概述

这个策略是一个基于多个技术指标的综合交易系统,主要利用指数移动平均线(EMA)、相对强弱指数(RSI)和交易量来生成交易信号并管理仓位。该策略通过EMA交叉来确定市场趋势,同时使用RSI指标来判断超买超卖情况,并结合交易量来确认信号强度。此外,策略还包含了动态止盈止损机制和固定持仓时间限制,以控制风险和优化交易表现。

策略原理

交易信号生成:

- 多头入场:EMA34上穿EMA89,且RSI大于30

- 空头入场:EMA34下穿EMA89,且RSI小于70

动态止盈止损:

- 当交易量大于20根K线平均交易量的3倍时,更新止盈止损价格

- 止盈止损价格设置为高交易量出现时的收盘价

固定持仓时间:

- 无论盈亏,在开仓后15根K线强制平仓

EMA止损:

- 使用EMA34作为动态止损线

交易量确认:

- 使用高交易量条件来确认信号强度和更新止盈止损价格

策略优势

多指标协同:结合EMA、RSI和交易量,全面分析市场情况,提高信号可靠性。

动态风险管理:根据市场波动实时调整止盈止损,适应不同市场环境。

固定持仓时间:避免长期持仓带来的风险,控制每笔交易的暴露时间。

EMA动态止损:利用均线作为动态支撑阻力,提供更灵活的止损保护。

交易量确认:利用交易量突破来确认信号强度,提高交易的准确性。

可视化辅助:在图表上标注买卖信号和关键价格水平,便于分析和决策。

策略风险

震荡市风险:在横盘震荡市场中,EMA交叉可能产生频繁的虚假信号。

RSI阈值固定:固定的RSI阈值可能不适用于所有市场环境。

交易量阈值敏感性:3倍平均交易量的阈值可能过高或过低,需要根据具体市场调整。

固定持仓时间限制:15根K线的固定平仓时间可能导致过早结束盈利交易。

止盈止损价格设置:以高交易量出现时的收盘价作为止盈止损价格可能不够优化。

策略优化方向

动态RSI阈值:根据市场波动性自动调整RSI的超买超卖阈值。

优化交易量阈值:引入自适应机制,根据历史数据动态调整交易量突破倍数。

改进持仓时间管理:结合趋势强度和盈利情况,动态调整最大持仓时间。

优化止盈止损设置:考虑引入ATR指标,根据市场波动性动态设置止盈止损价格。

增加趋势过滤器:引入长周期EMA或趋势指标,避免在主要趋势相反的方向交易。

引入价格行为分析:结合K线形态和支撑阻力水平,提高入场和出场的精确度。

考虑加入回撤控制:设置最大回撤限制,在达到特定回撤水平时强制平仓。

总结

这个多指标综合型动态交易策略通过结合EMA、RSI和交易量,创建了一个全面的交易系统。它不仅能够捕捉市场趋势,还能通过动态止盈止损和固定持仓时间来管理风险。策略的优势在于其多维度分析和灵活的风险管理,但同时也面临着市场环境变化带来的挑战。通过进一步优化RSI阈值、交易量判断标准、持仓时间管理以及止盈止损设置,该策略有潜力在不同市场环境中取得更好的表现。最终,这个策略为交易者提供了一个可靠的框架,可以根据个人交易风格和市场特点进行定制和改进。

