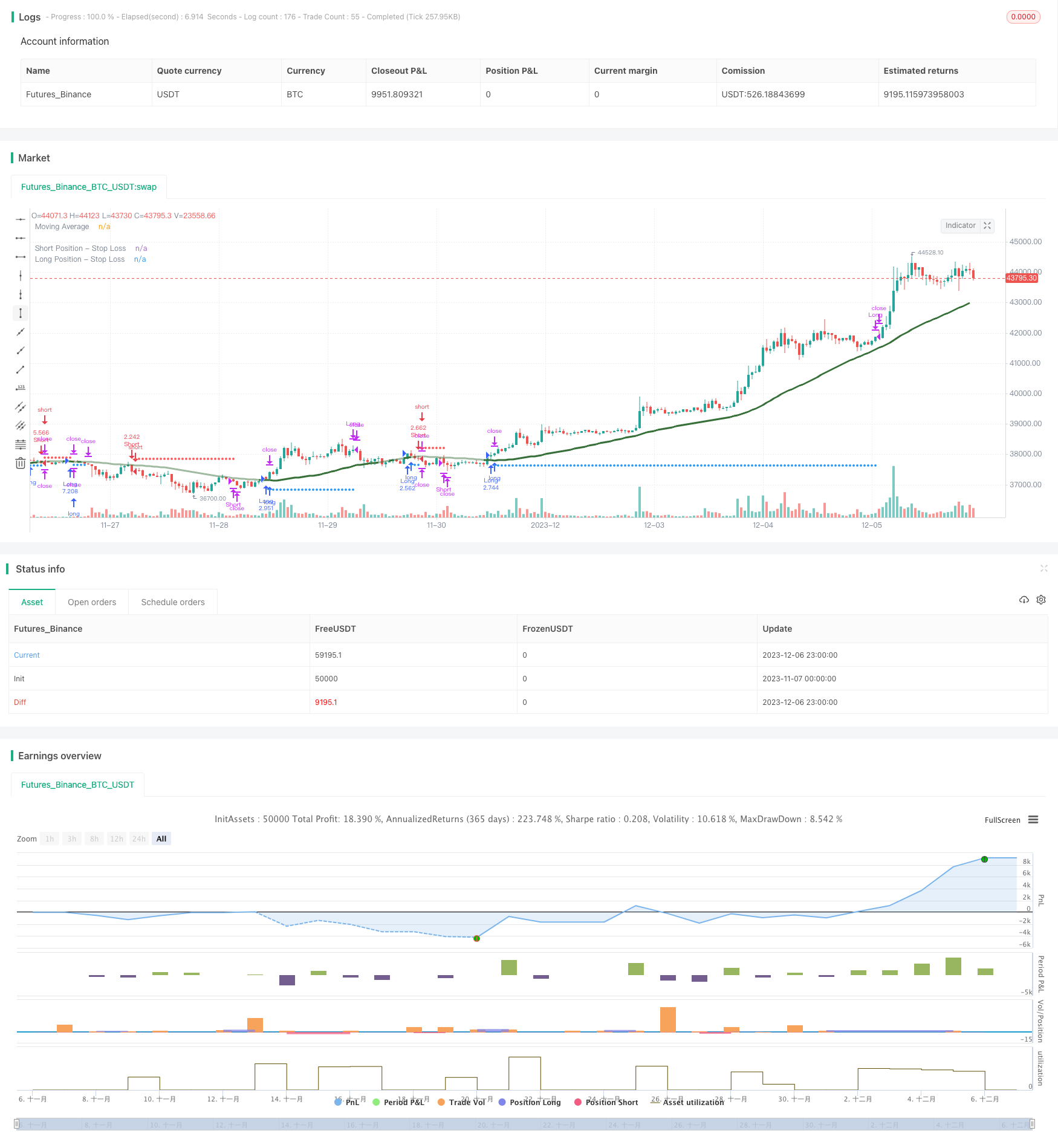

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title=" kNN-based| Trend Following | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

// This script, based on Capissimo's original indicator code, transforms a kNN-based machine learning indicator into a TradingView strategy.

// It incorporates a backtest date range filter, on/off controls for long and short positions, a moving average filter, and dynamic risk management for adaptive position sizing.

// Credit to Capissimo for the foundational kNN algorithm.

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2017"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//--------------------------------------

// kNN-based Strategy (FX and Crypto)

// Description:

// This strategy uses a classic machine learning algorithm - k Nearest Neighbours (kNN) -

// to let you find a prediction for the next (tomorrow's, next month's, etc.) market move.

// Being an unsupervised machine learning algorithm, kNN is one of the most simple learning algorithms.

// To do a prediction of the next market move, the kNN algorithm uses the historic data,

// collected in 3 arrays - feature1, feature2 and directions, - and finds the k-nearest

// neighbours of the current indicator(s) values.

