概述

该策略基于EMA交叉、RSI和MACD三个技术指标,构建了一个双重趋势确认的交易策略。策略通过EMA交叉判断趋势方向,并使用RSI和MACD作为过滤条件,在趋势确认后发出交易信号。该策略适用于追踪趋势行情,同时避免在震荡市场中过早入场。

策略原理

- 计算两条不同周期的EMA线,短期EMA反映近期价格变化,长期EMA反映中长期趋势。

- 计算RSI指标,用于判断市场超买超卖情况,避免在极端行情下入场。

- 计算MACD指标,MACD线与信号线的交叉可以作为趋势确认的信号。

- 多头开仓条件:短期EMA上穿长期EMA,RSI未达到超买区域,MACD线上穿信号线。

- 空头开仓条件:短期EMA下穿长期EMA,RSI未达到超卖区域,MACD线下穿信号线。

- 根据开仓条件发出交易信号,并在图表背景中显示信号。

策略优势

- 双重趋势确认:EMA交叉判断趋势方向,MACD交叉作为趋势确认,提高了信号的可靠性。

- RSI过滤:通过RSI判断超买超卖情况,避免在极端行情下入场,降低了风险。

- 参数灵活:用户可以根据不同市场特点,调整EMA、RSI和MACD的参数,优化策略表现。

- 直观明了:策略逻辑清晰,图表背景颜色为交易信号提供了直观的提示。

策略风险

- 参数优化:不同市场、不同时间周期,最优参数可能存在差异,需要根据实际情况进行优化。

- 震荡市:在震荡市场中,EMA交叉和MACD交叉可能频繁发生,导致交易信号过多,增加交易成本。

- 趋势转折:在趋势转折点,策略可能发出错误信号,导致损失。

- 风险管理:策略中未设置止损和止盈,需要根据实际情况,合理设置风险管理措施。

策略优化方向

- 加入趋势过滤:通过ATR、ADX等指标,判断市场是否处于趋势状态,避免在震荡市发出信号。

- 优化入场时机:根据市场特点,调整EMA、RSI和MACD的参数,找到最优入场点。

- 加入风险管理:设置合理的止损和止盈位置,控制单笔交易风险。

- 结合其他指标:如成交量、波动率等指标,提高信号的可靠性。

总结

该策略通过EMA交叉、RSI和MACD三个指标的结合,构建了一个双重趋势确认的交易策略。策略逻辑清晰,信号直观,适用于追踪趋势行情。但在实际应用中,需要注意参数优化、震荡市风险和趋势转折点的判断。通过加入趋势过滤、优化入场时机、设置风险管理等措施,可以进一步提高策略的稳定性和盈利能力。