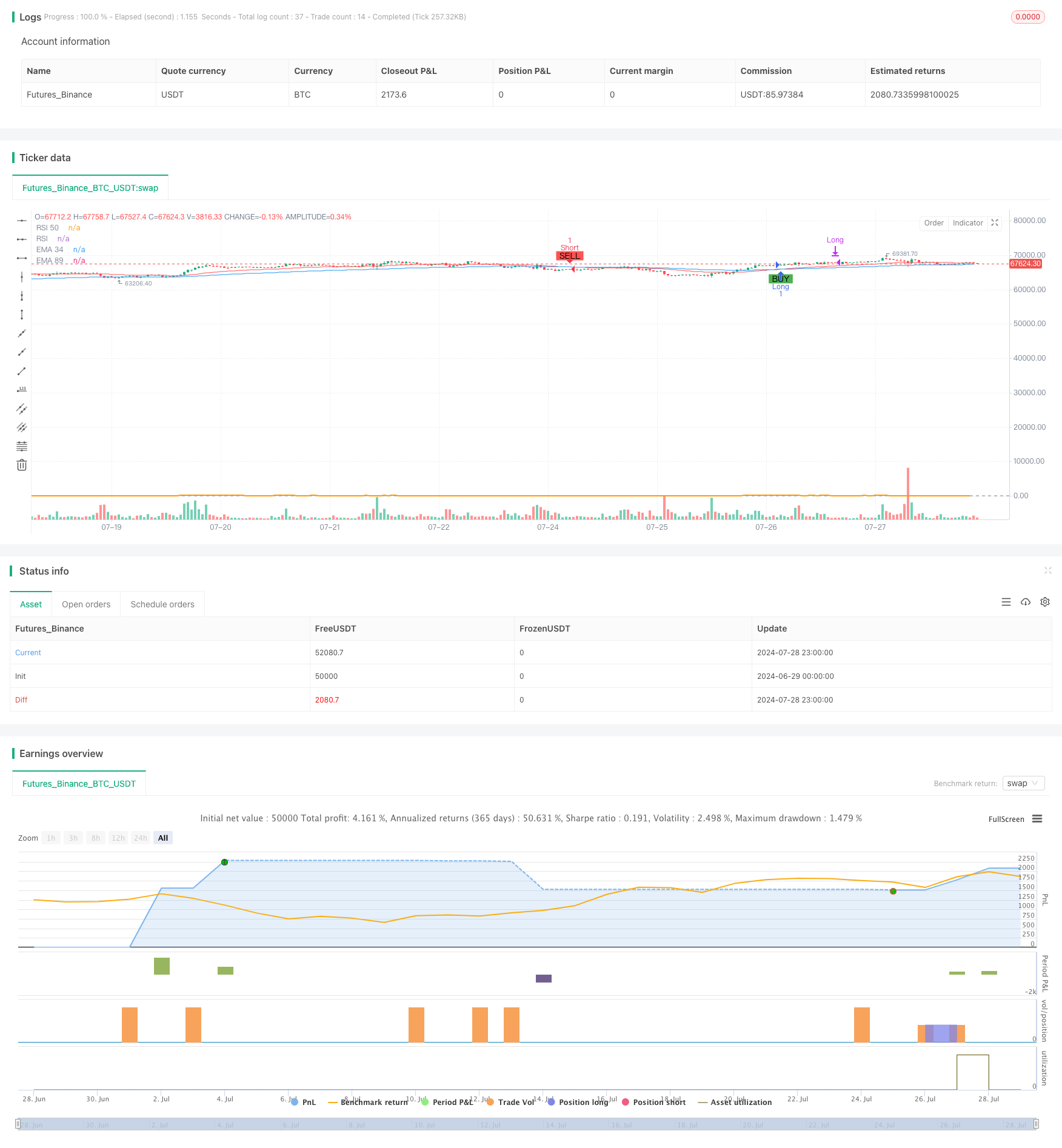

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA & RSI Strategy", overlay=true)

// Install indicators

ema34 = ta.ema(close, 34)

ema89 = ta.ema(close, 89)

ema54 = ta.ema(close, 54)

ema150 = ta.ema(close, 150)

rsi = ta.rsi(close, 14)

// Draw indicator

plot(ema34, color=color.red, title="EMA 34")

plot(ema89, color=color.blue, title="EMA 89")

//plot(ema54, color=color.green, title="EMA 54")

//plot(ema150, color=color.yellow, title="EMA 150")

hline(50, "RSI 50", color=color.gray)

plot(rsi, title="RSI", color=color.orange, linewidth=2, offset=-1)

// condition long or short

longCondition = ta.crossover(ema34, ema89) and rsi > 30

shortCondition = ta.crossunder(ema34, ema89) and rsi < 70

// Add strategy long

if (longCondition)

strategy.entry("Long", strategy.long)

// Add strategy short

if (shortCondition)

strategy.entry("Short", strategy.short)

// Calculate the average volume of previous candles

length = 20 // Number of candles to calculate average volume

avgVolume = ta.sma(volume, length)

highVolumeCondition = volume > 3 * avgVolume

// Determine take profit and stop loss prices when there is high volume

var float takeProfitPriceLong = na

var float stopLossPriceLong = na

var float takeProfitPriceShort = na

var float stopLossPriceShort = na

if (longCondition)

takeProfitPriceLong := na

stopLossPriceLong := na

if (shortCondition)

takeProfitPriceShort := na

stopLossPriceShort := na

// Update take profit and stop loss prices when volume is high

if (strategy.opentrades.entry_id(0) == "Long" and highVolumeCondition)

takeProfitPriceLong := close

stopLossPriceLong := close

if (strategy.opentrades.entry_id(0) == "Short" and highVolumeCondition)

takeProfitPriceShort := close

stopLossPriceShort := close

// Execute exit orders for buy and sell orders when there is high volume

if (not na(takeProfitPriceLong))

strategy.exit("Take Profit Long", from_entry="Long", limit=takeProfitPriceLong, stop=stopLossPriceLong)

if (not na(takeProfitPriceShort))

strategy.exit("Take Profit Short", from_entry="Short", limit=takeProfitPriceShort, stop=stopLossPriceShort)

