Стратегия Ichimoku Cloud Nine, ориентированная на торговлю

Автор:Чао Чжан, Дата: 2024-02-19 11:35:05Тэги:

Обзор

Стратегия Ichimoku Cloud Nine построена на индикаторе Ichimoku Cloud в сочетании с использованием фракталов Уильямса.

Логика стратегии

Стратегия в основном использует следующие сигналы Ichimoku для вступления в сделки:

- Kumo Breakout: генерирует сигнал, когда цена закрывается выше или ниже облака

- TK Cross: генерирует сигнал, когда Тенкан пересекает Киджун

- Kumo Twist: генерирует сигнал, когда Senkou Span A пересекает Senkou Span B

- Edge to Edge: генерирует сигнал, когда цена входит в обе стороны облака

Стратегия будет выходить из торгов в следующих ситуациях:

- Закрытие цены в облаке

- TK Пересечь в противоположном направлении

- Нарушение фрактала Уильямса в обратном направлении

Стратегия сочетает в себе несколько сигналов Ичимоку для повышения надежности, используя фракталы в качестве стоп-лосса для контроля риска.

Преимущества

По сравнению со стратегией одного сигнала, эта стратегия фильтрует сигналы через несколько сигналов Ичимоку, улучшая точность.

Использование фракталов в качестве стоп-лосса активно контролирует риск и блокирует прибыль.

Риски

Основные риски:

- Отстающая природа облака Ичимоку

- Многочисленные сигналы могут быть слишком консервативными, чтобы упустить возможности.

- Фрактальная остановка может быть удалена.

Уменьшения: корректировка параметров или удаление некоторых сигналов.

Возможности для расширения

Основные направления оптимизации:

- Настройка параметров Ichimoku для различных продуктов

- Удалить некоторые сигналы, сохранить основные правила

- Настройка фрактальных параметров для использования более высоких временных рамок или только частичного остановки

- Добавьте другие показатели, такие как объем

Заключение

Стратегия Ichimoku Cloud Nine улучшает торговлю Ichimoku путем сочетания сигналов для повышения точности и показателя выигрыша. Использование фракталов управляет рисками. Параметры и сигналы могут быть оптимизированы для автоматической торговли на разных продуктах.