// The two dimensional kNN algorithm just has a look on what has happened in the past when

// the two indicators had a similar level. It then looks at the k nearest neighbours,

// sees their state and thus classifies the current point.

// The kNN algorithm offers a framework to test all kinds of indicators easily to see if they

// have got any *predictive value*. One can easily add cog, wpr and others.

// Note: TradingViews's playback feature helps to see this strategy in action.

// Warning: Signals ARE repainting.

// Style tags: Trend Following, Trend Analysis

// Asset class: Equities, Futures, ETFs, Currencies and Commodities

// Dataset: FX Minutes/Hours+++/Days

//-- Preset Dates

int startdate = timestamp('01 Jan 2000 00:00:00 GMT+10')

int stopdate = timestamp('31 Dec 2025 23:45:00 GMT+10')

//-- Inputs

StartDate = input (startdate, 'Start Date', group="kNN-based Inputs")

StopDate = input (stopdate, 'Stop Date', group="kNN-based Inputs")

Indicator = input.string('RSI', 'Indicator', ['RSI','ROC','CCI','Volume','All'], group="kNN-based Inputs")

ShortWinow = input.int (8, 'Short Period [1..n]', 1, group="kNN-based Inputs")

LongWindow = input.int (29, 'Long Period [2..n]', 2, group="kNN-based Inputs")

BaseK = input.int (400, 'Base No. of Neighbours (K) [5..n]', 5, group="kNN-based Inputs")

Filter = input.bool (false, 'Volatility Filter', group="kNN-based Inputs")

Bars = input.int (300, 'Bar Threshold [2..5000]', 2, 5000, group="kNN-based Inputs")

//-- Constants

var int BUY = 1

var int SELL =-1

var int CLEAR = 0

var int k = math.floor(math.sqrt(BaseK)) // k Value for kNN algo

//-- Variable

// Training data, normalized to the range of [0,...,100]

var array<float> feature1 = array.new_float(0) // [0,...,100]

var array<float> feature2 = array.new_float(0) // ...

var array<int> directions = array.new_int(0) // [-1; +1]

// Result data

var array<int> predictions = array.new_int(0)

var float prediction = 0.0

var array<int> bars = array.new<int>(1, 0) // array used as a container for inter-bar variables

// Signals

var int signal = CLEAR

//-- Functions

minimax(float x, int p, float min, float max) =>

float hi = ta.highest(x, p), float lo = ta.lowest(x, p)

(max - min) * (x - lo)/(hi - lo) + min

cAqua(int g) => g>9?#0080FFff:g>8?#0080FFe5:g>7?#0080FFcc:g>6?#0080FFb2:g>5?#0080FF99:g>4?#0080FF7f:g>3?#0080FF66:g>2?#0080FF4c:g>1?#0080FF33:#00C0FF19

cPink(int g) => g>9?#FF0080ff:g>8?#FF0080e5:g>7?#FF0080cc:g>6?#FF0080b2:g>5?#FF008099:g>4?#FF00807f:g>3?#FF008066:g>2?#FF00804c:g>1?#FF008033:#FF008019

inside_window(float start, float stop) =>

time >= start and time <= stop ? true : false

//-- Logic

bool window = true

// 3 pairs of predictor indicators, long and short each

float rs = ta.rsi(close, LongWindow), float rf = ta.rsi(close, ShortWinow)

float cs = ta.cci(close, LongWindow), float cf = ta.cci(close, ShortWinow)

float os = ta.roc(close, LongWindow), float of = ta.roc(close, ShortWinow)

float vs = minimax(volume, LongWindow, 0, 99), float vf = minimax(volume, ShortWinow, 0, 99)

// TOADD or TOTRYOUT:

// ta.cmo(close, LongWindow), ta.cmo(close, ShortWinow)

// ta.mfi(close, LongWindow), ta.mfi(close, ShortWinow)

// ta.mom(close, LongWindow), ta.mom(close, ShortWinow)

float f1 = switch Indicator

'RSI' => rs

'CCI' => cs

'ROC' => os

'Volume' => vs

=> math.avg(rs, cs, os, vs)

float f2 = switch Indicator

'RSI' => rf

'CCI' => cf

'ROC' => of

'Volume' => vf

=> math.avg(rf, cf, of, vf)

// Classification data, what happens on the next bar

int class_label = int(math.sign(close[1] - close[0])) // eq. close[1]<close[0] ? SELL: close[1]>close[0] ? BUY : CLEAR

// Use particular training period

if window

// Store everything in arrays. Features represent a square 100 x 100 matrix,

// whose row-colum intersections represent class labels, showing historic directions

array.push(feature1, f1)

array.push(feature2, f2)

array.push(directions, class_label)

// Ucomment the followng statement (if barstate.islast) and tab everything below

// between BOBlock and EOBlock marks to see just the recent several signals gradually

// showing up, rather than all the preceding signals

//if barstate.islast

//==BOBlock

// Core logic of the algorithm

int size = array.size(directions)

float maxdist = -999.0

// Loop through the training arrays, getting distances and corresponding directions.

for i=0 to size-1

// Calculate the euclidean distance of current point to all historic points,

// here the metric used might as well be a manhattan distance or any other.

float d = math.sqrt(math.pow(f1 - array.get(feature1, i), 2) + math.pow(f2 - array.get(feature2, i), 2))

if d > maxdist

maxdist := d

if array.size(predictions) >= k

array.shift(predictions)

array.push(predictions, array.get(directions, i))

//==EOBlock

// Note: in this setup there's no need for distances array (i.e. array.push(distances, d)),

// but the drawback is that a sudden max value may shadow all the subsequent values.