// Track the number of candles since the order was opened

var int barsSinceEntryLong = na

var int barsSinceEntryShort = na

var bool longPositionClosed = false

var bool shortPositionClosed = false

if (longCondition)

barsSinceEntryLong := 0

longPositionClosed := false

if (shortCondition)

barsSinceEntryShort := 0

shortPositionClosed := false

if (strategy.opentrades.entry_id(0) == "Long")

barsSinceEntryLong := barsSinceEntryLong + 1

if (strategy.opentrades.entry_id(0) == "Short")

barsSinceEntryShort := barsSinceEntryShort + 1

// Check the conditions to close the order at the 15th candle

if (strategy.opentrades.entry_id(0) == "Long" and barsSinceEntryLong >= 15 and not longPositionClosed)

strategy.close("Long")

longPositionClosed := true

if (strategy.opentrades.entry_id(0) == "Short" and barsSinceEntryShort >= 15 and not shortPositionClosed)

strategy.close("Short")

shortPositionClosed := true

// Thêm stop loss theo EMA34

if (strategy.opentrades.entry_id(0) == "Long")

strategy.exit("Stop Loss Long", from_entry="Long", stop=ema34)

if (strategy.opentrades.entry_id(0) == "Short")

strategy.exit("Stop Loss Short", from_entry="Short", stop=ema34)

// Displays buy/sell signals and price levels on the chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Displays take profit and stop loss prices on the chart

// var line takeProfitLineLong = na

// var line stopLossLineLong = na

// var line takeProfitLineShort = na

// var line stopLossLineShort = na

// if (not na(takeProfitPriceLong))

// if na(takeProfitLineLong)

// takeProfitLineLong := line.new(x1=bar_index, y1=takeProfitPriceLong, x2=bar_index + 1, y2=takeProfitPriceLong, color=color.blue, width=1, style=line.style_dashed)

// else

// line.set_xy1(takeProfitLineLong, x=bar_index, y=takeProfitPriceLong)

// line.set_xy2(takeProfitLineLong, x=bar_index + 1, y=takeProfitPriceLong)

// if (not na(stopLossPriceLong))

// if na(stopLossLineLong)

// stopLossLineLong := line.new(x1=bar_index, y1=stopLossPriceLong, x2=bar_index + 1, y2=stopLossPriceLong, color=color.red, width=1, style=line.style_dashed)

// else

// line.set_xy1(stopLossLineLong, x=bar_index, y=stopLossPriceLong)

// line.set_xy2(stopLossLineLong, x=bar_index + 1, y=stopLossPriceLong)

// if (not na(takeProfitPriceShort))

// if na(takeProfitLineShort)

// takeProfitLineShort := line.new(x1=bar_index, y1=takeProfitPriceShort, x2=bar_index + 1, y2=takeProfitPriceShort, color=color.blue, width=1, style=line.style_dashed)

// else

// line.set_xy1(takeProfitLineShort, x=bar_index, y=takeProfitPriceShort)

// line.set_xy2(takeProfitLineShort, x=bar_index + 1, y=takeProfitPriceShort)

// if (not na(stopLossPriceShort))

// if na(stopLossLineShort)

// stopLossLineShort := line.new(x1=bar_index, y1=stopLossPriceShort, x2=bar_index + 1, y2=stopLossPriceShort, color=color.red, width=1, style=line.style_dashed)

// else

// line.set_xy1(stopLossLineShort, x=bar_index, y=stopLossPriceShort)

// line.set_xy2(stopLossLineShort, x=bar_index + 1, y=stopLossPriceShort)

// // Shows annotations for take profit and stop loss prices

// if (not na(takeProfitPriceLong))

// label.new(x=bar_index, y=takeProfitPriceLong, text="TP Long", style=label.style_label_down, color=color.blue, textcolor=color.white)

// if (not na(stopLossPriceLong))

// label.new(x=bar_index, y=stopLossPriceLong, text="SL Long", style=label.style_label_up, color=color.red, textcolor=color.white)

// if (not na(takeProfitPriceShort))

// label.new(x=bar_index, y=takeProfitPriceShort, text="TP Short", style=label.style_label_up, color=color.blue, textcolor=color.white)

// if (not na(stopLossPriceShort))

// label.new(x=bar_index, y=stopLossPriceShort, text="SL Short", style=label.style_label_down, color=color.red, textcolor=color.white)