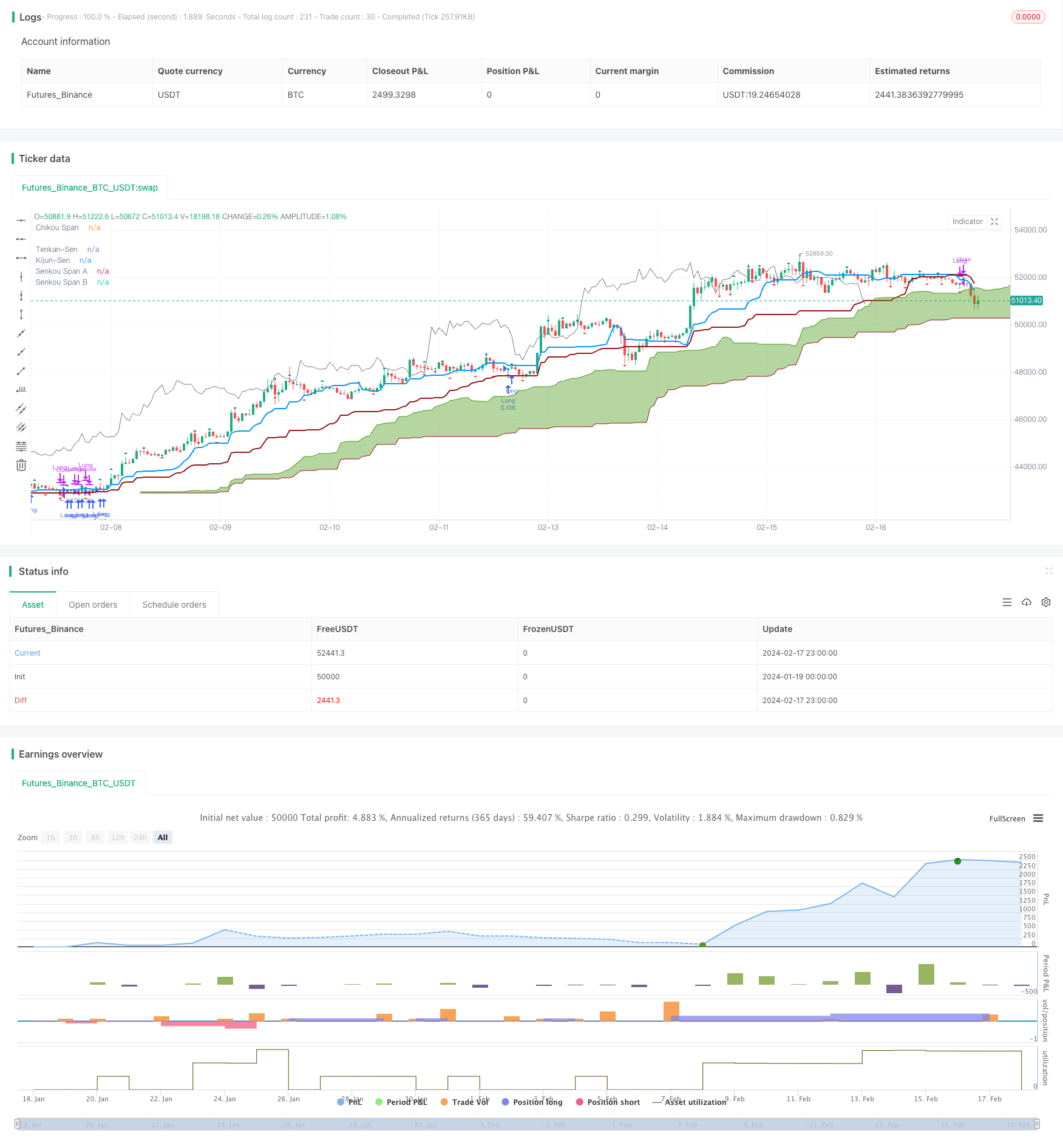

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud Nine", shorttitle="Ichimoku Cloud Nine", overlay=true, calc_on_every_tick = true, calc_on_order_fills = false, initial_capital = 5000, currency = "USD", default_qty_type = "percent_of_equity", default_qty_value = 10, pyramiding = 3, process_orders_on_close = true)

color green = #459915

color red = #991515

// --------

// Fractals

// --------

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

close_on_fractal = input.bool(false, title="Use William Fractals for SL?", group = "Fractals")

n = input.int(title="Periods", defval=2, minval=2, group = "Fractals")

fractal_close_percentage = input.int(100, minval=1, maxval=100, title="Position % to close on fractal breach", group = "Fractals")

selected_fractals_timeframe = input.timeframe('Current', "Timeframe", options=["Current", "1D", "12H", "8H", "4H", "1H"], group = "Fractals", tooltip = "Timeframe to use to look for fractals. Example: if 12H is selected, it will close positions when the last 12H fractal is breached.")

string fractals_timeframe = switch selected_fractals_timeframe

"1D" => "1D"

"12H" => "720"

"8H" => "480"

"4H" => "240"

"1H" => "60"

// Default used when the three first cases do not match.

=> ""

prev_high = request.security(syminfo.tickerid, fractals_timeframe, high)

prev_low = request.security(syminfo.tickerid, fractals_timeframe, low)

period_high=prev_high

period_low=prev_low

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (period_high[n-i] < period_high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (period_high[n+i] < period_high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (period_high[n+1] <= period_high[n] and period_high[n+i + 1] < period_high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+i + 2] < period_high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+i + 3] < period_high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+4] <= period_high[n] and period_high[n+i + 4] < period_high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

var float upFractalPrice = 0

if (upFractal)

upFractalPrice := period_high[n]

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (period_low[n-i] > period_low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (period_low[n+i] > period_low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (period_low[n+1] >= period_low[n] and period_low[n+i + 1] > period_low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+i + 2] > period_low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+i + 3] > period_low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+4] >= period_low[n] and period_low[n+i + 4] > period_low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

var float downFractalPrice = 0

if (downFractal)

downFractalPrice := period_low[n]

plotshape(downFractal, style=shape.triangledown, location=location.belowbar, offset=-n, color=#F44336, size = size.auto)

plotshape(upFractal, style=shape.triangleup, location=location.abovebar, offset=-n, color=#009688, size = size.auto)

// --------

// Ichimoku

// --------

previous_close = close[1]

conversionPeriods = input.int(20, minval=1, title="Conversion Line Periods", group = "Cloud Settings"),

basePeriods = input.int(60, minval=1, title="Base Line Periods", group = "Cloud Settings")

laggingSpan2Periods = input.int(120, minval=1, title="Lagging Span 2 Periods", group = "Cloud Settings"),

displacement = input.int(30, minval=1, title="Displacement", group = "Cloud Settings")

long_entry = input.bool(true, title="Longs", group = "Entries", tooltip = "Will look for longs")

short_entry = input.bool(true, title="Shorts", group = "Entries", tooltip = "Will look for shorts")

wait_for_twist = input.bool(true, title="Wait for kumo twist?", group = "Entries", tooltip = "Will wait for the Kumo to turn green (longs) or red (shorts)")

ignore_lagging_span = input.bool(true, title="Ignore Lagging Span Signal?", group = "Entries", tooltip = "Will not wait for lagging span to be above/below price and cloud")

bounce_entry = input.bool(true, title="Kijun Bounce", group = "Entries", tooltip = "Will enter position on a Kijun bounce")

e2e_entry = input.bool(true, title="Enable", group = "Edge 2 Edge", tooltip = "Will look for edge-to-edge trades")

e2e_entry_tk_confluence = input.bool(true, title="Require TK Confluence?", group = "Edge 2 Edge", tooltip = "Require confluent TK cross in order to enter an e2e trade")