策略源码

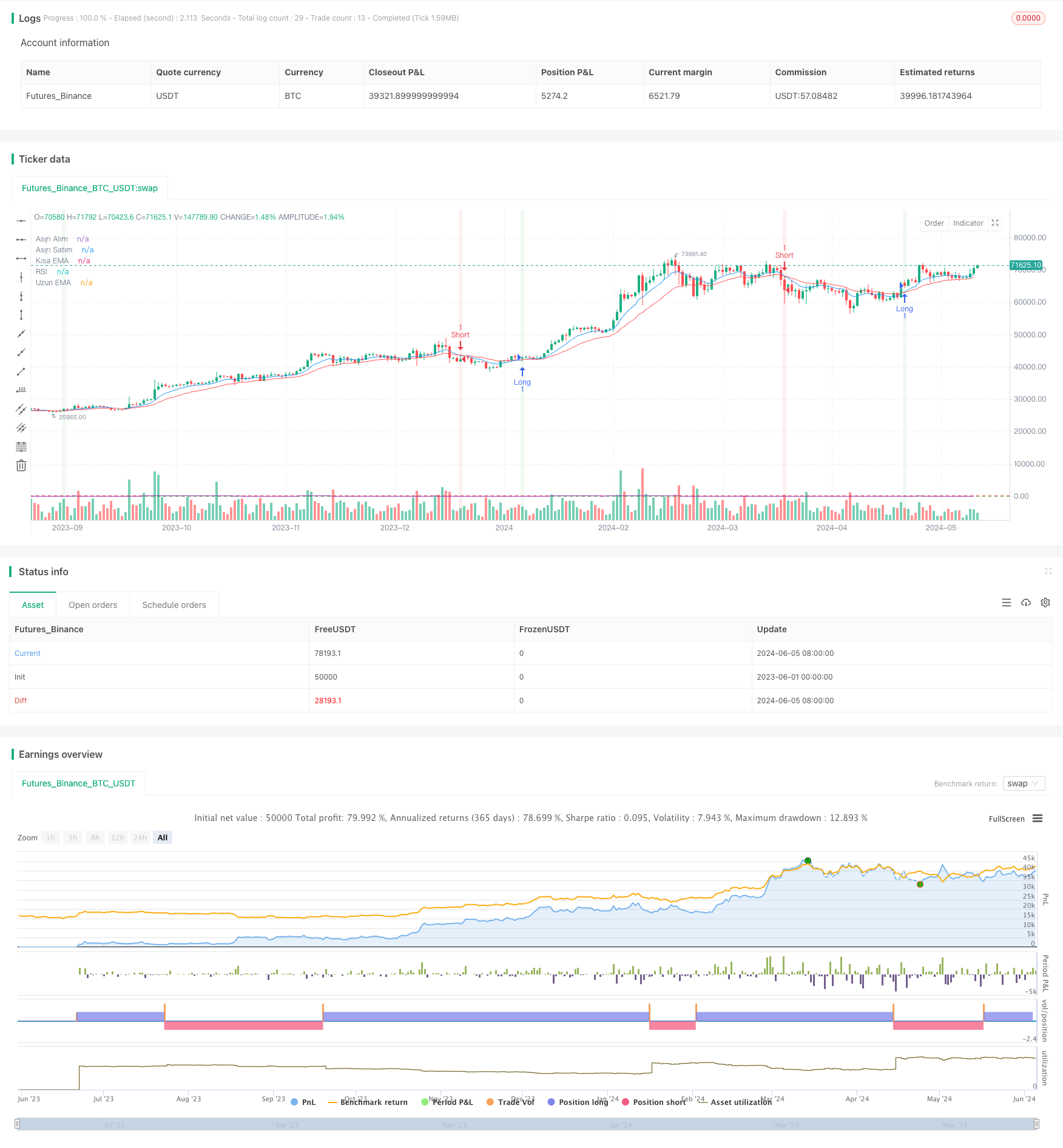

/*backtest

start: 2023-06-01 00:00:00

end: 2024-06-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("15 Dakikalık Göstergelerle Strateji", shorttitle="15m Strat", overlay=true)

// Parametreler

short_ma_length = input.int(9, title="Kısa EMA")

long_ma_length = input.int(21, title="Uzun EMA")

rsi_length = input.int(14, title="RSI Periyodu")

rsi_overbought = input.int(70, title="RSI Aşırı Alım")

rsi_oversold = input.int(30, title="RSI Aşırı Satım")

// EMA Hesaplamaları

short_ema = ta.ema(close, short_ma_length)

long_ema = ta.ema(close, long_ma_length)

// RSI Hesaplaması

rsi = ta.rsi(close, rsi_length)

// MACD Hesaplaması

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Göstergeleri Grafiğe Çizme

plot(short_ema, title="Kısa EMA", color=color.blue)

plot(long_ema, title="Uzun EMA", color=color.red)

hline(rsi_overbought, "Aşırı Alım", color=color.red)

hline(rsi_oversold, "Aşırı Satım", color=color.green)

plot(rsi, title="RSI", color=color.purple)

// İşlem Koşulları

longCondition = ta.crossover(short_ema, long_ema) and rsi < rsi_overbought and macdLine > signalLine

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = ta.crossunder(short_ema, long_ema) and rsi > rsi_oversold and macdLine < signalLine

if (shortCondition)

strategy.entry("Short", strategy.short)

// Grafik Arkaplanı İşlem Koşullarına Göre Değiştirme

bgcolor(longCondition ? color.new(color.green, 90) : na, title="Long Signal Background")

bgcolor(shortCondition ? color.new(color.red, 90) : na, title="Short Signal Background")

相关推荐