Chiến lược đảo ngược đáy

Tác giả:ChaoZhang, Ngày: 2023-12-15 11:07:41Tags:

Tổng quan

Chiến lược này dựa trên đáy thị trường để giao dịch đảo ngược. Nó sử dụng các điểm thấp nhất của đường EMA 200 ngày kết hợp với mức hỗ trợ / kháng cự Camarilla để xác định đáy thị trường. Nó kéo dài khi giá hồi phục.

Chiến lược logic

- Tính toán giá thấp nhất EMA200Lows của EMA 200 ngày. Khi giá đóng dưới EMA này, thị trường được coi là gần đáy.

- Tính toán EMA 9 ngày của Camarilla hỗ trợ mức 3 (S3), ema_s3_9, như một mức hỗ trợ quan trọng.

- Cũng tính EMA 9 ngày của điểm trung bình Camarilla ema_center_9 như tín hiệu đảo ngược.

- Khi ema_center_9 vượt qua ema200Lows, và 3 thanh cuối cùng thấp hơn ema200Lows, đi dài.

- Sử dụng ATR trailing stop loss để khóa lợi nhuận, theo dõi giá thấp nhất.

- Mục tiêu lợi nhuận là ema_h4_9 (Camarilla Resistance Level 4) và ema_s3_9.

Phân tích lợi thế

- Giá EMA thấp nhất 200 ngày tránh mua vị trí trước đáy thực tế.

- Mức Camarilla kết hợp với điểm giữa xác định sự đảo ngược đáng tin cậy.

- ATR dừng lỗ hợp lý hơn theo dõi giá thấp hơn cho phép lợi nhuận lớn hơn.

Phân tích rủi ro

- Thời gian giữ dài làm tăng rủi ro. Chiến lược này ưu tiên giao dịch ngắn hạn.

- Chuyển động thị trường lớn có thể dẫn đến lỗ dừng lớn. Điều chỉnh các thông số ATR phù hợp.

- Các tín hiệu đảo ngược không phải lúc nào cũng chính xác.

Hướng dẫn tối ưu hóa

- Xem xét thêm các chỉ số như RSI để bổ sung các tín hiệu đảo ngược.

- Nghiên cứu các thông số tối ưu cho các sản phẩm khác nhau.

- Khám phá máy học để ATR dừng mất năng động.

Tóm lại

Chiến lược này xác định đáy thị trường và đảo ngược bằng cách sử dụng mức thấp EMA và Camarilla. Nó khóa lợi nhuận với ATR trailing stops. Nhìn chung nó khá hoàn chỉnh với giá trị thực tế.

