概述

该策略结合了VWAP(成交量加权平均价)、RSI(相对强弱指数)和布林带三个技术指标,通过动态止盈止损的方式实现了一个简单易用的量化交易策略。策略的主要思路是利用VWAP指标判断价格在过去一段时间内的走势,同时结合RSI指标和布林带指标判断价格是否处于超买或超卖区间,从而确定交易信号。一旦确定交易信号,策略会根据ATR(平均真实波幅)指标计算动态止盈止损价位,以控制风险和锁定利润。

策略原理

- 计算VWAP、RSI和布林带三个技术指标的值。

- 通过判断过去15根K线的收盘价与VWAP的关系,确定价格走势是上涨、下跌还是震荡。

- 如果价格在布林带下轨以下,RSI小于45,且VWAP信号显示下跌,则产生做多信号;如果价格在布林带上轨以上,RSI大于55,且VWAP信号显示上涨,则产生做空信号。

- 一旦确定交易信号,策略会根据ATR指标计算止盈和止损价位,止盈止损比例为1.5:1。

- 如果已持有多头仓位,当RSI大于等于90时,策略会平掉多头仓位;如果已持有空头仓位,当RSI小于等于10时,策略会平掉空头仓位。

策略优势

- 结合多个技术指标,提高了交易信号的可靠性。

- 采用动态止盈止损,可以有效控制风险和锁定利润。

- 代码结构清晰,易于理解和优化。

- 适用于各种市场环境,包括趋势和震荡市场。

策略风险

- 在市场波动较大时,频繁的交易可能会导致高昂的交易成本。

- 如果市场出现突发事件或非理性行为,策略可能会产生错误的交易信号。

- 策略的参数设置可能需要根据不同的市场环境进行调整,以保证策略的有效性。

策略优化方向

- 可以尝试调整VWAP、RSI和布林带的参数设置,以适应不同的市场环境和交易品种。

- 可以引入其他技术指标,如MACD、KDJ等,以进一步提高交易信号的可靠性。

- 可以优化止盈止损的计算方法,如采用移动止损或利润保护止损等方式,以更好地控制风险和锁定利润。

- 可以结合基本面分析,如经济数据、政策变化等,以提高策略的综合表现。

总结

该策略通过结合VWAP、RSI和布林带三个技术指标,实现了一个简单易用的量化交易策略。策略采用动态止盈止损的方式,可以有效控制风险和锁定利润。尽管策略存在一些潜在的风险,但通过合理的参数设置和不断的优化,相信该策略能够在实际交易中取得不错的效果。