// One of the ways to bypass this is to:

// 1) store d in distances array,

// 2) calculate newdirs = bubbleSort(distances, directions), and then

// 3) take a slice with array.slice(newdirs) from the end

// Get the overall prediction of k nearest neighbours

prediction := array.sum(predictions)

bool filter = Filter ? ta.atr(10) > ta.atr(40) : true // filter out by volatility or ex. ta.atr(1) > ta.atr(10)...

// Now that we got a prediction for the next market move, we need to make use of this prediction and

// trade it. The returns then will show if everything works as predicted.

// Over here is a simple long/short interpretation of the prediction,

// but of course one could also use the quality of the prediction (+5 or +1) in some sort of way,

// ex. for position sizing.

bool long = prediction > 0 and filter

bool short = prediction < 0 and filter

bool clear = not(long and short)

if array.get(bars, 0)==Bars // stop by trade duration

signal := CLEAR

array.set(bars, 0, 0)

else

array.set(bars, 0, array.get(bars, 0) + 1)

signal := long ? BUY : short ? SELL : clear ? CLEAR : nz(signal[1])

int changed = ta.change(signal)

bool startLongTrade = changed and signal==BUY

bool startShortTrade = changed and signal==SELL

// bool endLongTrade = changed and signal==SELL

// bool endShortTrade = changed and signal==BUY

bool clear_condition = changed and signal==CLEAR //or (changed and signal==SELL) or (changed and signal==BUY)

float maxpos = ta.highest(high, 10)

float minpos = ta.lowest (low, 10)

//----//MA INPUTS

MAFilter = input.bool(title='Use MA as Filter', defval=true, group = "MA Inputs")

averageType1 = input.string(defval="SMA", group="MA Inputs", title="MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=40, title="MA Length", group="MA Inputs")

averageSource1 = input(close, title="MA Source", group="MA Inputs")

//MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

// MA COLOR VALUES

ma = MovAvgType1(averageType1, averageSource1, averageLength1)

ma_plot = close > ma ? color.rgb(54, 111, 56) : color.rgb(54, 111, 56, 52)

// MA BUY/SELL CONDITIONS

bullish_ma = MAFilter ? close > ma : inTradeWindow

bearish_ma = MAFilter ? close < ma : inTradeWindow

// MA ALTERNATING PLOT

plot(MAFilter ? ma : na, color=ma_plot, title="Moving Average", linewidth=3)

//--------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and startLongTrade and bullish_ma and LongPositions

true

long_exit = if inTradeWindow and startShortTrade

true

short_entry = if inTradeWindow and startShortTrade and bearish_ma and ShortPositions

true

short_exit = if inTradeWindow and startLongTrade

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(7, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry and not short_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry and not long_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)

//strategy.risk.allow_entry_in(strategy.direction.long)

- Стратегия тренда биномиальной скользящей средней

- Стратегия перекрестного использования скользящей средней

- Многофункциональная алгоритмическая стратегия торговли, основанная на перекрестном использовании тренда и скользящей средней

- Стратегия прорыва скользящей средней полосы Боллинджера

- Тенденция, следующая за сетевой стратегией

- Количественная стратегия торговли, объединяющая обратные и будущие линии демаркации

- Стратегия пересечения между диапазонами Боллинджера и индикатором Халла

- Приспособленная стратегия торговли Turtle Breakout Drawdown

- RSI Trend Following Strategy with Trailing Stop Loss (Тенденция RSI в соответствии со стратегией с последующим остановкой потери)

- Инверсия динамических поворотных точек Экспоненциальная стратегия скользящей средней

- Простая стратегия импульса на основе SMA, EMA и объема

- Концепция объемной торговли Donchian Channels

- N Последовательное повышение закрывает стратегию прорыва

- Умная количественная стратегия торговли с обратным движением вниз

- Двойная стратегия Bollinger + RSI (только длинная) v1.2

- Стратегия CCI по нулевой перекрестной торговле

- Стратегия двойного перемещения средней цены

- Стратегия обратной торговли движущимися средними

- Движущаяся средняя агрегация Williams Коммерческая стратегия индикатора давления покупки и продажи

- Стратегия отслеживания двойной переменной средней