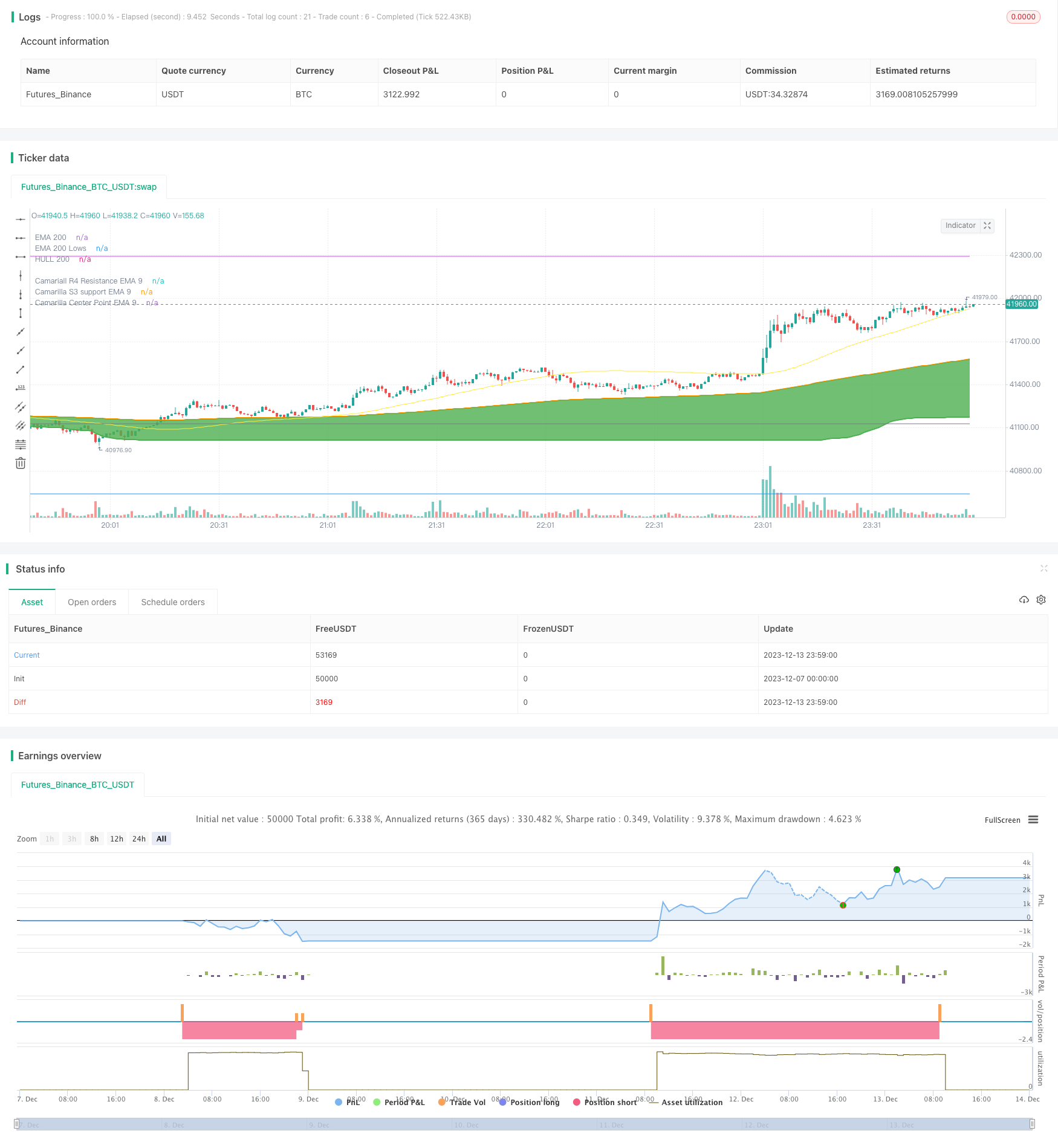

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//Using the lowest of low of ema200, you can find the bottom

//wait for price to close below ema200Lows line

//when pivot

//@version=4

strategy(title="PickingupFromBottom Strategy", overlay=true ) //default_qty_value=10, default_qty_type=strategy.fixed,

//HMA

HMA(src1, length1) => wma(2 * wma(src1, length1/2) - wma(src1, length1), round(sqrt(length1)))

//variables BEGIN

length1=input(200,title="EMA 1 Length")

length2=input(50,title="EMA 2 Length")

length3=input(20,title="EMA 3 Length")

sourceForHighs= input(hlc3, title="Source for Highs", type=input.source)

sourceForLows = input(hlc3, title="Source for Lows" , type=input.source)

hiLoLength=input(7, title="HiLo Band Length")

atrLength=input(14, title="ATR Length")

atrMultiplier=input(3.5, title="ATR Multiplier")

//takePartialProfits = input(true, title="Take Partial Profits (if this selected, RSI 13 higher reading over 80 is considered for partial closing ) ")

ema200=ema(close,length1)

hma200=HMA(close,length1)

////Camarilla pivot points

//study(title="Camarilla Pivots", shorttitle="Camarilla", overlay=true)

t = input(title = "Pivot Resolution", defval="D", options=["D","W","M"])

//Get previous day/week bar and avoiding realtime calculation by taking the previous to current bar

sopen = security(syminfo.tickerid, t, open[1], barmerge.gaps_off, barmerge.lookahead_on)

shigh = security(syminfo.tickerid, t, high[1], barmerge.gaps_off, barmerge.lookahead_on)

slow = security(syminfo.tickerid, t, low[1], barmerge.gaps_off, barmerge.lookahead_on)

sclose = security(syminfo.tickerid, t, close[1], barmerge.gaps_off, barmerge.lookahead_on)

r = shigh-slow

//Calculate pivots

//center=(sclose)

//center=(close[1] + high[1] + low[1])/3

center=sclose - r*(0.618)

h1=sclose + r*(1.1/12)

h2=sclose + r*(1.1/6)

h3=sclose + r*(1.1/4)

h4=sclose + r*(1.1/2)

h5=(shigh/slow)*sclose

l1=sclose - r*(1.1/12)

l2=sclose - r*(1.1/6)

l3=sclose - r*(1.1/4)

l4=sclose - r*(1.1/2)

l5=sclose - (h5-sclose)

//Colors (<ternary conditional operator> expression prevents continuous lines on history)

c5=sopen != sopen[1] ? na : color.red

c4=sopen != sopen[1] ? na : color.purple

c3=sopen != sopen[1] ? na : color.fuchsia

c2=sopen != sopen[1] ? na : color.blue

c1=sopen != sopen[1] ? na : color.gray

cc=sopen != sopen[1] ? na : color.blue

//Plotting

//plot(center, title="Central",color=color.blue, linewidth=2)

//plot(h5, title="H5",color=c5, linewidth=1)

//plot(h4, title="H4",color=c4, linewidth=2)

//plot(h3, title="H3",color=c3, linewidth=1)

//plot(h2, title="H2",color=c2, linewidth=1)

//plot(h1, title="H1",color=c1, linewidth=1)

//plot(l1, title="L1",color=c1, linewidth=1)

//plot(l2, title="L2",color=c2, linewidth=1)

//plot(l3, title="L3",color=c3, linewidth=1)

//plot(l4, title="L4",color=c4, linewidth=2)