策略源码

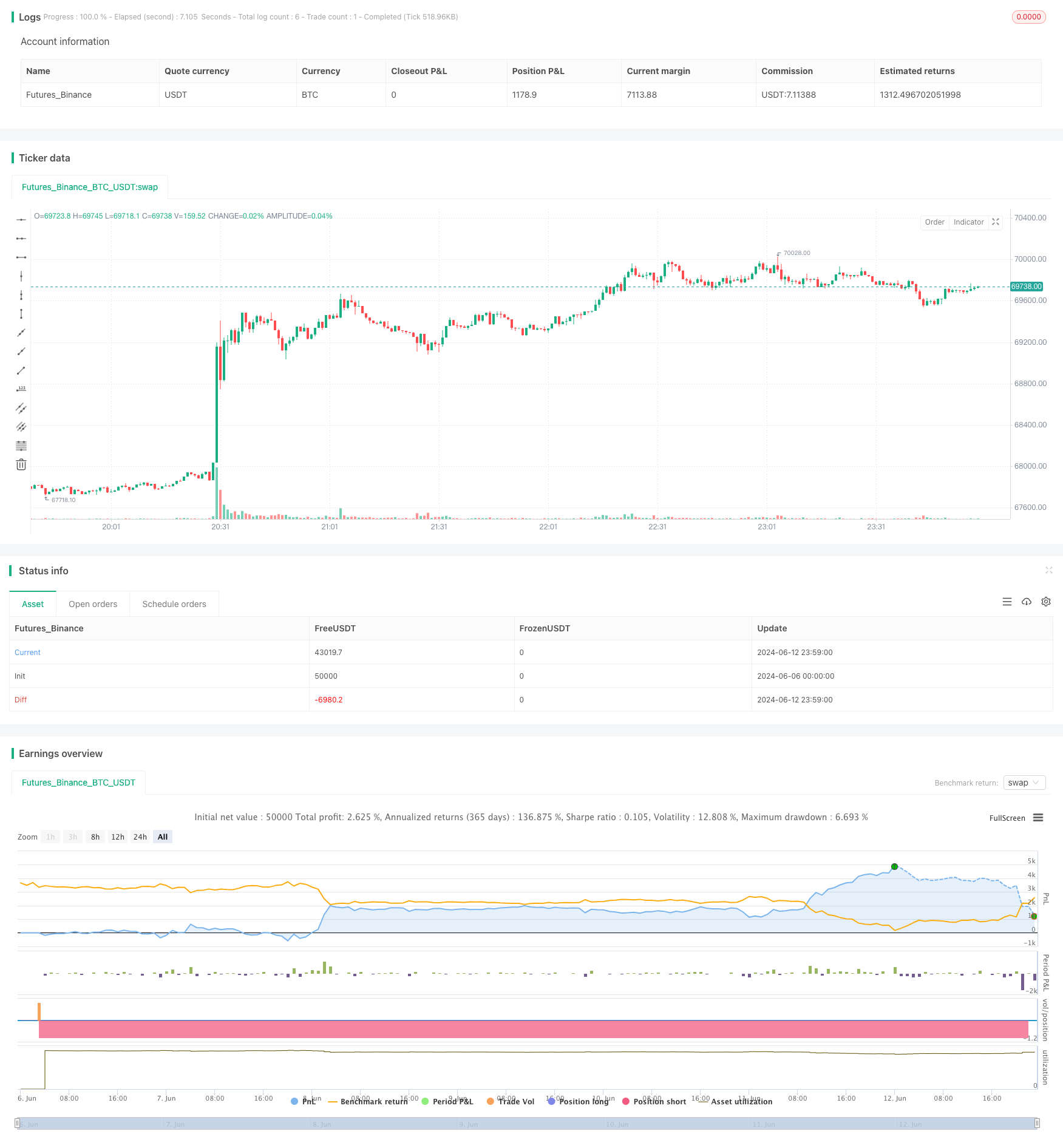

/*backtest

start: 2024-06-06 00:00:00

end: 2024-06-13 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("VWAP and RSI Strategy", overlay=true)

// VWAP calculation

vwap = ta.vwap(close)

// RSI calculation

rsi_length = 16

rsi = ta.rsi(close, rsi_length)

// Bollinger Bands calculation

bb_length = 14

bb_std = 2.0

[bb_middle, bb_upper, bb_lower] = ta.bb(close, bb_length, bb_std)

// Variables for VWAP signal calculation

backcandles = 15

float vwapsignal = na

// Function to check if last 15 candles are above or below VWAP

calc_vwapsignal(backcandles) =>

upt = true

dnt = true

for i = 0 to backcandles - 1

if close[i] < vwap[i]

upt := false

if close[i] > vwap[i]

dnt := false

if upt and dnt

3

else if upt

2

else if dnt

1

else

0

// Calculate VWAP signal for each bar

vwapsignal := calc_vwapsignal(backcandles)

// Calculate total signal

totalsignal = 0

if vwapsignal == 2 and close <= bb_lower and rsi < 45

totalsignal := 2

else if vwapsignal == 1 and close >= bb_upper and rsi > 55

totalsignal := 1

// Define strategy entry and exit conditions

slatr = 1.2 * ta.atr(7)

TPSLRatio = 1.5

if (totalsignal == 2 and strategy.opentrades == 0)

strategy.entry("Long", strategy.long, stop=close - slatr, limit=close + slatr * TPSLRatio)

if (totalsignal == 1 and strategy.opentrades == 0)

strategy.entry("Short", strategy.short, stop=close + slatr, limit=close - slatr * TPSLRatio)

// Additional exit conditions based on RSI

if (strategy.opentrades > 0)

if (strategy.position_size > 0 and rsi >= 90)

strategy.close("Long")

if (strategy.position_size < 0 and rsi <= 10)

strategy.close("Short")

相关推荐