概述

本策略主要思想是利用价格的重叠差额来判断市场趋势,当差额从负数反转到正数时做多,从正数反转到负数时做空,属于反转交易策略。

原理

该策略首先计算价格的重叠差额(Close-Close[1]),即今天的收盘价减去昨天的收盘价,然后计算最近30天内差额的总和。当总和从负数反转到正数时产生做多信号,当总和从正数反转到负数时产生做空信号,属于典型的反转交易策略。

具体来说,策略维护三个指标:

- ff:最近30天内差额的总和

- dd1: ff的15日加权移动平均线

- dd2: ff的30日加权移动平均线

当ff从负数反转到正数,即小于0变大于0,并且dd1也从负数反转到正数时,产生做多信号。

当ff从正数反转到负数,即大于0变小于0,并且dd1也从正数反转到负数时,产生做空信号。

做多做空后会设置止盈止损线。

优势

该策略具有以下优势:

- 思路清晰,容易理解和实现。

- 利用价格反转特征,在市场转折点能够获得较好入场时机。

- 结合双重确认机制,可以过滤假突破。

- 可自定义参数,适应不同市场环境。

风险

该策略也存在一些风险:

- 反转失败的概率较大,区间震荡市场中容易止损。

- 参数设置不当可能导致交易频繁,增大交易成本。

- 需要联合其他指标过滤性入场,避免追顶和接底。

对应解决方法如下:

- 合理设置止损比例,控制单笔损失。

- 优化参数,找到最佳参数组合。

- 增加过滤条件,避免不必要入场。

优化方向

该策略可以从以下方面进行优化:

- 增加成交量的过滤,例如突破时需成交量放大。

- 结合趋势指标过滤,避免逆势操作。

- 动态调整参数,让参数能根据市场状态变化。

- 优化止损机制,例如随价格移动止损。

总结

本策略通过计算价格差额的反转来判断市场转折点,是一种典型的反转交易策略。策略思路清晰,易于实现,有一定的实用价值。但也存在一些风险,需要进一步优化以适应市场的变化。总的来说,本策略为量化交易提供了一个基础框架,可在此基础上进行扩展。

策略源码

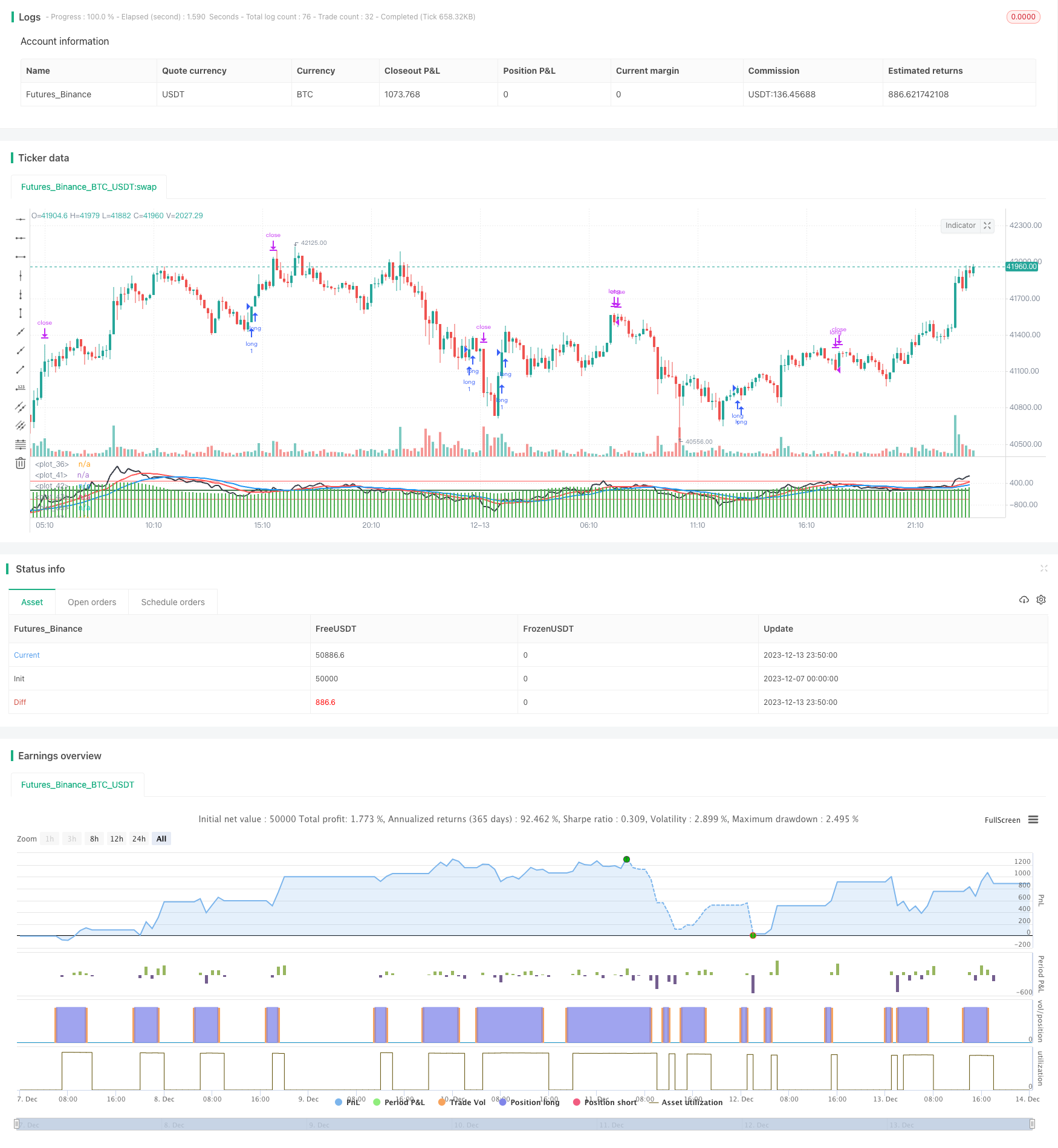

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Fst",currency="USD",initial_capital=100000)

//Length0 = input(30, title="fastperiod", minval=1)

Length = input(30, title="SUMM")

Length1 = input(15, title="Signalperiod", minval=1)

Length2= input(30, title="Info", minval=1)

profit=input(95, title="profit", minval=1)

loss=input(95, title="loss", minval=1)

//f=iff(close>open,close-open,iff(close>open[1],close[1]-open[1],0))

f=0.0

dd1=0.0

dd2=0.0

ff=0.0

ff0=0.0

f:=close-close[1]

ff:=sum(f,Length)

//ff0:=sum(f,Length0)

dd1:=wma(ff,Length1)

dd2:=wma(ff,Length2)

bull=ff<0 and dd1<0 and ff[1]<dd1 and ff>dd1 and abs(ff)>20

bear=ff>0 and dd1>0 and ff[1]>dd1 and ff<dd1 and abs(ff)>20

if(bull)

strategy.entry("long", strategy.long)

strategy.exit("exit", "long", profit = close*profit/1000, loss=close*loss/1000)

strategy.close("long", when = bear)

plotchar(bull,size=size.small,location=location.bottom)

plot(ff,color=black,linewidth=2)

plot(ff0,color=green,linewidth=2)

plot(wma(ff,Length1),color=red,linewidth=2)

plot(wma(ff,Length2),color=blue,linewidth=2)

plot(wma(ff,Length1)-wma(ff,Length2),color=green,style=columns)

plot(0,linewidth=1,color=black)

plot(500,linewidth=1,color=red)

plot(-500,linewidth=1,color=red)

更多内容