معاونت اور مزاحمت کی مقدار میں اتار چڑھاؤ کی حکمت عملی

مصنف:چاؤ ژانگ، تاریخ: 2024-01-25 15:53:06ٹیگز:

جائزہ

یہ حکمت عملی RSI کراس اوور حکمت عملی کو بہتر اسٹاپ نقصان کی حکمت عملی کے ساتھ جوڑتی ہے تاکہ عین مطابق منطقی کنٹرول اور درست اسٹاپ نقصان اور منافع حاصل کیا جاسکے۔ دریں اثنا ، سگنل کی اصلاح متعارف کرانے سے ، یہ رجحان کو بہتر طور پر سمجھ سکتا ہے اور معقول سرمایہ کاری کا انتظام حاصل کرسکتا ہے۔

حکمت عملی کا اصول

- آر ایس آئی اشارے سے زیادہ خریدنے اور زیادہ فروخت ہونے والے علاقے کا تعین ہوتا ہے۔ K اور D کی قدر کے ساتھ مل کر گولڈن کراس اور ڈیڈ کراس ٹریڈنگ سگنل بناتے ہیں۔

- غلط تجارت سے بچنے کے لئے رجحان سگنل کا فیصلہ کرنے میں مدد کے لئے موم بتی پیٹرن کی شناخت متعارف کراتا ہے۔

فوائد کا تجزیہ

- آر ایس آئی پیرامیٹر کی اصلاح غلط تجارت سے بچنے کے لئے زیادہ خریدنے اور زیادہ فروخت کرنے والے علاقے کا تعین کرتی ہے۔

- ایس ایم اے لائنز اہم رجحان کی سمت کا فیصلہ کرنے میں مدد کرتی ہیں، رجحان کے خلاف تجارت سے بچتی ہیں.

خطرے کا تجزیہ

- جب مارکیٹ میں کمی جاری رہے گی تو زیادہ خطرہ کا سامنا کرنا پڑے گا۔

- تجارت کی اعلی تعدد تجارت کی لاگت اور سلائڈ لاگت میں اضافہ کرتی ہے۔

حکمت عملی کی اصلاح

- RSI پیرامیٹرز کو ایڈجسٹ کریں، زیادہ سے زیادہ خریدا زیادہ سے زیادہ فروخت فیصلے کو بہتر بنائیں.

- سگنل کے معیار کو بہتر بنانے کے لئے ایس ٹی او پیرامیٹرز، ہموار اور مدت کو ایڈجسٹ کریں.

- رجحان کی تشخیص کو بہتر بنانے کے لئے چلتی اوسط مدت کو ایڈجسٹ کریں.

