概述

大红蜡烛突破买入策略是一种基于价格行为的交易策略,主要利用大幅下跌后的反弹机会。该策略通过识别大幅下跌的红色蜡烛,并在随后的突破中寻找买入信号,旨在捕捉市场情绪转变和潜在的反转机会。策略的核心思想是在市场超卖后寻找反弹的入场点,通过设置止损和目标来管理风险和收益。

策略原理

大红蜡烛识别:策略首先寻找一根大幅下跌的红色蜡烛,通常定义为至少20个点的跌幅。这表示市场出现了显著的卖压。

突破信号生成:在识别到大红蜡烛后,策略会监控随后的蜡烛。当第二根蜡烛的低点突破第一根大红蜡烛的低点,并且收盘价高于开盘价时,生成买入信号。

仓位管理:策略使用动态的仓位管理方法。初始仓位设置为1,但当策略盈利达到初始资金的150%时,会增加1个单位的仓位。

风险管理:每次交易都设置了20个点的止损和50个点的目标利润。这有助于控制每笔交易的风险,同时锁定潜在的利润。

资金管理:策略的初始资金设置为24000,这为交易提供了足够的缓冲,同时也限制了过度杠杆的风险。

策略优势

价格行为驱动:该策略直接基于价格行为,无需复杂的技术指标,这使得策略更加直观和反应迅速。

捕捉反转机会:通过识别大幅下跌后的潜在反弹,策略能够在市场情绪转变的早期阶段进场。

明确的入场和出场规则:策略有清晰的入场信号和预设的止损与目标,这有助于交易者保持纪律性。

动态仓位管理:随着盈利的增加而增加仓位的方法,允许策略在成功时扩大收益。

风险控制:预设的止损和目标确保了每笔交易的风险回报比得到控制。

适应性强:虽然在5分钟时间框架上进行了回测,但策略的逻辑可以应用于不同的市场和时间框架。

策略风险

假突破风险:市场可能出现假突破,导致触发止损。为减少这种风险,可以考虑增加确认指标或延迟入场。

过度交易:在剧烈波动的市场中,策略可能产生过多的信号。可以通过增加信号过滤器或限制每日交易次数来缓解。

趋势逆转:如果在强劲下跌趋势中使用,可能面临持续下跌的风险。可以结合趋势指标来优化入场时机。

滑点风险:在快速市场中,实际成交价可能与信号价格有显著差异。使用限价单和设置最大允许滑点可以帮助控制这种风险。

资金管理风险:随着盈利增加仓位可能导致风险过度集中。可以设置最大仓位限制来管理这一风险。

策略优化方向

引入波动率调整:考虑使用ATR(Average True Range)来动态调整止损和目标位置,使策略更好地适应不同的市场波动条件。

增加趋势过滤器:结合移动平均线或ADX指标,只在整体趋势方向上进行交易,可能会提高策略的成功率。

优化入场确认:可以考虑使用RSI或随机指标来确认超卖条件,进一步提高入场的准确性。

改进仓位管理:可以实现更复杂的仓位管理算法,如基于账户净值百分比或凯利准则来调整仓位大小。

增加时间过滤:考虑市场的活跃时段,在特定时间段内才允许交易,以避开波动较小或不规律的时段。

引入成交量分析:将成交量作为额外的确认指标,只有在成交量支持的情况下才进行交易。

多时间框架分析:结合更高时间框架的趋势信息,以提高交易的整体方向性。

总结

大红蜡烛突破买入策略是一种基于价格行为的交易方法,旨在捕捉市场超卖后的反弹机会。通过识别大幅下跌的蜡烛和随后的突破模式,策略提供了一种相对简单但潜在有效的交易方法。其优势在于直观的价格行为分析、明确的规则和内置的风险管理机制。然而,策略也面临假突破和趋势逆转等风险。

通过引入额外的技术指标、优化仓位管理和增加市场环境过滤器,该策略有潜力进一步提高其性能。交易者在使用此策略时,应当注意市场条件的变化,并根据个人的风险承受能力和交易目标进行适当的调整。总的来说,这是一个值得进一步探索和优化的策略框架,特别适合那些偏好价格行为分析和寻求清晰交易规则的交易者。

