概述

本策略是一个结合了双均线系统、相对强弱指标(RSI)和相对强度(RS)分析的综合交易系统。策略通过13日与21日指数移动平均线(EMA)的交叉确认趋势,同时结合RSI和相对于基准指数的RS值进行交易信号的确认,实现了多维度的交易决策机制。该策略还包含了基于52周高点的风险控制机制和重新入场条件的判断。

策略原理

策略采用多重信号确认机制: 1. 入场信号需同时满足以下条件: - EMA13上穿EMA21或价格高于EMA13 - RSI大于60 - 相对强度(RS)为正值 2. 退出条件包括: - 价格跌破EMA21 - RSI低于50 - RS转为负值 3. 重新入场条件: - 价格上穿EMA13且EMA13大于EMA21 - RS保持为正值 - 或价格突破上周高点

策略优势

- 多重信号确认机制降低了假突破风险

- 结合相对强度分析,有效筛选强势品种

- 采用自适应的时间周期调整机制

- 具备完善的风险控制体系

- 包含智能的重新入场机制

- 提供实时的交易状态可视化

策略风险

- 震荡市场可能产生频繁交易

- 依赖多重指标可能导致信号滞后

- 固定的RSI阈值可能不适应所有市场环境

- 相对强度计算依赖基准指数的准确性

- 52周高点止损位可能过于宽松

策略优化方向

- 引入自适应的RSI阈值

- 优化重新入场条件的判断逻辑

- 增加交易量分析维度

- 完善止盈止损机制

- 加入波动率过滤器

- 优化相对强度计算周期

总结

该策略通过结合技术分析和相对强度分析,构建了一个全面的交易系统。其多重信号确认机制和风险控制体系使其具有较强的实用性。通过建议的优化方向,策略还有进一步提升的空间。策略的成功实施需要交易者对市场有深入的理解,并根据具体交易品种特点进行适当的参数调整。

策略源码

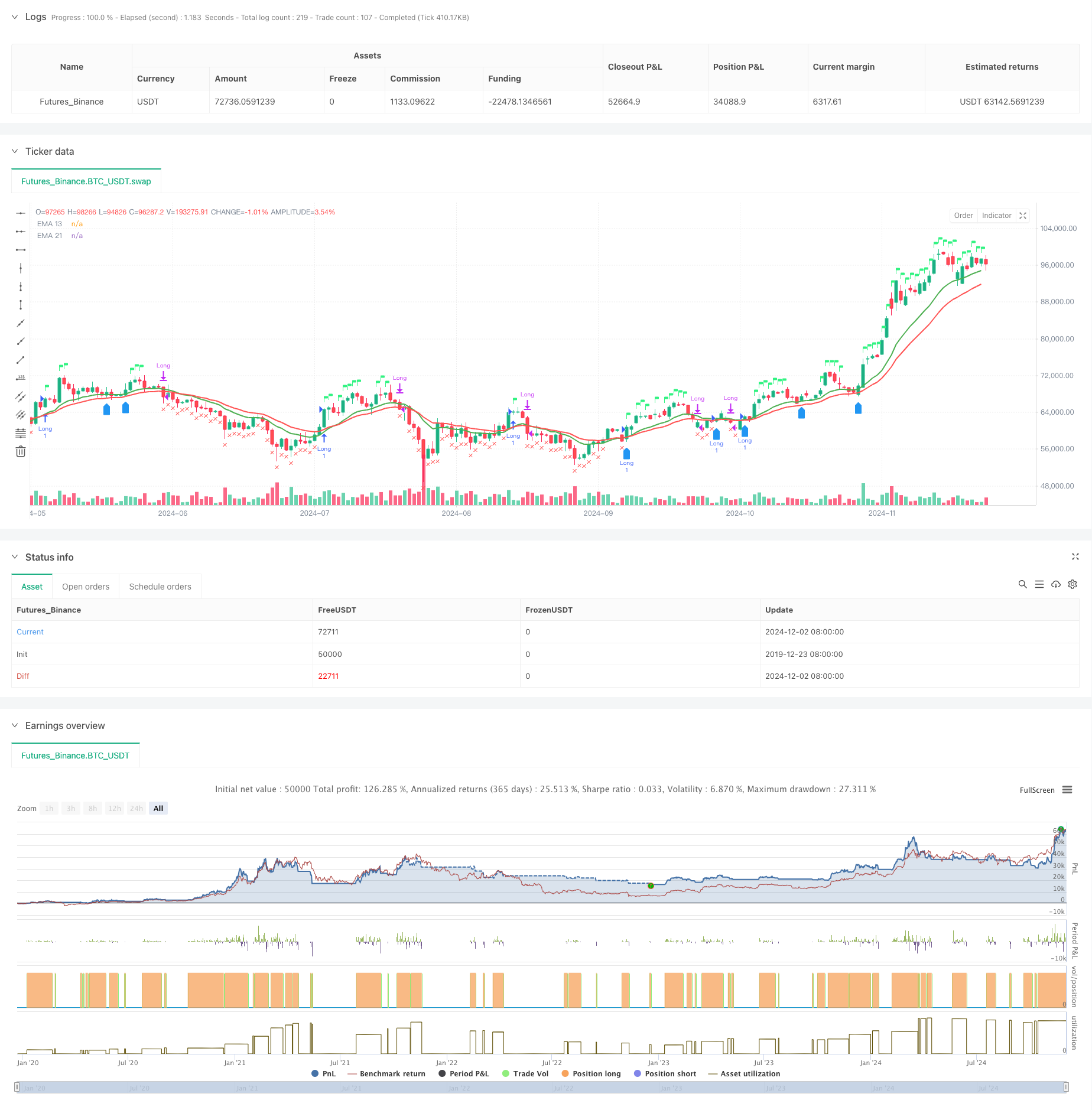

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-03 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA 13 & 21 Entry Exit", overlay=true)