- سگنل کی درستگی کو بہتر بنانے کے لئے مزید تکنیکی اشارے متعارف کروائیں۔

- اسٹاپ نقصان کا تناسب بہتر بنائیں تاکہ ایک ہی تجارت کے خطرے کو کم کیا جا سکے۔

نتیجہ

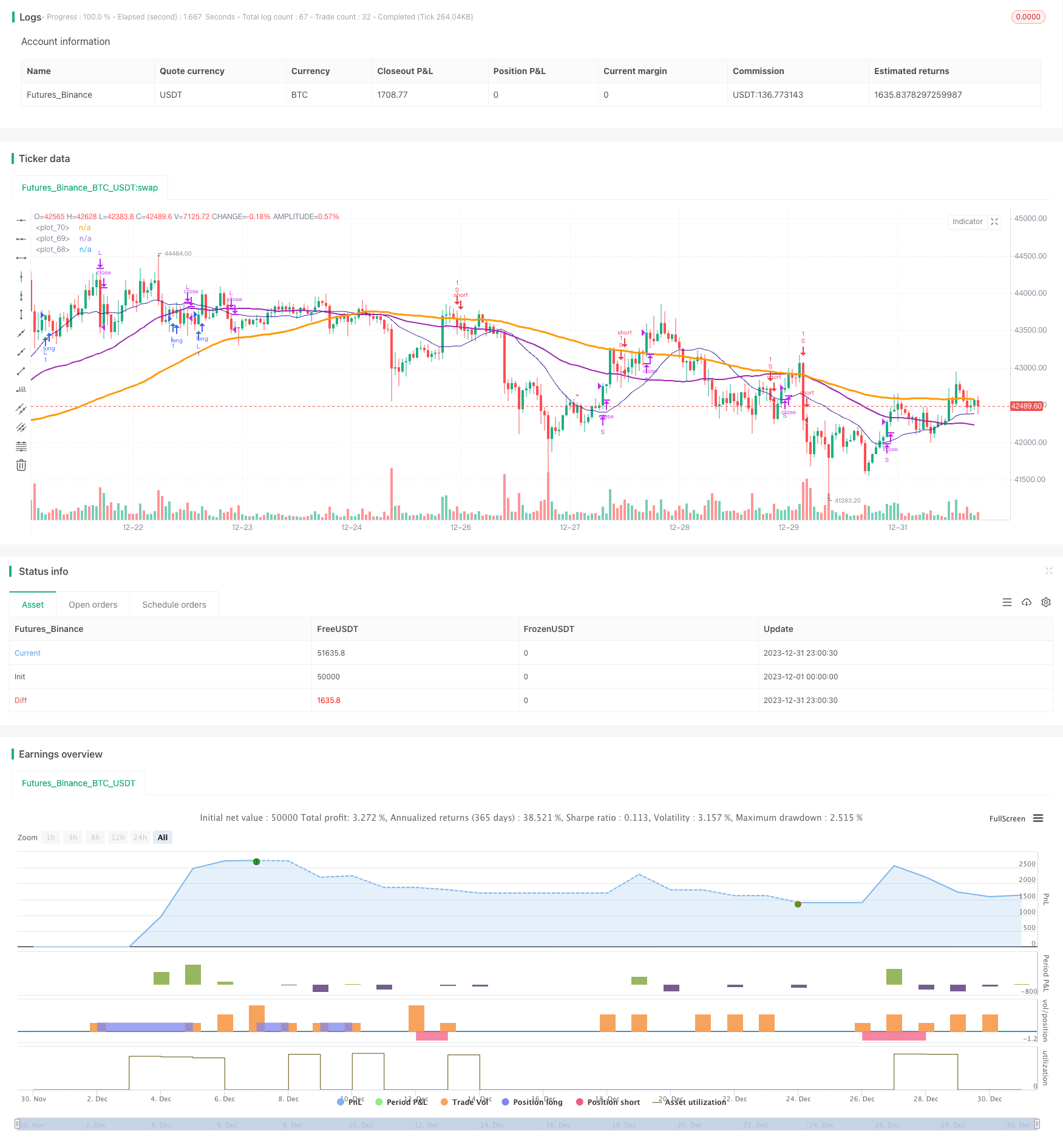

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true)

strategy(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true )

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

overbought = input(80, minval=1)

oversold = input(20, minval=1)

smaLengh = input(100, minval=1)

smaLengh2 = input(50, minval=1)

smaLengh3 = input(20, minval=1)

src = input(close, title="RSI Source")

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testPeriod() =>

time >= testPeriodStart ? true : false

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

crossBuy = crossover(k, d) and k < oversold

crossSell = crossunder(k, d) and k > overbought

dcLower = lowest(low, 10)

dcUpper = highest(high, 10)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashiPositive = heikinashi_close >= heikinashi_open

heikinashiBuy = heikinashiPositive == true and heikinashiPositive[1] == false and heikinashiPositive[2] == false

heikinashiSell = heikinashiPositive == false and heikinashiPositive[1] == true and heikinashiPositive[2] == true

//plotshape(heikinashiBuy, style=shape.arrowup, color=green, location=location.belowbar, size=size.tiny)