//plot(l5, title="L5",color=c5, linewidth=1)////Camarilla pivot points

ema_s3_9=ema(l3, 9)

ema_s3_50=ema(l3, 50)

ema_h4_9=ema(h4, 9)

ema_center_9=ema(center, 9)

plot(ema_h4_9, title="Camariall R4 Resistance EMA 9", color=color.fuchsia)

plot(ema_s3_9, title="Camarilla S3 support EMA 9", color=color.gray, linewidth=1)

//plot(ema_s3_50, title="Camarilla S3 support EMA 50", color=color.green, linewidth=2)

plot(ema_center_9, title="Camarilla Center Point EMA 9", color=color.blue)

plot(hma200, title="HULL 200", color=color.yellow, transp=25)

plotEma200=plot(ema200, title="EMA 200", style=plot.style_linebr, linewidth=2 , color=color.orange)

ema200High = ema(highest(sourceForHighs,length1), hiLoLength)

ema200Low= ema(lowest(sourceForLows,length1), hiLoLength)

ema50High = ema(highest(sourceForHighs,length2), hiLoLength)

ema50Low= ema(lowest(sourceForLows,length2), hiLoLength)

ema20High = ema(highest(sourceForHighs,length3), hiLoLength)

ema20Low= ema(lowest(sourceForLows,length3), hiLoLength)

//plot(ema200High, title="EMA 200 Highs", linewidth=2, color=color.orange, transp=30)

plotEma200Low=plot(ema200Low, title="EMA 200 Lows", linewidth=2, color=color.green, transp=30, style=plot.style_linebr)

//plot(ema50High, title="EMA 50 Highs", linewidth=2, color=color.blue, transp=30)

//plotEma50Low=plot(ema50Low, title="EMA 50 Lows", linewidth=2, color=color.blue, transp=30)

fill(plotEma200, plotEma200Low, color=color.green )

// Drawings /////////////////////////////////////////

//Highlight when centerpont crossing up ema200Low a

ema200LowBuyColor=color.new(color.green, transp=50)

bgcolor(crossover(ema_center_9,ema200Low) and (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low)? ema200LowBuyColor : na)

//ema200LowBuyCondition= (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low)

strategy.entry(id="ema200Low Buy", comment="LE2", qty=2, long=true, when= crossover(ema_center_9,ema200Low) and (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low) ) //or (close>open and low<ema20Low and close>ema20Low) ) ) // // aroonOsc<0

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

sl_val = atrMultiplier * atr(atrLength)

trailing_sl = 0.0

//trailing_sl := max(low[1] - sl_val, nz(trailing_sl[1]))

trailing_sl := strategy.position_size>=1 ? max(low - sl_val, nz(trailing_sl[1])) : na

//draw initil stop loss

//plot(strategy.position_size>=1 ? trailing_sl : na, color = color.blue , style=plot.style_linebr, linewidth = 2, title = "stop loss")

plot(trailing_sl, title="ATR Trailing Stop Loss", style=plot.style_linebr, linewidth=1, color=color.red, transp=30)

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

strategy.close(id="ema200Low Buy", comment="TP1="+tostring(close - strategy.position_avg_price, "####.##"), qty=1, when=abs(strategy.position_size)>=1 and crossunder(close, ema_h4_9) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89

strategy.close(id="ema200Low Buy", comment="TP2="+tostring(close - strategy.position_avg_price, "####.##"), qty=1, when=abs(strategy.position_size)>=1 and crossunder(close, ema_s3_9) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89

Thêm nữa

- Chiến lược đảo ngược dài MACD

- Chiến lược theo dõi xu hướng hai khung thời gian

- Chiến lược đột phá với xác nhận trên nhiều khung thời gian

- Chiến lược toàn diện của nhiều mô hình nến

- Chiến lược phá vỡ hợp nhất

- Bốn chiến lược chéo EMA

- Chiến lược giao dịch lượng dựa trên hoạt động trung bình động hàng tháng và hàng quý

- Một chiến lược kết hợp nhiều yếu tố với trung bình di chuyển thích nghi

- EMA Golden Cross Chiến lược giao dịch ngắn hạn

- Heiken Ashi và chiến lược kết hợp siêu xu hướng

- Chiến lược giao dịch dao động động động lực động

- WMX Williams Fractals Reversal Pivot Chiến lược

- Chiến lược ngắn và dài giao thoa theo Stochastic

- MACD tuyến tính mở khóa phép thuật hồi quy tuyến tính trong giao dịch

- Chiến lược nến đảo ngược trục trục

- Valeria 181 Robot Chiến lược được cải thiện 2.4

- Chiến lược chỉ số RSI ngẫu nhiên cho giao dịch tiền điện tử

- Chiến lược theo dõi xu hướng đảo ngược kép

- Khối lượng trọng số trung bình động Convergence Divergence

- Chiến lược đảo ngược kết hợp dựa trên yếu tố chuyển đổi ngẫu nhiên và tín hiệu đảo ngược chính