// Define the EMAs

ema13 = ta.ema(close, 13)

ema21 = ta.ema(close, 21)

// Define the RSI

rsi = ta.rsi(close, 14)

// Calculate the closing price relative to Nifty 50

//nifty50 = request.security("NSE:NIFTY", timeframe.period, close)

//closeRelative = close / nifty50

// Define a base period (e.g., 123) and adjust it based on the timeframe

//basePeriod = 123

// Calculate the effective period based on the timeframe

//effectivePeriod = basePeriod * (timeframe.isintraday ? (60 / timeframe.multiplier) : 1)

// Calculate the EMA

//rs = ta.ema(closeRelative, effectivePeriod)

// Define the Relative Strength with respect to NIFTY 50

nifty50 = request.security("swap", "D", close)

rs = ta.ema(close / nifty50, 55 )

// Define the previous 2-week low and last week's high

twoWeekLow = ta.lowest(low, 10) // 10 trading days roughly equal to 2 weeks

lastWeekHigh = ta.highest(high, 5) // 5 trading days roughly equal to 1 week

fiftytwoWeekhigh = ta.highest(high, 52*5) // 252 tradingdays roughly equal to 52 week.

// Long condition: EMA 21 crossing above EMA 55, price above EMA 21, RSI > 50, and RS > 0

longCondition = ta.crossover(ema13, ema21) or close > ema13 and rsi > 60 and rs > 0

// Exit condition: Price closing below EMA 55 or below the previous 2-week low

exitCondition = close < ema21 or rsi < 50 or rs < 0 //or close < fiftytwoWeekhigh*0.80

// Re-entry condition: Price crossing above EMA 21 after an exit, EMA 21 > EMA 55, and RS > 1

reEntryCondition = ta.crossover(close, ema13) and ema13 > ema21 and rs > 0

// Re-entry condition if trailing stop loss is hit: Price crossing above last week's high

reEntryAfterSL = ta.crossover(close, lastWeekHigh)

// Plot the EMAs

plot(ema13 ,color=color.green, title="EMA 13",linewidth = 2)

plot(ema21, color=color.red, title="EMA 21",linewidth = 2)

// Plot buy and sell signals

plotshape(series=longCondition, location=location.abovebar, color=color.rgb(50, 243, 130), style=shape.flag, title="Buy Signal")

plotshape(series=exitCondition, location=location.belowbar, color=color.red, style=shape.xcross, title="Sell Signal")

plotshape(series=reEntryCondition or reEntryAfterSL, location=location.belowbar, color=color.blue, style=shape.labelup, title="Re-entry Signal")

//plotshape(series = fiftytwoWeekhigh,location=location.abovebar, color=color.blue,style=shape.flag, title="52WH")

// Plot background color for RS > 0

//bgcolor(rs > 0 ? color.new(color.green, 90) : na, title="RS Positive Background")

// Plot the previous 2-week low and last week's high

// plot(twoWeekLow, color=color.orange, title="2-Week Low")

// plot(lastWeekHigh, color=color.purple, title="Last Week High")

// Strategy logic

if (longCondition or reEntryCondition or reEntryAfterSL)

strategy.entry("Long", strategy.long)

if (exitCondition)

strategy.close("Long")

// Calculate Stop Loss (SL) and Profit

var float entryPrice = na

var float stopLoss = na

var float profit = na

if (strategy.opentrades > 0)

entryPrice := strategy.opentrades.entry_price(strategy.opentrades - 1)

stopLoss := fiftytwoWeekhigh * 0.80

profit := (close - entryPrice) / entryPrice * 100

// Display the strategy table

var table strategyTable = table.new(position.top_right, 4, 2, border_width = 1)

// Make the table movable

tableX = input.int(0, title="Table X Position")

tableY = input.int(0, title="Table Y Position")

// Add size options for the table

tableSize = input.string("small", title="Table Size", options=["tiny", "small", "large"])

// Adjust table size based on user input

tableWidth = tableSize == "tiny" ? 2 : tableSize == "small" ? 4 : 6

tableHeight = tableSize == "tiny" ? 1 : tableSize == "small" ? 2 : 3

// Create the table with the specified size

//table = table.new(position.top_right, tableWidth, tableHeight, border_width = 1)

// Position the table based on user input

// table.cell(strategyTable, tableX, tableY, "Entry Price", bgcolor=#18eef9)

// table.cell(strategyTable, tableX, tableY + 1, str.tostring(entryPrice, format.mintick), bgcolor=#18eef9)

// table.cell(strategyTable, tableX + 1, tableY, "Stop Loss (20%)", bgcolor=color.red)

// table.cell(strategyTable, tableX + 1, tableY + 1, str.tostring(stopLoss, format.mintick), bgcolor=color.red)

// table.cell(strategyTable, tableX + 2, tableY, "Profit (%)", bgcolor=color.green)

// table.cell(strategyTable, tableX + 2, tableY + 1, str.tostring(profit, format.percent), bgcolor=color.green)

相关推荐