min_cloud_thickness = input.float(10, minval=1, title="Minimun Cloud Thickness (%)", group = "Edge 2 Edge", tooltip = "Minimum cloud thickness for entering e2e trades")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(conversionPeriods)

kijun = donchian(basePeriods)

spanA = math.avg(tenkan, kijun)

spanB = donchian(laggingSpan2Periods)

plot(tenkan, color=#0496ff, title="Tenkan-Sen", linewidth = 2)

plot(kijun, color=red, title="Kijun-Sen", linewidth = 2)

plot(close, offset = -displacement, color=color.gray, title="Chikou Span")

p1 = plot(spanA, offset = displacement, color=green, title="Senkou Span A")

p2 = plot(spanB, offset = displacement, color=red, title="Senkou Span B")

fill(p1, p2, color = spanA > spanB ? color.new(green, 50) : color.new(red, 50))

cloud_high = math.max(spanA[displacement], spanB[displacement])

cloud_low = math.min(spanA[displacement], spanB[displacement])

lagging_span_above_price_and_cloud = (close > close[displacement] and close > cloud_high[displacement]) or ignore_lagging_span

lagging_span_below_price_and_cloud = (close < close[displacement] and close < cloud_low[displacement]) or ignore_lagging_span

step1=cloud_high-cloud_low

step2=(cloud_high+cloud_low)/2

cloud_thickness = (step1/step2)*100

// --------

// Trades

// --------

// LONGS

// kumo breakout

if (long_entry and ta.crossover(close, cloud_high) and tenkan > kijun and close > kijun and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - Kumo Breakout"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross above cloud

if (long_entry and close > cloud_high and ta.crossover(tenkan, kijun) and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - TK Cross"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (long_entry and close > cloud_high and tenkan > kijun and ta.crossover(spanA, spanB) and lagging_span_above_price_and_cloud)

comment = "Long - Kumo Twist"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossunder(close, cloud_high))

comment = "Close Long - Close inside cloud"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bearish tk cross

if (ta.crossunder(tenkan, kijun))

comment = "Close Long - TK Cross"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long - Fractal"

strategy.close("Long", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// SHORTS

// kumo breakout

if (short_entry and ta.crossunder(close, cloud_low) and tenkan < kijun and close < kijun and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - Kumo Breakout"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross below cloud

if (short_entry and close < cloud_low and ta.crossunder(tenkan, kijun) and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - TK Cross"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (short_entry and close < cloud_low and tenkan < kijun and lagging_span_below_price_and_cloud and ta.crossunder(spanA, spanB))

comment = "Short - Kumo Twist"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossover(close, cloud_low))

comment = "Close Short - Close inside cloud"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bullish tk cross

if (ta.crossover(tenkan, kijun))

comment = "Close Short - TK Cross"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short - Fractal"

strategy.close("Short", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BULL EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and tenkan > kijun and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(high, cloud_high))

comment = "Close Long e2e - Target Hit"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossunder(close, cloud_low))

comment = "Close Long e2e - Close below cloud"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long e2e - Fractal"

strategy.close("Long e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BEAR EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and tenkan < kijun and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(low, cloud_low))

comment = "Close Short e2e - Target Hit"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossover(close, cloud_high))

comment = "Close Short e2e - Close below cloud"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short e2e - Fractal"

strategy.close("Short e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// Kijun Bounce

if (bounce_entry and long_entry and open > cloud_high and open > kijun and ta.crossunder(low, kijun) and close > kijun and tenkan > kijun and kijun > cloud_high and lagging_span_above_price_and_cloud)

comment = "Long - Kijun Bounce"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (bounce_entry and short_entry and open < cloud_low and open < kijun and ta.crossover(high, kijun) and close < kijun and tenkan < kijun and kijun < cloud_low and lagging_span_below_price_and_cloud)

comment = "Short - Kijun Bounce"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

- Количественная стратегия торговли, основанная на фракталах и моделях

- Стратегия CAT для отмены колебаний

- Стратегия торговли VWAP по ценовому каналу

- Стратегия пересечения переплетенных скользящих средних

- Стратегия прорыва скользящей средней и прорыва полосы Боллинджера

- Стратегия индикатора абсолютного импульса

- Стратегия перекрестного использования супертенденции и скользящей средней

- Стратегия двойного тренда

- Количественная стратегия торговли по каналу SSL и волновой тенденции

- Тенденция Super ATR в соответствии со стратегией

- LPB Микроциклы Стратегия отслеживания контура адаптивных колебаний

- Лучшая стратегия торговли паттерном ABCD с отслеживанием стоп-лосса и прибыли

- Основной индикатор тенденции длинный

- Стратегия с несколькими временными рамками

- Динамическая балансирующая инвестиционная стратегия в ЭФП с использованием кредитного плеча

- Стратегия торговли с перекрестным использованием индикаторов MACD на несколько временных рамок

- Стратегия выхода из Gem Forest в одну минуту

- Три высокие стратегии обратной свечи

- Движущаяся средняя комбинация MACD Транспериодная стратегия динамического тренда

- Стратегия скальпинга Gem Forest One Minute