//plotshape(heikinashiSell, style=shape.arrowdown, color=red, location=location.abovebar, size=size.tiny)

buy = (crossBuy == true or crossBuy[1] == true or crossBuy[2] == true) and (heikinashiBuy == true or heikinashiBuy[1] == true or heikinashiBuy[2] == true)

sell = (crossSell == true or crossSell[1] == true or crossSell[2] == true) and (heikinashiSell == true or heikinashiSell[1] == true or heikinashiSell[2] == true)

mult = timeframe.period == '15' ? 4 : 1

mult2 = timeframe.period == '240' ? 0.25 : mult

movingAverage = sma(close, round(smaLengh))

movingAverage2 = sma(close, round(smaLengh2))

movingAverage3 = sma(close, round(smaLengh3))

uptrend = movingAverage < movingAverage2 and movingAverage2 < movingAverage3 and close > movingAverage

downtrend = movingAverage > movingAverage2 and movingAverage2 > movingAverage3 and close < movingAverage

signalBuy = (buy[1] == false and buy[2] == false and buy == true) and uptrend

signalSell = (sell[1] == false and sell[2] == false and sell == true) and downtrend

takeProfitSell = (buy[1] == false and buy[2] == false and buy == true) and uptrend == false

takeProfitBuy = (sell[1] == false and sell[2] == false and sell == true) and uptrend

plotshape(signalBuy, style=shape.triangleup, color=green, location=location.belowbar, size=size.tiny)

plotshape(signalSell, style=shape.triangledown, color=red, location=location.abovebar, size=size.tiny)

plot(movingAverage, linewidth=3, color=orange, transp=0)

plot(movingAverage2, linewidth=2, color=purple, transp=0)

plot(movingAverage3, linewidth=1, color=navy, transp=0)

alertcondition(signalBuy, title='Signal Buy', message='Signal Buy')

alertcondition(signalSell, title='Signal Sell', message='Signal Sell')

strategy.close("L", when=dcLower[1] > low)

strategy.close("S", when=dcUpper[1] < high)

strategy.entry("L", strategy.long, 1, when = signalBuy and testPeriod() and uptrend)

strategy.entry("S", strategy.short, 1, when = signalSell and testPeriod() and uptrend ==false)

//strategy.exit("Exit Long", from_entry = "L", loss = 25000000, profit=25000000)

//strategy.exit("Exit Short", from_entry = "S", loss = 25000000, profit=25000000)

مزید

- رفتار رجحان کی حکمت عملی

- رفتار منتقل اوسط کراس اوور مقدار کی حکمت عملی

- دوہری حرکت پذیر اوسط الٹ اور اے ٹی آر ٹریلنگ اسٹاپ کی مجموعی حکمت عملی

- لیورجڈ مارٹنگل فیوچر ٹریڈنگ کی حکمت عملی

- رفتار واپس لینے کی حکمت عملی

- ڈبل موم بتی کی پیشن گوئی قریبی حکمت عملی

- اسٹوکاسٹک سپر ٹرینڈ ٹریکنگ سٹاپ نقصان ٹریڈنگ کی حکمت عملی

- دوہری الٹ آسنٹلنگ بینڈ ٹرینڈ اسٹریٹجی کے بعد

- ڈی ایم آئی اور آر ایس آئی پر مبنی حکمت عملی کے بعد رجحان

- 3 ای ایم اے، ڈی ایم آئی اور ایم اے سی ڈی کے ساتھ رجحان کی پیروی کرنے والی حکمت عملی

- دوہری اشارے کی اہم حکمت عملی

- پیٹ ویو ٹریڈنگ سسٹم کی حکمت عملی

- ایکسپونینشل حرکت پذیر اوسط اور حجم وزن پر مبنی مقداری حکمت عملی

- ہموار چلتی اوسط پر مبنی Origix Ashi حکمت عملی

- بلیک بٹ ٹریڈر XO میکرو ٹرینڈ سکینر حکمت عملی

- خام تیل ADX رجحان حکمت عملی کے بعد

- MT-تعاون تجارتی حکمت عملی

- ڈبل فیکٹر ریورس اور بہتر قیمت حجم رجحان کی کمبوڈ حکمت عملی

- رجحان زاویہ منتقل اوسط کراس اوور حکمت عملی