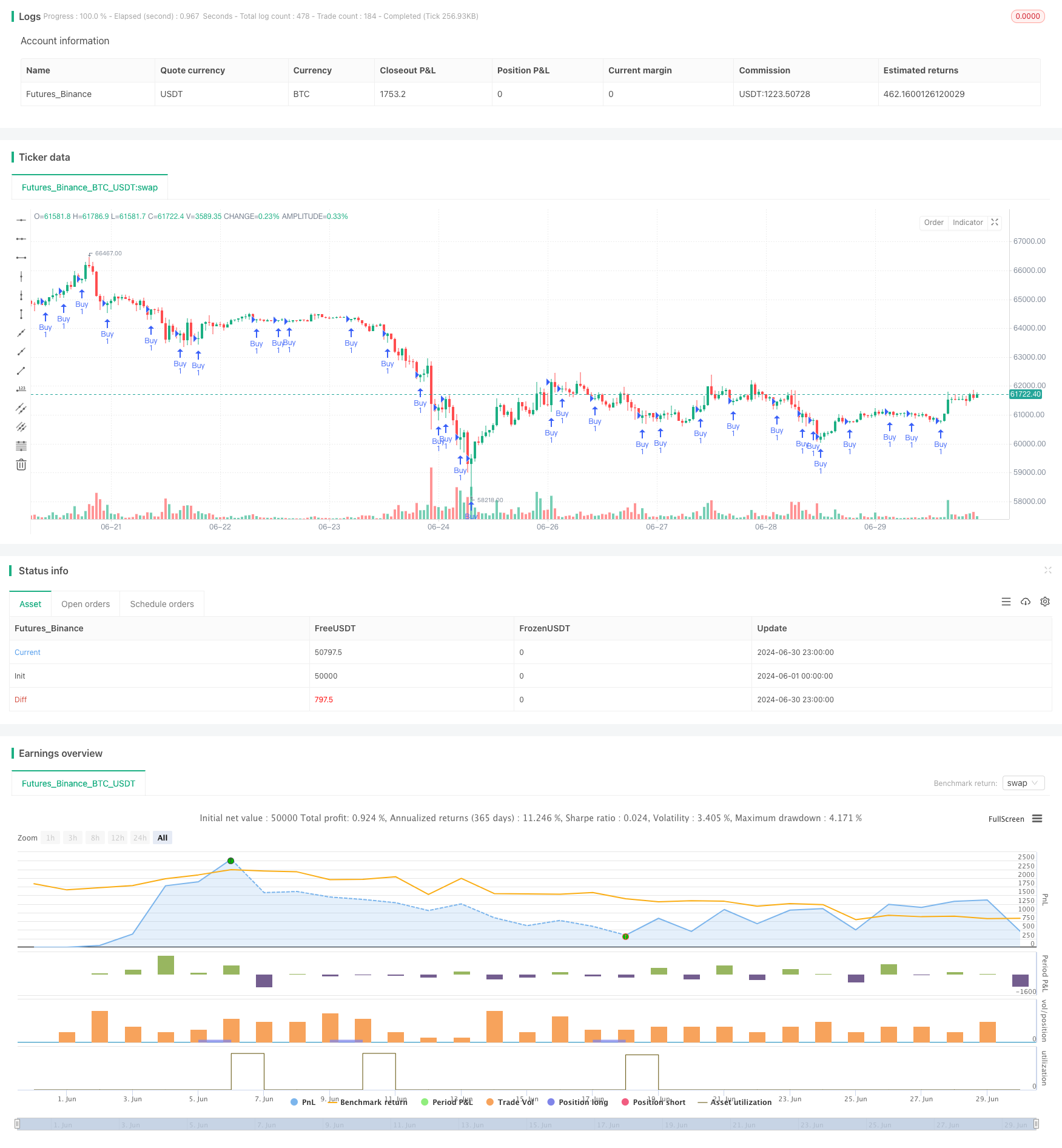

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Red Candle Breakout Buy Strategy", overlay=true, initial_capital=24000)

// Inputs

bigRedCandlePoints = input(20, title="Big Red Candle Points")

defaultQuantity = input(1, title="Default Quantity")

stopLossPoints = input(20, title="Stop Loss Points")

targetPoints = input(50, title="Target Points")

// Detect a big red candle

bigRedCandle = (high - low >= bigRedCandlePoints) and (close < open)

// Track the first big red candle

var float firstRedCandleLow = na

var bool firstRedCandleDetected = false

if bigRedCandle

firstRedCandleLow := low

firstRedCandleDetected := true

// Reset if a new big red candle is detected

if bigRedCandle and firstRedCandleDetected

firstRedCandleLow := low

// Generate buy signal on the second candle breaking the first red candle's low

buySignal = (firstRedCandleDetected and low < firstRedCandleLow and close > open)

// Variables to handle quantity adjustment

var float lastEquity = strategy.initial_capital

var float currentQuantity = defaultQuantity

// Check for equity increase and adjust quantity

if strategy.opentrades.profit(strategy.opentrades - 1) >= lastEquity * 1.50

currentQuantity := currentQuantity + 1

lastEquity := strategy.opentrades.profit(strategy.opentrades - 1)

// Execute the strategy

if buySignal

strategy.entry("Buy", strategy.long, qty=currentQuantity)

// Define stop loss and profit target levels

strategy.exit("Exit", from_entry="Buy", stop=close - stopLossPoints, limit=close + targetPoints)